Fiduciary Plan Investment Responsibilities

Meeting investment responsibilities sounds pretty intimidating, but theyre actually reasonably easy to fulfill. Here are the main duties:

Pick Prudent Investments

As the person managing investment, you have the responsibility to pick investments that meet their objectives for a reasonable fee.

This rule is often called the prudent person rule – a nice, common sense rule that states if youre in charge of someones assets, you have to manage them like a reasonable person with an eye to growing those assets.

These days, that’s easier than ever. Many index funds offer comparable returns and low fees and can be an excellent option.

Meet Diversification Requirements

In essence, this requires you to offer a range of investment options – ensuring that employees can distribute their plan assets appropriately.

Model the Federal Thrift Savings Plan

A simple way for employers to meet their investment-related fiduciary responsibilities is modeling their 401 fund lineup after the Federal governments Thrift Savings Plan whose prudent investments would meet ERISA 404 diversification requirements. While the funds used by the TSP are not available to the general public, its possible for any employer to model their fund lineup after the TSP using commercially-available index funds.

But the responsibilities of being a 401 fiduciary dont stop at just investment options. Theres still work to be done.

Review and Monitor the Investments

What Does A Plan Administrator Do

A plan administrator is responsible for the regular operations of the retirement planâs activities. Some of the functions that a plan administrator is required to perform include:

Plan design– the plan administrator consults with the employer on how the plan should be structured.

Monitor compliance-As regulations change, the plan administrator ensures that the 401 complies with federal regulations and the plan rules.

: If you request a 401 loan or distribution from the 401 plan, the plan administrator must approve these transactions.

Perform tests– the plan administrator must perform routine tests to ensure fairness and equity among participants.

Filings and disclosures: the plan must make periodic statutory filings and disclosures required by regulators. Some of these filings may include Form 5500, Form 1099-R, and Safe Harbor notices.

Making payments to beneficiaries– the plan administrator is required to make scheduled payments to beneficiaries who inherit a participantâs 401 money.

Employee communication– the plan administrator responds to participantsâ questions and concerns. They also send periodic account statements to the planâs participants.

Qualified Default Investment Alternatives

A plan must also select a default investment for plan contributions made by participants who have not made an investment selection, such as participants who are automatically enrolled in the plan. If a plan sponsor chooses an investment that meets the requirements of a Qualified Default Investment Alternative , the plan will be relieved of fiduciary liability for participant losses.

Four investment vehicles qualify as a QDIA:

- Life cycle or target date funds

- Professionally managed accounts

- Balanced funds

- Capital preservation products

To obtain fiduciary relief for QDIA investment, plan sponsors must provide a written notice to participants describing the circumstances under which a participants describing the circumstances under which a participants account may be invested in a QDIA, the participants right to select an alternative investment, a description of the QDIA and explanation of where to obtain additional information. Information on the QDIA, such as a prospectus, must also be provided to participants or made available via web link.

Also Check: What’s The Maximum Contribution To A 401k

Who Is A Fiduciary

Part One: Fiduciary Rules

Employee benefit plans, including retirement plans, offer many benefits for both you and your employees. Although the Employee Retirement Income Security Act of 1974 , as amended has long imposed standards on those who manage such plans, retirement plan litigation and media attention continues to draw considerable focus on employee benefit plan governance. Given this scrutiny, it is imperative that employee benefit plan fiduciaries understand their responsibilities and continually adhere to the standards that apply to them. The information in this Learning Center is designed to provide an overview of ERISAs provisions to assist you in complying with ERISAs fiduciary responsibilities and other requirements.

Investment Policy Statement Considerations

Named fiduciaries

Every employee benefit plan must provide for one or more named fiduciaries with the authority to control the operation and administration of the plan. The named fiduciary is identified in the plan document or pursuant to a procedure specified in the plan. In addition, ERISA defines other roles such as investment manager, plan administrator, discretionary trustee, and investment advisor as fiduciary roles.

Functional fiduciaries

An individual who is not serving in a named fiduciary capacity may nonetheless be a fiduciary by virtue of a functional test embedded in ERISAs fiduciary definition. Specifically, ERISA provides that a person is a plan fiduciary to the extent he/she:

Paying Only Reasonable Expenses From Plan Assets

Employers have a fiduciary responsibility to pay only “reasonable” 401 fees from plan assets. Keeping 401 fees in check is of the most important fiduciary responsibilities because even small excessive fee amounts today can dramatically reduce a participants account balance decades from now.

