How Much Money Can You Put In A Starbucks Account

Anything over 4% is not matched by Starbucks. So if you contribute 10% $50 per paycheck, Starbucks will only match the first 4%, which is $20. After youve set your contribution amount youll need to decide where to put your money.

I don’t know how difficult this would be with you/another employer but my with my last employer I was able to set up a portion of my paycheck to go into an online account. CapitalOne360. I did nothing with that account, I actually forgot about it, that was the only way I was able to save an okay amount of money.

User account menu. 4. Starbucks 401k. Retirement. Close. 4. Posted by 4 years ago. Archived. Starbucks 401k. Retirement. How do you guys suggest a Starbucks barista set up their 401k? I make about $15,200 a year pre tax and I live in California, Starbucks matches up to 5%. How much of my income should I put into my 401k vs Roth? What is Roth?

Starbucks Corporation 401 Plan. This section shows the list of assets in the plan these are the investment options available in this plan. This list was developed based on user input. The display of the asset list was organized based on asset category.

Starbucks succeeds when our partners do, and we believe that success is best when shared. Our world-class benefits and programs for eligible part- and full-time partners are tailored to your needs. Your Total Rewards package includes base pay and bonus, benefits, retirement savings, stock and perks.

How Much To Save

Here is the simple rule. You want to save at least enough to get the maximum amount of matching money from your company that you can. So if your company offers a 100% match up to 4% of your salary, you need to save at least 4%. If your company offers a 50% match up to 6%, you need to save at least 6% of your salary. This is as close as it gets to free money, and you want to take advantage of any money that your company is willing to give you.

If you are behind on your retirement savings, you might need to save more than the maximum amount your company will match. You should consult a financial advisor if you are unsure where you stand. They will be able to conduct a financial analysis predicting the future growth of your savings and compare it to the amount of time you have left before retirement, and how much you will need to survive on while you are retired. Many financial experts recommend that people save a minimum of 10% of their pay into their retirement accounts. This may seem high, but when you do the math you will probably realize that you need it.

Starbucks Employee Benefit: Retirement Plan

It can take up to a week to withdraw from a 401 . Moving money from a 401 to a bank account is simple enough, given you’re over the penalty-free minimum withdrawal age of 59 ½ years old. However, just how long it takes for the money to actually reach you varies.

Orders tend to be bigger, Frappuccino’s, refreshers, beverages that take more time to prepare. I like to avoid being on the bar position alone at that time of day. To finish, the closing shift, or anything after 5 is way more relaxed, the main focus is to clean everything, stock up, and get ready for the next day.

You can put aside $5,500 per year , and when you take distributions in retirement, they’re completely tax-free. Motley Fool Returns Stock Advisor S& P 500

Starbucks Coffee Company, as we know it today, began in 1987, when Howard Schultz, the current chairman and CEO, acquired the assets from the original founders, whom he had worked with from 1982 to 1985. In 1987, Starbucks had 11 stores. The original business plan, and promise to the investors, was to have 125 stores within five years.

That is a really great point and one I think I would have to dedicate a whole post to. But my quick opinion on this would be, I think it might be best to set up some traditional retirement accounts like 401ks for money that will be used after 60. All while having a significant amount in taxable accounts.

Read Also: Is There A Maximum You Can Contribute To A 401k

Create Plan Documents And Disclosures

After you select a provider, youll receive a package of documents referred to as an employer kit or employer application to set up your plan. You can expect the package to contain several documents and disclosures, and most of the forms are self-explanatory.

Documents that need to be completed for your provider include:

- Client agreement

- QRP basic plan document

- Adoption agreement

Youll need to make initial elections on your investment choices during this phase of the process, but they can be changed at any point in the future. Go through the disclosures to make sure you understand how the plan works and what you need to do to remain compliant, and then sign the appropriate paperwork.

From a regulatory perspective, a Solo 401 is like a traditional 401, but with only one participant. Even though you dont have employees who can participate in your Solo 401, your plan administrator will need to provide disclosures that contain information on the plan and the benefits of tax-free savings.

