Should You Split Contributions Between The Two

Splitting your contributions between a Roth and a traditional 401 has its benefits.

Namely, allowing you to enjoy tax-free retirement income on some of your money while paying taxes on some.

But even though your employer may allow split contributions, should you divide your contributions?

Ideally, it might be easier to focus on one aspect of saving entirely.

Iras Offer A Better Investment Selection

If you want the best possible selection of investments, then an IRA especially at an online brokerage will offer you the most options. Youll have the full suite of assets on offer at the institution: stocks, bonds, CDs, mutual funds, ETFs and more.

Generally, for investment selection and overall management of your funds, I would say IRAs have a clear advantage, says Lackwood.

In contrast, 401 plans usually offer only a relatively small selection of investments, even if it does offer the key fundamental types, such as a money market fund and a Standard & Poors 500 index fund.

Usually, employers restrict the 401 the choice of investments to 15-20 positions whereas an IRA allows thousands of different choices, says Lackwood.

IRAs tend to allow significantly more investment options than the average 401 plan does and can therefore be better tailored to each individual, says Burke.

Suggested Next Steps For You

Whether youre looking for additional tax deductions or just a way to boost your savings, talk to your Personal Capital financial advisor about opening an IRA in addition to your workplace 401k. Once you retire, youll be glad you saved for all those years.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital. Personal Capital Advisors Corporation is an investment adviser registered with the Securities and Exchange Commission . Registration does not imply a certain level of skill or training nor does it imply endorsement by the SEC.

Recommended Reading: How To Avoid Penalty On 401k Withdrawal

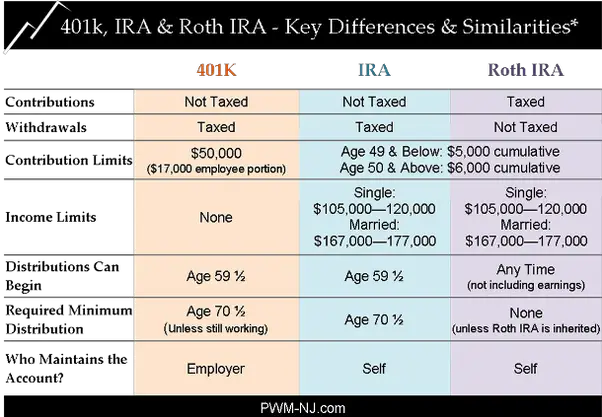

Contribution And Income Limits

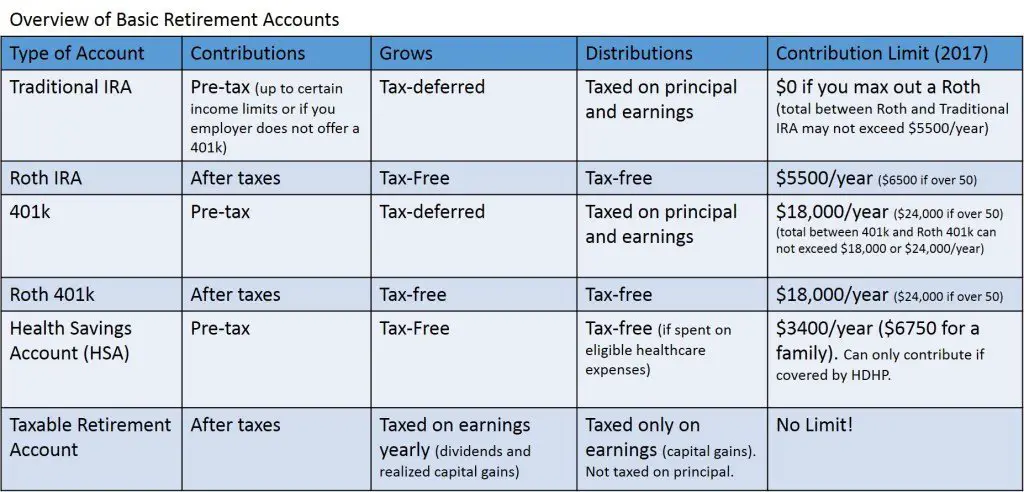

With both Roth and Traditional IRAs, you can contribute up to $6,000 annually for 2021. If you’re over the age of 50, you qualify to make extra or catch-up contributions up to $1,000 each year. Anyone can open a traditional IRA and contribute funds.

In order to contribute to a Roth IRA, your modified gross income must be less than $125,000 if you’re single and $198,000 if you’re married and file taxes jointly. These income limits are subject to change each year.

With a SEP IRA, you can contribute up to $58,000 or 25% of your income each year.

Who Is Eligible To Open An Ira Can Anyone Open One

- Traditional IRA. If youre younger than 72 and you have taxable income, you or your spouse can contribute to a traditional IRA. How much of your contributions will be deductible will depend on your income and filing status.

- Roth IRA. Anyone with earned income under a certain limit, and his or her spouse, can open and contribute to a Roth IRA. Theres no age restriction.

Read Also: How To Recover 401k From Old Job

How Are They Different

| Employers provide a 401 to employees as a benefit | An IRA is an individual retirement account, so it belongs to you individually |

| Lowers your taxable income because most 401 contributions are made before taxes are taken out | Your traditional IRA contributions are made from your taxable earnings, you are then permitted to deduct the contributions from your income in certain situations |

| The employer selects the investment options offered in the plan | Typically offers a wider range of investment options than a 401 |

| The employer may match up to a certain percentage of your contribution | Isnt tied to your employer, so you dont get a match on your contributionhowever, you have more control and flexibility when and how you contribute |

| You may be able to roll over an old 401 from a previous job into the 401 at your current job | You can roll multiple outside accounts like old 401s or other IRAs into one IRA to simplify your savings |

What Is The Savers Credit

To encourage taxpayers to save for retirement, the government offers an incentive: the Retirement Savings Contributions Credit, also known as the Savers Credit. Available to low- and moderate-income earners, you may be eligible for the credit if:

You make contributions to an IRA or an employer-sponsored retirement plan

You are age 18 or older

Youre not a full-time student

You arent claimed as a dependent on someone elses tax return

For IRA contributions, the amount of the Savers Credit is 50%, 20%, or 10% of your contributions, depending on your adjusted gross income. The maximum qualifying contribution is $2,000 , so the maximum Savers Credit is $1,000.

Recommended Reading: What Is An Ira Account Vs 401k

Can I Roll Over My Workplace Retirement Plan Account Into An Ira

Almost any type of plan distribution can be rolled over into an IRA except:

-

Distributions of excess contributions and related earnings,

- A distribution that is one of a series of substantially equal payments,

- Withdrawals electing out of automatic contribution arrangements,

- Distributions to pay for accident, health or life insurance,

- Dividends on employer securities, or

- S corporation allocations treated as deemed distributions.

For details, see rollovers of retirement plan distributions. Distributions from a designated Roth account can only be rolled over to another designated Roth account or to a Roth IRA.

Yes If You Can Max Out Both Accounts

Heres a simple question to ask yourself: Can I contribute to 401 and IRA plans up to the annual limits, based on my income and spending? If so, this can go a long way in funding your dreams for retirement.

This assumes, of course, that you can realistically afford to contribute $19,500 to a 401 each year along with up to $6,000 to an IRA. If youre trying to pay down debt, save for your childs college expenses, or reach other financial goals, then fully funding multiple retirement accounts may not be realistic.

If you are planning to contribute the maximum to both a traditional IRA and a 401, consider your budget and spending. And youll need to do some research into how that may affect your retirement tax deductions.

Don’t Miss: How Do I Transfer 401k To New Employer

Lets Take A Further Look At The Limitations

For an SEP plan, your contribution each year cannot exceed the lesser of 25% of your compensation or $57,000 for 2020. Catch-up contributions do not apply to employer contributions. The maximum amount of self-employment compensation that applies for 2020 is $285,000. For self-employed individuals, the amount of compensation used for these purposes is your net earnings from self-employment less the deductible portion of self-employment tax, and the amount of your own retirement plan contribution deducted on the 1040. These limits not only apply to an SEP plan. They are the total limits for all defined contribution plans.

