Do You Have To File Extension For 401k Contribution

As a result, sole proprietors and independent contractors are automatically granted this extension and do not have to file any extension forms or call the IRS to qualify for this automatic federal tax filing and payment relief. The solo 401k contribution deadline is generally driven by the self-employed business entity type.

Starting A 401 Without A Job

If you dont currently have a job, you may have some challenges. 401 plans are employer-sponsored plans, meaning only an employer can establish one. If you dont have your own organization and you dont have a job, you may want to evaluate contributing to an IRA instead. However, those accounts may require earned income during the year to contribute, so its not as simple as you might hope. That said, a spousal IRA may allow certain couples to contribute to a retirement account with no job.

How Much Does A 401k Audit Cost

The issue of 401k audit is a nerve-wracking one for employers. You should be aware that they are a requirement for many employers and are therefore quite common.

Audits require careful preparation and planning and the cost to complete one is on top of the regular cost of partnering with a third party administrator to handle your 401k plan.

The cost of a 401k audit will vary depending on the number of eligible plan participants you have and other factors. Some of the things that may impact the cost of your 401k audit include:

- The number of eligible participants in your 401k plan

- The complexity of your 401k plan

- The date of your audit

- The location of your business

The audit date is an element of cost that is often overlooked. Since many businesses have 401k plans that run in tandem with the calendar year, TPAs tend to be extremely busy with end-of-year audits in December. Thats a factor that can increase the price.

The same goes for the location of your office. If your auditor must travel to get to your office, travel expenses will impact the total cost of your audit.

At Cook Martin Poulson, we work closely with our 401k audit clients to determine the scope of the audit and quote a fair price. Were happy to talk to you about your audit needs at any time.

Don’t Miss: How Can I Invest My 401k

What Types Of Investments Can I Use In My Solo 401k

Most Solo 401k plans are brokerage accounts held at large, well-known custodians where the participants invest in stocks, bonds, mutual funds, and REITs. Some specialty 401k custodians are designed for self-directed investors who want to hold physical real estate, gold, shares in their own company, and other alternative investments. These self-directed plans can get complex and be expensive to administer, and they are more likely to run into trouble with the IRS.

