What’s My 401 Cost Basis

I participate in a 401 where my employer matches my contributions. Is the employer match included in the cost basis of the 401’s investments when I start to take distributions, or are only my personal contributions to the account included in calculating my basis? — Bruce Ryan

Bruce,

Your 401 doesn’t have a cost basis unless you’ve made after-tax contributions.

Ask your tax questions on the

TSC Tax Forum board.

Pretax contributions, including your employer’s match, have no cost basis. When you take distributions, you will pay tax on the fair market value of the investments you are withdrawing from the account, says Bill Fleming, director of personal financial services for

PricewaterhouseCoopers

in Hartford, Conn.

If your employer allows you to make after-tax contributions, that money would have a cost basis since you’ve already paid tax on those amounts. Keep track of that basis so you don’t pay tax again on that money when you withdraw it. But you’ll still owe tax on any earnings.

What Is 401 Matching

401 matching is when your employer makes contributions to your 401 on your behalf. It is called matching because the contributions your employer makes are based on employee contributions i.e. the contributions you make.

For example, you employer can offer a 100% match on up to 5% of your income. That means, for every dollar you contribute to your 401, up to 5% of your paycheck, your employer will also contribute one dollar.

100% Match on 4% of income at $50,000 salary.

| Your contribution | |

| $5,000 | $2,000 |

Once you contribute up to the matching limit, which in this example is 5% of your income, your employer stops contributing, but you can continue to contribute. That means that you want to contribute up to the matching limit if at all possible, to get the most value out of the match.

Employer matching plans can get complicated depending on your employer. Some employers offer graduated matching tiers, such as 100% match on the first 4% of income and a 50% match on the next 4%, giving you a 6% contribution if you make an 8% contribution.

100% Match on 3% and a 50% match on the next 3% of income at $50,000 salary.

| Your contribution |

| $2,250 |

Read the specifics of your plan to learn exactly how much your employer will contribute and how much you need to contribute to max out the benefit.

Are Exchange Members Traders

I am a self-employed local floor trader of futures in Chicago. I know that I will be defined as a “trader” by the IRS, given my trading activity. I am curious to find out if I am subject to self-employment tax. I am not certain if the standard definition of a “trader” applies to me because I am a member of the Chicago Board of Trade. I am currently getting inaccurate information on this from both sides. — Dan Szeezil

Dan,

You can be a member of the Chicago Board of Trade or any exchange and still qualify for trader status, says Gail Winawer, tax securities partner at

American Express Tax & Business Services

in New York.

But saying you’re “self-employed” raises other issues. Does that mean you’re a one-man shop who trades for others? Or do you just trade for yourself?

If you trade for others and collect commissions, you’re a dealer, and you can’t qualify for trader status. Your gains and losses will be subject to ordinary income tax. But if you keep a separate account that you trade for yourself, you could claim trader status when reporting that income and the related expenses.

If you have a seat on the exchange and just trade for yourself, you can qualify for trader status, and you won’t be subject to self-employment tax. See our

Taxes for Traders series for more of the pros and cons of trader filing status.

Recommended Reading: Can You Roll A Traditional 401k Into A Roth Ira

Why Do Employers Match 401s Anyways

401s and other defined contribution plans are more cost-effective for the employer than managing a traditional pension plan funded entirely by the company, and are also preferred by most private-sector employees.

While an employer match is not required by the IRS, this company match can be a selling point for recruiting employees particularly if competing firms are offering a generous 401 matching plan.

Employers also get tax benefits for contributing to 401 accounts employer matches can be deducted on their federal corporate income tax returns, and theyre often exempt from payroll taxes and state taxes as well.

Not Sure How Much To Contribute To Your 401 Try This

Here’s a closer look at a few approaches you can use to decide how much you want to contribute to your 401 going forward.

A good starting point: Get your full employer match

If you’re starting a new job and your employer asks how much you want to defer to your 401 from each paycheck, your answer should be at least enough to get your company’s full match. That assumes it offers one, of course. These funds are basically like a bonus for you, but you have to contribute to your retirement account in order to claim it.

Each company has its own matching structure that determines how much it will contribute to your 401. Usually, this involves a dollar-for-dollar match or a $0.50 on the dollar match up to a certain percentage of your income. If your company does a $0.50 on the dollar match up to 6% of your salary and you earn $50,000 per year, you would contribute 6% of your salary, or $3,000. Then, your employer would match half of this, contributing another $1,500 on your behalf. You’re free to contribute more if you want, but you’re on your own from there.

If you’re unsure how your company’s 401 match works, ask your HR department to find out. Then, make sure it’s feasible for you to contribute enough to get your full employer match. If doing so would make it difficult to pay your bills right now, scale your contributions back. The solution below may work better for you.

The bare minimum: Start with 1% of your salary

The ideal: Create a custom retirement plan

Read Also: Can You Contribute To 401k And Roth Ira

What’s The Cost Basis Of My Employer’s 401 Contribution

Happy New Year! If you’re reading this, you survived the Y2K Armageddon. And so did we!

