How To Pick An Ira To Roll Over To

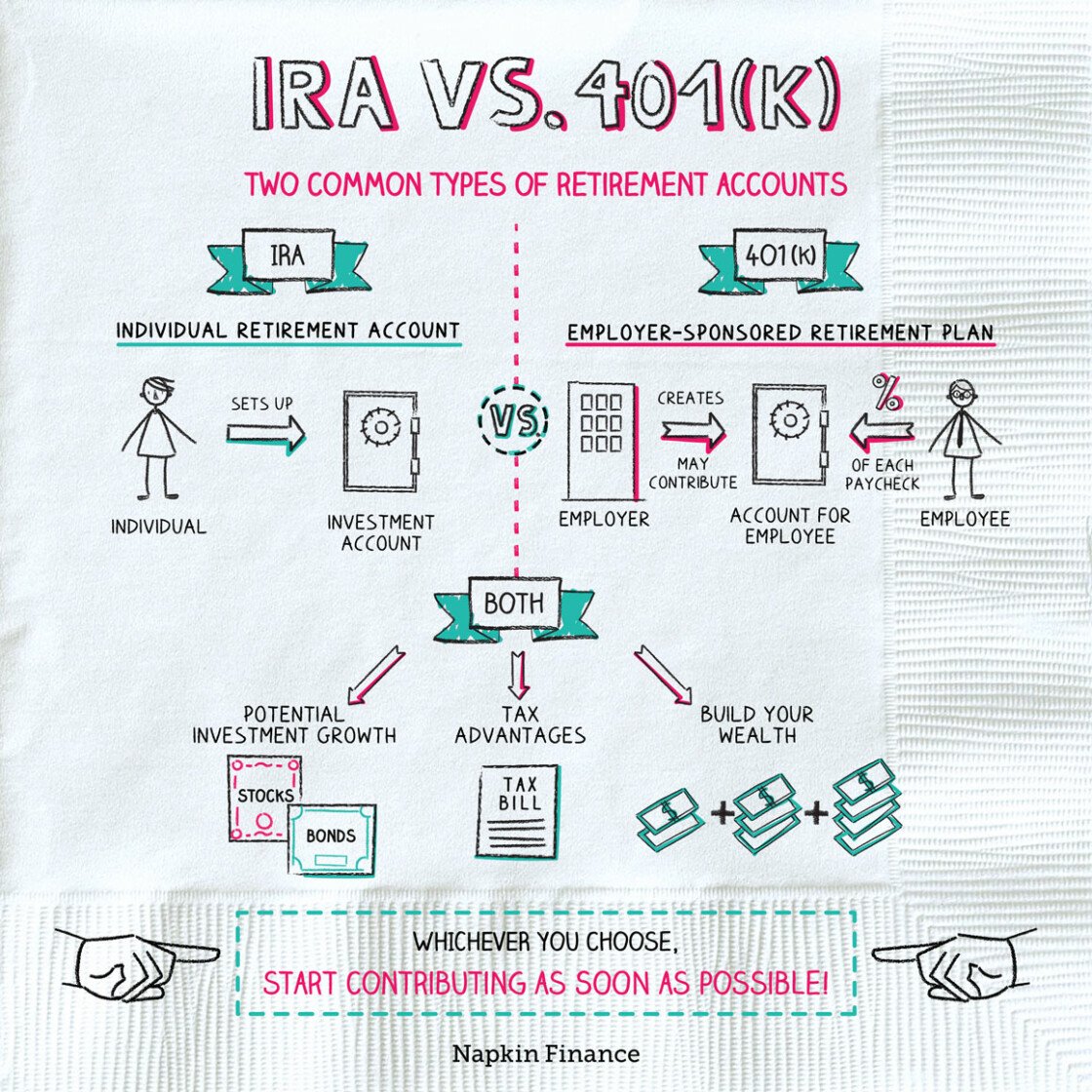

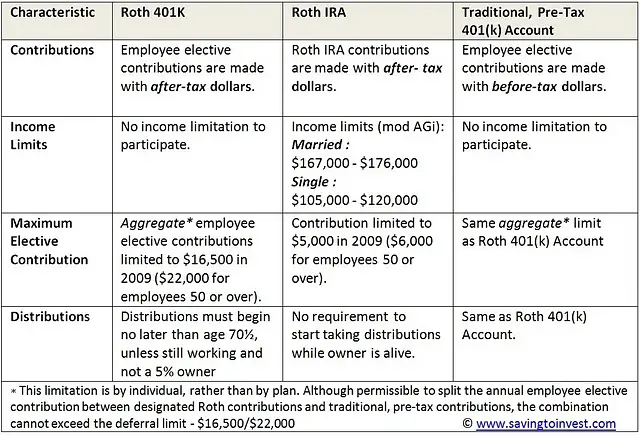

The most important question you need to ask is whether you want to start a traditional IRA or a Roth IRA. Traditional IRAs work much like traditional 401 plans. You contribute money before you pay taxes. The 2021 maximum contribution limit for traditional and Roth IRAs is $6,000.

With a traditional IRA, the money you contribute is deducted from your taxable income for the year. When you reach retirement, the money is taxable as you withdraw it. A Roth IRA, however, works differently. You contribute money post-taxes. The money is then not taxable when you withdraw it in retirement. If you think you might want to keep contributing to your new IRA after the rollover is complete, its important to decide which type of IRA you want.

