How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Your Account Balance Fluctuates A Lot

It can be exciting to see your balance run up quickly, but its important to realize that this could be an effect of a 401 thats invested too heavily in stock funds and not enough in safer alternatives.

If you take someone with an account balance of $100,000 and after one month their account is now $110,000, or 10 percent growth in a month, what that tells me is that they probably have most of their money in stocks, says Matthew Trujillo, CFP at Center for Financial Planning in Southfield, Michigan.

This will feel great when things are going up, but that investor needs to be prepared to see some significant paper losses when we experience a downturn like what we just saw in March and April, says Trujillo.

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

Don’t Miss: Can A Qualified Charitable Distribution Be Made From A 401k

The Similarities Between Roth And Traditional 401 Savings

To make sure we have our feet underneath us, lets get started by talking through whats the same between these two savings types.

- Theres no income limit to participate. With company-sponsored plans, theres no cap to how much money you earn to be able to contribute to either type of accountunlike IRAs, which do have a limit.

- Theyre both tax advantaged. Your money grows tax freethat is, you wont pay any taxes on the earnings as they accrue in your account for either traditional or Roth savings within these accounts. With Roth savings, youll never pay tax on those earnings with traditional, pre-tax savings, youll pay taxes on the earnings when you withdraw them.

- They share an annual contribution limit. Whether your 401 or 403 comprise traditional or Roth, you can only put in so much money. The limit is updated annually based on cost-of-living adjustments. In 2021, the cap is $19,500. If youre over 50, your plan might let you put in more using catch-up contributions.

- Early withdrawals typically incur a penalty. With either savings option, if you want to take money out before you turn 59½, youll pay a 10 percent penalty. In special circumstances and other hardships, including COVID-19 and buying your first house, this penalty is waived.

- Your income will be taxed at some point. Upon withdrawal, youll pay income taxes on any money that hasnt already been taxed. This is a similarity, but also the key differencewhich well get into now.

How Much Should You Have In Your 401 By 30

So how much should you have saved for retirement before your 30th birthday?

Assuming you have been working since you were 22 or 23, at 30, a great target is to have a 401 or IRA equal to about one years salary.

For example, if you make $40,000 a year, you could try to have $40,000 saved for retirement. .

Related: If you still dont believe in the power of compound interest, you have to see this

That said, dont freak out if your retirement saving isnt on this level yet. The sooner you start, the better. But if you start at 30 and dont plan on retiring until youre 65, that still gives your money plenty of time to earn interest.

Use this calculator to estimate what your 401 balance would be at retirement, based on your personal financial status:

No two investors are alike, especially beginning investors. Your starting salary range and the number of years you have been working are going to be much bigger factors in determining your retirement savings balance at 30 than they will be at 40 or 50, when you will have had additional years to make catch-up contributions or adjust your portfolio as necessary.

Also Check: How Is 401k Paid Out

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Two Favorite Real Estate Platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most investors, investing in a diversified portfolio is the best way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations. They also have higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Ive personally invested $810,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

How Much Should I Have Saved In My 401k By Age is a Financial Samurai original post.

Filed Under: Most Popular, Retirement

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

Current recommendations:

Recommended Reading: How To Take My Money Out Of 401k

Not Sure How Much To Contribute To Your 401 Try This

Here’s a closer look at a few approaches you can use to decide how much you want to contribute to your 401 going forward.

