How 72 Works Step

No lie, its a tad on the confusing side. Well use an example first:

How To Get Started Investing

The international bestseller by CERTIFIED FINANCIAL PLANNER Scott Alan Turner. Choose the right accounts & investments so your money grows for you automatically. No jargon, confusion, or pie in the sky promises. Just a proven plan that works.

The amount of the SEPP is based on:

- your age

- the age of your beneficiary

- account balance

- the expected rate of return

- how long you expect to live, based on the IRS mortality tables. Note there are three ways to determine life expectancy. Ive included one here for reference.

- which IRS-approved method is used to calculate the SEPP

What Are The Pros And Cons Of Withdrawal Vs A 401 Loan

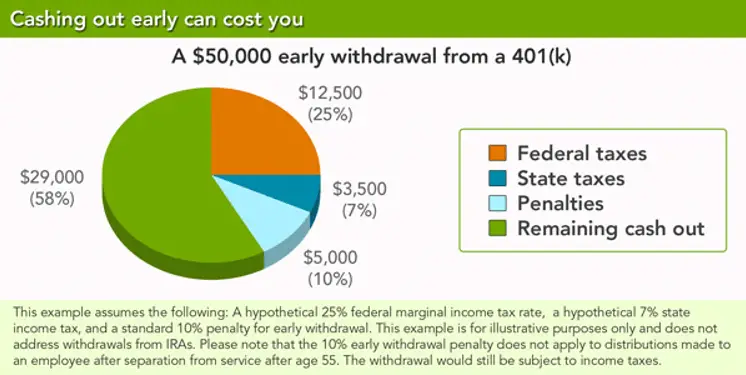

A withdrawal is permanent. While you won’t have to pay the money back, you will have to pay the taxes right away and possibly a penalty. Additionally, by pulling out money early, you’ll miss out on the long-term growth that a larger sum of money in your 401 would have yielded. A loan has to be paid back, but on the upside, if it is paid back in a timely manner, you at least won’t lose out on long-term growth.

Is It A Good Idea To Use The Rule Of 55

Just because you can take distributions from your 401 or 403 early doesn’t mean you should. Depending on your financial situation, it might be better to let your money continue to grow. Holding off withdrawals could help you better position yourself for a financially sound future. If you’re tempted to withdraw retirement funds before you’re eligible, instead consider finding another job, drawing from your savings or using other sources of income until you need to tap into your retirement savings.

If you decide to begin withdrawing funds from your 401 early, the long-term value of your portfolio will likely decrease. It’s essential that you time your withdrawals carefully and take into account how much they would cost you in taxes. To create a strategy that makes sense in your situation, consider working with a financial advisor or a retirement planner.

Recommended Reading: Should I Rollover My 401k When I Retire

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal aren’t interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isn’t required.

- There’s no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isn’t taxed initially, and there’s no penalty. If you can’t pay it back within the specified time frame, the outstanding balance is taxed and you’ll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

Important Things To Know About Sepp

Like with the Rule of 55, if you dont plan properly and start pulling money out of your retirement plan early you could go broke.

Taking substantially equal periodic payments comes with another big warning:

Once you begin taking distributions, you MUST continue taking distributions until age 59 1/2 OR five years, whichever is longer.

For example, if you start taking payments at age 50, you must take them until age 59 1/2 .

If you start taking payments at age 57, you have to take them until age 62 .

If you start taking distributions and modify or stop taking payments, youll get hit with a retroactive 10% penalty for every year from when you started taking distributions.

Example: Joe is age 50. He decides to start taking SEPP from his 401 of $20,000/year. At age 53 the markets begin a three-year decline At age 56 Joe decides he cant stomach the losses anymore and he needs to stop taking distributions and go back to work or else hes going to run out of money later on. Joe will pay a 10% penalty on $20,000 $2,000 for every one of the six years he took distributions: $2,000 X 6 years = $12,000 tax penalty.

So you see, once you start taking distributions, its a very bad idea to stop. Which is why you need to do your homework and work with a professional whos done 72 work for clients to get the plan right.

Note: The five-year rule is waived upon death or disability.

Don’t Miss: How To Transfer 401k From Old Job

Youve Experienced A Hardship

Penalty-free withdrawals are allowed for certain hardships, such as:

- Medical debt that exceeds 7.5% of your Adjusted Gross Income .

- Suffering a permanent disability.

- Court-ordered withdrawal to pay a former spouse or dependent.

- Being called to active duty military service.

Some 401 plans allow savers early access to funds to buy a primary residence, pay for educational expenses, cover funeral costs, make necessary home repairs, or prevent foreclosure but a penalty must be paid. Each plan is different, so its important to ask before taking the money out.

Once you take a hardship withdrawal, youre generally barred from contributing to the 401 for at least six months. You will also be limited to the principal funds youve contributed, and you will still have to pay taxes on traditional 401 funds.

Other Ways To Avoid The Early Withdrawal Penalty

You can also receive penalty-free early distributions under certain other circumstances such as if:

- You become disabled.

- You’re ordered to pay some of your 401 funds to another person .

- You accept a series of substantially equal payments for at least five years, or until you turn age 59 1/2.

- You leave your job in the calendar year that you turn age 55.

Another way to avoid the early withdrawal penalty is to consider a 401 loan instead. If your plan offers them, 401 loans are easy to obtain and enable you to borrow from your own 401 account and pay yourself back with interest. Provided that you repay a 401 loan on schedule, you can avoid the consequences of an early 401 withdrawal.

Also Check: Can I Rollover 401k To Ira While Still Employed

Can I Take Money Out Of My 401k At Age 60 Without Penalty

in your 401 plan60canfrom withdrawingmoneynottaking money out

. Correspondingly, can I cash out my 401k at age 62?

The IRS allows penalty-free withdrawals from retirement accounts after age 59 1/2 and requires withdrawals after age 70 1/2 . Given these consequences, withdrawing from a 401k or IRA early is not ideal.

Beside above, what is the earliest age you can withdraw from a 401k without penalty? The age 59½ distribution rule says any 401k participant may begin to withdraw money from his or her plan after reaching the age of 59½ without having to pay a 10 percent early withdrawal penalty.

Similarly one may ask, how do I withdraw money from my 401k after 59 1 2?

There’s no limit for the number of withdrawals you can make. After you become 59 ½ years old, you can take your money out without needing to pay an early withdrawal penalty. You can choose a traditional or a Roth 401 plan.

How can I avoid paying taxes on my 401k withdrawal?

Avoid penalties and minimize taxes as you pull money out of your retirement accounts.

How 401 Hardship Withdrawals Work

A hardship withdrawal is an emergency removal of funds from a retirement plan, sought in response to what the IRS terms “an immediate and heavy financial need.” It’s actually up to the individual plan administrator whether to allow such withdrawals or not. Manythough not allmajor employers do this, provided that employees meet specific guidelines and present evidence of the hardship to them.

According to IRS rules, a hardship withdrawal lets you pull money out of the account without paying the usual 10% early withdrawal penalty charged to individuals under age 59½. The table below summarizes when you owe a penalty and when you do not:

A 401 hardship withdrawal isn’t the same as a 401 loan, mind you. There are a number of differences, the most notable one being that hardship withdrawals usually do not allow money to be paid back into the account. You will be able to keep contributing new funds to the account, however.

Recommended Reading: Can You Convert A Roth 401k To A Roth Ira

What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% fee by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the fee is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

What You Need To Know To Avoid Costly Mistakes

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

You May Like: Should I Open A 401k

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Recommended Reading: Can You Have A Solo 401k And An Employer 401k

Youre Rolling Over Funds

If you leave, quit, or get fired from the company at age 55 or older, you can cash out that account in a lump sum withdrawal without incurring a penalty.

If youre under 55 years of age , you have up to 60 days to rollover your funds to a new 401 or IRA without triggering a taxable event. The best way to accomplish the rollover is to transfer the money directly from the old custodian to the new custodian to avoid having 20% automatically withheld for income tax.

If you fail to put the entire amount into a new retirement account within two months, it will be considered a distribution that is not only taxed but penalized if youre under 59 ½.

Consider The Costs Of Taking Retirement Money

Giving Americans the ability to take $100,000 in penalty-free withdrawals is probably rooted in the right place, says Timothy Ellis Jr., a certified financial planner with Memphis-based Waddell & Associates.

But those withdrawals could have a long-term negative impact on retirement plans and needs moving forward, Ellis says.

Especially because the worst time to withdraw investment assets is in the middle of a dramatic market downturn. Because the investments are worth less, consumers may have to withdraw a larger percentage of the account, Ellis says.

Then there’s the opportunity cost to raiding your retirement savings early. “Accessing retirement plan accounts, especially for younger workers, can put a permanent dent in plan balances,” Ellis says. In fact, for an investor who makes steady retirement contributions over their career, the amounts saved during the first 10 years may end up accounting for half of their retirement account balance at age 65.

That’s because compounding is one of the most powerful tools to boost retirement savings, and making a withdrawal, especially during the early stages of investing, reduces that ability, Ellis adds. Even a smaller withdrawal adds up in the long run. A $5,000 balance today could be worth $57,900 in 35 years, assuming a 7% annual rate of return.

Recommended Reading: Can Business Owners Have A 401k

What Happens To My 401k If I Quit My Job

Since your 401 is tied to your employer, when you quit your job, you wont be able to contribute to it anymore. But the money already in the account is still yours, and it can usually just stay put in that account for as long as you want with a couple of exceptions.

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Also Check: How To Make 401k Grow Faster

Maturity Option #: Make A Lump Sum Rrsp Withdrawal

You can choose to withdraw all the funds in your RRSP as a lump sum, but the withdrawn amount will be subject to withholding tax. The withholding tax gets taken out of your withdrawal immediately and paid to the government.

Additionally, this amount must be added to your income when filing your taxes.

Which Is Right For You

For many, 401 loans are a better option than early withdrawals. After all, as long as you pay the money back during the required time period, you won’t have to pay taxes on the amount withdrawn. Plus, the interest you’ll pay is added to your own retirement account balance.

However, there are several reasons to think twice before taking out a 401 loan.

For example, if you left your job in December of 2021 and had a $2,000 outstanding balance on your loan, you would have until to repay $2,000 in full.

- If you’re not able to repay the loan, your employer will treat the unpaid balance as a distribution.

- Typically, it will be considered taxable income and subject to the 10% early withdrawal penalty.

Ideally, you want to leave your 401 alone until retirement. However, if you find yourself in a really tough spot, borrowing from your 401 might be a better option than simply cashing out your balance. Just make sure you understand the potential consequences and do what you can to repay the balance quickly so you can start rebuilding your retirement nest egg.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. Whether you have a simple or complex tax situation, we’ve got you covered. Feel confident doing your own taxes.

Don’t Miss: How Much To Invest In 401k To Be A Millionaire