How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Avoid Early Withdrawal Penalty

Withdrawals made before age 59 ½ are subject to a 10% early withdrawal penalty and income taxes depending on your tax bracket. However, if you leave your current employer at age 55 or later, you may qualify to get a penalty-free 401 withdrawal. However, the distribution will still be subject to ordinary income tax at your tax bracket. The IRS requires that an employee must have left their employer to qualify for a penalty-free distribution. This rule is known as the Rule of 55, and it does not apply to earlier plans or Individual Retirement Accounts.

What Are The Disadvantages Of Withdrawing Money From Your 401 In Cases Of Hardship

- Taking a hardship withdrawal will reduce the size of your retirement nest egg, and the funds you withdraw will no longer grow tax deferred.

- Hardship withdrawals are generally subject to federal income tax. A 10 percent federal penalty tax may also apply if you’re under age 59½. contributions, only the portion of the withdrawal representing earnings will be subject to tax and penalties.)

- You may not be able to contribute to your 401 plan for six months following a hardship distribution.

Also Check: How To Check How Much Is In Your 401k

Are You A Us Citizen Or A Us Person For Tax Purposes

If yes, your client will likely have a bigger tax bill from collapsing a retirement plan than someone whos not. But it depends.

While Canadian residents are only taxed 15% on 401 and IRA withdrawals, withdrawals for U.S. persons are taxed as ordinary income at their marginal rate, which is usually higher than 15%. So, a 60-year-old U.S. person in the 33% bracket would only net $67,000 when collapsing a $100,000 IRA. If he transferred his IRA to an RRSP, his FTC would be $33,000 and he would need to owe $33,000 in Canadian tax to be in a tax-neutral position. The larger the FTC, the more unlikely it is that the person has enough Canadian tax owing to offset the entire FTC.

In the Go Public case mentioned earlier, the couples bank overlooked the fact that the husband was a U.S. citizen. Which brings us to

Are Taxes Going Up

Death and taxes are two certainties in life. Generally speaking, taxes increase over time while deductions for most people decrease over time. Unless Congress takes a special action, we know some favorable tax reductions for most middle-class Americans will sunset in 2026.

If you think taxes will be higher in the future, or you know your deductions will be lower, cashing out a 401 to move money to a place that does not pay taxes again can make sense.

Among other things, potential tax-saving strategies may include a rollover to a Roth IRA or buying permanent whole life insurance designed for high cash value accumulation.

Also Check: Should I Roll My Old 401k Into My New 401k

The Federal Thrift Savings Plan

The Thrift Savings Plan is a lot like a 401 plan on steroids, and its available to government workers and members of the uniformed services.

Participants choose from five low-cost investment options, including a bond fund, an S& P 500 index fund, a small-cap fund and an international stock fund plus a fund that invests in specially issued Treasury securities.

On top of that, federal workers can choose from among several lifecycle funds with different target retirement dates that invest in those core funds, making investment decisions relatively easy.

Pros: Federal employees can get a 5 percent employer contribution to the TSP, which includes a 1 percent non-elective contribution, a dollar-for-dollar match for the next 3 percent and a 50 percent match for the next 2 percent contributed.

The formula is a bit complicated, but if you put in 5 percent, they put in 5 percent, says Littell. Another positive is that the investment fees are shockingly low four hundredths of a percentage point. That translates to 40 cents annually per $1,000 invested much lower than youll find elsewhere.

Cons: As with all defined contribution plans, theres always uncertainty about what your account balance might be when you retire.

What it means to you: You still need to decide how much to contribute, how to invest, and whether to make the Roth election. However, it makes a lot of sense to contribute at least 5 percent of your salary to get the maximum employer contribution.

Taxes On Employer Contributions To Your 401

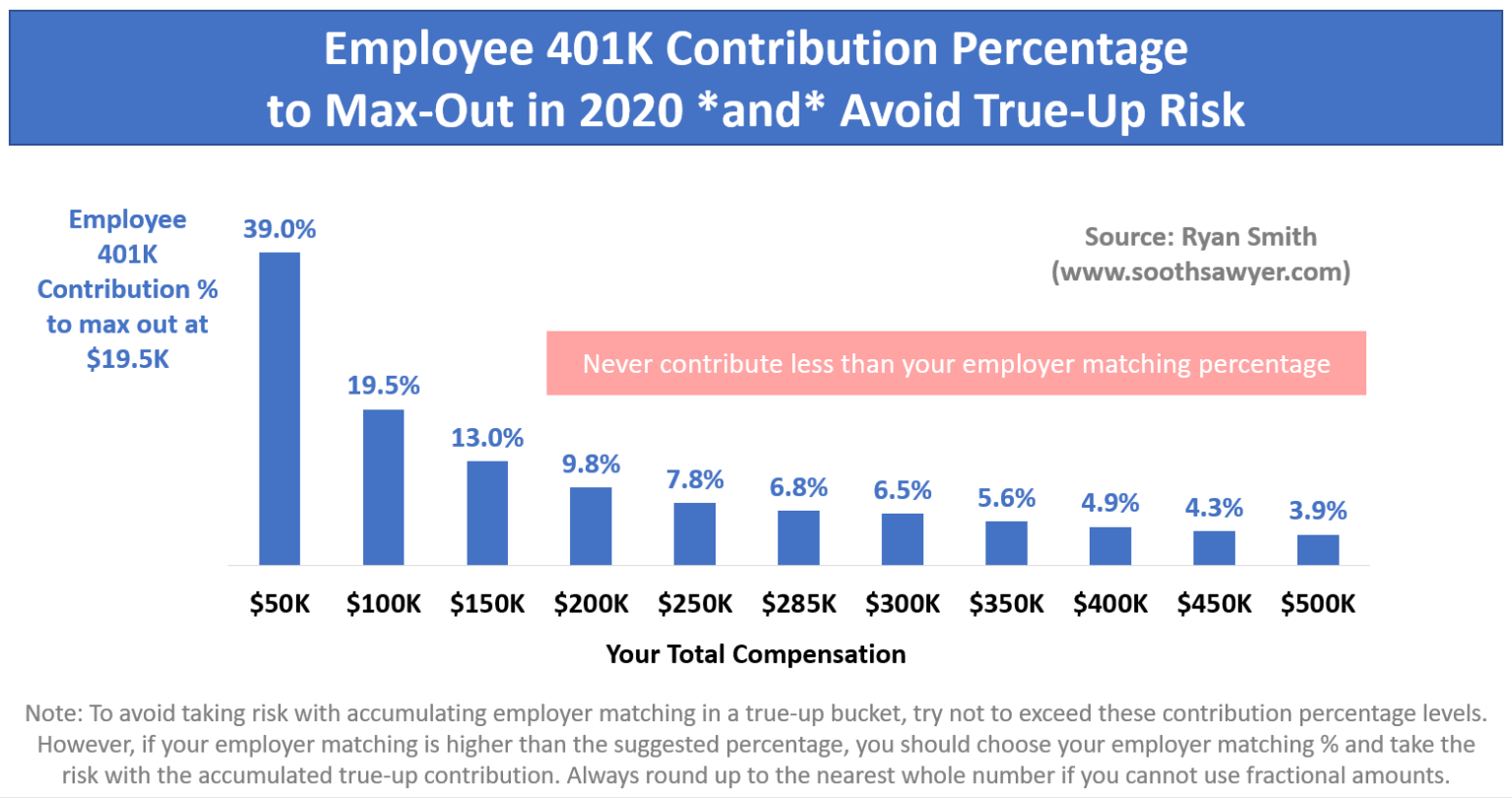

In addition to your contributions, an employer may also put money into your 401. Once that money is in your account, the IRS treats it the same as your contributions. You wont pay any taxes while the money is in your account, but you will pay income taxes when you withdraw it. Unlike your own contributions, you dont pay any payroll taxes when your employer contributes to your account. Its truly free money. It doesnt even count toward the $19,500 contribution limit for 2021.

Recommended Reading: How Do I Find Previous 401k Accounts

Do You Pay Tax On 401 Contributions

A 401 is a tax-deferred account. That means you do not pay income taxes when you contribute money. Instead, your employer withholds your contribution from your paycheck before the money can be subjected to income tax. As you choose investments within your 401 and as those investments grow, you also do not need to pay income taxes on the growth. Instead, you defer paying those taxes until you withdraw the money.

Keep in mind that while you do not have to pay income taxes on money you contribute to a 401, you still pay FICA taxes, which go toward Social Security and Medicare. That means that the FICA taxes are still calculated based on the full paycheck amount, including your 401 contribution.

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½. With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions, or RMDs.

Also Check: Can I Buy 401k Myself

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

What Kind Of Plan Is It And Have You Already Started Withdrawing From It

If the client has already started withdrawing from the plan, she cannot transfer it into an RRSP, says Power. She adds 401s that have been rolled over into annuities cannot be transferred.

There are considerations for each plan. For 401s, only the employee-contributed amounts can be transferred to an RRSP without using up RRSP room. Any employer contributions can still be transferred, but the client needs commensurate RRSP room. To get around that, We always recommend converting from a 401 to an IRA first, says Altro. Thats not a taxable event, he adds, and it allows both portions to be transferred to an RRSP without using up contribution room.

Another reason to convert is if a client was a Canadian resident while she participated in the 401 planfor instance, a cross-border commuter, says Wong. Thats because shes ineligible for a direct 401 to RRSP transfer.

For IRA-to-RRSP transfers, Wong says that the transferred value cannot include amounts contributed from someone other than the taxpayer or taxpayers spouse, such as employer pension amounts.

With 401s, the employer plan administrator is responsible for keeping track of the after-tax and pre-tax contributions. With IRAs s are rolled over to IRAs), that tracking responsibility shifts to the individual, says Altro. Advisors must ask clients if they have any after-tax contributions in their U.S. plans.

Don’t Miss: How Do I Look At My 401k

Additional Safe Harbor Requirements

Making contributions to your employees 401 is the most notable Safe Harbor requirement, but there are additional rules surrounding when and how you offer your plan.

Safe Harbor deadlinesFor new plans, October 1 is the final deadline for starting a new Safe Harbor 401. But dont wait until a few days before the deadline to set up your plan, because if youre making a matching contribution, youre also required to notify your employees 30 days before the plan starts, and it can take a week or more to set up your plan. So, make sure you talk to your 401 plan provider well before September 1. For existing plans, the deadlines depend on the type of Safe Harbor contribution you are adding to the plan and are detailed below.

Important dates for new plans:

It is important to be aware that if a Safe Harbor feature is added to a new plan, it must be in place for the entire plan year. If the plan year is set up retroactive to January 1, contributions will be required based on eligible compensation for the entire year.

Important dates for existing plans-Safe Harbor match

If you want to add a Safe Harbor matching provision to an existing 401, your administrator can make a plan amendment that goes into effect January 1 of any future year. Remember, there is an employee 30-day notice requirement, and it may take some time for your administrator to amend the plan, so try to get this taken care of by the end of November to go into effect January 1. to take effect 2022.)

Do People Really Make 401k Hardship Withdrawals

401k Hardship withdrawals have been on the rise. According to a study by Fidelity, 2.2% of all 401 participants had made a hardship withdrawal at some point over the preceding 12 months.

Thats up from 2% in the prior year and was the highest level in 10 years.

Are you thinking of becoming part of the 2.2%? Sometimes the withdraw rules can be confusing, so its important to know when you are allowed to pull money from your 401k because of hardship.

