But Avoid Being Too Aggressive

If you have a long time horizon, it can be smart to get aggressive with your portfolio, but those closer to retirement should be careful, too. For retirees and near-retirees, it may be time to shift into preserving your assets rather than trying to play catch-up.

Yet many are focused on growing their assets including aggressive investment strategies rather than preserving their assets against sudden market downturns, says David Potter, former spokesperson for MassMutual Financial, citing the companys research. Many people may be taking more risk than they realize.

Potter suggests that investors reevaluate their portfolio regularly to consider how they would fare if the market declined significantly.

Typically, financial professionals recommend that retirement savers dial back their exposure to stocks as they get within five years of retirement and within the first five years after retiring, he says. A steep market downturn of 20 percent or more during those periods could irreversibly reduce your income in retirement.

Heres how to tell if your portfolio is too aggressive.

Open A Health Savings Account

Experts say an HSA is one of the most tax-favored, yet underused, investment vehicles.

People with a high-deductible health plan are eligible for a tax-advantaged Health Savings Account. Pros highly recommend that those who have an HSA use it not just as a medical fund for unexpected emergencies, but also as a long-term retirement savings account.

HSA has a triple-tax benefit: The money you put into an HSA is tax-deductible the balance grows tax-free and rolls over each year and withdrawals from your HSA for qualified medical expenses are not taxed. There are a variety of HSA investment options, from regular savings accounts to mutual funds.

The annual maximum HSA contribution in 2022 is $3,700 for an individual and $7,300 for a family. If you are at least 55 years old, you can contribute an additional $1,000 annually. Experts suggest you max it out if you can, given its triple-tax benefits. While you must have a high-deductible health plan to contribute to an HSA, you get to keep and use the funds even after youve changed insurance coverage.

You can search for HSAs on DepositAccounts.com, which, like MagnifyMoney, is a subsidiary of LendingTree. This may help you navigate the hundreds of plan providers out there.

Best for: People who have a high-deductible health plan.

Among The Best: Low Cost Stock Index Funds

Over the decades, the stock market has delivered returnsthat compoundedat around a 9.6% annualized rate. Thats enough to turn $500 invested each month into around $2.8 million over thecourse of a 40-year career.The challenge, though, is that for youto achieve the markets returns, you need to own the market at as low of a costas you can.

A mere 2% of performance lost to fees or other frictioncosts each year knocksmore than $1.2 million off the value of those 40 years of investing.Indexfunds dont have to make many decisions on what to own, and they dontchange holdings very often. Those factors help them keep both internalmanagement and trading friction costs down to the bare minimum, enabling you tokeep more of the returns for yourself.