The problem? While this responsibility is clear, the definition of reasonable is not. ERISA does not define the word and government agencies only provide general guidance for evaluating 401 fees. The Department of Labor suggests establishing an objective process to aid in your decision making”. This process should include an understanding of the fees and expenses you will pay and a review of those charges as they relate to the services to be provided and the investments you are considering.

An objective process is generally understood to mean benchmarking 401 fees vs. competing 401 providers or industry averages. For an employer to benchmark their 401 fees vs. competing 401 providers, they can:

- Calculate the all-in fee for their plan

- Compare this fee to the all-in fee of 3 or more competing 401 providers

401 fee benchmarking should be done at least every 3 years.

Also Check: Can You Rollover Your 401k Into A Roth Ira

Employers Should Not Fear Their 401 Fiduciary Responsibilities

While hiring an ERISA 3 financial advisor can be a great idea, I dont recommend that employers outsource other 401 fiduciary responsibilities to their 401 provider. Thats because monitoring a 401 provider with fiduciary control over plan assets or administration can be difficult to impossible which, ironically, increases an employer’s fiduciary liability.

Instead, I recommend employers meet their 401 fiduciary responsibilities themselves. They are nothing to be afraid of. With some basic guidance, they can be easily met.

About Eric Droblyen

Eric Droblyen began his career as an ERISA compliance specialist with Charles Schwab in the mid-1990s. His keen grasp on 401k plan administration and compliance matters has made Eric a sought after speaker. He has delivered presentations at a number of events, including the American Society of Pension Professionals and Actuaries Annual Conference. As President and CEO of Employee Fiduciary, Eric is responsible for all aspects of the companys operations and service delivery.

- Connect with Eric Droblyen

The Duty Of Loyalty As A Fiduciary

So, I have a dog who is the epitome of NOT being loyal. Maybe it is because she is more of a dog-cat-rat. She naps like a cat, hides things like a rat, but is only a dog in name because she has no loyalty to anyone. In other words, if you are a fiduciary you should be like any other dog would be: loyal. Do not be like my dog.

Unlike my dog, plan fiduciaries may not place their own interests, or those of the company officers, over those of the plan participants and beneficiaries. Fiduciaries may not engage in conflicts of interest or self-dealing, that is, acts that serve personal interests or those of the company sponsoring the plan. Fiduciaries must act solely in the interest of the plan participants and beneficiaries. Kind of like the first point, but emphasis on the NO with self-dealing.

For example, if you had a CFO that had a close personal friend that was a wholesaler for a particularly seedy 401 provider that charged out of this world expenses through poor investment offerings , and although it was clearly not the best option for the employees of the company to use that provider, the CFO convinced the CEO it was the best option to use them because it wouldnt cost the company anything plan tantissimo). Oh, and did I mention the friend also bought season passes to that one thing that the CFO really likes for joining their platform. Yeah, that would not be good. This is self-dealing. Again, no SELF-DEALING!

You May Like: Are Part Time Employees Eligible For 401k

Importance Of 401 Plans

401 plans provide a great tax incentive to save money and invest for retirement. They also provide an attractive benefit for recruiting staff members in a competitive labor market. A well-run 401 is a powerful retention tool as wellone that allows the\owner/operator a chance to share in profits while inducing employees to think long-term about their career path in the company. Likewise, high-income owners stand to benefit from the tools found in 401 plans, such as tax-deferred profit sharing and deductibility of employer contributions.

Offering A 401 Know Your Fiduciary Responsibility

Offering your employees a retirement plan is about more than helping them achieve a comfortable retirement it’s also about following regulations to ensure that your business is protected from liability. Fiduciary responsibility is one concept you’ll need to understand before you offer a plan to your employees.

Recommended Reading: How Do I Take Money Out Of My Fidelity 401k

What Are The Duties Of The Fiduciary

As fiduciaries, following procedural prudence is crucial. What is procedural prudence, you ask? Well, it is the process to ensure decisions are in the best interests of participants and their beneficiaries. Remember the Mother Teresa example? That applies here. Plan fiduciaries must also be able to show they properly investigate and document each plan fiduciary decision.