And no doubt, the

Internal Revenue Service

did, too. So, let’s get down to the business of coping with taxes in the new millennium. Today, we’ll help you figure out your 401 cost basis, examine whether stock or commodities exchange members can be traders, determine if paying your parents’ bills is a gift for tax purposes and discuss whether W-2 income disqualifies you from trader status.

Send any other questions to

Understand The Importance Of 401 Contributions

Financial experts typically recommend you save at least 15% of your pre-tax income for retirement. One of the benefits of contributing to a traditional 401 is that you contribute using pre-tax income, which also means you get a tax deduction on your contributions. For example, if you make $3,000 a month and contribute $100 a month to your 401, this would reduce your taxable income or the amount of your income the government can tax to $2,900 a month.

Another reason to contribute to a 401 is that time in the market or the amount of time your money is invested gives your money time to potentially grow and recover from economic swings. This can be a better approach than trying to predict when the stock market will go up or down. Even the most seasoned investors and experts have no idea when this will happen, so it’s therefore wise to invest steadily over time.

An employer match is another good reason to contribute to a 401. Some employers will match your contributions up to a certain percentage. For example, if you contribute 3% of your salary to a 401, your employer might also contribute 3%. This is essentially free money you can use to grow your retirement savings, so try to contribute at least the amount your employer matches, if possible, to take full advantage of this benefit.

Read Also: What Is Max Amount To Contribute To 401k

What Is Contribution Amount

What is Contribution? Contribution is the amount of earnings remaining after all direct costs have been subtracted from revenue. This remainder is the amount available to pay for any fixed costs that a business incurs during a reporting period. Any excess of contribution over fixed costs equals the profit earned.

Decide How Much You Want To Save

Once you have a target retirement age, you can work to decide what percentage of your income you’re able to save. First, look at all your expenses and your after-tax monthly income. How much do you have left over? If it’s $500 a month, you may decide to put $250 into your 401 and the remaining $250 into an emergency fund.

You can also schedule automatic monthly withdrawals from your checking or savings account to go toward your retirement account. That way, you never have to think about it. This can also help build your savings habit. After all, if the money immediately goes into your retirement account each month, you likely won’t miss it.

You May Like: How Much Do You Get From 401k

General Pros And Cons Of A 401

Pros

Cons

- Few investment optionsGenerally speaking, 401s have few investment options because they normally originate from employers, they are limited to what is offered through employers’ 401 plans, as compared to a typical, taxable brokerage account.

- High feesCompared to other forms of retirement savings, 401 plans charge higher fees, sometimes as a percentage of funds. This is mainly due to administration costs. Plan participants have little or no control over this, except to choose low-cost index funds or exchange-traded funds to compensate.

- Illiquid 401 funds can only be withdrawn without penalty in rare cases before 59 ½. This includes all contributions and any earnings over time.

- Vesting periodsEmployers may utilize vesting periods, meaning that employer contributions don’t fully belong to employees until after a set point in time. For instance, if an employee were to part ways with their employer and a 401 plan that they were 50% vested in, they can only take half of the value of the assets contributed by their employer.

- Waiting periodsSome employers don’t allow participation in their 401s until after a waiting period is over, usually to reduce employee turnover. 6 month waiting periods are fairly common, while a one-year waiting period is the longest waiting period permitted by law.

Consider Opening A Roth Or Traditional Ira

Along with contributing to your 401, consider opening a Roth or traditional IRA. A Roth IRA is funded with after-tax dollars, while a traditional IRA is funded with pre-tax income.

Once you reach age 59½, both Roth and traditional IRAs allow you to withdraw money without incurring tax penalties, as long as other requirements are met. A Roth IRA allows you to take out money without needing to pay taxes on the withdrawals. A traditional IRA allows you to save pre-tax dollars which can help build your retirement savings and allow you to deduct your contributions, thereby reducing your taxable income but you’ll have to pay taxes on withdrawals.

If you have additional money left in your budget at the end of the month, funding IRAs can help put you on the path to a more comfortable retirement. Again, the more time your funds have to grow, the larger they could potentially be when you’re ready to retire.

If you’re still wondering how much you should put in a 401 in your 20s, consider reaching out to an experienced financial professional for more insight. Starting now could prevent you from having to save larger amounts when you’re older.

As the saying goes, the early bird catches the worm. With retirement, that can be especially true.

Read Also: How To Know If You Have A 401k

Why Employers Offer 401s

In 1978, when the law authorizing the creation of the 401 was passed, employers commonly attracted and retained talent by offering a secure retirement through a pension . The 401 created an entirely new system, with more flexibility for both employer and employee. One of the ways it did so was by giving employers the option to match employee contributions.

Matching is a very transparent process: for every dollar you put into your 401, your employer also puts in a dollar, up to a certain amount or percentage of your income. Theres no mystery here. If your employer promises to match all 401 contributions up to 5% of your income, and you contribute that amount every month, your employer will match you dollar for dollar, every month. Its a win-win situation. You are doubling your money, and your employer is building a happy workforce.