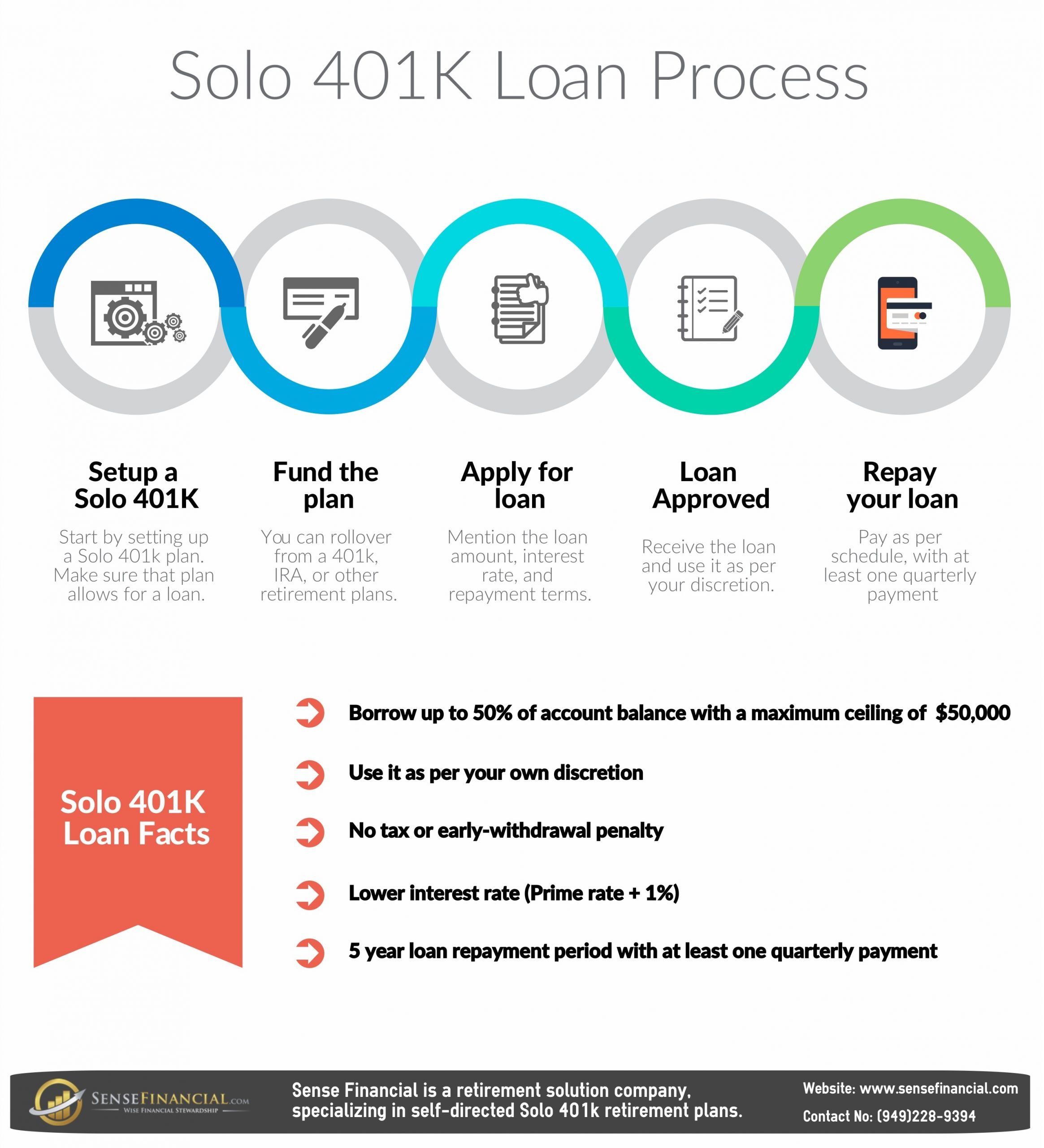

Rolling Into A Solo 401

As mentioned above, your solo 401 can accept tax-free rollovers from certain qualified retirement plans, including traditional IRAs, SEP IRAs, former employers 401s, and more.

Rollover funds go to a pre-tax portion of your solo 401.

Note that rolled-over funds are not subject to the contribution limits or deadlines mentioned earlier in this article you can roll over any amount of qualified funds into your solo 401 this year and still make your normal contributions by the deadlines stated above.

Read Also: How Much Should I Have In My 401k At 55

Third Party Solo 401k Providers

If you need something a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

We’re not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. I just wanted to list some of the most popular third party plan providers that you can reference in your search for the best plan.

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

Also, you can use these plans to execute a Mega Backdoor Roth IRA. In fact, several of these companies specifically advertise that they offer it.

This isn’t an exhaustive list. There are also local firms in most areas that can create 401k plan documentation as well.

Third Party Administrator Services

As your TPA, Pension Inc. will provide you:

Account setup and generation of all plan legal documents Dedicated Pension Inc Account Executive for the Plan Fast and courteous answers to your questions Complete retirement plan consulting Determination of plan contributions via sponsor provided earnings for tax year Technical administration, required governmental filings, and regulatory compliance Implementation of periodic plan amendments due to law changes and mandatory restatements

New Plan Setup & Plan CostsA Solo must be established by the end of your tax year. Your signed intent to adopt the plan and contribute employee deferrals to the plan must be on file with Pension Inc. no less than 10 days before the last day of your fiscal year to make your plan exist for your current tax year. Plans with documents received after the date are not guaranteed to be established by year end and may result in rush processing fees.

To begin setup, review the document below to learn more about Pension Inc. fees and services and to start the plan installation.

Recommended Reading: Should I Transfer 401k To New Employer

Deposit Limits And Deadlines

Total contributions depend on annual plan limits and your net business income. Negative income means no Employee Deferral or Employer contributions can be made. Clients typically consult with their tax advisor regarding allowable contributions, but Pension Inc. can also assist with contribution calculations.

Deadline for your deposits depend upon whether you file as a Corporation or a Self-Employed business .

