What Is Unclaimed Money

Unclaimed money is money that oftentimes has simply been forgotten about, in one way or another, and tends to wind up being held at a state agency until it is rightfully claimed. Accounts may be considered unclaimed or abandoned in as short as a year called the dormancy period if theyve been unused or the institution has been unable to contact the account owner.

After the dormancy period and efforts to find the rightful owner have been made, the institution can declare it unclaimed and send the money to state agencies in charge of unclaimed money. As part of this process, the institution has to include any identifying information it has.

Financial accounts can often be forgotten about, especially during the inheritance process. If all a decedents accounts are not listed during the process of estate planning, it can be very easy for an heir to overlook an account. The account may then sit dormant for years, if not decades, accumulating interest, dividends or capital gains.

Many types of unclaimed accounts exist, including:

- Retirement accounts, such as 401, 403 and IRAs.

- Insurance accounts or annuities.

- Forgotten savings bonds.

- Accounts from bank or credit union failures.

Unclaimed money can also take other forms, so if you know theres money out there with your name on it , youll need to contact the right agency.

Search For Money From A Former Employer

You have at least a couple ways to track down money from a former employer:

- If you think youre owed back wages, you can turn to the Department of Labors database and see if its holding your cash. The department holds unpaid wages for up to three years.

- If youre searching for unclaimed pensions because a company went out of business or ended a defined benefit plan, you can turn to the Pension Benefit Guaranty Corp.s website. More than 80,000 people have earned a pension but havent claimed it, the organization says.

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Don’t Miss: What Happens To 401k When You Leave Your Job

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

Read Also: Can You Rollover A 401k Into A Traditional Ira

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

How To Check 401 Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

You May Like: Does Maximum 401k Include Employer Match

Using Life Insurance For Sustainable Wealth

Many people like to fund whole life insurance during their career instead of maxing out 401 contributions. High cash values in life insurance can be valuable when opportunities arise where 401 funds are off-limit.

For example, my brothers run a metal fabrication business and recently had an opportunity to buy a machine shop for only $50,000 on a special liquidation deal. This equipment would have run close to $250,000 if they had to buy it piecemeal at used prices.

They were able to get a policy loan against their whole life insurance policies and take advantage of this deal quickly.

Some people like to fund whole life insurance with money from a 401, so they have a permanent death benefit and accessible cash values going into their golden years.

If they need more money during retirement 10-15+ years later, they can withdraw more than they paid for the policy or roll a policy to an annuity to create guaranteed passive income for the rest of their life. A high percentage of this income is usually tax-free.

Owning life insurance can also help with estate planning needs or as a volatility buffer where a policy owner can take a loan or withdrawal to cover lifestyle expenses in times when volatile market investments are down. This can allow time for the market to recover instead of further drawing down assets in an invested account.

How And Why To Check On Your 401

If youre like many Americans, you may feel some unease when there is volatility in the markets. No matter what happens, try not to cash out your retirement savings, a move that could trigger taxes and reduce your retirement security in the long run. Be patient, and let your money keep growing through the markets ups and inevitable downs. But, do pay attention to the investment choices you make within these plans and their diversification.

Now could be the perfect time to give yourself a retirement plan checkup, perhaps with the help of a CFP® professional or your accountant. Just like your car, your retirement plan needs regular maintenance to make sure it will get you where youre going. A retirement plan tune up can feel like a chore. But you may get a pleasant surprise as you open the statements and check your online balances.

Here are five steps to a retirement plan tune up.

1. Remember all your different retirement accounts. Many people have multiple IRAs and 401s from different employers. Make a list. If you have old 401s at previous employers and havent accessed the accounts or collected the paper statements, now would be a great time to reach out either to the employer or the financial institution that held the account to get copies of statements. You might also have to reset passwords to gain access to online accounts.Consider rolling over your old 401s into your current one, or into IRAs. That will make it easier to do your financial checkup each year.

You May Like: How To Find Out Where Your 401k Is

Types Of 401 Rollovers

There are two types of rollovers: direct and indirect.

#1 Direct Rollover

When you transfer your money from one retirement account directly into another. With a direct rollover into your new employers 401 plan or into your IRA, you never touch the money, and no money is withheld for taxes.

