Can You Retire On A Million Dollars

These days, thanks to cost-of-living increases and lifestyle changes, retiring on $1 million isnt as carefree. Though it does not provide for the sumptuous lifestyle of years past, having $1 million for retirement is still a blessing. Many retirees rely on Social Security benefits for at least 50% of their income.

Use Fidelitys Rule Of Thumb As A Guide

According to Fidelitys viewpoint, retirees should have ten times their income saved by the time they retire at 67. They further explain that you should have:

- 1x your salary by age 30.

- 2x by 35.

- 8x by 60.

- And 10x by 67.

With these numbers, Fidelity is assuming that retirees are targeting to replace 45% of their income from their nest egg and using Social Security to cover the rest of their needed expenses.

These are rough milestones, but use the numbers to see if you need to add more or less to your 401k.

Get Help With Your 401

Already have a 401? While youre researching contributions, take a minute to analyze your current holdings toothere could be big savings to be found.

is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduced expensesit can even show you how changing funds within your existing 401 might save you thousands. or read our review.

Blooom is a new tool that can automatically manage and optimize your 401 for just $10 a month. Designed especially for 401 accounts, blooom works with your available investments to find the lowest-cost and best allocation for your goals. You can get a free 401 analysis from Blooom or learn more in our review. Plus they have a special promotion where you can get $15 off your first year of Blooom with code BLMSMART

is a great all-in-one financial app that allows account holders to take control over their finances, automate saving and investing, and manage their accounts all in one place. Wealthfronts Self-Driving Money tool continuously monitors your cash flows to ensure that bills are paid and savings are instantly routed into the right investment accounts. Wealthfront account holders can also take advantage of the apps automated investment services, like daily rebalancing and tax-loss harvesting.

Read Also: How To Start A 401k Self Employed

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a matching contribution, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual income. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual contribution limit is $19,500 for tax year 2021, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older.

What Are The Tax Implications Of 401 Contributions

Once you figure out how much to put into your 401, take a look at the different contribution types. Each has a unique tax treatment.

Pre-tax 401 contributions are not included in your taxable income for the year. They can lower your tax liability for the tax year in which you make the contribution. But you will pay income taxes on withdrawals from a traditional 401 plan.

This type is best if you are in a higher tax bracket in the years you are making contributions and expect to be in a lower tax bracket when you withdraw money from the 401 plan. What if you already have a lot of money in tax-deferred accounts? In that case, you might want to do more long-term planning before deciding if you should contribute even more pre-tax money to the plan.

Read Also: How To Figure Out Employer Match 401k

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $19,500 for 2021 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: What Is The Tax Rate On 401k Withdrawals

Contribution Limits In 2020 And 2021

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits |

|---|

Recommended Reading: How To Withdraw My 401k From Fidelity

Where To Invest If You Dont Have A 401

Dont worry if your employer doesnt offer a 401 there are still ways you can save for retirement on your own.

Many big banks and brokerages offer Individual Retirement Accounts, or IRAs, that allow you to put your retirement money into a range of investments, such as individual stocks, bonds, index funds, mutual funds and CDs. Just like with a 401, you can set up automatic contributions into your IRA from a checking or savings account.

When shopping around for an IRA, choose an account that has no minimum deposits, offers commission-free trading and provides a variety of investment options. Taking these factors into account, Select narrowed down our favorites for every type of retirement saver.

Don’t Miss: Can You Transfer An Ira Into A 401k

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $6,000.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, Pa. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

We Hope To See You Again Soon

Youre about to leave Regions to use an external site.

Regions provides links to other websites merely and strictly for your convenience. The site that you are entering is operated or controlled by a third party that is unaffiliated with Regions. Regions does not monitor the linked website and has no responsibility whatsoever for or control over the content, services or products provided on the linked website. The privacy policies and security at the linked website may differ from Regions privacy and security policies and procedures. You should consult privacy disclosures at the linked website for further information.

You May Like: How To Find Out If Someone Has A 401k

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

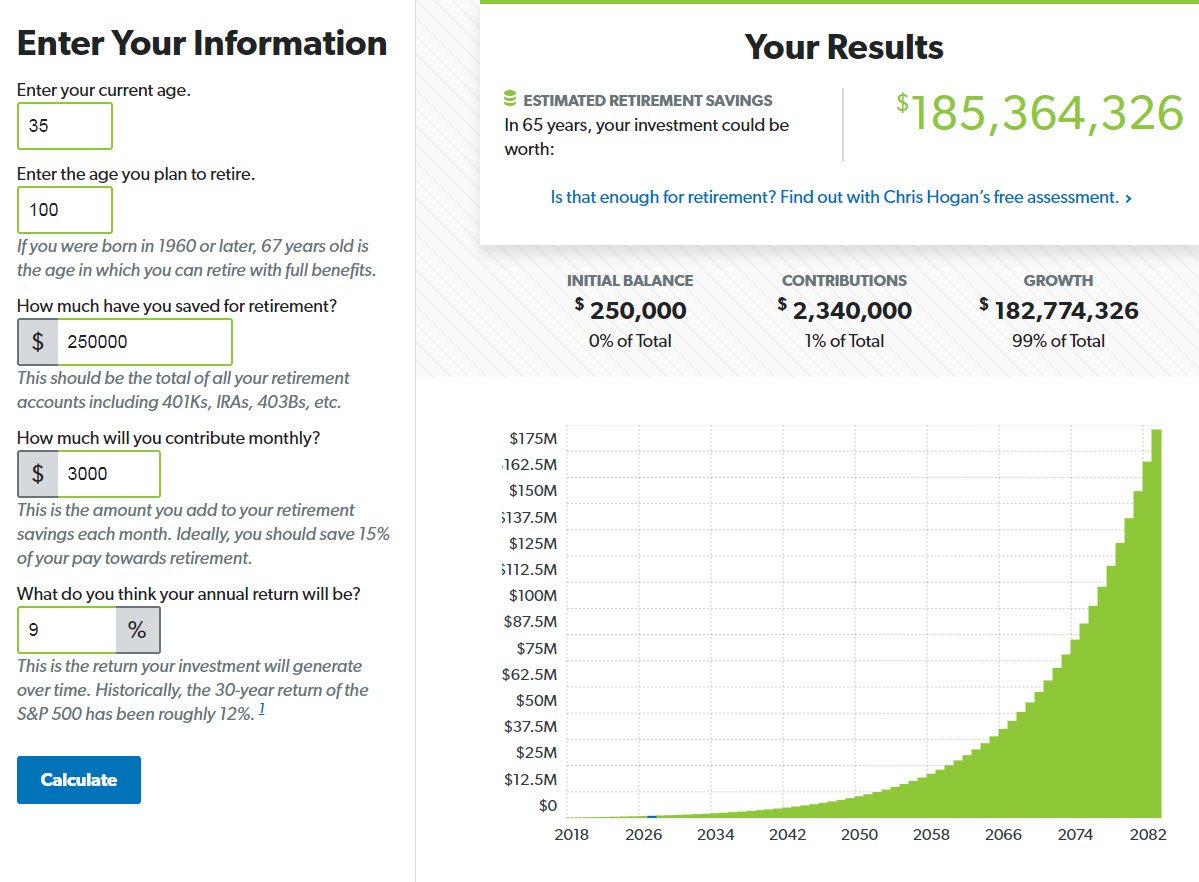

The Power Of Compound Returns

The earlier you start saving for retirement, the less youll need to save each month. You can thank compounding, which is basically the returns you make on returns. Once youre making money on your earnings, your returns compound at an accelerated rate.

Suppose you want to retire at age 60 with $2 million and that you get average returns of 10%. Thats slightly less than what the S& P 500 index has delivered before inflation over the past 60 years with dividends reinvested.

Heres what youd need to invest, between your own contributions and your employers match, if you have a $50,000 annual salary.

- If you started investing at 20: Youd need to invest $316.25 per month, or 7.6% of your salary.

