Rollover The Money Into Your New Employers 401k Plan

If your new employer offers a 401k plan with low costs and a wide variety of investment options, this might be a viable option to consider. However, we generally recommend that people rollover their 401k plans into an IRA as they are usually lower cost and have more investment options, but more on that later.

If you are interested in rolling the money over into your new employers 401k, meet with the HR department or retirement plan custodian to find out more about your new companys plan, including whether you will be allowed to participate as soon as youre hired or will have to work for a certain number of days before youre eligible.

To accomplish this rollover, you will instruct the administrator of your former employers 401k to transfer your assets directly into your new employers plan once your account has been established. Alternatively, you can instruct the former employers 401k administrator to send you a check but you must deposit the funds into your new account within 60 days to avoid paying income taxes and a potential penalty on distribution.

What Happens To 401k When You Quit

Since your 401k was opened for you by your employer, they wont want to continue to manage your account if you quit or leave your job. And, if they’ve been contributing to your 401k, theyll take back the money they gave you if you arent fully vested in the company.

What happens to your 401k when you quit depends a lot on how much money is in it. For amounts under $5,000, your employer could ask you to move it to a different account or do an involuntary cashout, where they move your money into an IRA for you.

If there’s less than $1,000 in your 401k, your employer may just send you a check. If they do that, be sure to put it directly into another retirement account to avoid any taxes or penalties from the IRS.

For 401k accounts of $5,000 or more, there are a few options if you quit your job:

Leave the money where it is.

Roll it over into a new retirement account.

Withdraw it.

Just remember that if you choose to withdraw the money from your 401k, you may have to pay taxes on that money, along with substantial IRS penalties.

Start Making Qualified Distributions

If you meet the age requirement, you can begin making qualified distributions from your former employers 401k plan. While you wont be assessed a 10% penalty on these distributions, you will have to pay income taxes at your current ordinary income tax rate if the distributions are made from a traditional 401k.

Read Also: How Do I Get My 401k

What Happens To A 401k When You Quit

So, youve decided to quit your job. What now? Very often, employees leave their jobs without considering what to do with their retirement account. As a result, they end up leaving that account behind, in the 401 plan of the former employer. The thing to keep in mind in this situation is that you will not be able to contribute to the account anymore if you quit. The money you contributed still belongs to you, though, so you have to think about what to do with it.

Usually, plans let employees who leave their job keep the funds in their accounts as long as there is more than $5,000 saved. When there is less than $5,000 in your account, you can get a check from the plan sponsor so your account can be closed.

Other people choose to leave the money they saved behind. After all, its very easy to simply walk away and forget about the 401 plan you made with the former employer. But its not the best thing to do. Basically, when you leave the account behind, you dont monitor it anymore. Because of that, you dont know what happens with your money, and this is not good considering that its money you worked for every month. Moreover, if you leave money in various 401 plan accounts you made with different employers, the issue may become even worse.

Can Anybody Cash Out A 401 K Early

If you resign early, you might want to cash out your 401 k. However, you might face a financial penalty for doing so. If you haven’t reached retirement age, you can often expect to be charged 10% plus ordinary income tax on the amount in your 401 k for an early withdrawal. If you think you might want to take your 401 k money out of the IRA early, you should discuss this with your current employer.