A direct rollover is advisable.

#2Indirect Rollover

When your 401 account funds are given to you via check for deposit into a personal account, with the intention of reinvesting those funds into a new retirement account within 60 days or less.

You can make a rollover at any age, but there are specific rules that must be followed.

Most importantly, you must generally complete the rollover within 60 days of the date the funds are paid from the distributing plan.

If properly completed, indirect rollovers arent subject to income tax.

If you fail to complete the rollover or miss the 60-day deadline, all or part of your distribution may be taxed and subject to a 10% early distribution penalty .

In addition, your employer must withhold 20% of the payment for income taxes. After taxes are taken out, you will be sent the funds via check.

This means that, if you want to roll over your entire distribution, youll need to come up with that extra 20% from your other funds .

Note that the IRS only allows for one indirect rollover per 12-month period.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Don’t Miss: Can A Qualified Charitable Distribution Be Made From A 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Increase Your Income If Need Be

Sometimes a lack of retirement savings is caused by mismanaged income. Its common to get caught up in everyday frivolous spending that seems harmless but causes major savings deficits over the years.

Other times there is a real lack of income that has caused a persons inability to save for retirement.

If youre managing your money well and minimizing waste but dont make enough to save what you need to save for retirement you may need to increase your income.

Luckily, there are several options for boosting your income:

- Get a part-time job

- Sell unwanted items

Then take that cash and use it to fund your 401k or other retirement accounts.

However, its important to remember that as you increase your income, you need to be sure to take that extra money and target it all toward retirement savings.

It might be tempting to use it for fun stuff like vacations and new and shiny things especially if youve been living on a tight budget for a long period of time.

Dont make that mistake. Instead, commit to funneling all extra income into your 401k or other retirement accounts, even if its only for a specified period like five years or ten years.

After that time is up, youll likely see a significant increase in your retirement savings. That increase will help ensure you wont be struggling to live in your later years.