- If you started investing at 30: Youd need to invest $884.76 per month, or 21.2% of your salary.

- If you started investing at 40: Youd need to invest $2,633.76 per month, or 63.2% of your salary.

The examples above show not only how much more youll have to contribute to your 401 each month if you start saving later, but also how much more youll have to save overall. In the first example, youd invest just under $152,000 total by starting at 20. But if you didnt get started until 40, youd wind up investing more than $632,000 to reach your goal.

Keep in mind that 10% is an average, not the 401 rate of return you should expect every year. Your returns will vary, based on how your investments perform, along with the risk tolerance you indicate when you choose your investments.

Read Also: How To Select 401k Investments

How Much Should I Have Saved So I Can Retire Early

The general rule of thumb for whatever age you plan on retiring is to have 80% of your pre-retirement income replaced. Create a careful budget of your expected total expenses per year in retirement and multiply that by how many years you wish to be in retirement. Suppose you plan on retiring around 40 or shortly after. In that case, you need to consider things like waiting to qualify for Medicare or Social Security benefits when considering how much your expenses will be.

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pretax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions, because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

Read Also: When Can I Use My 401k

How Much You Should Have Saved In Your 401k By Age 50

The assumptions for the below chart are as follows:

* The Low End column accounts for lower maximum contribution amounts available to savers above 45.

* The Mid End column accounts for lower maximum contribution amounts available to savers below 45.

* The High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

* Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

* $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

* No after tax income contribution, although more power to you if you have the disposable income to do so.

* The rate of return assumptions are between 0% 10%.

* Company match assumption is between 0% 3%.

* The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

* You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

A High 401k Amount By Age 50 Means Aggressive Savings

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to help ensure a comfortable retirement.

After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

As a 50 year old, youve only got 9.5 years left until you can withdraw from your 401k penalty free. Make your contributions count! Also, make sure you have a proper asset allocation of stocks and bonds that is more conservative.

Too many people were too aggressive investing in stocks right before the financial crisis hit in 2009. As a result, not only did many lose 50% in their investments, they also had to work for years to come.

Don’t Miss: How Do I Stop My 401k

What If Even 10% Is Too Much

For those who havent saved anything, I know its very hard to get started. But no matter what, you should at least contribute enough to get the employer match. A popular employer matching scheme is to match 50% of your first 6% of your salary. Lets say thats what your employer gives. For someone who make $50,000 a year that can contribute 6% a year, they will get $1,500 for free. $3,000 still sounds like a lot, I know, but do your best. Thats a little over $115 a paycheck. Find ways to spend less on what you already spend money on. Figure out what you can cut out of your budget. Think about it. Saving for retirement is still going to benefit you. Its not like you lose the money you saved in your 401k.

How Much You Should Have In Your Retirement Fund At Ages 30 40 50 And 60

Age 30: The 1X Recommendation

By age 30, you should have saved an amount equal to your annual salary for retirement, as both Fidelity and Ally Bank recommend. If your salary is $75,000, you should have $75,000 put away. How do you do that?”When starting your career, commit to automatic savings of 20% per year into your 401. It will discipline you to live and give on the remaining 80%,” said Jason Parker of Parker Financial in the Seattle area, author of “Sound Retirement Planning” and host of the “Sound Retirement Radio” podcast.

Taxes: Most Tax-Friendly States To Retire

Age 30: Planning Starts in Your 20s

Age 40: The 3X Recommendation

Both Fidelity and Ally Bank recommend having three times your annual salary put away for retirement at age 40. If you don’t have a retirement savings strategy as part of your overall financial plan by this point, don’t delay, one expert said.”Every household, regardless of their net worth or stage of life, owes it to themselves to create a comprehensive, individualized financial plan,” said Drew Parker, creator of The Complete Retirement Planner.

Age 40: Resist the Temptation

Age 50: The 5X Recommendation

Age 50: Cut Costs

Age 60: The 7X Recommendation

Age 60: Reduce Risk

More From GOBankingRates:

You May Like: Why Choose A Roth Ira Over A 401k