How Does A Self

The solo 401 is like the classic 401. You contribute into the account from your pre-tax income, and you can invest the savings without paying taxes. However, you will pay taxes on withdrawals when you retire. A self-employed 401 allows your spouse to contribute in the same plan.

A major difference between an individual 401, a standard 401, and other personal 401 options is that you can make more contributions. If you qualify for a self-employed 401, the higher contribution restrictions, and easy administration of the account, makes it an ideal choice for retirement savings.

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

What Is A Sep Ira

Congress created the Simplified Employee Pension Individual Retirement Account in 1978 to extend the IRA concept to small businesses. The term pension in this case is a bit archaica SEP IRA is not a defined benefit plan. Rather, it lets the self-employed and small businesses and their employees benefit from simple, tax-advantaged retirement savings accounts similar to personal individual retirement accounts .

SEP IRAs are available from most major brokerage firms and easy to set up. Unlike a traditional 401 plan, SEP IRAs have little to no administrative overhead. Companies with only a single employee can take advantage of SEP IRAs, meaning they can be a good choice for solo entrepreneurs or gig workers.

Most importantly, SEP IRAs offer more generous tax breaks than personal IRAs. In some cases, the tax deduction for a SEP IRA can be nearly 10 times that of an IRA.

Don’t Miss: How Do I Take Money Out Of My Voya 401k

Exchange Promissory Note Investment Question:

Such investment would result in a prohibited transaction. You cannot assign an investment that you personally own to your own solo 401k plan.

Sale, exchange, or leasing of property between a plan and a disqualified person.

- Your Spouse

- Your natural children and/or your adopted children

- The spouses of your natural children

- Any fiduciary of your Solo 401k

- Any people providing services to your Solo 401ksuch as your stockbrokeras well as his employees and both his and his employees blood relatives

- Your Solo 401k trust document provider or administrator

Do I Have To Roll All My Retirement Savings Into My New Business With Robs

No. You can use as much or as little of your retirement assets as you want. We do suggest that you roll over at least $50,000, as there are diminishing returns to rolling a smaller amount. If you decide later on that youd like to roll more funds into your business, youre able to do so with an Additional Rollover Capital transaction.

Read Also: How Can I Get Money Out Of My 401k

How To Buy Real Estate With A 401

A 401 can help fund real estate investments under certain circumstances.

Diversifying assets to include real estate can help you spread risk across a mix of investments. Whether buying property for direct use or for rental income, your 401 might be a funding source. The way you use a 401 for real estate investments determines any tax or penalty consequences you may face. It also can leave you with less money to fund your retirement.

Td Ameritrade Solo 401k

TD Ameritrade is another low cost brokerage that offers a prototype free solo 401k plan. Their plan is the hardest to dissect, but here is what we could gather. However, after discussing their plan with them, here is what we found.

The TD Ameritrade solo 401k plan does allow both traditional and Roth contributions. They also allow loans from their solo 401k plan. We couldn’t get a clear answer on what types of rollover options they allow into and out of their solo 401k plan.

Looking at their plan document, they only allow rollovers from 401, 401, 403, 403, 408, and 457 accounts.

They also offer a lot of investment choices within their 401k plan. For example, they offer Vanguard ETFs commission free.

There are no setup fees or annual account fees with TD Ameritrade’s plan. All regular trades within the 401k are subject to their standard commission which is $0 per stock, ETF, and option trade. However, even beyond the Vanguard ETFs, they offer other ETFs commission free as well.

Learn more about in our TD Ameritrade Review.

Recommended Reading: How Much Do You Get From 401k

Invest In Cars Question:

A Solo 401k may passively invest in permissible investments but cant own & operate a business, including buying & refurbishing motor vehicles. You could borrow through a solo 401k participant loan up to 50% of the balance of your account and then use those funds however you wish including buying & refurbishing motor vehicles.

Charles Schwab Solo 401k

Schwab is another discount brokerage that offers a prototype solo 401k plan for free. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered.

I was disappointed to learn that Schwab only offers traditional 401k contributions – they do not have a Roth option on their plan. They also do not offer loans under their plan.

It appears that you can rollover a 401k into your Schwab solo 401k, but you cannot do an IRA rollover.

Schwab does offer a lot of investing options, including Vanguard mutual funds and commission free ETFs.

There are no fees to open the solo 401k, and there are no yearly maintenance fees. Inside the 401k, traditional Schwab pricing applies – $0 per stock trade, with $0 on Schwab funds and ETFs.

Learn more about Charles Schwab in our Charles Schwab Review.

Read Also: How Much In 401k To Retire

Saving For Retirement If Youre Self

Okay, if youre self-employed and don’t have any employees, a one-participant 401also known as a solo 401may be right up your alley. Contributions are tax-deductible, and you can contribute up to $19,500 every year . Then, on top of that, you can put in up to 25% of your incomeas long as what you contribute is less than $58,000 per year.6

Another option is the are primarily used by small-business owners who want to help their employees with retirement, but freelancers and the self-employed can also use this option. You can contribute to your own retirement this way, but again, you cant exceed either 25% of your income or $58,000 .7

Think About Switching Jobs

You may be willing to do without benefits when you start working if your goal is to gain experience, or because you really believe in a company. Some startups may not have retirement plans in the first few years, but they plan to offer them later. But you may want to think about switching jobs to a more established company to make the most out of your savings if you’ve been there for years with no change in benefits.

Read Also: Can You Invest In 401k And Roth Ira

What Do I Have To Do As A Business Owner Who Uses Robs

ROBS has guidelines via the IRS and Department of Labor for small business or franchise owners that use it. These guidelines make sure youre staying compliant, supporting your business, and helping your employees.

- Thrift Savings Plan

- Roth 401, 403, or 457 accounts

Please note that Roth IRAs are not eligible for ROBS because Roth IRA accounts cant be rolled into a 401 plan according to IRS guidelines.

Open Your Account And Find Out How To Conduct A Rollover

After youve found a brokerage or robo-advisor that meets your needs, open your IRA account. Once its open, you can begin the process for rolling over your 401 money into the account.

Each brokerage and robo-advisor has its own process for conducting a rollover, so youll need to contact the institution for your new account to see exactly whats needed. Youll want to follow their procedures exactly. If youre rolling over money into your current 401, contact your new plan administrator for instructions on what to do.

For example, if the 401 company is sending a check, your IRA institution may request that the check be written in a certain way and they might require that the check contains your IRA account number on it.

Again, follow your institutions instructions carefully to avoid complications.

Recommended Reading: How To Open A 401k Plan

Talk To Your Employer

If you don’t have a retirement plan, start by talking about it with your company.

“Sometimes the employer doesn’t know that there’s a need for it, so they don’t look at the options available and set one up for their employees,” said financial advisor Winnie Sun, founder at Sun Group Wealth Partners.

Be sure to let your employer know that there are incentives for them to offer such a plan.

That includes tax credits that are available for employers who sponsor a retirement plan, according to Aaron Pottichen, senior vice president at Alliant Retirement Consulting.

The owner, your boss, could use the plan to shelter their own taxable income. And instead of paying bonuses in cash, they can instead contribute to the savings program and build incentives for employees to stay, Pottichen said.

Dmitriy Fomichenko President Sense Financial

That’s a good question. You will have to check the availability of a 401k plan with your employer. A lot of companies offer a 401k plan, and in your case, you’re eligible to open a 401k plan with your employer. If your employer doesn’t offer one, you can open an IRA instead.

Here is a resource from Investopedia.com to help you get started.

Also Check: Can I Move Money From 401k To Roth Ira

Can I Invest My 401 Myself

Holding more than $3.5 trillion in total assets, Americans have a large amount invested in 401 plans, which have become the main way that most people save for their retirement. With so much riding on your plan, you must make good decisions about how to invest the money in order to meet your financial goals. Fortunately, in most cases, you do have options for investing your 401 yourself.

Investing Outside Of Retirement Accounts

You don’t have to stop saving for retirement just because you reach your maximum allowed savings for the year. You can save with other investments. It doesn’t have to be an official retirement account.