Top Contribution Method: Max Your 401k Percentage

If you want maximum funding for your 401k plan, then determining the contribution percentage is straightforward, even without a 401k max contribution calculator. The maximum contribution per year is age based and changes depending on whether you’re age 50 and over, or whether you’re under the age of 50, as set forth below. To calculate the correct percentage to contribute, divide the annual limit by the number of total yearly paychecks. The result should then be divided by your gross salary per paycheck to learn the contribution percentage.

Don’t Miss: How Much Does A 401k Cost A Small Business

Not A Math Whiz No Worries

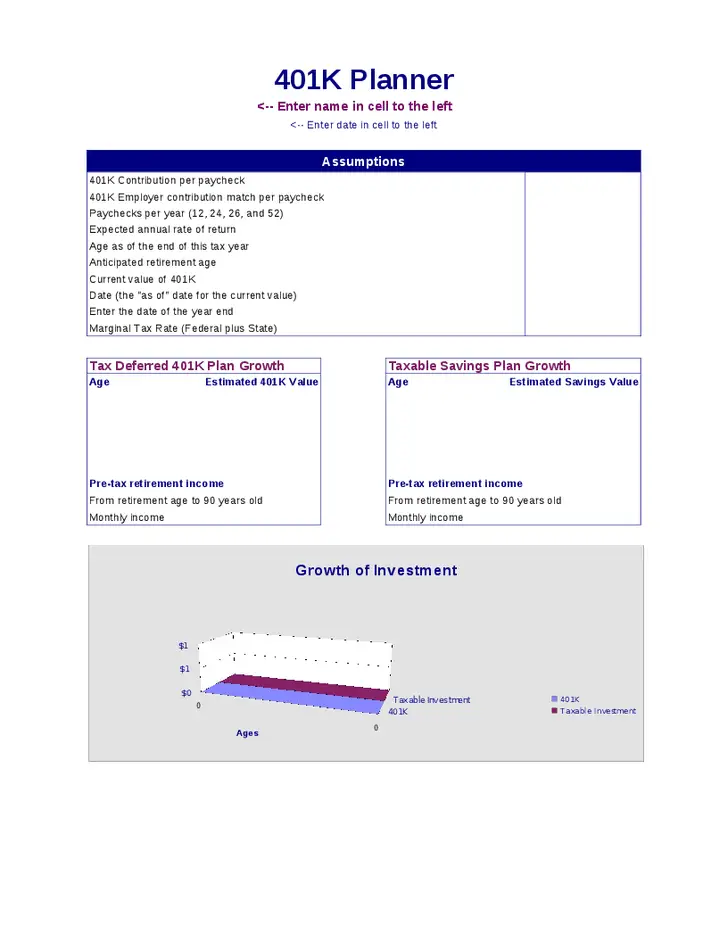

You can find out how much your 401k will grow without the help of a financial wizard. Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

Play around with the actuals and the extras to model various what if scenarios to reach your financial goals. This Simple 401k Calculator can be your best tool for creating a secure retirement. The following step-by-step procedure will show you how

Calculating the compound interest growth and future value of your monthly contributions is as simple as entering your beginning balance, the combined contributions , an estimate of your return on investment, and the number of years until retirement.

Related:5 Financial Planning Mistakes That Cost You Big-Time Explained in 5 Free Video Lessons

How To Calculate The Employer Match In A 401

Employer 401k matching programs are smart employee investments because you have the option to maximize your retirement plan contributions for free. Some employers match your own plan contributions dollar-for-dollar, up to a certain percentage. The most common matching percentage a company authorizes is 3 percent of your gross income, although some companies authorize a matching portion on up to 5 percent of your gross income. Once you determine the amount your employer matches on your behalf, you can quickly calculate the amount of free money invested into your 401k plan.

Determine your elective contribution percentage. You may elect to defer any amount of your salary as a 401k contribution, up to the annual limit established by the IRS. As of the time of publication, the annual contribution limit for most employees is $16,500, but most employees select a flat percentage of gross income to contribute each paycheck.

Determine your employers match percentage. Your employer may select a matching percentage based on the type of 401k plan maintained by the company and the matching contribution limits. Your employers contribution percentage is disclosed on your 401k plan documents.

Pay attention to the maximum amount your employer contributes. For example, if your employer contributes a maximum of 3 percent of your compensation and you elect to contribute 6 percent of your compensation, your employer matching portion is still only 3 percent.

References

You May Like: When Can You Take Out 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Could You Invest Just 2 Percent More

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Even 2 percent more from your pay could make a big difference. Enter information about your current situation, your current and proposed new contribution rate, anticipated pay increases and how long the money might be invested, as well as your own assumptions about the growth rate of your investments, and see the difference for yourself*. For additional information, see How to use the Contribution Calculator.

*This calculator is intended to serve as an educational tool, not investment advice. It enables you to enter hypothetical data. The variables you choose are not meant to reflect the performance of any security or current economic conditions. The examples are intended for illustrative purposes only and are not a prediction of investment results.

Calculations are based on the values entered into the calculator and do not take into account any limits imposed by IRS or plan rules. Also, the calculations assume a steady rate of contribution for the number of years invested that is entered.

You May Like: How Do I Know Where My 401k Is