In addition to requesting information on you and your business, this paperwork may include items that would go on IRS Form 5500 if you have over $250,000 in your account or have additional plan participants. Should you later convert your Solo 401 to a traditional 401 with more participants, you or your plan administrator will need to give each eligible employee the same set of disclosures in an enrollment package.

The primary disclosures for a Solo 401 plan include:

Consult With Our Experts

At Employee Fiduciary, we dont sell cookie-cutter 401 plans. Instead, we start every plan setup with a consultation where our experts will…

- Walk you through the plan design process step-by-step

- Help you decide if a Safe Harbor 401 is right for you

- Discuss plan features that can save you money, minimize admin work, and help you pass annual compliance tests

- Design an optional employer contribution scheme, including non-elective, matching, or profit-sharing contributions

Read Also: How To Get Your 401k Without Penalty

Should I Contribute To A 401 If Im A Foreign National

If you are a foreign national investing in a 401 depends on your individual situation. You are still eligible to receive the lucrative tax benefits of 401 as US resident. Most financial planners think the pros outweigh the cons, but if you are certain you will leave the US in short amount of time it may not be the best investment option.

What If I Don’t Have Access To A 401

If you don’t work for a company that offers a 401, you can save for retirement using one or more of these other accounts:

- 403: A 403 is similar to a 401, but it’s available only to public school employees, select ministers, and employees of tax-exempt organizations.

- SIMPLE IRA: A SIMPLE IRA is designed for self-employed individuals and small business owners. It offers fairly high contribution limits and has mandatory contribution requirements for employers.

- : A SEP IRA is available to self-employed individuals with or without employees. Contribution limits depend in part on annual income.