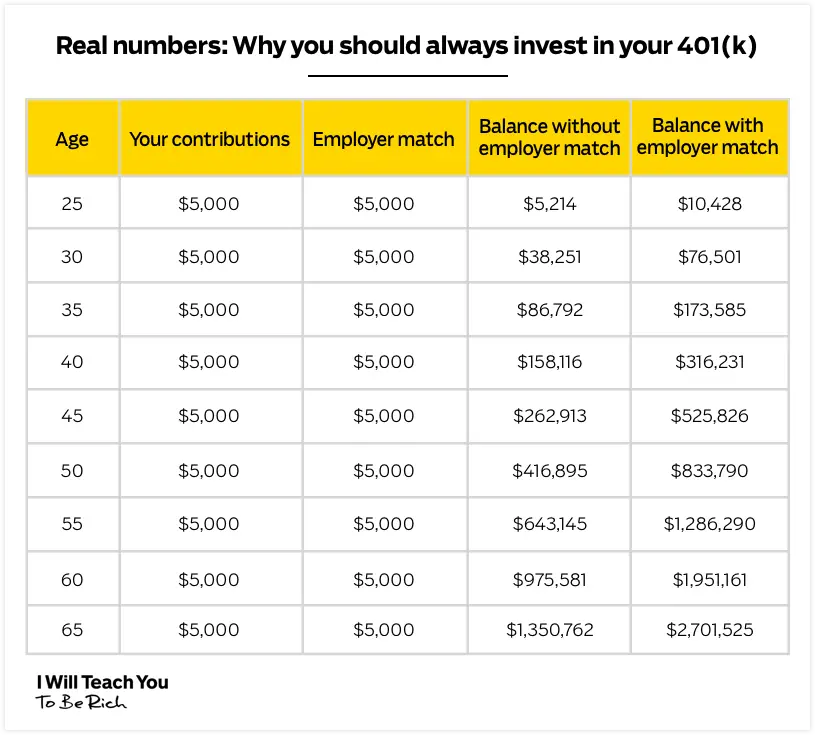

A good starting point: Get your full employer match

If you’re starting a new job and your employer asks how much you want to defer to your 401 from each paycheck, your answer should be at least enough to get your company’s full match. That assumes it offers one, of course. These funds are basically like a bonus for you, but you have to contribute to your retirement account in order to claim it.

Each company has its own matching structure that determines how much it will contribute to your 401. Usually, this involves a dollar-for-dollar match or a $0.50 on the dollar match up to a certain percentage of your income. If your company does a $0.50 on the dollar match up to 6% of your salary and you earn $50,000 per year, you would contribute 6% of your salary, or $3,000. Then, your employer would match half of this, contributing another $1,500 on your behalf. You’re free to contribute more if you want, but you’re on your own from there.

If you’re unsure how your company’s 401 match works, ask your HR department to find out. Then, make sure it’s feasible for you to contribute enough to get your full employer match. If doing so would make it difficult to pay your bills right now, scale your contributions back. The solution below may work better for you.

The bare minimum: Start with 1% of your salary

The ideal: Create a custom retirement plan

Dont Beat Yourself Up If You Cant Save That Much Money In Your 401 By 30

There are a couple of good reasons some twentysomethings dont start putting away for retirement immediately:

- Youre in grad school

- Youre battling big debts

If youre a student, its unlikely youll have extra money to tuck away for retirement. And thats okay, because your education will hopefully increase your lifelong earning potential.

If youve got high-interest credit card debt, your top priority should be to pay that down. Debt interest rates could crush even the best retirement account returns, so its best to use extra funds to dispatch credit card balances quickly.

The one exception? If your employer matches 401 contributions. In this case, contribute the maximum percentage your employer will match, then increase retirement savings after your debt is gone.

Don’t Miss: How Do I Cash Out My 401k Early

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Heres An Example Of How You Could Have A Years Worth Of Salary Saved In Your 401 By Age 30

Here are our assumptions:

- You start work at 22

- You can immediately contribute to a 401

- Your employer will match 50% of your contributions up to a maximum of 6% of your salary

- Your investments get an 8% average return

- You get annual raises of 3%

With these assumptions, youll need to contribute about 9% of your salary every year to reach this goal. Here are year-by-year totals:

You May Like: When Leaving A Company What To Do With 401k

How To Invest When To Withdraw

Pfau’s research highlights two other important variables. First, he notes that over time the safe withdrawal ratethe amount you can withdraw after retirement to sustain your nest egg for 30 yearswas as low as 4.1% in some years and as high as 10% in others. He believes that “we shift the focus away from the safe withdrawal rate and instead toward the savings rate that will safely provide for the desired retirement expenditures.”

Second, he assumes an investment allocation of 60% large-cap stocks and 40% short-term fixed-income investments. Unlike some studies, this allocation doesnt change throughout the 60-year cycle of the retirement fund . Changes in the persons portfolio allocation could have a significant impact on these numbers, as can fees for managing that portfolio. Pfau notes that “simply introducing a fee of 1% of assets deducted at the end of each year would increase the baseline scenarios safe savings rate rather dramatically from 16.62% to 22.15%.”

This study not only highlights the pre-retirement savings needed but emphasizes that retirees have to continue managing their money to prevent spending too much too early in retirement.

Question #: Do You Have Any High Interest Debt Like Credit Card Debt Or Personal Loans

If you answered yes to this, you may want to consider paying off this debt before maxing your 401 contribution. You dont want to pay more interest than necessary on high-interest debt. If you can, put the minimum in your 401 to receive the company match, and then funnel the remainder of your usable budget towards paying off high-interest debt. Once thats paid off, all of those funds are freed up to do other things, plus, it feels pretty great to be debt-free!

Also Check: How To Invest My 401k Money

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Get Help With Your 401

Already have a 401? While youre researching contributions, take a minute to analyze your current holdings toothere could be big savings to be found.

is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduced expensesit can even show you how changing funds within your existing 401 might save you thousands. or read our review.

Blooom is a new tool that can automatically manage and optimize your 401 for just $10 a month. Designed especially for 401 accounts, blooom works with your available investments to find the lowest-cost and best allocation for your goals. You can get a free 401 analysis from Blooom or learn more in our review. Plus they have a special promotion where you can get $15 off your first year of Blooom with code BLMSMART

is a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place. Wealthfronts Self-Driving Money tool continuously monitors your cash flows to ensure that bills are paid and savings are instantly routed into the right investment accounts. Wealthfront account holders can also take advantage of the apps automated investment services, like daily rebalancing and tax-loss harvesting.

Don’t Miss: How To Find My 401k Money

What If You Can’t Meet Your Employer Match

If you aren’t yet in a position to contribute enough to meet your employer’s match, and thus not enough to reach the desired 15% savings rate, aim to boost your retirement contributions by 1% to 2% each year. If you opt in to do so, some companies will automatically raise your contribution rate annually, so it’s worth making sure you are signed up for what is called an “auto-escalation” feature.

Ivory Johnson, a CFP and founder of Delancey Wealth Management, recommends increasing your contribution rate as you get pay raises until you max out the limit. There is a limit to how much you can contribute annually to your 401. In 2021, the standard annual contribution limit is $19,500 for 401 plans. And those over age 50 can use catch-up contributions to add an extra $6,500 in their 401 account. Employer contributions don’t count towards those specific limits.

Lynch reminds retirement savers to be strategic with the magic number they would like to contribute to their 401 before automatically trying to max it out, however.

“Situations can arise where you may need to prioritize your cash savings in your emergency fund or save for a different reason, such as for a down payment on property or a vehicle,” she adds. “$19,500 isn’t a small chunk of change.”

Keep in mind that although you don’t pay income taxes on the money you set aside in a 401, you’ll have to pay taxes later on when you eventually withdraw the funds in your nonworking years.

How Much Should You Contribute To Your 401

Modified date: May. 17, 2021

Ten percent? Twenty percent? More?

Ive written a lot about the benefits of both 401s and IRAs. Weve also looked at the emerging Roth 401 option and when it makes sense for young investors.

But everybodys next question is: Okay, okay, but how much should I put into my 401?

Whats Ahead:

Also Check: How To Open A 401k Plan

Ways To Maximize Your Tax

Choose both. The best news is that you dont have to choose between traditional pre-tax and Roth savings option. You can split your contributions. Or, you can make an annual decision about which investment works better for you that year. Investing through both a traditional option and a Roth option is one way to create a diversified retirement portfolio and mitigate against your tax bracket at retirement being different than you anticipated.

Invest in a traditional 401 and convert to Roth. Maybe youre not ready to pay the taxes on a Roth right now. Your no this year doesnt have to be a permanent no. In fact, if you time a conversion properly, you can lessen your tax liability. Or, perhaps you have traditional 401 savings and youd like to convert it now. A few signals a conversion could work for you: your traditional 401 has lost value, your income is low, or your deductions are very high. We recommend working with your financial advisor to figure out your Roth conversion strategy and with your employer to confirm that its available within your retirement plan.

Use Roth 401 savings to save for your heirs. As long as your account will have been open for at least five years before your heir takes a distribution, theyll be able to make those withdrawals tax-free. They wont need to pay taxes or consider the tax implications of making any withdrawals. Youll have already taken care of that for them.

Read more from our blog: