Roll It Over Into Your New 401

If you get a distribution from one qualified retirement plan and contribute all or part of it to another qualified retirement plan within 60 days, it’s considered a rollover, and the transaction isn’t taxed. When you leave your job, your plan administrator will give you a written explanation of your rollover options.

Unless your former employer cashed out your 401 and gave you a check, you don’t have to complete a rollover right away. In fact, it’s often wise to wait until any probationary period on the new job is complete and you’re sure you’ll be with this employer for a while. You should also make sure you’re satisfied with the investment options your new employer’s 401 plan offers. If you’re not, rolling your existing account over to an IRA may be a better move.

Leave The Money Or Move It

Your first option for handling your retirement savings is to leave it in your former employer’s plan, if permitted. Of course, you can no longer contribute to the plan or receive any employer match.

However, while this might be the easiest immediate option, it could lead to more work in the future.

“The risk is that you are going to forget about it down the road,” said Will Hansen, executive director of the Plan Sponsor Council of America.

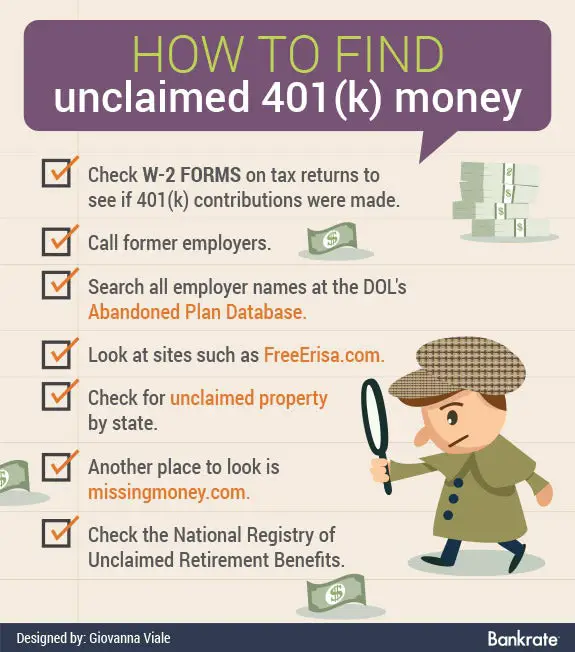

Basically, finding old 401 accounts can be tricky if you lose track of them.

Consider A Clever Company

Theres a little-known way to save on your tax bill if you hold company stock in your 401. Normally, if you roll over your company stock into an IRA, youll owe steep ordinary income taxes on the money when you eventually withdraw it in retirement . If you instead take a payout of the company stock now, youll owe income taxes on just your original purchase price of the stock, but youll pay the lower capital gains tax rate 15 percent on the appreciation. This strategy is called Net Unrealized Appreciation or NUA the difference between your original price, or cost basis, and the market price.

Its probably not worth it unless the company stock has zoomed higher, increasing the share of your holdings that are capital gains. You may want to consult a financial planner to see whether its right for you, or use the Net Unrealized Appreciation vs. IRA Rollover calculator at CalcXML.com. Caveat: If your company didnt keep track of the shares cost basis , youre out of luck.

Also Check: Can I Rollover My 401k Into An Existing Ira

What Is A 401 Again

Lets refresh: A 401 is a specific type of investing account that lets you put money away for retirement with some sweet tax benefits. There are two main 401 types: traditional and Roth.

If you have a typical 401, its because your employer offered it as a benefit. Any contributions you make to your 401 come directly out of your paycheck. employer match meaning your employer contributes money to your 401, too.)

Managing Taxes And Your 401k

If you want to avoid paying tax on your entire 401k or age is an issue, you can choose to roll the money into an IRA. When you roll the money from your 401k to an IRA account, you can freeze most or all tax responsibility you have. This allows you to continue using the money for investment purposes as you did before. Once youve reached retirement age, you can withdraw the money in your IRA and use it however youd like.

Financial and tax advisors often recommend that you let the money stay in your IRA until youve reached retirement age. One reason is that the process of withdrawal can be somewhat messy and lengthy. Once youve started the process, you cant go back. IRA accounts and 401k plans are subject to far less tax and regulation than regular types of investment. Unless you really need the money, you should let it stay in your IRA and use it for investment purposes. This allows you to generate a considerable quantity of passive income. Once youve retired, you should see the benefit of letting the money accumulate passively.

Don’t Miss: How To Get Your 401k After Quitting Job

Before You Make Up Your Mind To Leave

Maybe you’re feeling stuck or unhappy in your current position, and you’re starting to get serious about making a move. Before you commit to leaving, back up your thinking and spend some time exploring the real reasons why you think you need something new.

