Traditional 401 Vs Roth 401

There are two types of 401 plans: Traditional and Roth 401s.

The traditional 401, named after the relevant section of the IRS code, has been around since 1978.

With this plan, any contributions you make to the 401 account will reduce your income taxes for that year and will be taxed when they are withdrawn.

Roth 401s, named after former senator William Roth of Delaware, were introduced in 2006.

Unlike a traditional 401, all contributions are made with after-tax dollars and the funds in the Roth 401 account accrue tax free.

Typically, employees can take advantage of both plans at the same time, which is recommended among financial advisors to maximize retirement savings.

Because of the way the contribution limits work, it is possible to invest different amounts into each account, even year-to-year, so long as the total contribution does not exceed the set limit.

How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

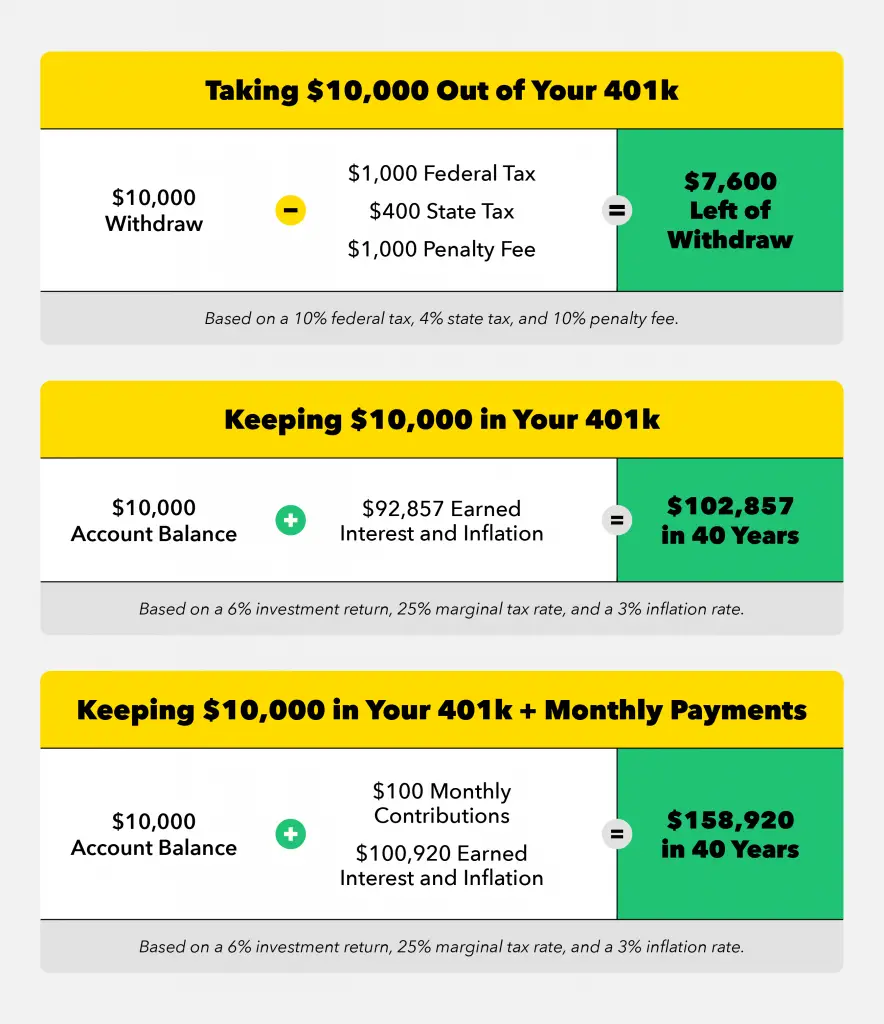

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Should I Pay Someone To Manage My 401k

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

What Is Unclaimed Money

Unclaimed money is money that oftentimes has simply been forgotten about, in one way or another, and tends to wind up being held at a state agency until it is rightfully claimed. Accounts may be considered unclaimed or abandoned in as short as a year called the dormancy period if theyve been unused or the institution has been unable to contact the account owner.

