What Is The Easiest Way To Add Money To A Self

There are two types of transactions that let you re-arrange funds between multiple IRAs. These are known as transfers and rollovers. Remember, you have to stay in line with the rules we mentioned above. Roth accounts are, by definition, funded after taxes are paid. Therefore, you cant roll pre-tax funds into one. At least not without getting in trouble with Uncle Sam. We promise you dont want that.

Know The Rules For Roth 401 Rollovers

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

If you have moved jobs while holding a traditional 401, you are probably familiar with the rollover options for these ubiquitous retirement accounts. You may be less sure, though, of your options when you leave an employer with whom you hold a Roth 401, the newer and less prevalent cousin of the traditional 401.

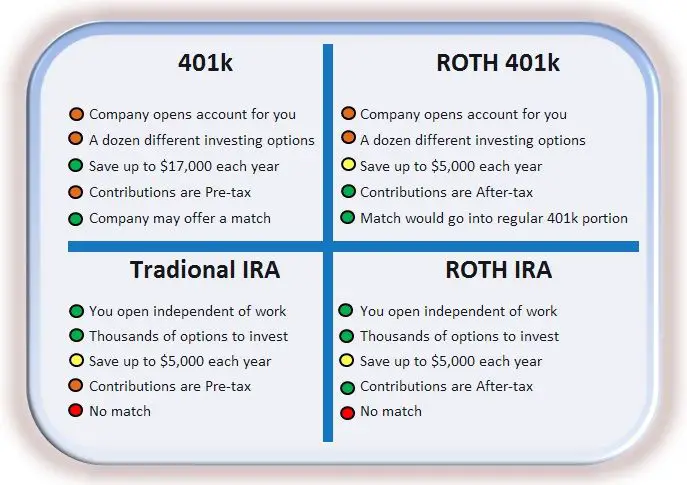

The main difference between the traditional 401 and the Roth 401 is that the former is funded with pretax dollars while Roth contributions are in post-tax dollars so there is no tax hit from a qualified withdrawal made in the future.

If your job is at stake, or you are considering a career move, here are your options regarding your Roth 401 account when changing employers.

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.

Don’t Miss: How Do You Take Money Out Of 401k

Are You A Us Citizen Or A Us Person For Tax Purposes

If yes, your client will likely have a bigger tax bill from collapsing a retirement plan than someone whos not. But it depends.

While Canadian residents are only taxed 15% on 401 and IRA withdrawals, withdrawals for U.S. persons are taxed as ordinary income at their marginal rate, which is usually higher than 15%. So, a 60-year-old U.S. person in the 33% bracket would only net $67,000 when collapsing a $100,000 IRA. If he transferred his IRA to an RRSP, his FTC would be $33,000 and he would need to owe $33,000 in Canadian tax to be in a tax-neutral position. The larger the FTC, the more unlikely it is that the person has enough Canadian tax owing to offset the entire FTC.

In the Go Public case mentioned earlier, the couples bank overlooked the fact that the husband was a U.S. citizen. Which brings us to

One: Roll Over Your 401 To A Traditional Ira

Contributions to your 401 plan were pre-tax. This means your employer deducted them from your taxable salary when reporting your income to the IRS. Same goes for any employer matches. So you have yet to pay taxes on any contributions and on any accrued earnings.

Traditional individual retirement accounts are also tax-advantaged. The difference, of course, is that individuals rather than employers send their contributions to their financial institutions and claim the deduction when filing their taxes. So like 401 balances, the money in an IRA is tax-deferred. You wont owe taxes on it until you retire and start taking distributions.

This is why rolling over your 401 to a traditional IRA is fairly straightforward. Its an apples-to-apples transaction.

Also Check: How To Collect My 401k Money

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

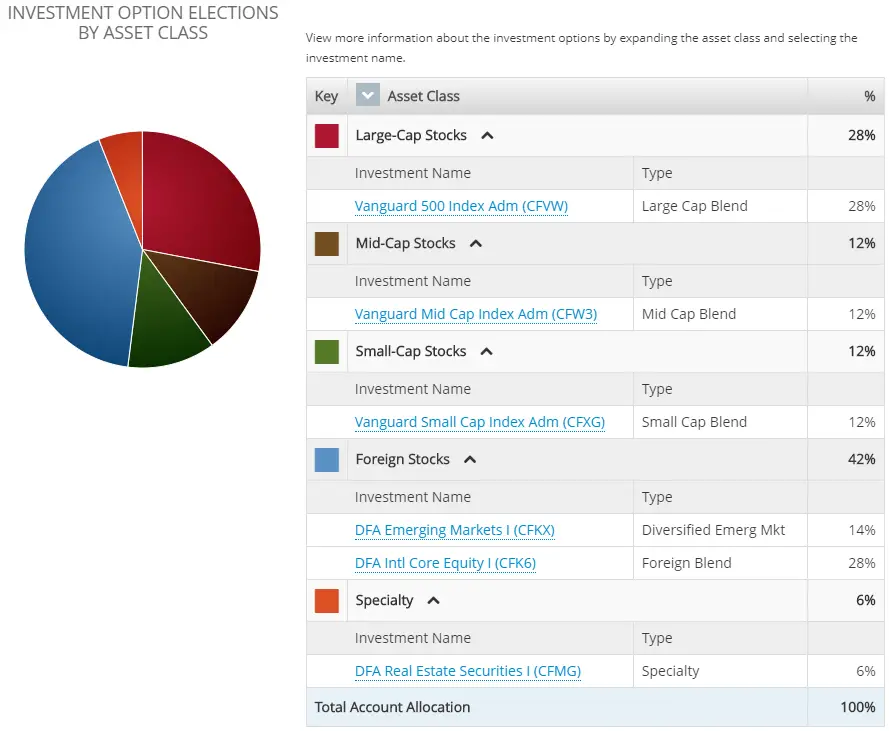

Recommended Reading: How To Diversify 401k Portfolio

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Roth Conversion: Things To Be Aware Of

Roth IRAs have a 5-year aging rule which requires you to wait 5 years after your first Roth IRA contribution before you can withdraw earnings tax-free in retirement or qualify for an exception to the 10% penalty.

There’s also a 5-year waiting period for conversions money). In this case, if you are under the age of 59½, you’ll need to wait 5 years before you can withdraw that money without incurring a 10% penalty. Note that this only applies to taxable money that was converted it does not apply to any balances that were not taxable when converted.

Another important fact to understandthere’s no way to undo a Roth conversion.

Before the Tax Cuts and Jobs Act was enacted in December 2017, you could undo a Roth conversion. That option is no longer available.

Finally, investors should be aware that taxes are not the only factor when it comes to rolling funds from a 401 plan to an IRA, of any type. There may be considerations related to fees, investment choices, creditor protection, RMDs, and other factors that need to be weighed in deciding whether a rollover is appropriate for you. Consider consulting a financial advisor before making any decisions.

Read Also: How Do I Know Where My 401k Is

Why The Roth 401k Is The Unsung Hero Of Retirement Plans

One retirement savings vehicle doesn’t get the attention it deserves, according to one financial expert. The Roth 401k is “the unsung hero, if you will, of your retirement plan,” Sun Group Wealth Partners Managing Director Winnie Sun, especially for her clients whose “No. 1 goal” is to have tax-free savings in retirement.

Need To Open A Roth Ira

My favorite online broker is Ally Invest but you can check out our recap on the best places to open a Roth IRA and the best online stock broker sign up bonuses. There are many good options out there, but I have had the best overall experience with Ally Invest. No matter which option you choose the most important thing with any investing is to get started.

You May Like: Why Cant I Take Money Out Of My 401k

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors in your area in 5 minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

Also Check: How To Withdraw My 401k From Fidelity

What Happens If I Take A Distribution From My Designated Roth Account Before The End Of The 5

If you take a distribution from your designated Roth account before the end of the 5-taxable-year period, it is a nonqualified distribution. You must include the earnings portion of the nonqualified distribution in gross income. However, the basis portion of the nonqualified distribution is not included in gross income. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to the total designated Roth account balance. For example, if a nonqualified distribution of $5,000 is made from your designated Roth account when the account consists of $9,400 of designated Roth contributions and $600 of earnings, the distribution consists of $4,700 of designated Roth contributions and $300 of earnings .

See Q& As regarding Rollovers of Designated Roth Contributions, for additional rules for rolling over both qualified and nonqualified distributions from designated Roth accounts.

This Is How You Convert An Inherited 401 To A Roth Ira

Jim Blankenship is the founder and principal of Blankenship Financial Planning, Ltd., a financial planning firm providing hourly, as-needed financial planning and advice. A financial services professional for over 25 years, Jim is a CFP professional and has earned the Enrolled Agent designation, a designation that qualifies him as enrolled to practice before the IRS. Jim is also a NAPFA-registered financial advisor, which designates him as a Fee-Only Financial Advisor.

One of the provisions that is available to the individual who inherits a 401 or other Qualified Retirement Plan is the ability to convert the fund to a Roth IRA.

This gives the beneficiary of the original QRP the option of having all of the tax paid up front on the account, and then all growth in the account in the future is tax free, as with all Roth IRA accounts.

Whats a bit different about this kind of conversion is that, since it came from an inherited account, the beneficiary must take distribution of the account over his or her lifetime, according to the single life table. This means that, in order for this maneuver to be beneficial, the heir should be relatively young, such that there will be time for a lengthy growth period for the account making the tax-free nature of the Roth account worthwhile.

Also Check: Can You Roll A 401k Into A Roth

Five Questions To Ask Yourself Before Switching To A Roth 401

Roth 401k vs traditional. Comparison of retirement plans.

getty

If you have a 401 at work, youre probably familiar with the standard advice about such plans: make sure to contribute enough to receive any employer match and make the maximum contribution if youre able. But some employers offer both a traditional 401 and a Roth 401, and it can be difficult to determine if it makes sense to switch. It is worth understanding how the two types of retirement accounts work along with five questions to ask yourself to select which one is best for you.

Traditional vs. Roth 401s

Regardless of the kind of 401 account you use, you still have the same contribution limit: in 2021, you can save a total of up to $19,500, plus an additional $6,500 if youre over age 50. When you reach retirement, both kinds of 401s have required minimum distributions for account holders over the age of 72. This is a significant difference from a Roth IRA, which has no distribution requirements. The owner of a Roth 401 could eliminate their distribution requirement by rolling it into a Roth IRA, though he or she would want to compare the particulars of both accounts before doing so.

The Roth 401 essentially works the opposite way: contributions are made with post-tax dollars, providing no tax benefit in the year of the contribution, but withdrawals are tax-free as long as youre over age 59 ½ and have held the account for at least five years.

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Also Check: How To Know If You Have A 401k

Recommendation Roth 401k Transfer To Roth Ira

Our #1 choice for high interest savings account is BlockFi. BlockFi offers a fantastic solution to the old, obsolete, typical savings accounts which

usually pay.03% APY or much less. Roth 401k Transfer to Roth Ira

High Yield Savings in cryptocurrency are an excellent method to get interest on your cryptocurrency.

Its likewise easy to protect super fast lendings against it. They are simply launching their BlockFi bank card and also ought to be a welcome enhancement.

Roth 401 And Roth Ira Income Limits 2021

Roth IRAs have income limits. If you make too much money, you are not eligible to contribute to a Roth IRA. Those limits for 2021 are $140,000 Modified Adjusted Gross Income for single filers and $208,000 MAGI for Married Filing Jointly.

Roth 401s do not have income limits. Regardless of how much you make, if your company offers a Roth 401 option, you can participate. This difference allows higher-income earners to have tax-free retirement savings they might not otherwise have had.

Don’t Miss: How To Pull From 401k

Is A Distribution From My Designated Roth Account For Reasons Beyond My Control A Qualified Distribution Even Though It Doesn’t Meet The Criteria For A Qualified Distribution

No, if you have not held the account for more than 5 years or if the distribution is not made after death, disability, or age 59 ½, then the distribution is not a qualified distribution. However, you could roll the distribution over into a designated Roth account in another plan or into your Roth IRA. A transfer to another designated Roth account must be made through a direct rollover.

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Don’t Miss: How Do I Cash Out My 401k Early