When Is The Deadline To Contribute To A Solo 401k

If the entity type is an LLC taxed as a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is filed. If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is filed.

Read Also: How Do I Transfer My 401k To A Roth Ira

How Much Do I Need To Earn To Contribute The Maximum

There are two contribution limits: a salary-deferral contribution and a profit-sharing contribution. Both contributions are tax-deductible.

Salary-Deferral Contribution:

You can contribute up to 100% of your personal compensation for the salary-deferral portion, up to a maximum of $19,500 if you are under 50, or $26,000 if age 50 or older. Your compensation is considered to be your W-2 wages, assuming your business is taxed as a corporation. Compensation is based on net-adjusted business profits if your business is taxed as a sole proprietorship. Net-adjusted business profit is calculated by taking your business revenues, minus business expenses, and then also subtracting 50% of your self-employment taxes .

Profit-Sharing Contribution:

A profit-sharing contribution can also be made. The profit-sharing contribution is limited to 25% of W-2 wages if your business is taxed as a corporation. For sole proprietorships, your profit-sharing contribution is limited to 20% of net-adjusted business profits .

How To Set Up A 401 Plan

Now that you know the landscape, youre ready to set up a plan as an employer or self-employed individual. Whether youre establishing a plan for a large enterprise or or on your own the next steps are:

- If youre self employed, decide if you want a SoloK, SEP, or SIMPLE providers).

- Decide which plan provisions you want , Safe Harbor, matching, vesting schedules?).

- Choose a vendor .

- Complete the adoption agreement along with other agreements and submit to your vendor.

- Communicate and educate: Inform employees of the plans existence and features.

- Set up individual participant accounts.

- Fund the plan through payroll or any employer contributions.

- Review the plan regularly to ensure its meeting the needs of plan participants.

- Monitor and adjust the plan as regulations change and your needs evolve.

- Provide required information to participants on an ongoing basis.

Recommended Reading: How Do You Know If You Have An Old 401k

Who Should Get A Solo 401

Solo 401 plans are best for business owners who want the most flexibility in how they save for retirement. Before signing up for a Solo 401, you may also want to consider a SEP IRA or SIMPLE IRA as well.

Solo 401 plans take more paperwork to get started but offer more flexibility in what you are able to contribute. For example, SEP plans only accept employer contributions, while a solo 401 takes contributions from either the employee or employer. SIMPLE IRAs are available to businesses with up to 100 employees. SEP IRAs dont have that limit.

Determine The Right Plan

There are several different types of 401k plans. They include: traditional 401k plans safe harbor 401k plans SIMPLE 401k plans and solo 401k plans. Each plan has a different set of rules and requirements. In addition, there are pros and cons to different plans.

Solo 401k plans are popular for business owners with no employees. They can also be easily established and the plan participant can be the trustee. This allows the participant to self-direct the investments. It is the simpliest plan to set up and to administer.