Read on to learn what actually happens when you make a 401k hardship withdrawal.

Don’t Miss: Is Rolling Over 401k To Ira Taxable

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

Medical expenses that exceed 10% of your adjusted gross income

Permanent disability

If you leave your employer at age 55 or older

A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation.

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

Also Check: When Can I Roll A 401k Into An Ira

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying a tax penalty.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the owner of a traditional 401 makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals, as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against the money they have contributed to a 401 plan. Basically, they’re borrowing from themselves. If you consider this option, keep in mind that if you leave the job before the money is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

How Long Will It Take To Process Your Application

We begin to process your application once we receive your completed application form. It will take:

- 7 to 14 days for online applications

- normally within 120 days for applications delivered at a Service Canada Centre

- normally within 120 days for applications sent by mail

It could take longer to process your application if Service Canada does not have a complete application.

Recommended Reading: Why Choose A Roth Ira Over A 401k

Managing 401 Plans For A Small Business

Setting up a 401 can be complicated, but you don’t have to do it alone. Look for a provider with an excellent track record that can help you get started, manage your plan, and even share ideas and guidance to maximize the value to you and your employees. Doing so can go a long way in ensuring an ongoing, positive benefit for years to come.

How To Bring 401s And Iras To Canada

Ways to avoid common tax pitfalls

- 00:11

Crossing borders for work often means cross-border tax issues, especially when it comes to retirement accounts.

Moving 401s and IRAs to Canada must be done with plenty of forethought otherwise, owners could face big tax bills on both sides of the border. In a case that got accountants buzzing, CBCs Go Public reported that an Ontario couple lost almost a quarter of their U.S. retirement savings to taxes when they followed improper advice about making the transfer.

And even if clients dont want to move their money, they may be forced to. Plans have the ability to kick a participant out either due to account size or non-residency in the U.S., says Debbie Wong, a CPA and vice-president with Raymond James in Vancouver. That means Canadian residents could be out of luck.

Jacqueline Power of Mackenzie Investments in Toronto agrees. A lot of U.S. suppliers dont want to deal with Canadians anymore, she says. Weve had lots of advisors saying their clients are being essentially forced out of the U.S.

L.J. Eiben, president and CEO of Raymond James Ltd. in Vancouver, says a U.S. firm usually gives the individual 30 to 60 days to transfer out. If not done by that date, the firm will liquidate the retirement account and send the participant a cheque for the remaining proceeds minus withholding tax, penalties, et cetera.

Don’t Miss: Can Anyone Have A 401k

Feel More Confident With Your Retirement Plan

You offer a retirement planor youre thinking about it. Thats a great thing. But it comes with some questions. You may want help with things like plan compliance and participant engagement.

Thats where we come in. Were one of the leaders for 401 and 403 plans focused on helping you follow retirement plan rules and increase participation and savings rateswhile making your plan administration as efficient as possible.1

Talk to your financial professional about your defined contribution plan options or give us a call at 800-952-3343 to discuss how we can help.

How Much Should An Employer Contribute To The Plan

The amount you as an employer decide to contribute is entirely up to you. As you make this decision, consider the tax savings you can receive for making employer contributions. Employer matches are tax-deductible on federal corporate income tax returns, and some administrative fees associated with managing a 401 plan are tax-deductible as well.

You can match as much as you want as long as it stays within the IRS limitations, which combine both employer and employee contributions. According to the IRS, this combined total is the lesser of 100 percent of an employee’s compensation or $58,000 for 2021, not including “catch-up” elective deferrals of $6,500 for employees age 50 or older.

Also consider factors such as the positive impact a matching contribution can have on employee morale and worker retention strategies. Given the steep costs of hiring and training new employees, an employer match offers the opportunity to truly invest in your workforce. These considerations may help guide your decisions about how much to contribute to the 401 plan.

You May Like: Should You Always Rollover Your 401k