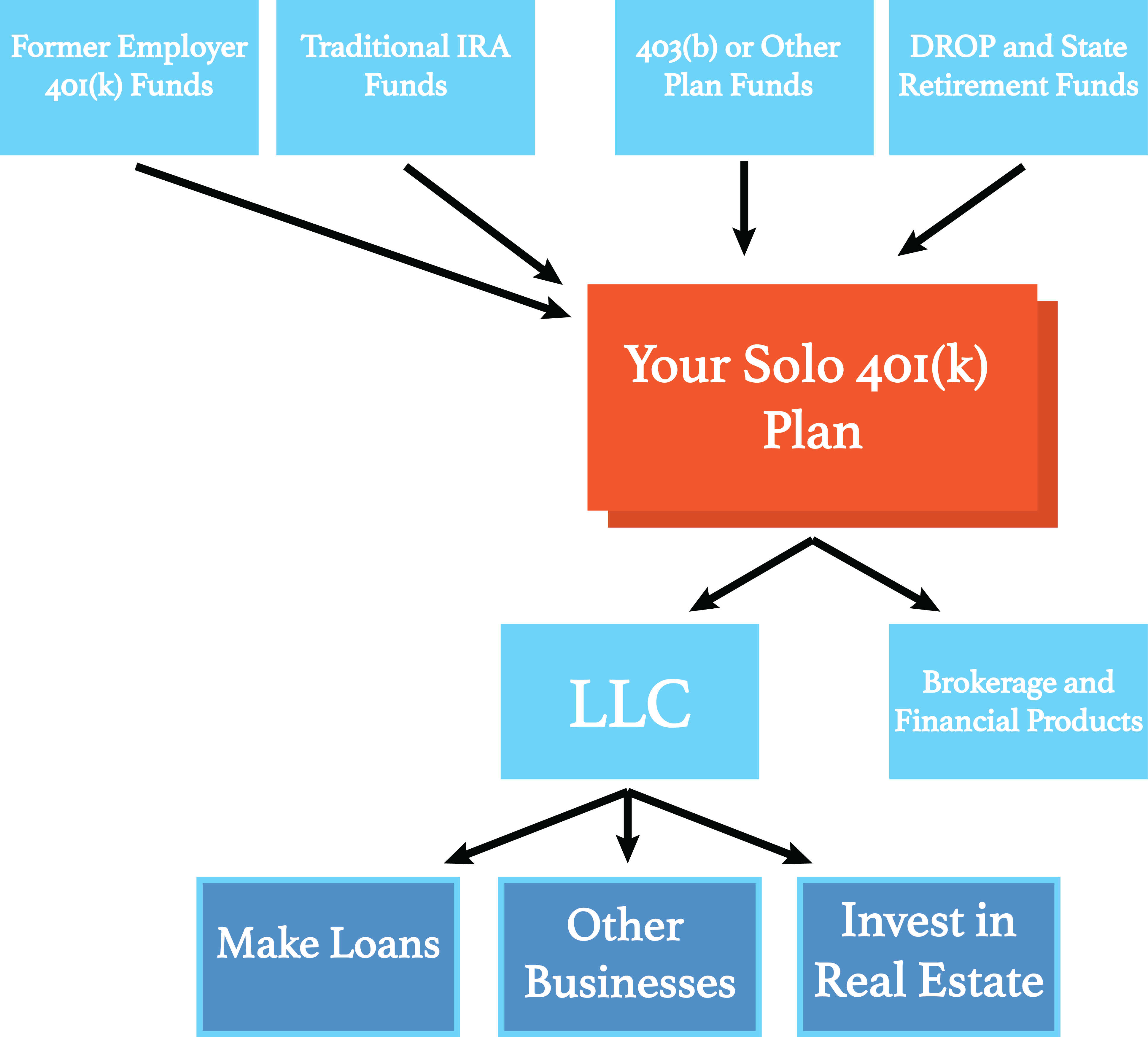

- Solo 401: A solo 401 is simply a 401 that a self-employed person can open for themselves. Contribution limits are higher than for traditional 401s because you can make contributions as both employee and employer.

- IRA: Anyone can open and contribute to an IRA if they’re earning income throughout the year, but these accounts have more restricted contribution limits.

Don’t Miss: How Do I Transfer 401k To New Employer

Supplement Your Savings Outside Of A 401

The IRS is so keen on individuals saving for retirement that its willing to allow workers to save in multiple types of tax-favored accounts at once. Combining the powers of a 401 and an IRA can really supersize an individuals tax savings and future financial freedom.

The ability to contribute to a Roth or traditional IRA is not just beneficial for workers stuck with a subpar 401. IRAs offer a lot more flexibility and control for all investors in terms of investment choices , access to portfolio building and investment management tools, and control over account fees.

Starbucks Corporation 401 Plan Funds

*Health/dental, health flex card and 401K are taken out of paycheck b efore take home pay *Savings is set-up just like any other bill/expense in your budget *Set-up bills through your bank to disburse a day or two before d ue dates to ensure your payments are never late *Funds have to be in your account ahead of due dates

Practice the 80/20 rule. Put 80 percent of your income towards living expenses and any other spending needs, Kylen says. As for the remaining 20 percent, That goes right into retirement savings.. And yup, she said 20 percent. Kylen cites the example of a 20-year-old grad making $30,000, saving 20 percent annually to yield $6,000 a year.

Required Cookies & Technologies. Some of the technologies we use are necessary for critical functions like security and site integrity, account authentication, security and privacy preferences, internal site usage and maintenance data, and to make the site work correctly for browsing and transactions.

All of the money in the account belongs to the child, but the assets are managed by the custodian until the child reaches the age of majority, which is either 18 or 21 depending on the state. The first step, then, to helping your child fund a Child IRA is to set one up.

Read Also: How To Use Your 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Allocating Your Own Investments

If for some reason you do not want to use this broker, or he/she is unwilling or unable to provide good help, here is a basic guide on how to set up your allocations, with a couple of options.

Buy a Target Date Fund

Perhaps the easiest, and if you are overwhelmed by all of this then the smartest option is to buy a target-date fund. Pretty much every 401 plan offers them these days, and they are easy to use. All you do is choose the date that corresponds with your most likely retirement date. This is the only fund you buy, and as you get close to retirement the fund will automatically rebalance to become more conservative. You want your investments to be more conservative when you are closer to retirement because you dont have time to hold through a market crash.

