What Does Rolling Over A 401 Mean

Rolling over your 401 fundamentally means moving the funds from one place to another, and it customarily happens between different places of employment.

When you leave a job for any reason, you generally have three opportunities. You can either leave your 401 with your current employer, roll over the funds to an IRA, or roll over the funds to a new employers 401 plan.

In any case, you should either be able to execute a direct or an indirect rollover. A direct rollover implies that the assets move directly from your previous 401 plan to the one at your new job. The indirect rollover transpires when you receive the funds as a distribution from your previous employer, but you have to put it into the new account within 60 days or face taxes and penalties.

Leaving your 401 with an old employer is very uncommon and has many drawbacks. If you possess less than $5,000 in savings they could force you out by presenting you a check, in which case you will have to do an indirect rollover to your next employers plan.

You also wont be able to generate contributions and take out loans, and your former employer may even add administration fees. Because of this most plan participants roll over their 401 to their new employer.

Rolling over to a different 401 plan can be done directly or indirectly and is usually the best choice.

Retirement Savings Can Benefit

As you make loan repayments to your 401 account, they usually are allocated back into your portfolio’s investments. You will repay the account a bit more than you borrowed from it, and the difference is called “interest.” The loan produces no impact on your retirement if any lost investment earnings match the “interest” paid ini.e., earnings opportunities are offset dollar-for-dollar by interest payments.

If the interest paid exceeds any lost investment earnings, taking a 401 loan can actually increase your retirement savings progress. Keep in mind, however, that this will proportionally reduce your personal savings.

No More Earned Interest

When you borrow money from your 401, those funds stop earning compound interest until they are repaid. Even if your 401 balance is small, a couple hundred dollars in interest over a few years could turn into many thousands over 30 years.

Even more important, contributions to your 401 are dependent on you being eligible to receive that benefit from your current employer. If, for any reason, you leave your employer, the entire balance of your 401 loan becomes due.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Can You Borrow From Your 401

Plan offerings: Before you count on a loan, verify that you actually can borrow from your 401 under your plans rules. Not every plan allows loans its just an option that some employers offer and theres no requirement that says 401 plans need to have loans. Some companies prefer not to. Employers might want to discourage employees from raiding their retirement savings, or they may have other reasons. For example, they dont feel like processing loan requests and repayments. How do you find out if you can borrow from your 401 plan? Ask your employer, or read through your plans Summary Plan Description . If loans are not allowed, there might be other ways to get money out.

Former employees: 401 loans are generally only allowed while youre still employed. If you no longer work for the company, youd have to take a distribution from the plan instead. Former employees dont have any way to repay the loan: You cant make payments through payroll deduction because youre not on the payroll any more.

Is It A Good Idea To Borrow From Your 401

Using a 401 loan for elective expenses like entertainment or gifts isn’t a healthy habit. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash.

On the flip side of what’s been discussed so far, borrowing from your 401 might be beneficial long-termand could even help your overall finances. For example, using a 401 loan to pay off high-interest debt, like credit cards, could reduce the amount you pay in interest to lenders. What’s more, 401 loans don’t require a credit check, and they don’t show up as debt on your credit report.

Another potentially positive way to use a 401 loan is to fund major home improvement projects that raise the value of your property enough to offset the fact that you are paying the loan back with after-tax money, as well as any foregone retirement savings.

If you decide a 401 loan is right for you, here are some helpful tips:

- Pay it off on time and in full

- Avoid borrowing more than you need or too many times

- Continue saving for retirement

It might be tempting to reduce or pause your contributions while you’re paying off your loan, but keeping up with your regular contributions is essential to keeping your retirement strategy on track.

Long-term impact of taking $15,000 from a $38,000 account balance

Recommended Reading: Should I Roll My 401k Into An Annuity

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

What Is The Tax Penalty For Withdrawing Money From A 401

It depends on when you make the withdrawal. If you are age 59 1/2 or older, then there is no tax penalty. However, if you make a withdrawal before reaching this age, you will be charged an extra 10% penalty on top of your regular income taxes that you pay on the funds. In some cases, you might be able to take a withdrawal without being required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your financial planner to discuss your specific situation to see if you can qualify for a penalty-free withdrawal.

You May Like: How Much Can You Contribute To 401k Per Year

What Is A Lump

A lump-sum payment is an often large sum that is paid in one single payment instead of broken up into installments. It is also known as a bullet repayment when dealing with a loan. They are sometimes associated with pension plans and other retirement vehicles, such as 401k accounts, where retirees accept a smaller upfront lump-sum payment rather than a larger sum paid out over time. These are often paid out in the event of debentures.

Lump-sum payments are also used to describe a bulk payment to acquire a group of items, such as a company paying one sum for the inventory of another business. Lottery winners will also typically have the option to take a lump-sum payout versus yearly payments.

Establish A Rollover Ira

If youre changing places of employment and you have more than $5,000 in your account, your plan sponsor will ordinarily distribute those funds to you but keep 20% of it for penalties if youre under the age of 59 ½.

You can roll over your funds into an IRA account if you want to sidestep this penalty, but you have to do it within 60 days. You can also put your assets into a traditional IRA to avoid current taxes.

You May Like: How To Contribute To 401k Without Employer

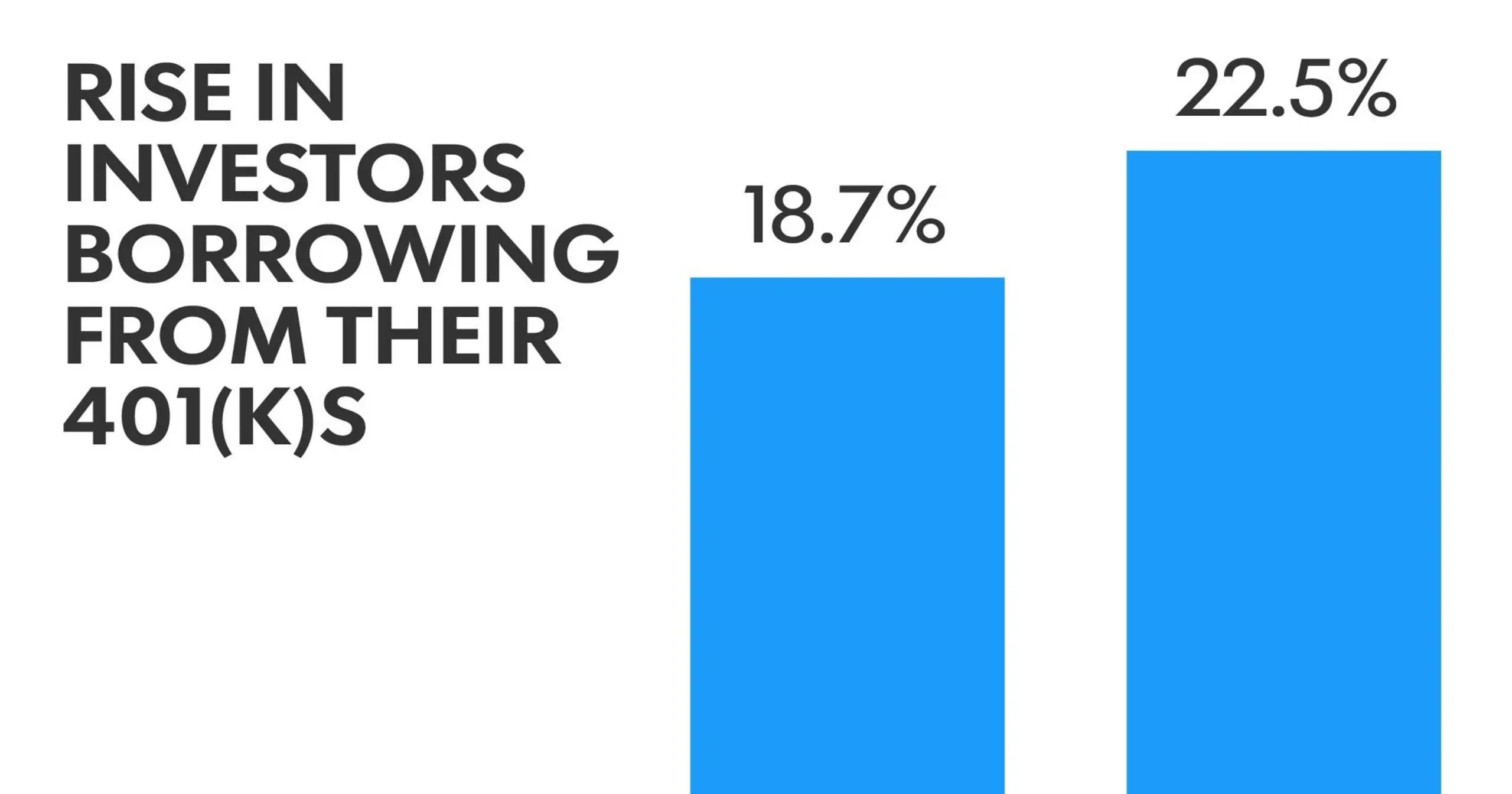

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Don’t Miss: How To Take A Loan From 401k