Previous

3 of 11

Read Also: How To Check If You Have A 401k

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

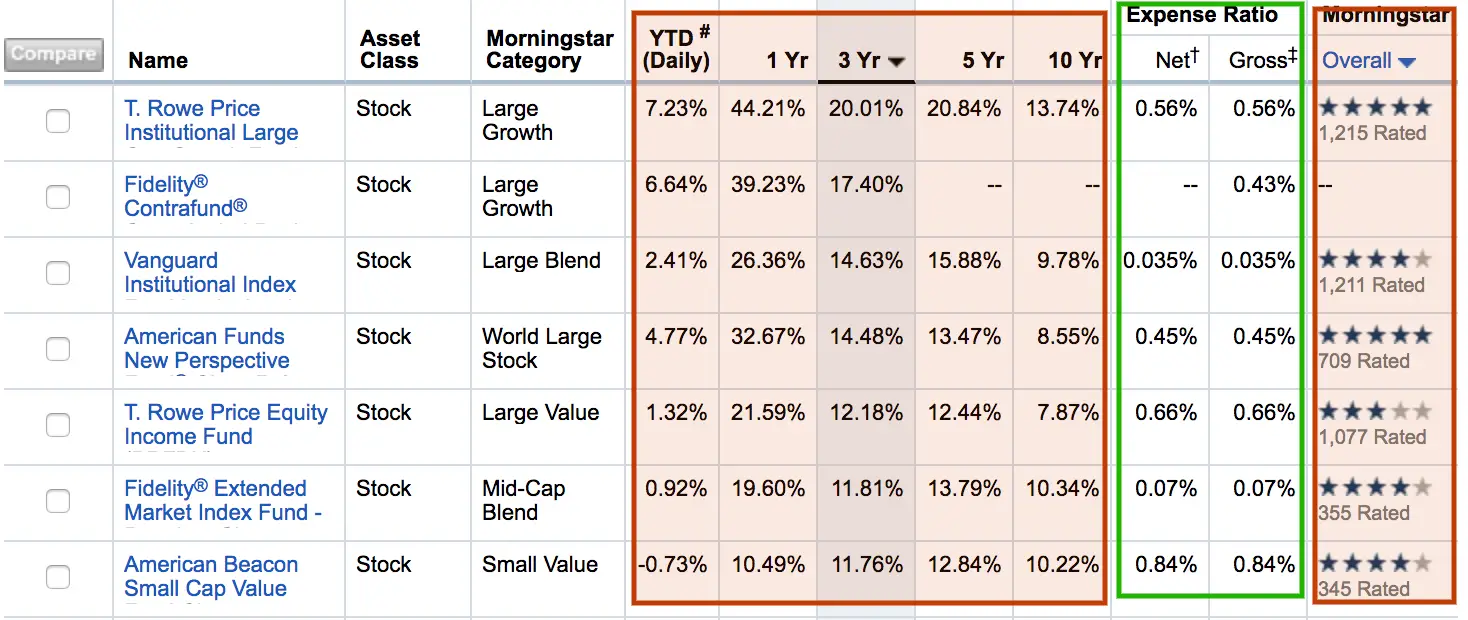

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

You May Like: What Is Qualified Domestic Relations Order 401k

Best Funds For A 401k: Fidelity Total Emerging Markets

Type: Emerging MarketsExpenses: 1.4%*

Continuing along the theme of low-cost, high-quality funds to hold in a 401k plan, one of the best funds in the emerging markets category is Fidelity Total Emerging Markets .

Emerging markets stock funds carry more market risk, and are therefore more volatile than diversified international stock funds that focus more on companies in developed economies like those in Western Europe. However, a measured allocation to a well-managed emerging markets fund with solid performance record can be a good diversification tool in a 401k plan.

Although the fund has only been in existence for a little more than four years, the performance looks strong during a currently harsh period for emerging markets funds. Manager John H. Carlson has been at the helm of FTEMX since the November 2011 inception, and the three-year performance rank places the fund ahead of nearly 90% of emerging markets funds.

Vanguard Emerging Markets Index : Charges 0.33%.American Funds New World R-6 : Charges 0.65%.

Eq Bank Rsp Savings Account*

At 1.25%, EQ Bank is currently offering the highest interest rate available on a savings account in Canada. If youre looking for a no-risk and stable way to grow your RRSP funds, this account may be the right place to put your money. The EQ Bank RSP Savings Account could be ideal if youre nearing retirement and dont want to worry about investment fluctuations, or if youre an aspiring first-time home buyer planning on leveraging the Home Buyers Plan and want to safely invest your down payment.

Theres no minimum balance or monthly account fees. And EQ Bank, owned and operated by Canadas ninth-largest Schedule 1 bank Equitable Bank, is a member of the Canada Deposit Insurance Corporation, just like with the big banks.

- Interest rate: 1.25%

Also Check: How To Figure Out Employer Match 401k

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

The Best Rrsp Investments 2021

By Rebecca Cuneo Keenan and Keph Senett on February 24, 2021

You can hold a wide variety of investments inside a Registered Retirement Savings Plan . This guide will help you choose the ones that fit your risk tolerance and investment goals.

A registered retirement savings plan is an investment that is registered with the Canadian federal government. RRSPs are often described as being tax-advantaged. That means you dont pay income tax on the amount you are contributing to an RRSP, in the year you earn that contribution. However, you will have to pay income tax when you withdraw money during your retirement. The advantage is built on the assumption that your income is higher now than it will be in retirement. If you plan things right, you will be in a lower tax bracket in retirement, meaning that you pay less tax on your withdrawals than you saved initially by stashing your money inside an RRSP.

You can open an RRSP and contribute income up until the year you turn 71, at which point it has to become a registered retirement income fund and you begin to withdraw the money as taxable income.

You May Like: What’s The Max You Can Put In A 401k

Mistake #: Borrowing From Your Qrp

Many QRPs allow you to borrow from your account. Unless you need the money for an emergency, try not to. Borrowing can be an expensive choice, in two ways:

- Smaller retirement savings: When you take out a loan you are losing the potential for investment growth and that could leave you with a smaller retirement savings. How much smaller? This depends on a number of factors, including the size of the loan, the repayment period, whether you continue contributions during this period, the earnings on your account, and the loan interest rate. Also, if you stop contributing while you are paying back your loan, you wont receive any employer matching contributions.

- Repayment requirements: If you lose your job or take another one, youll have to repay the money quickly, usually within 30 to 60 days. However, if not repaid, the outstanding loan balance is generally subject to income tax and possibly an IRS 10% additional tax for early or pre-59 1/2 distributions. The 2020 Coronavirus, Aid, Relief and Economic Security Act includes provisions providing greater repayment flexibility for certain individuals affected by the coronavirus pandemic. If these apply to you, you should still consider the potential effects of borrowing from your QRP on your ability to reach your retirement goals.

In addition, cashing out of your 401 when you move to a new employer might be costly as well. Know your distribution options when changing jobs.