If you are going to be 70 in the year 2035, or close to it, allocate 100% to the 2035 target-date fund, and let the fund managers do the rest. You wont need to think about any logistics along the way. Target date funds have become an excellent option for the average investors retirement portfolio.

Build an Intermediate Risk Portfolio

Within this 30/70 portfolio, we suggest that you do some research into the various funds. Try to split up the money between at least 3 stock funds and at least 2 bond funds. Dont be afraid to split the money between 8 or 10 funds if you are comfortable doing this, but it is not necessary.

Types of Stock Funds

Don’t Miss: How Do I Invest In My 401k

The 2021 Solo 401k Establishment/ Adoption Deadline Is Fast Approaching

The deadline to setup a solo 401k plan for 2021 is fast approaching. The good news is that as long as the solo 401k establishment documents is signed by 12/31/2021 business owners will be able to fund both the employee and employer contributions for tax year 2020 in 2022 by their business tax return due date including the business tax return extension.

Why You Need To Enroll

You need to enroll for three very important reasons. The first is that you need the money for retirement, the second is that you are incentivized to do it through the tax code, and the third and most important reason is that if your company offers a match, you have the opportunity to give yourself free money!

Most companies offer what is called a match, meaning that they will add matching money for every dollar you put into your 401 plan up to a certain amount. Typically, a company will offer a matching scheme such as a dollar for dollar match up to 3%, or a 50% match up to 5%. Companies do have the freedom and discretion to choose how, and if, they provide matching money for their employee salary deferral. Whatever they provide, you need to take advantage of this very powerful feature to give yourself free money. Its like giving yourself a raise.

Keep in mind that whatever money you defer from your salary, it will come out of your paycheck tax-free. So if your money is taxed at 30% and you put in $1, it actually only reduces your net pay by $ .70. You may not really notice much of a difference in your actual check, despite the fact that you are putting away a significant amount of money. The money is taxed when it is withdrawn from the account.

As we said before, beware! If you need to take money out of your 401 before age 59.5, you will be subject to a 10% tax penalty, on top of any federal tax you already owe. Each state also has individual tax rates for withdrawals.

Also Check: When Leaving A Company What To Do With 401k

Open An Account With Your Provider

Now that youve chosen your provider and obtained all required documents and disclosures, its time to open the Solo 401. This account should be formed any time prior to your tax-filing deadline and needs to be formed in accordance with any guidelines in your plan documents.

While youre allowed to set up a Solo 401 account after the year ends and make prior-year contributions in a way thats similar to how you fund an IRA, its typically a best practice to set up a new account in the year that itll be effective and make your first contributions in the same year.

Other Things To Consider When Setting Up Your 401

Youll need to manage and regulate your 401 plan on an ongoing basis. To complete the setup process, youll need to:

-

Select a plan administrator, who will monitor the 401 to make sure it meets important deadlines.

-

Choose a Third Party Administrator , who will complete tax filings and process requests for loans or distributions.

-

Select a record-keeper, which will manage the plans investments, including the website you use to invest.

While this may sound like a lot to arrange, youll often not be required to complete each step separately. Some vendors offer comprehensive packages that include a plan administrator and a TPA. Some TPA companies also function as record-keepers.

Don’t Miss: How Do I Stop My 401k

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

Read Also: Can Business Owners Have A 401k

How Much Can Self Employed Contribute To 401k

How Much Can I Contribute To My Self-Employed 401 Plan? The IRS says you can contribute up to $54,000 in your tax-deferred Self-Employed 401 for 2017, a $1,000 increase from 2016. If youre at least age 50, then you can make an additional $6,000 catch-up contribution, which increases your limit to $60,000.

Solo 401. The self-employed 401 is good for sole proprietorships and partnerships and leaves room for a spouse to join. To qualify, you cant have any employees. If you hire your spouse, you can both contribute $53,000 each per year, and there is no annual paperwork until your account reaches $250,000. When youre 50 or older, you can each contribute $6,500 more per year. Contributions up to $18,000 are tax-deferred, and then you can contribute up to 25 percent of business profit-sharing. Funds are available for early withdrawals before age 59½ at a 10 percent penalty or through hardship loans.