How To Set Up A Retirement Plan For Your Small Business

Unfortunately, most of us wont wake up on our 65th birthday and ride off into the sweet sunset of money-filled retirement bliss. Retirement is something you have to plan for, work towards, and eventually earn.

Despite knowing this, Americans arent saving nearly enough for retirement. According to a survey from Bankrate, 21 percent of working adults save nothing, and 48 percent of those who do save are putting away less than experts recommend. And entrepreneurs arent exempt from the problemnearly 60 percent of small business owners arent saving enough money to retire.

Why arent more small businesses helping their employees and themselves plan for retirement? For many, it can be challenging enough to find extra cash to put aside for an emergency fund. Only half of small businesses have a large enough cash buffer to keep their business afloat for a month. And typically, if there is some extra cash to spare, it will be pumped back into the business.

But what most business owners dont know is that setting up a retirement plan and investing in their businesses arent contradicting actions. While the former might not have an immediate benefit like taking out a small business loan to open a new location or hire additional staff would, a retirement plan is still a business investment.

Retirement plans truly can help grow your business. Keep reading to learn how to start your own.

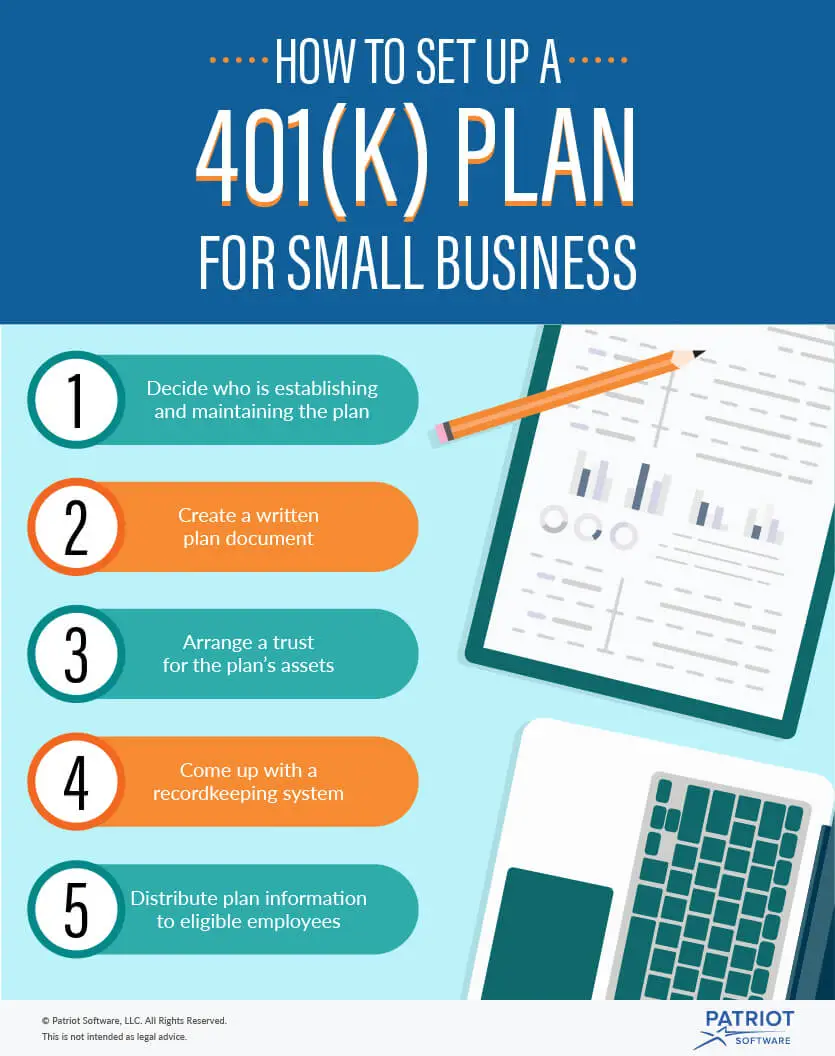

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

Employee Plans Robs Project

EP initiated a ROBS project in 2009 to:

- Define traits of compliant versus noncompliant ROBS plans,

- Identify ROBS plans that are noncompliant and take action to correct them, and

- Use results to design compliance strategies focusing on identified issues and trends .

Using compliance checks, we initially focused on companies that sponsored a plan and received a DL but didnt file a Form 5500, Annual Return/Report of Employee Benefit Plan, or Form 5500-EZ, Annual Return of One-Participant Retirement Plan PDF, and/or Form 1120, U.S. Corporation Income Tax Return.

Our contact letter to plan sponsors asked questions about the ROBS plans recordkeeping and information reporting requirements, including:

- the plans current status

- stock valuation and stock purchases

- general information about the business itself

- why no Form 5500 or 5500-EZ and/or Form 1120 were filed

The plan sponsor can also furnish any other documents or materials that they believe would be helpful for us to review as part of the compliance check.