Required Minimum Distribution Method

This will result in an annual payment to the recipient. The account balance is divided by the life expectancy factor of the recipient to arrive at the annual amount. The amount is recalculated each year based on the new account balance, but the life table used in the original calculation is used for the duration of the payments.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How Do I Take Money Out Of My Fidelity 401k

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as you’ll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

You May Like: How Do I Find My Old 401k

A Deeper Dive On The 401 Loan Option

A loan is more strategic than a withdrawal, which torpedoes your savings altogether. With a full cash-out, instantly you lose a big chunk, paying a 10% penalty to the IRS if you leave the plan under age 55 plus another 20% for federal taxes. For instance, with a $50,000 withdrawal, you may keep just $32,500 and pay $17,500 in state and federal taxes. And the leftover sum you receive, if you happen to be in a higher tax bracket, may nudge you into paying even more taxes for that additional annual income.

Another adjustment in 2020 for workers affected by COVID-19: If your plan allows or through your IRA, you can withdraw up to $100,000 without the 10% penalty even if youre younger than 59½. The standard 20% federal tax withholding does not apply, but 10% withholding will unless you decide otherwise. You also can spread your income tax payments on the withdrawal over three years.

We understand emergencies can leave people with limited choices. Just remember that even the less extreme option of a 401 loan may paint your future self into a corner. The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

At the very least, dont start stacking loans . Some employer retirement plans allow as many as three.

What Else Do I Need To Know

- If your employer makes contributions to your 401 plan you may be able to withdraw those dollars once you become vested . Check with your plan administrator for your plan’s withdrawal rules.

- If you are a reservist called to active duty after September 11, 2001, special rules may apply to you.

Important Note: Equitable believes that education is a key step toward addressing your financial goals, and this discussion serves simply as an informational and educational resource. It does not constitute investment advice, nor does it make a direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your unique needs, goals and circumstances require the individualized attention of your financial professional.

Equitable Financial Life Insurance Company issues life insurance and annuity products. Securities offered through Equitable Advisors, LLC, member FINRA, SIPC. Equitable Financial Life Insurance Company and Equitable Advisors are affiliated and do not provide tax or legal advice, and are not affiliated with Broadridge Investor Communication Solutions, Inc.

Take the next step

Read Also: How Much Should I Put In My 401k

When Should I Take Out A 401 Loan

Most employer-sponsored 401 retirement plans allow employees to borrow against their accounts, but employers can restrict what you’re allowed to use the funds for. You’re also putting your retirement savings at risk, so be careful about what you’re borrowing for regardless of if there’s a restriction.

Situations that may necessitate a 401 loan include:

- Funeral expenses

- Making a down payment on a house

- Covering costs to prevent foreclosure or eviction

- Paying education costs for yourself or your family members

What Happens If I Have A 401 Loan And Quit My Job

Outstanding 401 loans can cause problems when employees quit a job. Along with changing jobs, employees have to deal with what to do with their 401 loan.

Have a 401 loan and quit?

You are required to repay the remaining loan within 60 days.

Use Beagle instead. Beagle enables you to take a 401 loan that you don’t need to repay when you change jobs!

When faced with a difficult financial decision, it can be tempting to want to tap into your 401. However, income tax and IRS early withdrawal penalty tax can eat into your retirement savings and the amount you keep. A 401 loan can be a great alternative because it allows you to withdraw money from your 401 and avoid taxes and penalties. That money is repaid back into your 401 account, and your retirement funds continue to grow over time. But if you quit your job or get fired, you may find yourself in an even bigger mess.

If you quit your job with an outstanding 401 loan, the IRS requires you to repay the remaining loan balance within 60 days. Fail to repay within that time, and the IRS and your state will deem the balance as income for that tax year. Youâll need to pay income tax and face a 10% penalty tax in addition. If you spent the entire allotment of funds, that tax and penalty will need to be made up before April 15h of the following year.

You May Like: How Should I Roll Over My 401k

How Does A 401 Loan Work

Madelyn Goodnight / The Balance

Borrowing from your 401 isn’t the best ideaespecially if you don’t have any other savings put toward your retirement years. However, when it comes to a financial emergency, your 401 can offer loan terms that you won’t be able to find at any bank. Before you decide to borrow, make sure you fully understand the process and potential ramifications. Below are seven things you need to know about 401 loans before you take one out.