Are you feeling undervalued, and looking for a bump in compensation or recognition? Are you feeling bored and in need of a new challenge? Are you dreading going back to the office, and hoping for a new fully remote role? Or are you just feeling burnt outand in need of a real break from the daily grind?

Whatever your reasons, consider raising your needs with your current employer. See if they’re willing to work with you to find a way for you to stay . After all, many employers are having a hard time finding skilled employees right now, and most managers would prefer to hang on to their trusted employees rather than find and train someone new. A raise, promotion, new role, remote role, or sabbatical might be more in reach than you realize. But you’ll never know if you don’t ask.

Repay Any Loans From Your 401

When you leave your job, make sure that you have no outstanding loans from your 401. If you do, pay them off as soon as possible after your last day of work.

You have until the due date of your tax return to repay any loans you have taken from the plan, or you will default on the loan because your method of paying back the loanyour paycheckstops when you stop your employment.

If you default on the loan, you can expect your former plan to notify the Internal Revenue Service via an IRS Form 1099-R, which will report the unpaid amount.

That amount will be treated as taxable income subject to income tax. If youre under age 59.5, youll have to pay a 10 percent early withdrawal penalty, as well.

Read Also: How Do I Find My Old 401k

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

Dont Miss: Can I Move Money From 401k To Ira

Cashing Out A 401 In The Event Of Job Termination

In case you are fired, you can cash out your 401 plan even if you are below the age of 59 ½ years. You just need to contact the administrator of your plan and fill out certain forms for the distribution of your 401 funds. However, the Internal Revenue Service may charge you a penalty of 10% for early withdrawal, subject to certain exceptions.

Read Also: What To Know About 401k

Don’t Miss: Can I Convert My 401k Into A Roth Ira

Roll It Into A Traditional Individual Retirement Account

The pros: Because IRAs aren’t sponsored by employersyou own them directlyyou won’t have to worry about making changes to your account should you change jobs again in the future. IRA providers may also offer a wider array of investment options and services than either your old or new employer-sponsored plan.

The cons: Once you roll your funds into an IRA, they may no longer be eligible for a future rollover into a 401 plan, and RMDs apply at age 72, regardless of whether you’re employed. Also, you’ll need to specify how the funds in your traditional IRA are to be invested. Until you do so, the money will remain in cash or a cash equivalent, such as a money market account, rather than invested.

More From The New Road To Retirement:

Here’s a look at more retirement news.

Also be aware that if your balance is low enough, the plan might not let you remain in it even if you want to.

“If the balance is between $1,000 and $5,000, the plan can transfer the money to an in the name of the individual,” Hansen said. “If it’s under $1,000, they can cash you out.

“It’s up to the plan.”

Your other option is to roll over the balance to another qualified retirement plan. That could include a 401 at your new employer assuming rollovers from other plans are accepted or an IRA.

If under $1,000, they can cash you out. It’s up to the plan.Will HansenExecutive director of the Plan Sponsor Council of America

Be aware that if you have a Roth 401, it can only be rolled over to another Roth account. This type of 401 and IRA involves after-tax contributions, meaning you don’t get a tax break upfront as you do with traditional 401 plans and IRAs. But the Roth money grows tax-free and is untaxed when you make qualified withdrawals down the road.

If you decide to move your retirement savings, you should do a trustee-to-trustee rollover, where the transfer is sent directly to the new 401 plan or IRA custodian.

Also, while any money you put in your 401 is always yours, the same can’t be said about employer contributions.

Read Also: Can You Borrow From Your 401k Twice

What Happens If You Took Out A 401 Loan From Your Old Plan

It used to be that if you had an outstanding balance on a 401 loan and left employment, you had very little time to pay it all back, or the remaining balance would become a de-facto early withdrawal, with all the negative consequences mentioned above.

Following the 2017 Tax Cuts and Jobs Act, if you took out a 401 loan from your old plan and are leaving employment for any reason before paying it all back, you can continue making payments to a rollover IRA.

This new tax law gives you until your tax filing deadline to finish paying back the loan in full before considering the unpaid balance an early withdrawal, subject to all the consequences of such a withdrawal.

Direct Transfer Vs Indirect Rollover

Direct Transfer Rollover

A direct rollover protects you from the risk of missing a deadline. It also ensures you don’t owe taxes. A direct rollover allows you to transfer funds from your old 401 plan directly into another retirement account in the easiest method to choose. In a direct rollover, you set up the new account and discuss your intent with the administrator of both the sending and receiving institutions.

If an administrator insists on sending you a check directly, have the check made out to the new account. The administrator of your old plan fills out the paperwork to transfer the balance into your new account, and there is no tax withheld.