Read Also: What Is An Ira Account Vs 401k

Agree To Take The Distributions

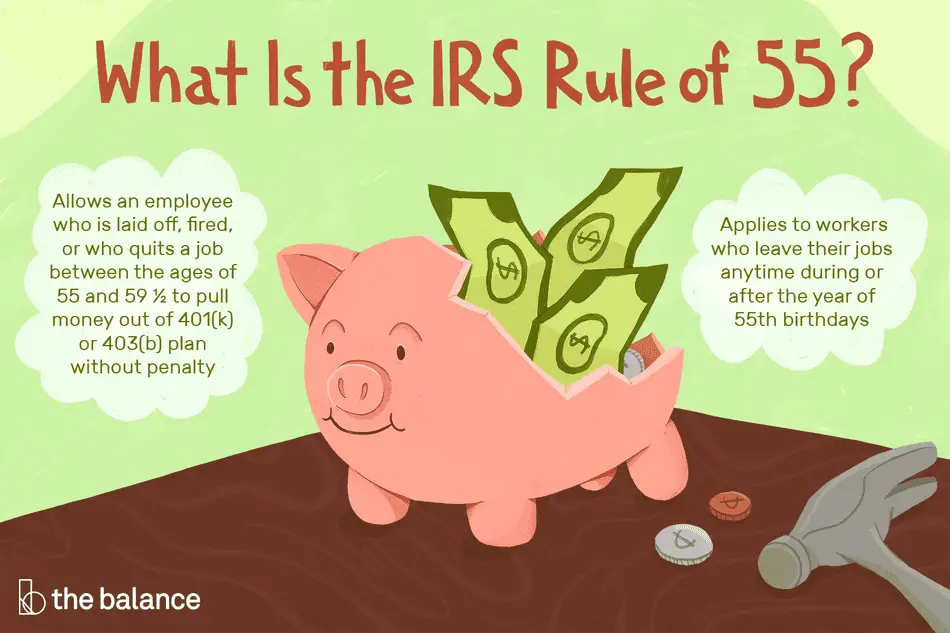

If you are retiring, you can take penalty-free distributions on your savings starting at age 59.5. If you are under age 59.5, you can still take a distribution, but you will need to pay a 10% penalty unless you meet the hardship exemption or IRS Rule of 55 criteria. If you are 72 or older, you must take minimum withdrawals. Keep in mind you will need to pay income tax on the withdrawn amount unless you set up a Roth 401 that you had for at least five years and paid taxes when you put the money in. If you fail to meet the five-year requirement, only the earnings portion of your distributions is subject to taxation.

Leave Your Money In The Plan

You may want to keep the balance in your old plan, especially if:

- you like the plans investment options,

- the plan has low fees, or

- you want to move the balance to a new employers plan later.

If your account balance is less than $5,000, your employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

Don’t Miss: Can You Pull From 401k To Buy A House

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Move The Money To A New Employers Plan

If you start a new job with an employer who offers a 401 plan, you will be able to roll over your assets to the new plan. This will give your assets the ability to continue growing tax deferred while consolidating into one plan. Most 401s have a wide range of investment options, but you will still be limited to the investment funds offered within the new plan.

You May Like: How Do I Find My Old 401k Account

You May Be Able To Leave Your Account With Your Former Employer At Least Temporarily

Changing jobs is stressful, even in the best of circumstances. If youve lost a job and are scrambling for re-employment, youre likely focused on that. But eventually you will need to figure out what to do with your 401.

If your balance is $5,000 or more, you can leave the money right where it is which will give you time to decide the best course of action for you.

What you should do right away, regardless of the 401 balance in your old plan, and as early as your first day at the new job, is to sign up for your new companys 401 plan. Even if your new employer has an automatic opt-in feature that does not kick in for one to three months and if you rely on that, rather than taking the initiative you can miss 30 to 90 days of contributions and matching funds, Bogosian advises.

After six months, youve got a handle on the job, know youre going to stay and have some experience with your new plan. Youre now in a better position to compare your last 401 plan with this new one, including the diversity of the investments and the costs.

But what happens if the balance in your old 401 is less than $5,000? Your former employer may force you out of the plan by placing your funds in an IRA in your name or cashing you out and sending you a check.

Some companies have recently adopted auto portability meaning your small balance may automatically transfer to your new employers plan. Check with your HR Department or plan sponsor to see if this applies.

What To Do With Your 401 When You Leave A Job

You’ve landed your dream job, or you’ve been laid off, and you’re ready to say goodbye to your current employer. But before you go, you have some decisions to make about your 401.

While there may be some guidance from human resources, is generally up to you to decide what you should do with your retirement savings when you change jobs. So, what happens to your 401k plan when you leave a job?

Recommended Reading: What Is Qualified Domestic Relations Order 401k

What Happens To Your 401k If You Quit And Your Balance Is Less Than $1000

If you have less than $1,000 in your 401k account, your old employer may just write you a check for that amount of money. You might not have any options if your balance is this low, but check with HR anyway.

That means that you could receive your final paycheck from the company and it will include or 401k payout amount as well. Or, you could receive two separate checks when you quit one will be your final paycheck, and the other will be your 401k payout. The latter is more likely.