In short, following the right steps as a fiduciary can satisfy required responsibilities regardless of the outcome. So, if you document the process and make sure you are being a procedural prude, youve got this.

What Is A 401 Plan Fiduciary

Employer-sponsored retirement plans, such as 401 plans, are governed by the Employee Retirement Income Security Act of 1974 and are primarily enforced by the U.S. Department of Labor . ERISA aims to promote the interests of a retirement plans participants and beneficiaries by establishing fiduciary standards of conduct, responsibility, and obligations.

Under ERISA, fiduciaries have several duties, not the least of which is to act solely in the interest of plan participants and their beneficiaries, with the exclusive purpose of providing benefits to them. Failure to do so can put both the employer and its fiduciaries in serious legal jeopardy therefore, it is critical that all parties understand their duties.

You can become a fiduciary under ERISA either by functioning or being named as one in the plan document.¹ Both types of fiduciaries are held to ERISAs standards of conduct.

Named fiduciaryA named fiduciary is designated in the plan document by name or title to have the authority to control and manage the operation and administration of the plan. The named fiduciary is often the employer or organization offering the planthe plan sponsorand, unless noted otherwise in the plan document, the plan sponsor will also be the plan administrator.

Don’t Miss: How Do I Close Out My 401k Account

Fiduciary Protection: Is Your 401 Plan Getting The Oversight It Needs

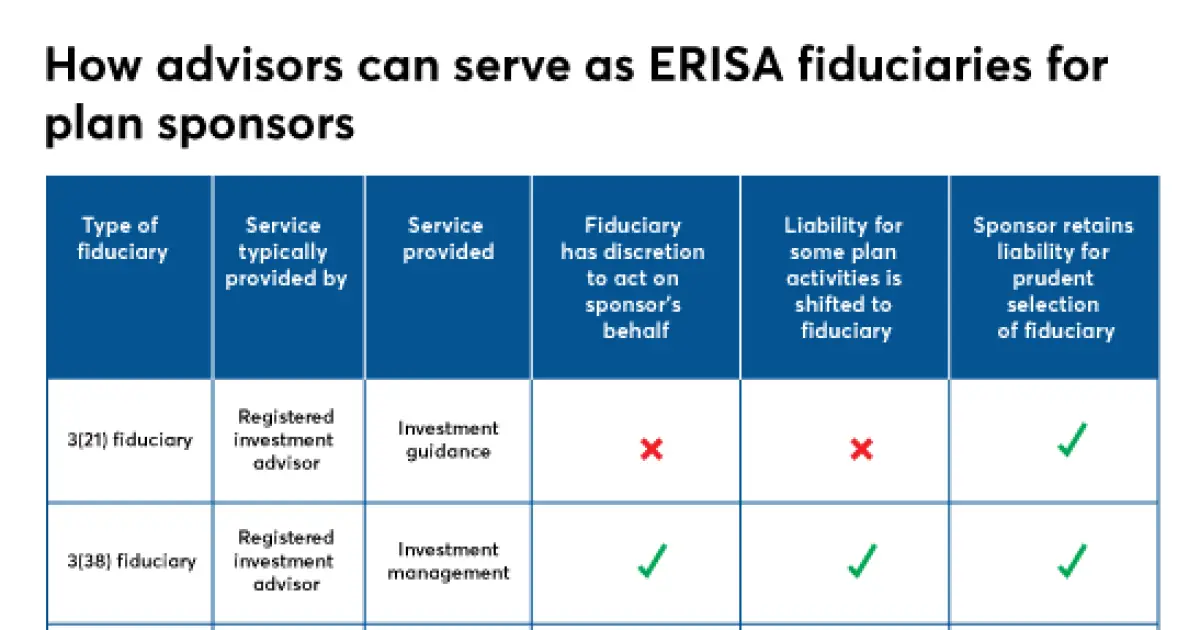

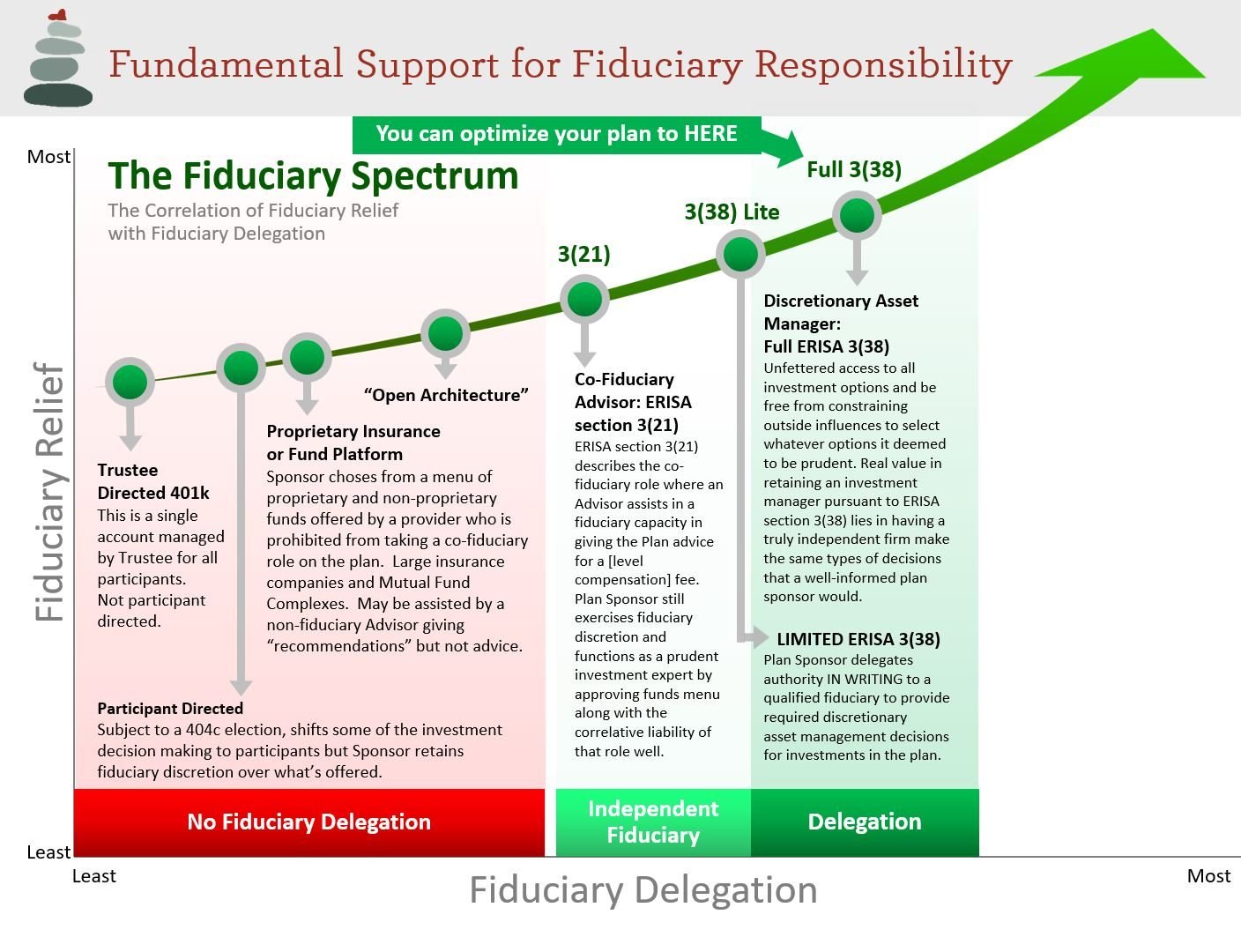

Within any discussion about fiduciary protection, its important to first identify and understand the different fiduciary roles present in a retirement plan. Under the Employee Retirement Income and Security Act of 1974 , fiduciaries are either named in the plan document, or identified due to the functions or activities they perform with regards to the 401k plan. There are three types of fiduciaries: 3, 3 and 3.

Typically, the plan sponsor is the named fiduciary in the plan document. That person is normally identified as the plan administrator and has general responsibility for oversight and administration of the plan. These functions generally fall under the 3 fiduciarys authority. Other fiduciaries would include anyone who exercises control or discretion over plan assets, plan management or plan administration. However, Its the control or discretion over plan assets and the roles of 3 and 3 fiduciaries that are the focus of this article.

Most plan sponsors do not have expertise in exercising discretion or control of investments. However, absent an advisor who fills that role for them, the fiduciary responsibility for selecting and monitoring investments falls solely on the plan sponsor. Many plan sponsors I have met are either unaware of this potential liability, or believe that their record keeper/TPA is assuming that role for them. In some cases, the record keeper can act as an investment fiduciary. If so, it should be specified in the contract with that provider.

Is It Better To Contribute To 401k Or Roth 401k

If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401. In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since its made after taxes rather than before.

Recommended Reading: How Do I Get A Loan From My 401k

There Are Different Types Of Retirement Plan Fiduciaries

Generally, an ERISA fiduciary is anyone who exercises discretionary authority or control over a plan or its assets, or who gives investment advice to a plan or its participants. If you sponsor a 401 plan, you’ll most likely have discretion over it in some capacity, and this makes you a fiduciary. Anyone who has discretionary authority with respect to plan administration and/or who selects or monitors the plan’s investment options is also an ERISA fiduciarywhich may include some of your co-workers, such as members of the plan’s benefits committee, as well as your plans financial professional. All fiduciaries, regardless of how narrow or broad their authority, must adhere to ERISA regulations.

How Many Years Do You Have To Work At Walmart Before You Can Retire

KEEP YOUR DISCOUNT CARD

You can keep your Associate Discount Card when you retire if youve been an associate for 20 years, or if youve been with us for at least 15 years and are age 55 or older, as long as you havent had a break in employment during that time. Learn more: One.Walmart.com/DiscountCard.

You May Like: How Do I Get My 401k When I Retire

The Consequences Of A Breach Of Erisa Fiduciary Duty

The duties outlined under ERISA are basic fiduciary guidelines that must be followed by law. Failure to comply with these duties can result in:

- Removal from your fiduciary role

- Personal liability for plan losses

- Possible civil penalties and, in certain circumstances, criminal prosecution, fines, and imprisonment

Optional Support For 401 Plan Administration

Given the scope of work behind 401 plan administrationnot to mention, the specialized knowledge requiredits common for plan sponsors and fiduciaries to bring specialists to the conversation. Sometimes, this means building out expertise within the business, such as appointing a retirement plan committee. Other times, it means partnering with outside service providers.

When hiring a service provider, the plan fiduciary should pay attention to the type of service being provided and the level of fiduciary responsibility the service provider has agreed to take, if any. If a service provider agrees to take fiduciary responsibility for a task or tasks, its important to review all service agreements to fully understand any limitations the provider may have.

You May Like: How To Transfer 401k Balance To New Employer

How Can A 401 Plan Administrator Help Me

A plan service provider can help every company and small business make the most out of a retirement plan and upgrade employees benefits as a result.

If you are an employee, make sure to find your 401 plan service provider in the plan document Summary Plan Description or on Form 5500. Feel free to ask for information about when the benefits will be paid, employer contributions, employee contributions, allowable plan contributions, and similar. They will provide you with up-to-date information in your best interest.

401 recordkeeper helps employers, too. If you are a company or a small business owner, you should consider hiring a plan service provider. They can provide a wealth of knowledge and expertise to ensure that your 401k plan is in compliance with the ever-changing regulations, laws, and rules. They can not make investment decisions for a fund, but they ensure that investments are in compliance with the company or small business goals.

Small businesses often hire an outside investment advisor, investment manager, or registered investment adviser to help them manage the plans assets. An investment manager can help you understand how your plan functions so that you know if it is performing well or not in comparison with other 401k plans. They will also help you design a plan that meets the needs of your employees and business.

The service agreement requires investment.

Providers That Take On Erisa 3 Advisory Status Take On A Fiduciary Duty For You

If your company currently works with a registered investment advisor supporting your plan, there are two roles they may take on . Compare the differences and you can see the protections and advantages that an ERISA 3 can offer your company:

ERISA 3 Advisor

- Takes on the investment management role for your company in managing the investment options available in your plan

- Plan sponsor relinquishes discretion and influence in roster decision

- Plan sponsor monitors the work of the advisor to ensure the 3 is performing its duties

- Plan sponsor is protected from suits and liability for investment roster decisions

- Saves the company the time, energy and costs of managing the investment roster

ERISA 3 Advisors takes on the fiduciary duty and liability for your firm for this aspect of your plan

ERISA 3 Advisor

Don’t Miss: How Do I Move My 401k