After the dormancy period and efforts to find the rightful owner have been made, the institution can declare it unclaimed and send the money to state agencies in charge of unclaimed money. As part of this process, the institution has to include any identifying information it has.

Financial accounts can often be forgotten about, especially during the inheritance process. If all a decedents accounts are not listed during the process of estate planning, it can be very easy for an heir to overlook an account. The account may then sit dormant for years, if not decades, accumulating interest, dividends or capital gains.

Many types of unclaimed accounts exist, including:

- Retirement accounts, such as 401, 403 and IRAs.

- Insurance accounts or annuities.

- Forgotten savings bonds.

- Accounts from bank or credit union failures.

Unclaimed money can also take other forms, so if you know theres money out there with your name on it , youll need to contact the right agency.

Recommended Reading: How To Invest My 401k Money

Next Steps For Your Money

If your old 401 plan is still with a former employer, one option is to leave the money there. But you may not pay as much attention to the account, which could lead to a portfolio thats not appropriate for your age and risk tolerance.

If youre still working and have a 401 at your new job, another option is to roll over the funds into your existing plan, assuming your employer allows it. Another option is to roll the money into an IRA. Having your savings in one place will make it easier to manage your investments.

If youve lost track of a pension, request a pension benefits statement from the plan administrator. Give the administrator your address and phone number so it can reach you to begin payments. You may need to prove your work history and eligibility for the pension you can do so by providing the plan administrator with old W-2 forms or an earnings statement from Social Security, which you can get by filing Form SSA-7050. You can get this form at www.socialsecurity.gov/online/ssa-7050.pdf or by calling Social Security at 800-772-1213.

Contact Your Former Employer

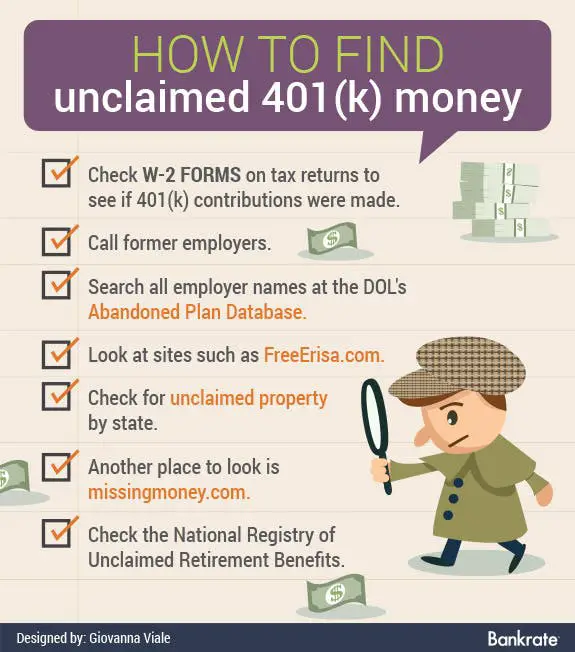

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Read Also: How Does Taking Money Out Of 401k Work

Rollover 401 To An Ira

The second option is to roll your employer 401 into an Individual Retirement Account . A new IRA can be opened at your choice of financial institutions like M1 Finance, or put into an existing IRA you already have.

Keep in mind that there are different tax advantages for different types of IRAs. For example, you may want to consider moving your 401 into a traditional IRA when you quit in order to continue deferring taxes. If you want to learn more about IRAs, check out Roth vs. Traditional IRA | How to Choose.

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Recommended Reading: How To Diversify 401k Portfolio

When Do I Become Vested

The vested portion of your 401 is the part that is yours to keep, even if you leave your job. Any money that you contribute is always 100% vested. The contributions made by your company, however, will be subject to a vesting requirement. There are two types of vesting schedules: graded and cliff.