If you have less than $1,000 in your 401k when you quit, its best to check with the HR department of the company that youre leaving to find out exactly how your money will be coming to you.

As a matter of fact, you should talk to your HR department about your 401k money regardless of how much is in there!

Leave Your Money With Your Former Employer

For some people, the most plausible option is to leave their investment with their former employer. This option allows you to continue making investments with the money even if you are not working with that employer. In most cases, old employers allow you to leave your investment if you have more than $5,000 in your 401 retirement savings account. If your account holds less than this amount, your previous employer may decide to cash out your plan and send you a check for the balance.

The advantage of this option is that it allows you to leave your 401 with your former employer if they offer good terms. Leaving your retirement account with your previous employer allows you to wait for registration to open with your new employer.

When you leave your 401 savings with your former employer, your access to your money can be limited. Some employers can levy huge maintenance fees, implement restrictions on investment choices and prevent access to your savings until you reach retirement age. Unless you’re about to retire and you know you won’t change jobs often, avoid leaving your 401 with your former employer.

Also Check: How To See How Much 401k You Have

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Rollover To An Investment Account

If you’ve been able to pay more than $1000 into the account, then the old employer should rollover your money into an IRA account for you. This is a convenient option, especially since you can keep the IRA account at your new company. Pay, income, and taxes shouldn’t affect this rollover process. The amount of time it takes for distributions to clear can depend on several factors, including your former employer’s plan. However, it shouldn’t take too long. Make sure you discuss your 401 k when you leave your former employer.

There are different investment options that come with a 401k. An individual retirement account provides various options to a rollover IRA, for example. What happens to these depends on your retirement savings and retirement plan. We recommend that you speak to a financial advisor to avoid any potential penalty from your former employer.

You May Like: Where Can I Get A 401k Plan

Decide Quickly Or Your Employer Might Decide For You

You want to make an informed choice, but don’t wait too long before deciding or your employer might make the choice for you and stick you with an unwanted outcome.

If your account balance is below $5,000, your former employer can force you out of the plan and into an IRA account that they designate if you drag your feet. The expenses of these accounts are usually high, and the investment choice is usually limited.

If your account is worth less than $1,000, they can send you a check, even though that isn’t what you want done, and it subjects you to taxes and perhaps penalties.

Your Old Employer Might Become Unstable

Fortunately, US law prevents a company from simply dissolving a 401k and taking your money. Still, that doesnt mean your old 401k is insulated from problems with your old employer. And lets face it, Covid-19 has taught us how fragile some employers can actually be.

If your old employer goes under, it will be a royal pain to access your retirement funds. Youll get the money eventually, but that could be a long time. An even bigger concern occurs if your old 401k account contains a large amount of the old employers stock. If you own shares of your old employer and that employer gets into trouble, undoubtedly, the price of that stock will decrease, perhaps plummeting if a bankruptcy filing is needed.

Also Check: How To Take A Loan From 401k

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

Can I Withdraw Money From My Ira And Then Put It Back

Even though individual retirement account money is meant to be held until you retire, borrowing from the account isnt out of the question. In particular, it is possible to make a withdrawal from your Roth IRA and put the funds back without tax consequences or penaltiesbut only under certain circumstances.

You May Like: How To Withdraw My 401k From Fidelity

Heres What Happens To Your 401k If You Quit With A Large Balance

Here, Im defining large balance as anything above $5,000. Six thousand still is not very much money, but if thats the size of your 401k, then you fall into this category because all accounts above a $5,000 balance follow the same rules.

Luckily for you, if you fall into this category youll have a few options for your 401k money after you leave your job! You can choose the option that makes the most financial sense for your individual situation.

Youve Got Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into a new account with your new employer, or roll it into an individual retirement account , but you must first see when you are eligible to participate in the new plan. You can also take some or all of the money out, but there are serious tax consequences to that.

Make sure to understand the particulars of the options available to you before deciding which route to take.

You May Like: Can I Buy Individual Stocks In My 401k

You Can Roll Your Old Plan Into Your New Employer’s Plan

If you don’t want to keep your money in your previous employer’s plan, you can choose to roll over your 401 account to your new employer’s plan.

Check with the administrator of your new plan to find out if you can roll it over right away, or if you have to wait until you’re eligible to participate in the plan to do so.

This option lets you keep all of your 401 money together in one account.