For a 401 plan, the 2020 limit is $19,500, plus a $6,500 catch-up contribution for those individuals over age 50. If these limits are less than a participants compensation in a year, the contributions are limited to 100% of compensation.

This Is A Great Question The Answer Is Yes You Can Have Both Should You Have Both It Depends

-

Yes, you can contribute to both a 401 and an IRA at the same time.

-

If youre under 50, you can contribute $19,500 to a 401 for 2021. Those age 50+ can contribute an additional $6,500 for a total of $26,000.

-

On top of that, those under 50 can contribute an additional $6,000 to an IRA. Those age 50+ can contribute $7,000.

Everyone knows that its important to save for retirement. But not everyone knows how. This is because there are many different ways you can save for retirementeither through your employer or on your ownand the different options may make retirement planning feel like solving a Rubiks cube to most.

Our customers have access to a personalized retirement plan, which offers recommendations on how they should save for retirement. Depending on your plan and personal situation, our advice can sometimes be to contribute to both a 401 through work while also contributing to an IRA on your own.

Generally, you can contribute to both a 401 and an IRA at the same time.

Recommended Reading: How To Pull From 401k

Do I Have To Start Taking Money Out Of My Ira At A Certain Age

- Traditional IRA. If your 70th birthday falls after July 1, 2019, you must start taking required minimum distributions at age 72 or face a heavy tax penalty.2

- Roth IRA. You actually dont have to withdraw any money at all. However, if you want to, you can start withdrawing funds once youve reached age 59½ and have had your account for at least 5 years.

You also will need to take the RMD if you have a rollover, SEP, SIMPLE IRA and for most 401 or 403 accounts.

When A 401 Is Better

A 401 is a better option than an IRA if you are looking to invest more for retirement and you’re not too picky about the investment options. Most plans are limited to which securities the employer chooses.

A 401 could also be better if your employer is offering to match your contributions and you plan to stay at the job for a while. If you’re contributing 3% of your income, an employer match would double that to 6%, so you’d basically be adding free money to your retirement account.

If you struggle with intentionally setting aside money to save, you’ll like the consistent pre-tax contributions before you even see your paycheck.

“Most people utilize a 401 through their employer and while I don’t have a problem with this, I typically recommend that people only participate in the plan up to the amount that the employer matches, typically 3%,” says Kovar. “If you are able to save more than what the employer matches, put that extra money into an IRA.”

| Pros | |

|

|

Also Check: How To Open A Solo 401k

Whats The Difference Between An Ira And A 401

As the name implies, an IRA is opened by an individual. A 401, on the other hand, is an employer-sponsored retirement plan. It allows employees to have money automatically deducted from their paychecks and put into their tax-advantaged 401 accounts. Employers can also match some or all of these contributions.

Other examples of employer-sponsored plans are:

- 403: offered by government or non-profit organizations

- 457/457: offered by state and local governments and some nonprofits

- Thrift Savings Plans : offered by the federal government and U.S. military

How To Get Started Investing In Either Iras Or 401s

If you want a 401 plan, check to see what your employer offers. You can only get a 401 plan through your job. The HR department is a good place to start looking for information about 401 plans at your work.

If you want an IRA, all you need to do is open an account with a broker. Figure out which IRA is best for you . Deposit your money and make sure its invested.

IRAs and 401s are not mutually exclusive you can get both.

Also Check: Why Cant I Take Money Out Of My 401k

How Much Does It Cost To Open An Ira

Most of the time, there are no account fees or minimums associated with opening an IRA. So, you can get started without having to contribute right away. However, some brokers or financial institutions do assess some charges or have limits. Account maintenance, brokerage commissions and other related fees vary by company and retirement savings options.

What If You Contribute Too Much

If you discover that you have contributed more to your IRA than you’re allowed, you’ll want to withdraw the amount of your overcontribution, and fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You will also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. What’s more, if you are under 59½, you’ll owe a 10% early withdrawal penalty on that amount.