Its also important to consider the tax implications. If you have a traditional 401 plan, that means you didnt pay taxes on the money when you contributed it to your account. If you want to move that money into a Roth IRA, youll have to pay taxes on it. You can roll over from a traditional 401 into a traditional IRA tax-free. Same goes for a Roth 401-to-Roth IRA rollover. You cant roll a Roth 401 into a traditional IRA.

Contact Your Current 401 Provider And New Ira Provider

Ideally, you want a direct rollover, in which your old 401 plan administrator transfers your savings directly to your new IRA account. This helps you avoid accidentally incurring taxes or penalties. However, not every custodian will do a direct rollover.

In many cases, youll end up with a check that you need to pass on to your new account provider, Henderson says. Open your new IRA before starting the rollover so you can tell the old provider how to make out the check.

The goal, Henderson says, is to avoid having to ever put the money into your personal bank account.

You only have 60 days to complete the transaction to avoid it being a taxable event, and its best to have everything set up before getting that check, Henderson says.

What If I Have Both Pretax And After

Generally, pretax assets are rolled into a rollover IRA or traditional IRA. After-tax assets or after-tax savings) are rolled into a Roth IRA.

You can choose to roll pretax savings into a Roth IRA, but doing so would be treated as a taxable event. Similarly, you can roll after-tax savings into a traditional IRA, but this requires careful tracking of your assets for when you start taking distributions. Before deciding, please consult your tax advisor about your personal circumstances.

Read Also: What Is Qualified Domestic Relations Order 401k

What To Lookout For Can I Move Money From 401k To Roth Ira

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Recommended Reading: When Leaving A Company What To Do With 401k

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around just got easier. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. When you leave the company and want to move your money, allocating these retirement funds to new plans becomes tricky.

The new allocation rules take effect beginning in 2015, but taxpayers can choose to apply them to distributions beginning on September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula. This resulted in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You now can choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

Here’s What You Need To Know About How To Properly Make The Switch

& #169 Jason York

Question: I made after-tax contributions to my 401. When I retire, can I roll that money into a Roth IRA tax-free?

Answer: Yes. After-tax funds can be segregated from other funds in the account and transferred directly to a Roth IRA. In fact, it would be a mistake not to. with contributions to a Roth 401, which are also made with after-tax dollars but to which slightly different rules apply.)

Suppose youre retiring and have $400,000 in your traditional 401 plan, including $50,000 of after-tax contributions. Rather than rolling the entire amount into a traditional IRA, you could move the $50,000 in after-tax contributions to a Roth IRA and roll the remaining $350,000 into a traditional IRA.

But there are some important caveats. You cant move the entire account to a traditional IRA and decide later to convert the after-tax portion to a Roth, says Tim Steffen, director of financial planning for Robert W. Baird you must split off your after-tax contributions at the time of the rollover. Once the money is in a traditional IRA, any distributionsincluding money converted to a Rothwill be taxed based on the ratio of pretax and after-tax assets in the plan.

You May Like: What Is The Interest Rate On A 401k

Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’re a “manage it for me” type or a DIY type.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.

You May Like: How Does Taking Money Out Of 401k Work

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Avoid required minimum distributions : After you reach age 70 1/2, the IRS may require you to take money out of pre-tax retirement accounts, which helps generate tax revenue. But if you are still working, you might be able to wait until you retire to take RMDs from your 401 . Some owners of the business even partial owners arent allowed to use that strategy, so check with the IRS or a good CPA before you attempt this. Switching from an IRA to your 401 allows you to delay taxes, potentially resulting in more compounding.

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

Age 55 withdrawals: 401s can be more flexible than IRAs if youre between the ages of 55 and 59 1/2. With an IRA, you have to wait until age 59 1/2 to take withdrawals without penalty taxes . With a 401, you can take withdrawals without penalty if you retire at 55 or older. Its probably not ideal to cash out all of your retirement money when youre that young, but its an option.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

You May Like: How To Find My 401k Money

What Is A Tax Rate

A tax rate is the percentage at which an individual or corporation is taxed. The United States uses a progressive tax rate system, in which the percentage of tax charged increases as the amount of the person’s or entity’s taxable income increases. A progressive tax rate results in a higher dollar amount collected from taxpayers with greater incomes.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early-withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

Recommended Reading: How To Rollover Fidelity 401k To Vanguard

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

You Can Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

Also Check: How To Pull From 401k

What If You Deposit The Funds In The Wrong Account

When you receive a rollover check, you have 60 days to deposit it into the appropriate account. If you miss the 60-day deadline, your rollover will not count as a rollover and will thus become taxable.

Exceptions to the 60 day rollover time frame are hard to come by unless your financial services company made a gross error. That’s why it’s important to have a clear plan for where your rollover funds are going and to make sure your financial advisor or plan administrator knows exactly where to put the money.

If you do miss your 60-day window, you can look at other ways to get money into a Roth IRA by converting an IRA to a Roth or contributing other eligible earned income to a Roth IRA.

What You Can Do

- Roll over a traditional 401 into a traditional IRA, tax-free.

- Roll over a Roth 401 into a Roth IRA, tax-free.

- Roll over a traditional 401 into a Roth IRAthis would be considered a “Roth conversion,” so you’d owe taxes. Note: A Roth conversion that happens at the same time as your rollover may not be eligible for all plans. We can usually complete the Roth conversion once your pre-tax assets arrive into your Vanguard IRA account, though.

Don’t Miss: Can You Have A Roth Ira And A 401k

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, youll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. If you convert in January, for example, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.