With graded vesting, funds vest over time. You may, for example, be 25% vested after your first year, 50% vested the next year, and so forth until you are fully vested. With cliff vesting, the employer contribution is 0% vested until you have been on the job for a specified amount of time , at which point it becomes 100% vested. Either way, once you become fully vested, all the money in the plan is yours, and you can take it with you when you change jobs or retire.

IRS rules now permit hardship withdrawals from a 401 to include not just your contributions but also your company’s match and earnings on these amounts. Check with your human resources department to determine your employer’s policy.

Plans Encourage Better 401 Participation

Employers sometimes require 401 contribution levels to be a certain percentage of taxable income, and 401s donât count 401 plans as taxable income.

401 participants who are required to contribute a certain percentage of their accounts often donât have working plans, and plans can help employers increase the participation rates.

Also Check: How To Take Money Out Of 401k Without Penalty

Revisit Your Beneficiaries Periodically

Whenever you have a change of life, such as getting married, having children, or separating from a spouse, revisit your 401. You may have named beneficiaries who would be eligible to receive your funds at maturity if youre no longer around. Its essential that you stay on top of your beneficiaries because you could get in trouble otherwise.

Consider a scenario where you get a divorce from your first partner and remarry a few years later. If you dont name your new spouse as your beneficiary, your former spouse would get your 401 funds instead. Dont assume this cant happen. It occurs more often than you might think and almost always causes hardships in families.

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

Read Also: When To Withdraw From 401k

What Is A 401 Plan

A 401 plan is a type of savings account that allows employees to save on their own , and pay lower taxes because all 401 accounts are taxed before contributions.

Deductions for these plans are commonly made pre-taxed, while deposits into traditional or Roth IRAâs are deposited post-taxed. 401 plans usually make a matching contribution in addition to whatever the employee contributes.

Track Down Previous Employer Via The Department Of Labor

If you cant find an old statement, you may still be able to track down contact information for the plan administrator via the plans tax return. Many plans are required to file an annual tax return, Form 5500, with the Internal Revenue Service and the Department of Labor . You can search for these 5500s by the name of your former employer at www.efast.dol.gov. If you can find a Form 5500 for an old plan, it should have contact information on it.

Once you locate contact information for the plan administrator, call them to check on your account. Again, youll need to have your personal information available.

Don’t Miss: How Much You Should Contribute To 401k

Know The Fees Youre Paying For The 401

Chances are good that youre going to pay fees for your 401. Its best to know the fee arrangement upfront. Ask your employer to provide you with all the fee information. Then, stay on top of your statements.