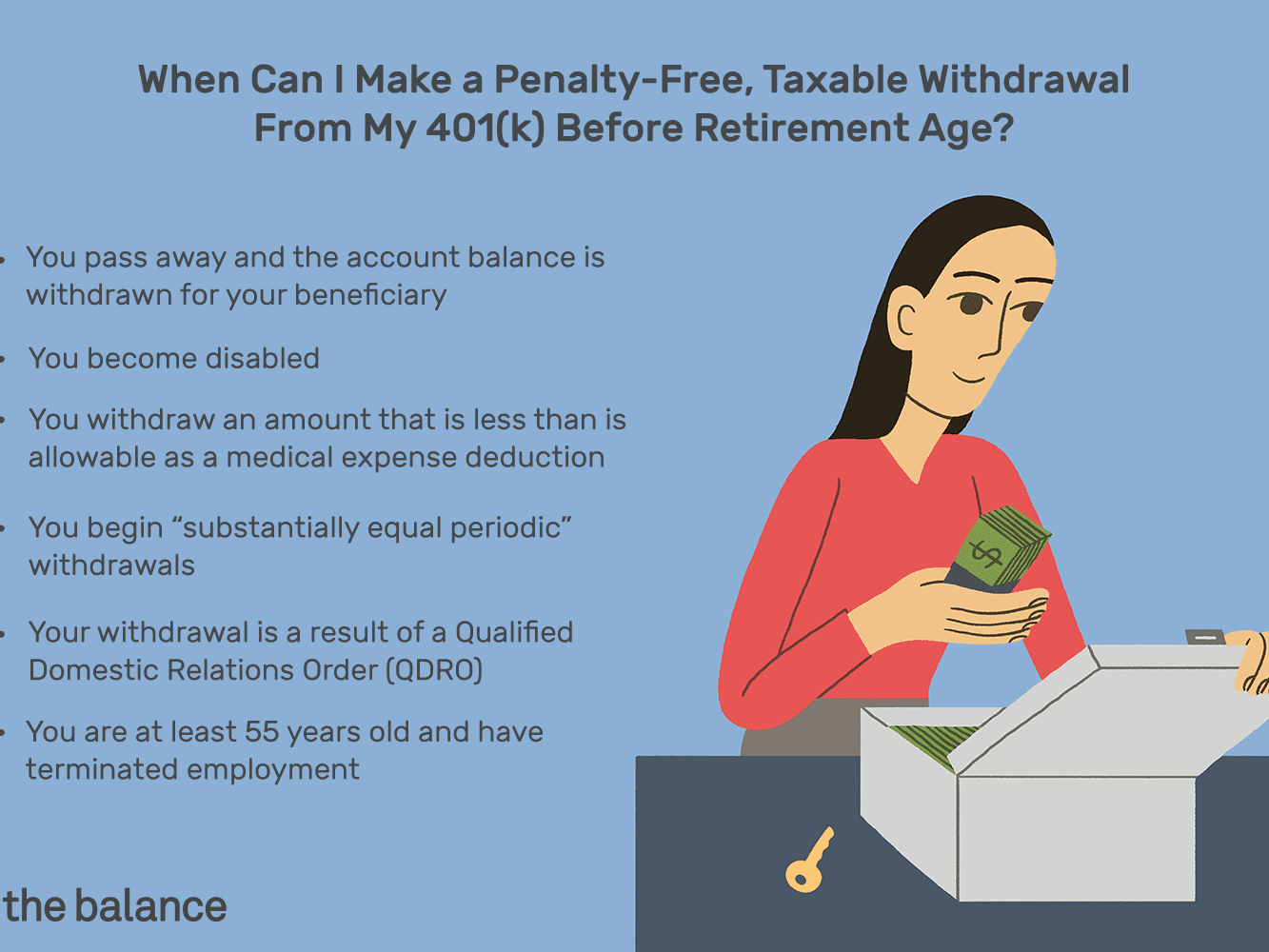

In fact, you’ll want to have a good portion of your benefits in separate accounts if you’re planning on retiring early so you can access the money without being hit with an early withdrawal penalty. You aren’t allowed to take money from either an IRA or a 401 without a 10% penalty until you reach age 59½. But there are a few exceptions.

You may want to retire sooner than that. Other investments will allow you to withdraw money before age 59½ to avoid the penalties.

Read Also: Can You Contribute To 401k And Roth Ira

Buy Bitcoin With Your 401 Savings Or Standard Ira

In as little as a few days from now, you can convert your 401 savings to buy bitcoin.

But most 401 programs dont allow the direct purchase of digital currency. So the easiest and quickest way to get the benefits weve listed above is to use a self-directed Digital IRA.