Recommended Reading: How Is 401k Paid Out

Solo 401 Plans Their Benefits To Self

- Starting a Retirement Plan

- Solo 401 Plans Their Benefits to Self-Employed Workers

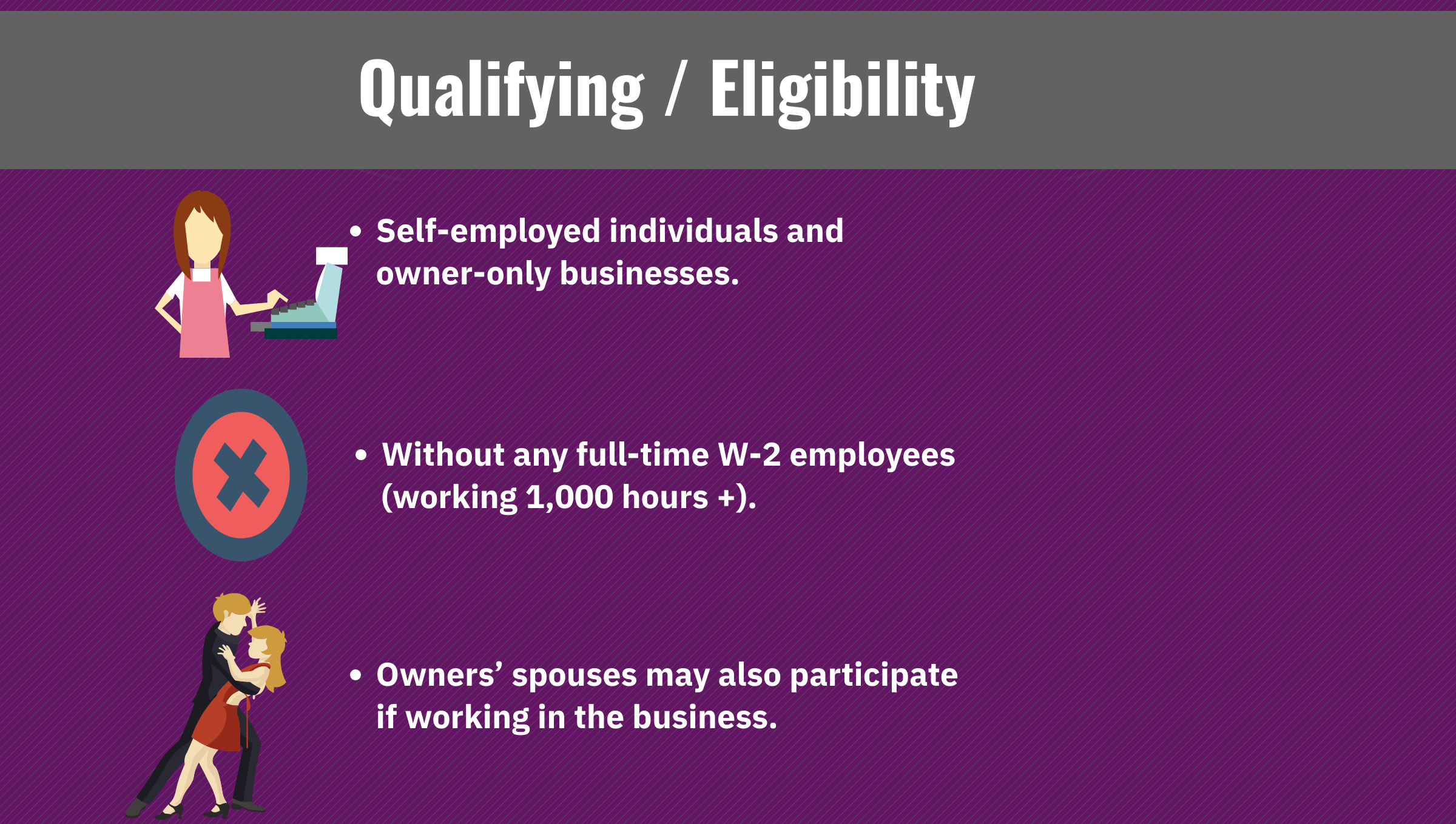

401 plans that only cover business owners – and their spouses are commonly called solo 401 plans. Because they dont cover non-owners, solo 401 plans arent subject to many of the most complex 401 plan qualification requirements including annual nondiscrimination testing. That makes these 401 plans easy to administer while allowing plan participants to receive large annual contributions – up to the 415 limit without restriction. These benefits have made solo 401 plans a popular retirement plan choice for business owners that want to save more than personal IRAs allow.

However, if youre considering a solo 401 plan for your small business, there are some things you should know. First, you want to be 100% sure your business is eligible to sponsor a solo 401 plan at all because the consequences for improperly excluding non-owners from a 401 plan can be severe. Second, you want to understand your solo 401 plan design options because not all 401 providers will give you the chance to take full advantage of them.

Fortunately, these pitfalls are easy to avoid with some basic education allowing you to enjoy the benefits of a solo 401 plan worry-free. Weve outlined the key points to consider below. If you need additional assistance, an experienced 401 provider should be able to help.