You May Like: How Do I Transfer My 401k To A Roth Ira

Will I Have To Pay The 10% Additional Tax On Early Distributions If I Am 47 Years Old And Ordered By A Divorce Court To Take Money Out Of My Traditional Ira To Pay My Former Spouse

Yes. Unless you qualify for an exception, you must still pay the 10% additional tax for taking an early distribution from your traditional IRA even if you take it to satisfy a divorce court order ). The 10% additional tax is charged on the early distribution amount you must include in your income and is in addition to any regular income tax from including this amount in income. Unlike distributions made to a former spouse from a qualified retirement plan under a Qualified Domestic Relations Order, there is no comparable exception.

The only divorce-related exception for IRAs is if you transfer your interest in the IRA to a spouse or former spouse, and the transfer is under a divorce or separation instrument ). However, the transfer must be done by:

- changing the name on the IRA from your name to that of your former spouse , or

- a trustee-to-trustee transfer from your IRA to one established by your former spouse. Note: an indirect rollover doesn’t qualify as a transfer to your former spouse even if the distributed amount is deposited into your former spouse’s IRA within 60-days.

See Retirement Topics – Divorce

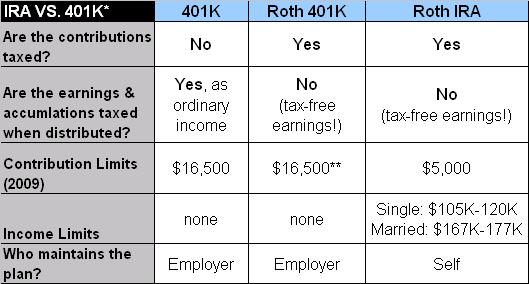

Tip : Tax Rateshigher Now Or Later

Retirement accounts like 401s, 403s, and IRAs have a lot in common. They all offer tax benefits for your retirement savingslike the potential for tax-deferred or tax-free growth. The key difference between a traditional and a Roth account is taxes. With a traditional account, your contributions are generally pretax. They generally reduce your taxable income and, in turn, lower your tax bill in the year you make them. On the other hand, you’ll typically pay income taxes on any money you withdraw from your traditional 401, 403, or IRA in retirement.

A Roth account is the opposite. Contributions are made with money that has already been taxed , and you generally don’t have to pay taxes when you withdraw the money in retirement.1

This means you need to choose between paying taxes now or in retirement. You may want to get the tax benefit when you think your marginal tax rates are going to be the highest. In general:

You May Like: How To Make 401k Grow Faster

How Long Do I Have To Roll Over A Distribution From A Retirement Plan To An Ira

You must complete the rollover by the 60th day following the day on which you receive the distribution. You may be eligible for an automatic waiver of the 60-day rollover requirement if a financial institution caused the error and other conditions are met. See Publication 590-A, Contributions to Individual Retirement Arrangements and Retirement Plans FAQs relating to Waivers of the 60-Day Rollover Requirement.

Can I Contribute To An Ira On Social Security

Numerous avenues of saving for retirement exist for Americans, including the individual retirement account . An IRA allows you to save money and accrue interest in a protected account throughout your life and begin withdrawing upon reaching age 59 1/2. Determining whether you can contribute to an IRA on Social Security requires an examination of rules and laws concerning IRAs and the nature of the Social Security program.

Also Check: Can You Convert Your 401k To A Roth Ira

You Can Take A Loan On A 401

Generally if you take out cash from an IRA or a 401, youll likely be charged taxes and penalties. But the 401 may allow you to take out a loan, depending on how your employers plan is structured.

Another clear advantage is that you can take loans from a 401 and continue to contribute to your 401, says Lackwood.

Like a normal loan, youll have to pay interest, and youll have a repayment period, not more than five years. But the rules differ from plan to plan, says Lackwood, so youll have to check on your specific 401 rules to see what youll need to do.

You can also take cash from a 401 for a hardship withdrawal, and you can do so from an IRA, too. But the terms in each case are strict.

401s allow for emergency withdrawals, but most plans offered through employers are very rigid and dont have much flexibility, says David Wilson, CFP and founder of Planning to Wealth.

But taking a non-retirement withdrawal can drastically set back your retirement plans.