Self-directed means youre in charge. While that may sound challenging, its really simple. Plus, you get to maintain complete control of your investments. On top of that, IRS guidelines allow these sorts of IRAs to invest in a complete assortment of different assets, including bitcoin. They can include gold, silver, real estate, private equity, and more.

What Is A 401k

A 401k is an employer-sponsored retirement plan that many, but not all, companies establish for their employees and often contribute some amount too. Upon enrollment in the plan, you can choose how much youd like to contribute either a set dollar amount or a percentage of your salary. That amount is then deducted from your paycheck and goes into your 401k investment plan on a pre-tax basis. As of 2019, people can invest up to $19,000 in their 401k each year.

Each plan has its own limited list of available investment options for you to choose from. If you do not select a specific plan, you will be auto-enrolled into a default investment selected by your plan provider.

The big thing to understand about a 401k is that you will be taxed upon withdrawing money from your account in retirement. It doesnt matter if the funds you withdraw came from your own contribution or the earnings from your investment in either case, the funds will be considered part of your gross income on your tax return and taxed accordingly.

Don’t Miss: What Percent Should You Put In 401k

Future Outlook For Silver

A Silver IRA functions in the same manner as your existing IRA, except that you hold tangible silver coins and bars instead of paper assets.

Silver can serve as a long-term hedge against inflation, and so you may want to add it to your assets for retirement. The fact that it is likely to continue to grow in popularity and demand gives it an advantage over conventional investment options. Its proven track record of value spans thousands of years and has even persisted through recent economic hard times.

Our Precious Metals Specialists can help you open a Silver IRA. Call now to further your journey along the path to diversifying your retirement.

Chapter : Comparing Rollovers For Business Start

The small business funding landscape has a variety of options to choose from. Take a look at each of them in comparison to Rollovers for Business Start-ups, to make an informed decision for your business. Why Rollovers for Business Start-ups is a Great Funding Option If you have read the Continue reading

Don’t Miss: Can I Contribute To Traditional Ira And 401k

How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

Do I Have To Quit My Job To Start Or Buy A Business With Robs

Needing to quit your job varies on an individual basis. Some ROBS-eligible retirement plans dont allow rollovers from a plan that belongs to an active employee, which means you may need to leave your job, if thats where the retirement funds are you intend to use for your ROBS transaction. But there are other situations in which you can keep your current job:

- Your retirement plan allows an in-service rollover of company-matched funds that are fully vested, regardless of your age.

- Youre over 59 ½ years old this may also make you eligible for an in-service rollover.

- You have a retirement fund from a previous employer.

Your ROBS provider or your retirement plan broker can help you understand your options.

Don’t Miss: Can I Transfer Money From 401k To Ira

Buying Or Distributing Solo 401k Owned Real Estate Question:

Excellent and popular questions. First, no you cannot buy property such as a condo from your own solo 401k plan as that would result in violation of the following prohibited transaction rule.

Sale, exchange, or leasing of property between a plan and a party in interest .

However, it would not be prohibited if you take an in-kind solo 401k distribution of the property since the rules allow for distributions in the form of an asset instead of cash. You can also spread the tax liability by taking partial in-kind distributions of the property. You will need to get the property appraised each time you process a partial distribution, however.

Disadvantages Of Rolling Over Your 401

1. You like your current 401

If the funds in your old 401 dont charge high fees, you might want to take advantage of this and remain with that plan. Compare the plans fee to the costs of having your money in an IRA.

In many cases the best advice is If it isnt broke, dont fix it. If you like the investment options you currently have, it might make sense to stay in your previous employers 401 plan.

2. A 401 may offer benefits that an IRA doesnt have

If you keep your retirement account in a 401, you may be able to access this money at age 55 without incurring a 10 percent additional early withdrawal tax, as you would with an IRA.

With a 401, you can avoid this penalty if distributions are made to you after you leave your employer and the separation occurred in or after the year you turned age 55.

This loophole does not work in an IRA, where you would generally incur a 10 percent penalty if you withdrew money before age 59 1/2.

3. You cant take a loan from an IRA, as you can with a 401

Many 401 plans allow you to take a loan. While loans from your retirement funds are not advised, it may be good to have this option in an extreme emergency or short-term crunch.

However, if you roll over your funds into an IRA, you will not have the option of a 401 loan. You might consider rolling over your old 401 into your new 401, and preserve the ability to borrow money.

Also Check: How Do I Open A 401k Account