Dont Miss: Can Anyone Open A 401k

Recommended Reading: How To Withdraw My 401k Money

How To Set Up A 401k For A Business

The path to a successful retirement savings program starts with plan design. And while its true that employers can set up 401ks on their own, its generally recommended to seek the help of a professional or a financial institution. Theyll provide expert guidance throughout each of the following steps:

What Else Do Small Business Owners Need To Know About 401 Plans

Small business owners who offer retirement savings plans may be able to take advantage of tax incentives. Matching employee contributions, for instance, is generally tax deductible as a business expense. For the first three years of the plan, employers may also be eligible for tax credits up to 50% of the start-up and administration costs or $5,000 , as well as a $500 automatic enrollment credit per year.

Recommended Reading: Who Are The Best 401k Providers For Small Businesses

Things You Need To Know Before Planning To Set Up A 401k Plan For Your Business

It is a fact that a lot of businesses entrust the setting up of their 401k plans to outsourcing firms. That in itself is not bad, and even if you too have decided to outsource yours, there are things you still need to know before you embark on this journey. They include

-

Know how a 401k plan would benefit your business

Businesses set up a 401k for different reasons, and you need to know why your company needs one of such plans. Failure to do this would mean that you would not maximize the opportunities presented by it. If you need your 401k to be a tool that would allow you to be competitive in the market place, then design the plan in such a way that your employees are rewarded.

If you need it as a tool for retention, then build in safeguards and incentives that would tempt employees to stay at the company and with the plan. If you want it as a tool to compensate management, then do the company contributions so that they flow through to management in a way that is legit. You must also look into your employees demography before setting up a plan so you do not waste your time.

-

There are fees involved in the plan

Setting up a 401k plan comes with a fee, especially if you are a small business owner. If you fall into this category, then you need to budget around $1,500 to $3,000 to get a 401 up and running. It can even be more than that in some circumstances, and it can be lesser than that too.

-

The 401k has different types

-

You would be required to go through annual testing

Deciding On A Business

We always knew that our business would have something to do with food or drink, two things we enjoy very much, said Diane. Two recurrent thoughts throughout the years were a brewery or a coffee shop. Jim came across a coffee roastery for sale at just the right time. Although we didnt buy it, it kind of pushed us towards the coffee idea. Whatever business you decide on, obviously it has to be something that you love and have a passion for.

I certainly agree with Diane on that thought! said Jim. With my culinary background, there were many options to explore. One Saturday during the pandemic, I was googling small businesses for sale. I came across a small coffee roastery for sale. We werent really looking to buy a business, just generate ideas. I tend to do things 110 percent, so I went way down the rabbit hole on specialty coffee.

Read Also: Can I Roll Over 401k Into Ira

How Much Does A Business 401 Cost For Employers

Starting up a 401k for your small business does carry a cost. Therefore, as an employer, it is important to understand the how and why behind these. After all, these will become your overhead costs once implemented. Here are a few of the costs to be prepared for:

- A one-time initial setup fee that covers setting up the plan and educating employees about the plan. This can run anywhere between $500-$2,000 but keep in mind that there is a tax credit for small businesses with less than 100 workers.

- Administration fees: Managing the plan on a day-to-day basis is a lot of work. Consequently, most companies hire a third party to maintain the plan. These companies charge around $1000-$3000 per year and provide valuable services by taking care of annual non-discrimination testing, completing necessary forms to keep the plan running smoothly, plan information materials, providing statements, and much more.

- Employer matching: This is optional, but it is an attractive feature for employees.

Other fees to look out for include:

- Rollover fees

- Payroll and retirement plan integration fees

What Are The Penalties For Withdrawing From My 401 Before Age 59

Unless you fall into one of the special exemption categories, you will pay a penalty of 10% of the amount of funds you withdraw. This can get quite pricey and really cut into your retirement savings. If you must make a withdrawal before reaching retirement age, then make sure you check the list of exemptions to the penalty. If you can qualify under one of the exemptions, then you will not be forced to pay this extra penalty.

Read Also: How To Figure Minimum Distribution On 401k

Building The Fund Lineup

When we say fund lineup, were referring to the menu of investment options that are available to plan participants. Getting this right is arguably the most important part of building a successful 401 plan.

Having risky, poorly-performing, or unnecessarily expensive mutual funds can significantly limit the amount your employees have in their accounts come retirement. It may even expose you to costly lawsuits.

If you feel any uncertainty around how to build an optimal 401 fund lineup thatll protect you from costly lawsuits, consider hiring an advisor. Not only do the good ones take this off your plate, but theyll even assume legal responsibility for it as well!

Irs Favorable Determination Letter

Providers and promoters of ROBS court prospective business owners, sometimes by requesting a Favorable Determination Letter from the IRS. The FDL is a way that providers try to assure a client that the IRS approves of the clients ROBS plan. The IRS typically issues a letter, but its based on acceptable compliance of the clients ROBS plan. This letter is neither a blanket approval of the plan nor legal protection if the plan is incorrectly set up or administered.