You May Like: How Do I Cash Out My 401k Early

Why Should I Use One

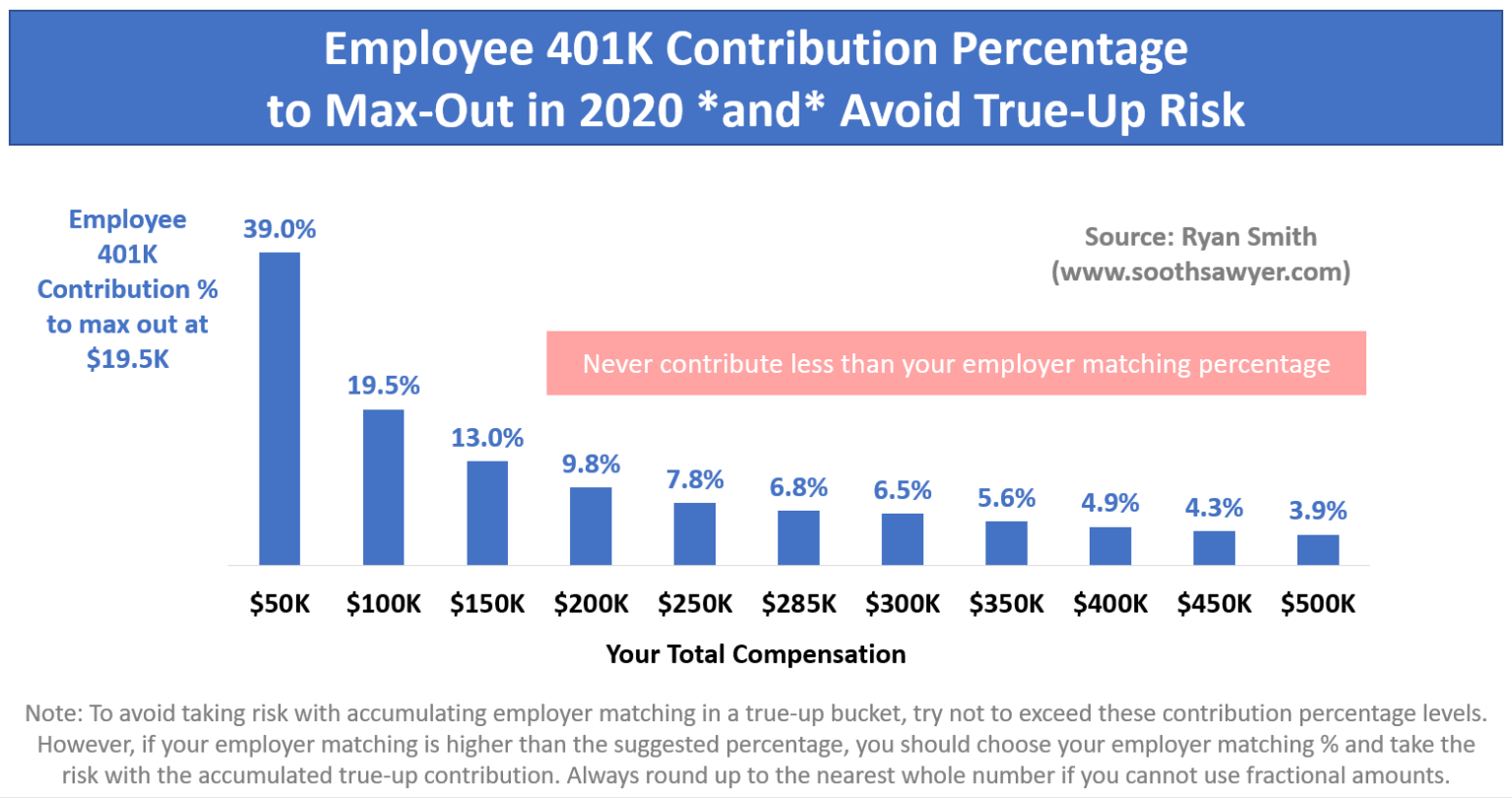

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a matching contribution, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual income. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual contribution limit is $19,500 for tax year 2021, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Read Also: Where Can I Find My 401k Balance

Find Your Retirement Accounts

In order to corral all your accounts, you first must locate all your retirement plans.

If you know you had a plan with certain employers but dont know how to access it, reach out to your former company. They should provide you with the information you need to access the account.

What happens if the company is no longer in business? Well, your retirement account should still be held somewhere. Its your money, after all. You can go to the Abandoned Plan database Opens in new window, hosted by the Department of Labor. There you can search the company, and you will be provided with information on how to locate the lost plan.

You can also search the National Registry of Unclaimed Retirement Benefits Opens in new window to find plans under your name.

Once you find one account, you can potentially spot a few more, as theres a possibility you have multiple plans hosted by the same company. The other accounts should come up as you log into the management companys website.

Roll It Over Into Your New Employer’s Plan

You’ll have to double check with your new employer to make sure they accept rollovers from a previous job. But if you get the go ahead to do this, you’d be able to just manage one 401 account rather than two different accounts potentially from two different plan providers .

“Some people find that having just one 401 account makes it easier to see all their money in one place,” MacDonald explained.

The money will still have the chance to grow in your new employer’s plan just make sure you like the new investment options available to you. And you’ll be able to save on all the additional costs that come with just keeping your balance with your old employer.

And unlike with the IRA rollover option, you won’t have to take required minimum distributions at age 72 if you move the money into your new employer’s 401 plan.

“Ultimately, it comes down to convenience,” MacDonald said. “And if you like seeing all of your assets in one place then this option could make sense.”

Recommended Reading: Can I Transfer My Ira To My 401k

Check Every Corner Of Your 401

Once you gain access to your account online or review your statement, check how your money is invested.

Most 401 administrators automatically invest your money into a target-date fund. Target date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date. Using your age, the percentage mix of these investments changes to match your risk tolerance as you near retirement.

If you don’t want to hold your money in a target-date fund, you have the option to change investments.

However, if your plan hasn’t automatically allocated your money, it may be waiting to be invested. In this case, your money will be sitting in your account, not growing in a glorified savings account.

Itâs a rare occurrence, but checking your 401 balance will help catch any funds not adequately invested.