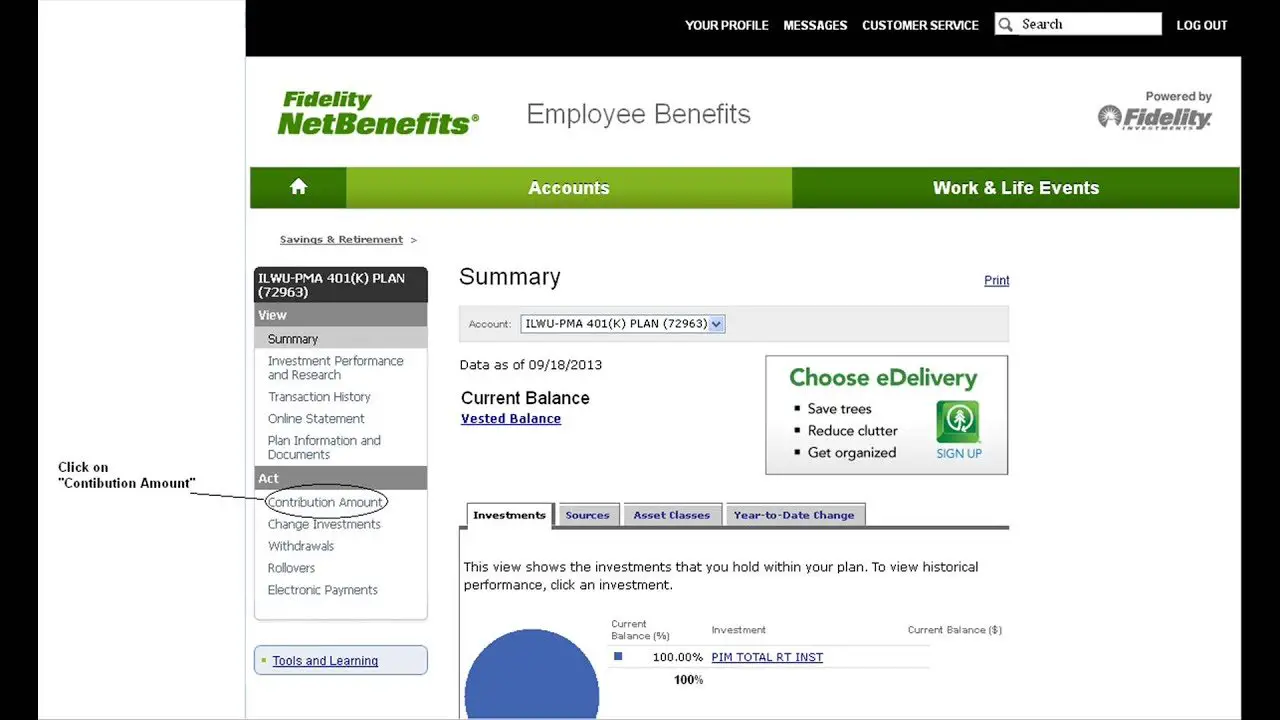

Many 401 providers now offer you the ability to check on your 401 health in real time online. Be sure to log onto the portal regularly so youre not surprised by anything. Notice a fee you werent expecting? Ask your company or the 401 partner your company uses. It never hurts to ask questions. The more you know about your 401 and the fees youre paying, the better youll be.

What Happens To My Money If I Leave The Company

Some employers let you keep your money in your 401 plan after you leave. Others, however, require you to take your funds with you. You may be able to roll your money to an individual retirement account or into a new employers sponsored plan. Or you could cash out via a distribution, though penalties may apply. Knowing the rules helps you avoid surprises and develop the best plan. Each choice may offer different investment options and services, fees, expenses and rules. These are complex choices, so take time to compare options.

Recommended Reading: How To Recover 401k From Old Job

Change Your Ratio Of Stocks Vs Bonds

Its not wise to change up your 401 too much, but from time to time, review your allocation of stocks versus bonds and make adjustments as needed. Remember that stocks are more volatile than bonds. Yes, their reward can be heftier but so can their risk.

Whats the best ratio to shoot for? One way of deciding upon stocks versus bonds is to subtract your age from 100, 110, and 120. Lets say youre 30. Your results would be 70, 80, and 90. In other words, you could probably get by with 70% to 90% stocks and, correspondingly, 10% to 30% bonds. As you celebrate birthdays, you may want to bring up your bonds and take away some stocks to give your portfolio a more appropriate, conservative balance.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

You May Like: How To Direct Transfer 401k To 403b

Which Investment Option Has The Lowest Expense Ratio

Many investments, including mutual funds and exchange-traded funds , charge shareholders an expense ratio to cover the funds total annual operating expenses. Expressed as a percentage of a funds average net assets, the expense ratio includes administrative, compliance, distribution, management, marketing, shareholder services, and record-keeping fees, as well as other operational costs.

The expense ratio directly reduces shareholder returns, thus lowering the value of your investment. Don’t assume an investment with the highest return is automatically the best choice. A lower-returning investment with a smaller expense ratio might make you more money in the long run.

Note that the least expensive or lowest-fee option may not always be the best option for your investment portfolio. Be sure to conduct thorough research in addition to looking solely at cost.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

You May Like: How To Transfer 401k To Another 401 K