Don’t Miss: How Do You Get Money From 401k

How To Start A 401k For My Small Business In 7 Steps

Employers do not have to offer retirement plans to their employees. However, retirement plans are an added benefit for many companies. Most employees look forward to what types of benefits their employers offer. In return, employees are more likely to stay with a company longer and increase their productivity for businesses that have a great benefits package.

The reason why many companies choose to offer their employees a 401K plan is that not only does it benefit them but also the business. A 401K plan is popular with many companies as employees contribute to their plans with pre-tax dollars. Because of this, an employee’s tax liability is decreased and they are able to save for retirement. Therefore, many companies, especially small businesses, should determine what reasons they have for wanting to offer a 401K plan. For many owners, once they know why, they can begin to determine how to start a 401K for my small business.

How Much Does A 401 Cost Small Business Employers

LAST REVIEWED Jul 18 202220 MIN READ

Key Takeaways

-

401 plan costs can be broken into three general categories: startup costs, employer contributions , and plan administration fees

-

Well review how plan costs can differand provide industry benchmarks for 401 service fees and other expenses

-

Comparing plan costs vs. industry averages can help you understand if you are overpaying

Think that 401 plans are an expensive benefit reserved exclusively for large businesses with deep pockets? Think again. While this may have been a reality in the past, many companies including small businessesarent aware that 401 plans can be affordable and attainable.

These days, 401 providers can use technology to cut costs. Additionally, there are tax credits that help cover startup costs for new plans. Finally, offering a 401 can provide businesses with tax deductions, which helps reduce the overall costs of the plan.

Given the options available, its a good idea to examine if a 401 plan might now be an option for your business.

Read Also: Can You Use Your 401k For A House Down Payment

To Do Right By Their Employees

According to the National Institute on Retirement Security, over 38 million working age households have zero retirement savings. With life expectancy getting longer and longer, its crucial that your employees have enough saved for a comfortable retirement.

Given that saving for retirement is the #1 source of financial stress for Americans, a 401 optimized for employee savings could have a big impact on their quality of life. Studies show reducing financial stress may even make them more productive at work.

In addition to all the aforementioned benefits, 401s can also earn your small business some major tax credits!

Once youre clear on your reasons for starting a 401 and what you need it to accomplish, youre ready to move on to step 2.

Make Sure Your Payroll Integration Scales With Your Business

If you do get a payroll integration for your 401, youll want to be sure that it works as your business scales up. Most businesses need to upgrade to new payroll systems around the 50 employee mark, as this is when compliance and reporting needs become too complex for simple small business payroll systems to handle. If the provider you choose doesnt integrate with payroll systems suited for larger businesses, you may need to change providers. And trust us, doing this can be a huge hassle.

You May Like: Can I Transfer My 401k To My Child

Get Clear On Why Youre Offering A Small Business 401

The 401 can be a very powerful benefit for you and your employees. In order to ensure that youre getting the most value you can out of your 401, youll need to be clear on your reasons for starting one. Here are 3 of the most compelling reasons why so many business owners nowadays are setting up a 401k for their small businesses:

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

You May Like: Can You Use Money From 401k To Buy A House

How To Setup A Solo 401 Plan

For small business owners who meet certain requirements, most financial institutions that offer retirement plan products have developed truncated versions of the regular 401 plan for use by business owners who want to adopt the solo 401.

As a result, less-complex documentation is needed to establish the plan. Fees may also be relatively low. Make sure to receive the proper documentation from your financial services provider.

As noted above, the solo 401 plan may be adopted only by businesses in which the only employees eligible to participate in the plan are the business owners and eligible spouses. For eligibility purposes, a spouse is considered an owner of the business, so if a spouse is employed by the business, you are still eligible to adopt the solo 401.

If your business has non-owner employees who are eligible to participate in the plan, your business may not adopt the solo 401 plan. Therefore, if you have non-owner employees, they must not meet the eligibility requirements you select for the plan, which must remain within the following limitations.

You may exclude nonresident aliens from a solo 401 who receive no U.S. income and those who receive benefits under a collective-bargaining agreement.

Retirement Accounts For Small Business Owners: How To Get Started

You own a small business. Maybe youre self-employed, a sole proprietor with just yourself and perhaps your spouse on the payroll, or a company with a handful of employees. Congratulations! Even in trying economic times like the ones were in now, businesses like yours are the backbone of this countrys economy.

The positives about starting and owning your own business are many being your own boss, creating a product or service your way and seeing it to fruition, building something to pass on, and more. But one disadvantage for small business owners that doesnt bedevil larger companies is not having the funds to offer perks and benefits like gym memberships, health insurance, HSAs, and the increasingly popular unlimited PTO.

The same goes for retirement savings accounts like 401s, IRAs, and other savings vehicles that larger companies can and do offer employees. If you have employees, are you offering them retirement savings accounts? If youre self-employed, have you started one for yourself?

The answer to that last question is likely no. Why? Let us count the reasons many small business owners dont have retirement accounts, and offer reasons why you should.

You May Like: How To Pull Money Out Of My 401k