The Best 401 Investment Accounts

Modified date: Nov. 26, 2020

What if you could choose the trustee for your 401 plan? In most cases, you cant, but if you could, we would recommend the five platforms below as the best 401 investment accounts available.

Weve also included two tools to help you manage your 401and .

But before we get into the best 401 investment accounts, lets first take a look at the basics of what 401 accounts are.

Whats Ahead:

Read Also: Can 401k Be Transferred To Another Company

For Passive Etf Investors: Wealthsimple Trade*

An absolute game-changer, Wealthsimple Trade* is the only trading platform in Canada with no commissions. With most other online brokerages charging anywhere from $4.95 to $9.99 per trade, using a Wealthsimple Trade* account will save you big from the first trade you complete.

Wealthsimple Trade* is ideal for passive investors looking to buy diversified ETFs listed on the TSX and NEO Canadian stock exchanges. This means you can track the performance of specific market segments, indexes and the global stock market. Wealthsimple Trade* offers RRSP and TFSA options.

This is a simple platform with no-in depth analytics tools or stock screeners. Additionally, account holders are not permitted to hold U.S. dollars, so you cant leverage the strategy of Norberts Gambit to minimize currency fees when buying U.S. equities. However, these are features more geared towards active investorsnot passive ETF investors, for whom Wealthsimple Trade* is hard to beat.

- Account, maintenance and low-activity fees: $0

- Commissions: $0

- Portfolio: Access to thousands of ETFs listed on the TSX and NEO exchanges

- Foreign currency fees: 1.5% when buying and selling equities listed on the NYSE

Best For Mutual Funds: Vanguard

Vanguard

Vanguard is well known for its own mutual funds and ETFs. If you prefer investing in Vanguard funds, a Vanguard Individual 401 plan gives you easy access with no trade costs, making the company our review’s best choice for mutual funds.

-

No fee to establish an account

-

Trade the Vanguard family of funds with no commissions or load fees

-

Roth contributions allowed

-

$20 annual fee for each Vanguard fund held in this type of account

-

401 loans are not supported

If youre looking to stick with a well-respected list of mutual funds from Vanguard, choose the Vanguard Individual 401. The account doesnt have an annual fee on its own for accounts with at least $10,000 in Vanguard funds. It charges a $20 annual fee below that balance plus a $20 annual fee for each Vanguard fund held in the account. Depending on how you invest, this fee can add up fast and could be a reason to consider buying those Vanguard funds elsewhere. You can also trade stocks and ETFs with no commission, in addition to options and fixed-income investments.

Vanguards founder, the late John Bogle, is credited as a pioneer in index investing, bringing the first index fund to market in 1976. Vanguard remains a leader in investment funds as the second-largest asset manager in the world with $6.2 trillion under management.

Read our full Vanguard review.

Also Check: Is A 401k A Defined Benefit Plan

Among The Worst: Municipal Bonds

Despite the potential benefits of bonds in general,municipal bonds dont make a good choice for your 401. This is becausemunicipal bonds already have tax advantages for investors, including the factthat their interestpayments can often be received tax free in an ordinary investing account.

As a result of that favorable tax treatment, municipal bondsdont belong in a tax-deferred investing account like your 401. In fact, ifyoure investing in a traditional 401, owning municipal bonds inside thatplan may very well force you to pay taxes on income that otherwise would havebeen tax free to you. This is because most withdrawals from traditional 401plans are taxed as ordinary income, no matter how the income being withdrawnwas originally earned.

6 of 11

Mistake #: Failing To Take Full Advantage Of Retirement Saving Plans

If your companys 401 or other qualified employer sponsored retirement plan , including 403 and governmental 457, offers a company match , you have an extra incentive. If you neglect to invest enough to receive the full company match, youre leaving money on the table. If you get a raise, consider increasing your QRP contribution.

Also Check: What Is A Pension Vs 401k

Best Investment Strategy For The Future

The best investment strategy focuses on strategy and asset allocation, not on picking the best investment year after year. Few people really have any investment strategy at all, and they lose money in years like 2008 and 2009. If you want to make money in your investment portfolio in the future, and sleep at night, read this. Ill keep it simple.

The best investment strategy is not about pulling your hair out to find the best investment or even the proper asset allocation or investment mix each year. Thats a formula for frustration. Instead, the MOST IMPORTANT thing you can do in the future, your best investment strategy, is much easier and requires no crystal ball. It starts with simple asset allocation and then comes the important part. First Ill tell you why most people have lost money in recent times, and then Ill tell you what you can do to make money in the investment game without sweating the details.

Most people invest much like they play any other game they dont really feel up to speed on. If they go into the game with a plan of action, they fall apart as soon as the unexpected happens. Then, they REACT as their emotions take over. Thats what investors as a group have done in recent times. Theyve sold stocks and stock funds out of fear because the stock market went south and put this money into bond funds for greater safety. The end result was predictable using hindsight, because this has happened before.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Use Your 401k