Trustee-To-Trustee

The most ideal way to send funds in a direct rollover is called “trustee-to-trustee,” and there is nothing for you to mess up. I would always recommend requesting this type of transfer if possible. You will never have to handle a physical check, and you will not have to worry about any tax withholdings.

A “same trustee transfer” refers to a rollover within the same financial institution and is the most seamless form of a trustee-to-trustee rollover which can often be done online. For example, this would be possible if you roll your Vanguard 401 plan to a new Vanguard Rollover IRA.

Indirect Transfer Rollover

In an indirect transfer, the administrator sends you a personal check, and you will need to take action to deposit the funds in the new account and complete the rollover.

Don’t Miss: How Much Tax On 401k Distribution

You Have $1000 To $5000 In Your 401

If you had contributed more than $1000 but below $5000, the plan administrator is required to roll over the funds to a new retirement plan instead of transferring the funds as a lump sum. The employer transfers the funds to a retirement plan of their choice, and this type of transfer takes a longer duration to complete, usually up to 60 days.

A retirement saver must wait until the forced transfer is complete to access the funds. If you are 59 ½ and older, you can withdraw the funds from the IRA without paying a penalty tax on the distribution. However, you will still owe income tax on the distribution, and you will be required to report the distribution in your taxable income for the year. If you don’t want the employer to decide for you, you should instruct your plan administrator what to do with your 401 money.

Can You Lose Your 401 If You Get Fired

There are two types of 401 contributions: Employers and employees contributions. You acquire full ownership of your employers contributions to your 401 after a certain period of time. This is called Vesting. If you are fired, you lose your right to any remaining unvested funds in your 401. You are always completely vested in your contributions and can not lose this portion of your 401.

Also Check: How To Buy Individual Stocks In 401k

The Database Isnt Slated Until 2025 What Can People Do Now

Other than hunting down contact information for your former company or the current plan administrator, theres not much people can do to find their retirement accounts.

However, later this year Vanguard and Fidelity plan to launch a so-called auto-portability program that allows them to find owners of lost plans of less than $5,000 that they oversee and automatically transfer the funds to their owners.

Vanguard and Fidelity joined Alight Solutions and Retirement Clearinghouse to create Portability Services Network, which will continue to add more plan administrators to the network so more people can be found and automatically reunited with their forgotten funds. Alight has already launched its program, but it remains small. When Fidelity and Vanguard join, though, the three companies together will hold records for about 40% of retirement accounts in America, Long said.

Social Security payments:Why you may have to claim Social Security early, even if you dont want to

Your Questions Answered: What Happens To 401k When You Quit

Are you planning to leave your job? While you must have your reasons, there are some considerations you need to make when you quit your job. If youre in the US, one of the most important things for you to consider is how it might impact your 401 k. 401 k plans are generally connected to your employer. If you leave your job or get a new employer, you may need to get a new 401 k plan as well. A 401 k connects part of your income to financial institutions. These institutions use this portion of the funds you earn for the purpose of investment. Part of the profits from this investment then goes back into your account. Its a gradual and stable way for you to generate income until retirement.

Your 401 k is more than retirement savings, too. For many, a 401 k account is the main insurance they have for their spouse or children in case they die before retirement. This is why you need to make sure your family is protected under your new plan by knowing what happens to your 401k when you die. Making a decision like leaving your job shouldnt be taken lightly. This article discusses some of your options when leaving a company or employer, as well as how it can affect your distributions and taxes.

Read Also: How To Start A 401k For My Small Business

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but that could mean serious tax consequences. Make sure to understand the particulars of the options available to you before deciding which route to take.

Employee Contributions Vs Employer Contributions

After enrolling in your company’s 401 plan, a percentage of your paycheck is paid directly into your retirement account. These allocations, which come from your paycheck, are known as employee contributions.

Your employer can match part or all of your contribution, which is laid out in the 401 policies. Often the details of the company match are laid out when you first enroll in the 401, but your HR department should be able to provide you with this information at any time.

You can elect an employee to contribute up to the maximum amount .

The maximum amount of your employer’s match is set forth based on your company’s 401 matching policy in accordance with IRS guidelines which outline parameters. Under these guidelines, employers could also choose to “profit share” and make additional 401 contributions to valuable employees- basically in the same way bonus are sometimes awarded.

Maximize Employer Match

The employer match contribution is free money which you should always aim to maximize. Often an employer will match a percentage of your employee contribution up to a maximum dollar amount. The match is an employers way to incentivize you to save more for retirement. I always recommend contributing as much as possible to your 401 to maximize as much of this free money as you can manage.

Of course, as mentioned above, employer-matched contributions often vest over time, so a portion of it may be “clawed back” from your 401 when you quit or get fired.

Also Check: How Can I Get Money From My 401k