How Do I Withdraw From My 401k After Age 60

Once you reach 59 1/2, you are allowed to earn money in the 401 program anytime you want, even if you are still working for the company. So, if you are sixty, your company cant stop you from withdrawing your money. However, just because you can earn money in your 401 does not mean you should.

Can I take money out of my 401k at age 60 without penalty?

The 401 Terms of Exemption for Older Persons 59 ½ Investing before paying tax in your 401 also allows for tax-free growth until you release it. There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

Do I pay taxes on 401k withdrawal after age 60?

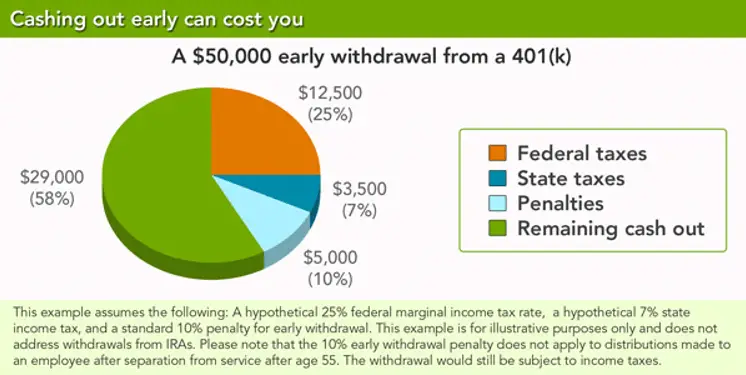

The IRS defines early withdrawal as withdrawal from your retirement plan before the age of 59½. In most cases, you will have to pay an additional 10 percent tax when you first deduct unless you qualify for the option. This is about your regular tax.

Can A Hardship Withdrawal Be Denied

Most 401 plans provide loans to participants who are facing financial hardship or have an immediate emergency need such as medical expenses or college education. If the reason for the 401 loan is a luxury expense that does not meet the financial hardship criteria, the loan application could be denied.

Age 72 And Over: Required Minimum Withdrawals Are Mandatory

Once you turn 72, you must start taking annual Required Minimum Distributions from your Traditional IRA. Your first RMD must be taken by April 1 of the year following the year you reach age 72. Every year thereafter you must take an RMD by December 31. The amount of your RMD is calculated by dividing the value of your Traditional IRA by a life expectancy factor, as determined by the IRS. You can always withdraw more than the RMD, but remember that all distributions are taxed as income. If you dont make withdrawals, youll have to pay a 50% penalty on the amount you shouldve withdrawn. Learn more about RMDs.

You May Like: How To Move Your 401k To A Roth Ira

The Rule Of 55 For Early Withdrawals From 401s

Here are a few things to keep in mind when considering retiring between age 55 and 59 1/2 and using the Rule of 55 to take early distributions:

If all that looks good to you, thats the simpler and less risky of the two methods to get your money sooner.

The pros of using the Rule of 55

The cons of using the Rule of 55

Do I Pay Taxes On 401k Withdrawal After Age 60

The IRS defines early withdrawal as withdrawal from your retirement plan before the age of 59½. In most cases, you will have to pay an additional 10 percent tax when you first deduct unless you qualify for the option. This is about your regular tax.

At what age can you withdraw from 401k without paying taxes?

The IRS allows for the removal of the penalty-exempt from retirement accounts after the age of 59 ½ and requires removal after 72 years .

Can I cash out my 401k at age 60?

Once you reach 59 1/2, you are allowed to earn money in the 401 program anytime you want, even if you are still working for the company. So, if you are sixty, your company cant stop you from withdrawing your money. You dont have to start taking money out until you are 75 years old.

Read Also: How Do I Transfer 401k To New Employer

You May Have To Sell Investments At A Bad Time

Pulling cash out of investment accounts after the market has fallen means youre locking in any losses youve incurred. Even if you reinvest these funds down the road, youll have missed reaping any gains those investments would have seen in the interim.

In 2020, the S& P 500 had its largest first-quarter decline in history, finishing down 20%. Stats like this can lead to panic selling, or, coupled with the loosened withdrawal rules, may tempt you to dip into retirement accounts to prevent further losses.

But remember: You havent lost anything until you sell. So if your cash crunch isnt an emergency, you can avoid losses by riding out the storm, and benefit from the rebound whenever it eventually occurs.

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less you’ll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

That’s why it’s important to carefully assess your situation if you’re experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If you’re certain that you can pay yourself back, there’s also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

You May Like: Should I Roll My Old 401k Into My New 401k

Withdrawing Funds From 401 At 72

If you are age 72, you must start taking annual distributions from the 401, commonly known as required minimum distributions . You must take the first distribution by April 1 of the year you turn 72, and thereafter, you will be required to take the annual withdrawals by December 31 each year. If you delay in taking the first distribution, you must take two distributions in the same year, which will push you to a higher tax bracket. If you miss taking a mandatory distribution, the IRS imposes a 50% penalty on the amount you were required to take during the specific period.

An exemption to the RMDs is if you are still working. To qualify for this exception, you must not own 50% or more of the employerâs company. You can use this exception to delay taking the mandatory distributions until when you stop working.

Withdrawing Funds From A 401 Before 55

If you are younger than 55, you may still qualify to withdraw money without quitting your current job. You can take a hardship withdrawal if you have a qualified expense. For example, you can take a hardship withdrawal to pay qualified educational fees, medical expenses, alimony and child support, repair of damage to your residence or to purchase your principal residence. You will owe income tax on the amount you take out from your retirement savings as a hardship withdrawal.

Read Also: Is It Worth Rolling Over A 401k

Required Minimum Distribution Method

This will result in an annual payment to the recipient. The account balance is divided by the life expectancy factor of the recipient to arrive at the annual amount. The amount is recalculated each year based on the new account balance, but the life table used in the original calculation is used for the duration of the payments.