What An Irs Audit Might Reveal: Mind These Five Solo 401 Plan Faux Pas

1. Youre Solo No Mo

If you have hired an employee and they are eligible to receive benefits, your solo 401 plan is no longer applicable. Instead, you are now subject to minimum coverage, nondiscrimination, and top-heavy rules not to mention ERISA reporting and disclosure requirements. If your business currently sponsors a one-participant 401 plan, but you have employees on the payroll, the IRS is sure to smell blood in the water and an agent may even be on their way. Remember, if your business has employees or if you plan to hire in the future, step away from the solo 401 plan option. This is especially important if any employee you hire is expected to work more than 1,000 hours annually.

2. Lack Of Control

Even if yours is a solo act, if your business actually falls under the common control of another entity that is currently the workplace of common law employees, yours may not even be eligible for the solo 401 plan option. Instead, because the employees of the other business could ultimately be eligible for the benefits outlined in your plan document you too are subject to the potential coverage, testing, and top-heavy issues mentioned earlier.

3. Missing Out On The EZ Requirement

4. Not Just Pushing The Limits Exceeding Them

5. Forgetting Your Plan Document

Recommended Reading: Can I Open A 401k Without An Employer

Best For Active Traders: Td Ameritrade

TD Ameritrade

Most retirement-focused investors would do well to stick with a passive investment style. However, if youre into active investing, TD Ameritrade offers industry-leading platform options and tools.

-

Choose between multiple web, mobile, and desktop platforms

-

Access the advanced thinkorswim® trading platform with no added costs

-

Roth contributions and 401 loans are supported

-

Accounts will move to Charles Schwab in the future

-

Advanced platforms may be overwhelming for newer traders

TD Ameritrade is another renowned discount brokerage and our choice as best for active traders. It offers an individual 401 account with no recurring fees and commission-free stock and ETF trades. Its solo 401 also supports Roth contributions and 401 loans. Its standout feature for active traders, though, is the thinkorswim® active trading platform, which is available on desktop, mobile, and the web.

Before diving into other details, its important to note that this brokerage has been acquired by Charles Schwab. TD Ameritrade accounts will become Schwab accounts at some point in the future. However, as you can see from its review on this list, were fans of Schwab as well and look forward to seeing the combined capabilities once the integration is complete.

Read our full TD Ameritrade review.

Solo 401 Withdrawals And Details

As with all qualified retirement plans, there are rules to when you can and must start taking withdrawals from your Solo 401 plan. You must begin taking the minimum required distribution no later than age 72 . There is a 10% early withdrawal penalty for distributions take before age 59 1/2, but exceptions may apply.

Please refer to the IRS page on individual 401s and review our Solo 401 Guide for additional details.

Read Also: Can I Use My 401k To Start A Business

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

Provide Information To Employees

Once your 401k is established, you are required to make certain employee communications. You must notify eligible employees of the plan benefits and requirements. A summary plan description is the main vehicle that informs participants and their beneficiaries about the plan and how it works. The SPD will be provided to you by the entity who establishes the plan on your behalf.

Read Also: How To Check My Walmart 401k

How To Start A 401k

Setting up a 401k retirement plan can be quite simple or complicated depending on your approach. Most people choose to outsource at least some portion of the process in other to ease up the burden involved. In particular, they use a template legal document to establish the 401k plan because its a lot cheaper than hiring an attorney to reinvent the wheel for you. Unless your retirement plan is especially tricky or youre trying to get fancy , youll probably use preconfigured programs from 401k vendors. These programs are often called volume submitter or prototype plans.

Choose Your Solo 401 Provider

The first step in setting up your solo 401 then is to choose your solo 401 provider, who will set up your documents and adoption agreement.

As you do your research, you will find that there are a wide range of providers at a variety of price points.

In general, your account and investment options will be more limited the less expensive your provider, while more expensive providers offer greater flexibility and more investment options for your account.

Don’t Miss: Can You Pull From 401k To Buy A House

Do You Need To Hire A 401k Administrator

The decision to hire a 401k administrator for small business may come down to one or more factors. If your company is small and your plan has fewer than 100 eligible participants, you can file your Form 5500 as a small plan. That means you will not be required to submit a 401k plan audit with your filing, and you may not need to hire a 401k administrator.

That said, there are some significant benefits to hiring a 401k administrator. They include: