What Hardship Withdrawals Will Cost You

Hardship withdrawals hurt you in the long run when it comes to saving for retirement. You’re removing money you’ve set aside for your post-pay-check years and losing the opportunity to use it then, and to have it continue to appreciate in the meantime. You’ll also be liable for paying income tax on the amount of the withdrawaland at your current rate, which may well be higher than you’d have paid if the funds were withdrawn in retirement.

If you are younger than 59½, it’s also very likely you’ll be charged at 10% penalty on the amount you withdraw.

Provide The Withdrawal Amount

Indicate how much you want to withdraw from your retirement account in the third section of the form. You are not held to any minimum or maximum withdrawal amounts unless you have a traditional IRA and are age 70 1/2 or older. In these cases the IRS requires you to withdraw a minimum amount from your accounts each year. The required minimum distribution amount varies depending on your age and how much you have in your retirement accounts. If you do not take the distribution, you will incur an additional 50 percent tax on the amount you should have taken. Merrill Lynch provides a required minimum distribution calculator, as well as an automatic required minimum distribution service to help customers determine how much they must take out. Roth IRA holders do not have to meet this requirement.

Eligibility For A Hardship Withdrawal

The Internal Revenue Service ‘s immediate and heavy financial need stipulation for a hardship withdrawal applies not only to the employee’s situation. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary.

Immediate and heavy expenses include the following:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence

You wont qualify for a hardship withdrawal if you have other assets that you could draw on to meet the need or insurance that will cover the need. However, you needn’t necessarily have taken a loan from your plan before you can file for a hardship withdrawal. That requirement was eliminated in the reforms, which were part of the Bipartisan Budget Act passed in 2018.

The $2-trillion coronavirus emergency stimulus bill signed into law on March 27, 2020, allows those affected by the coronavirus situation a hardship distribution to $100,000 without the 10% penalty those younger than 59½ normally owe account owners have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Don’t Miss: Can I Borrow From My 401k To Refinance My House

How Do I Withdraw Money From My Merrill Lynch 401k

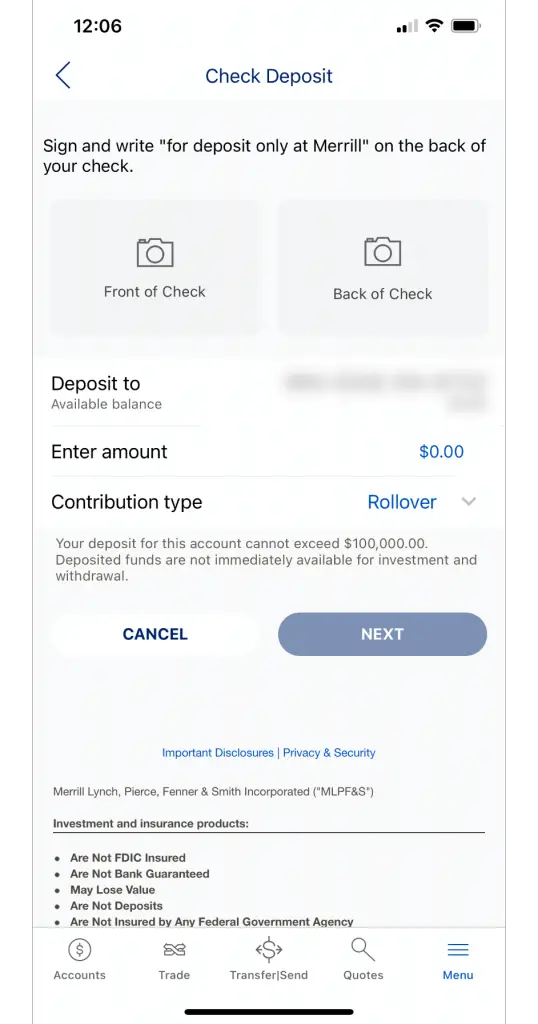

To start your withdrawal youll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

Can I Withdraw My Pension Fund When I Resign

If you have completed less than 10 years in your current job, you are eligible for withdrawal of the EPS balance or to get a certificate regarding the balance and the years of service. If, however, you have completed more thab 10 years in your current job, the only option you have is to get the EPS certificate.

Recommended Reading: How Do You Take A Loan Out Of Your 401k

Retirement Planning With Merrill Edge

For more information on rolling over your IRA, 401 , 403 or SEP IRA, visit our rollover page or call a Merrill rollover specialist at 888.637.3343. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Build An Emergency Fund

This should be the foundation of your financial plan and experts recommend having about six months worth of expenses saved. You can park this money in a high-yield savings account to earn more interest than you would in a traditional checking account. An emergency fund should help you manage most of lifes curveballs.

Also Check: When Leaving A Company What To Do With 401k

How Do I Contact Merrill Lynch 401k

Make Retirement Your Own Merrill Lynch

Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America Corporation. Trust, fiduciary and investment management services are provided by Bank of America, N.A. and its agents, Member FDIC, or U.S. Trust Company of Delaware.

Recommended Reading: How To Cash In Your 401k Early

How Long Does It Take To Get A 401k Loan Check From Merrill Lynch

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

How Long Does It Take For A Withdrawal From A Merrill Edge Account

Redemptions or withdrawals may not appear for up to 15 days after the receipt of the checks, and subject to applicable laws and regulations, within six days of the receipt of funds. How do I link an account? You can add new single accounts to your online portfolio view using a simple three-step process.

Don’t Miss: What Is The Best Fund To Invest In 401k

Transferring Money From A Roth 401 To A Bank Account

If you are taking a qualified distribution from a Roth 401, the IRS requires that participants must have contributed to the plan for at least five years, and have attained age 59 ½. To make a withdrawal, send a request to the 401 plan custodian, and choose to be paid via check or direct deposit. Roth 401 withdrawals can take seven to 10 days.

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Recommended Reading: When Can I Withdraw From My 401k

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

How Taking A 401 Distribution Affects Your Retirement

Time in the market and compounding interest are critical factors when it comes to your retirement savings. While investment returns will vary, in general more money in the market means more at retirement, while anything you withdraw now is that much less you’ll have for your golden years. Plus, taking money out means missing any potential gains your investments would have seen along the way, even if you reinvest the money down the road.

That’s why it’s important to carefully assess your situation if you’re experiencing a true emergency and your retirement is your only financial source, consider limiting the amount you take out to only what you need. If you’re certain that you can pay yourself back, there’s also less of a risk in going this route. But if you can go without touching your nest egg, over time you may be able to reap the rewards of compound interest and avoid any potential losses.

Don’t Miss: What Happens To My 401k After I Quit

Withdrawing From A Roth 401k

Most 401k plans involve pre-tax contributions, but some allow for Roth contributions, meaning those made after taxes already have been paid.

The benefit of making a Roth contribution to your 401k plan is that you already have paid the taxes and, when you withdraw the money, there is no tax on the amount gained as long as you meet these two provisions:

- You withdraw the money at least five years after your first contribution to the Roth account

- You are older than 59 ½ or you became disabled or the money goes to someone who is the beneficiary after your death

How Do I Close My Merrill Lynch 401k Account

4.6/5closeMerrill Lynch accountcloseaccount

Also know, how do I close my Merrill Lynch account?

You should send a closure request to the broker by logging into the Merrill Edge site and using the internal messaging system. You could also call the broker at 1-877-653-4732 and speak with a live agent. If you’re outside the United States, you should call 1-609-818-8900 instead.

Furthermore, how do I contact Merrill Lynch 401k? If you do not receive your User ID, or have any questions, please the Merrill Lynch Retirement and Benefits Contact Center at 1-866-820-1492 or 609-818-8894 .

Also know, how do I withdraw my 401k early from Merrill Lynch?

To start your withdrawal you’ll need a One Time Distribution form from Merrill Lynch. You must fill it out with your personal information, including your name, date of birth, phone number and Merrill Lynch retirement account number. This information must be accurate to avoid delays in getting your funds.

How long can an employer hold your 401k after termination?

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated.

Recommended Reading: How To Use Your 401k

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

Recommended Reading: What Is A Roth 401k Vs 401k

How Do You Get Money Out Of Your 401k

You can do a rollover of your 401 account balance to an IRA at a company of your choice. You pay no taxes if you do a rollover to an IRA, and your money can stay in your IRA for your later use. Then you can withdraw amounts from your IRA only as you need it. You only pay taxes on the amount you withdraw each year.

Can I Borrow From My 401k If I No Longer Work For The Company

401k Plan Loans An Overview. There are opportunity costs. If you quit working or change employers, the loan must be paid back. If you cant repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½.

Don’t Miss: When Can You Use Your 401k

How Long Does It Take To Get 401k Money After Termination

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

Why Did Gethuman Write How Do I Withdraw My Retirement Or 401k Money From My Merrill Lynch Account

After thousands of Merrill Lynch customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Withdraw My Retirement or 401k Money from My Merrill Lynch Account? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Merrill Lynch if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

You May Like: Who Has The Best 401k Match

Who Qualifies To Take A Cares Act 401k Withdrawal

To qualify for the tax penalty exemption:

- The account owner, their spouse, or dependent must have been diagnosed with COVID-19 by a CDC-approved test, or

- The account owner must have experienced adverse financial consequences as a result of COVID-19-related conditions. For example, adverse financial consequences might include a delayed start date for a job, a rescinded job offer, quarantine, lay off, job furlough, reduction in pay or hours, a reduction in self-employment income, the closing of a business, an inability to work due to lack of child care, or other factors.

The IRS explains those qualifications in more detail in Notice 2020-50, Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans Under the CARES Act.

Merrill Edge Withdrawal At A Glance

Whether you are using an online broker for short-term trading or for longer-term investments, there will come a point when you may want to enjoy the fruits of your trading activity if you’ve been making profitable transactions, or you just need access to your funds for any reason. To do that, first you have to withdraw money from your broker account.

That doesn’t sound very complicated, but brokers differ considerably in what withdrawal options they offer , as well as in the speed and convenience of withdrawal. And while withdrawal at many brokers is free in most cases, some brokers and some types of withdrawals may involve a fee.

So how does Merrill Edge fare in this regard? Before we dive into the details, let us show you at a glance how you can withdraw money from Merrill Edge and how Merrill Edge’s withdrawal fees and options compare to some of its close competitors.

Merrill Edge withdrawal fees and options snapshot| Merrill Edge |

|---|

Don’t Miss: What Is An Ira Account Vs 401k