How To Withdraw From A 401 At Age 55

Under the right circumstances, you can withdraw from a 401 at age 55 . If you retire, quit or get fired between age 55 and 59, you can withdraw without penalty from your 401. See IRS Publication 575

The tax doesnt apply to distributions that are: From a qualified retirement plan after your separation from service in or after the year you reached age 55

What is separation from service? Heres how the IRS defines it:

To meet the requirements for the first exception in the list above, you must have separated from service in or after the year in which you reach age 55 . You cant separate from service before that year, wait until you are age 55 , and take a distribution.

If you leave your job before age 55 you cant take a distribution without paying the 10% penalty. If you wait until after you turn 55 you can take a distribution without paying the 10% penalty.

See page 34 of the publication.

There are several important points to know about the Rule of 55.

Read Also: How To Move Your 401k To A New Job

How To Withdraw From Your 401 With An Existing Employer:

Whether it’s for personal reasons or an emergency, making an early 401 withdrawal doesn’t have favorable terms. If youre still working for the company that sponsors your 401 plan, you can apply for an Early 401 Distribution. This is subject to a 10 percent penalty, and youll still be taxed for the amount withdrawn.

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you’ll be paying income taxes on the contributions and earnings withdrawn.

“You get a three-year period to pay the taxes to Uncle Sam,” said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plan’s rules. Be aware that a workplace retirement plan may allow hardship distributions from participants’ savings, but it isn’t required to do so.

You’ll need to talk to your human resources department or your plan administrator before you proceed.

“A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal,” said Porretta.

Don’t Miss: Can I Start My Own 401k Plan

What Age Can You Withdraw From 401k

Different rules apply when determining what age to withdraw funds from 401. Find out the various ages when you can take out money from a 401.

401s have different rules on when a participant can access their retirement savings without paying an early withdrawal penalty. Younger participants have fewer opportunities to take out money from their 401s compared to their older colleagues who are already retired or approaching retirement age. The money in a 401 is intended to fund retirement, and the government enforces different rules to discourage withdrawals before attaining retirement age.

The IRS requires that a 401 participant must be at least 59 ½ to begin taking money out of a 401 penalty-free. If you want to start taking distributions before age 59 ½, you will pay income tax and a 10% early withdrawal penalty tax on the amount you take out of your 401. An exemption to this requirement is when an employee quits or is fired by the employer at age 55. This exception is known as the rule of 55, and it allows employees who leave the employer at 55 to withdraw their retirement savings without paying a penalty.

Loans Versus 401 Distributions: Which To Choose

With these new rules, the lines between a 401 loan and withdrawal can become a bit blurred. Both let you access up to $100,000 of your retirement funds penalty- and tax-free, but there are slight differences.

If you take a withdrawal:

-

Repayment isnt required.

-

Theres no withdrawal penalty.

-

It will be taxed as income initially, though you can claim a refund if you pay back the distribution in three years.

-

You have tax options.

Recommended Reading: How Often Can I Rollover 401k To Ira

Is It A Good Idea To Withdraw From Your Retirement Fund

These new regulations make withdrawing from your retirement fund more enticing, but is it a good idea to raid your savings? In general, the answer is no. Even if you won’t pay a penalty and you can spread your tax payments out over three years, there are still short- and long-term consequences to withdrawing your savings before retirement age.

For one, right now is not the best time to take money from your retirement account because stock prices are at rock bottom. You may be tempted to pull your money out of your retirement fund now if your investments have taken a hit in recent weeks, thinking you can salvage your savings before things get worse. However, you don’t technically lose any money until you sell your investments. So if you sell your investments now by withdrawing your cash, you’re locking in your losses by buying high and selling low. If you keep your cash invested, though, you’ll reap the rewards once the market recovers.

There are long-term consequences for withdrawing your cash, as well. Your investments rely on compound interest to help them grow, so the key to building a robust retirement fund is to leave your money alone for as long as you possibly can. Every time you withdraw your money, you’re essentially taking a step back and starting over. The less time your money has to grow, the more challenging it will be to accumulate a significant amount of cash.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Recommended Reading: How Do 401k Investments Work

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Can You Withdraw Money From A 401 Early

Yes, if your employer allows it.

However, there are financial consequences for doing so.

You also will owe a 10% tax penalty on the amount you withdraw, except in special cases:

- If it qualifies as a hardship withdrawal under IRS rules

- If it qualifies as an exception to the penalty under IRS rules

- If you need it for COVID-19-related costs

In any case, the person making the early withdrawal will owe regular income taxes year on the money withdrawn. If it’s a traditional IRA, the entire balance is taxable. If it’s a Roth IRA, any money withdrawn early that has not already been taxed will be taxed.

If the money does not qualify for any of these exceptions, the taxpayer will owe an additional 10% penalty on the money withdrawn.

Also Check: Can I Invest My 401k

Consequences Of A 401 Early Withdrawal

- IRS Penalty. If you took an early withdrawal of $10,000 from your 401 account, the IRS could assess a 10% penalty on the withdrawal if its not covered by any of the exceptions outlined below.

- Withdrawals are taxed. Even if it were covered by an exception, all early withdrawals from your 401 are taxed as ordinary income. The IRS typically withholds 20% of an early withdrawal to cover taxes. So if you withdrew $10,000, you might only receive $7,000 after the 20% IRS tax withholding and a 10% penalty.

- Less money for retirement. Perhaps the biggest consequence of an early 401 withdrawal is missing out on long-term returns in the market. The stock markets average returns have been around 9.6% a year since the end of the Great Depression. If you withdrew $10,000 from your 401 and were about 30 years away from retirement, you could be giving up more than $117,000 in total returns.