When To Borrow From Your 401

Only borrow from your 401 when no other reasonable loan rates are available and only if the situation is dire.

Vacations are ruled out. So are 50-inch 4K TVs, shopping sprees and any form of consumerism that might be considered excessive. There are, however, emergencies or dead-end scenarios when a 401 loan may be your best or only option.

If youre suffering a medical setback and need cash fast, your 401 may be a good place to look. You may even qualify for a hardship withdrawal. In this case you wont have to pay the loan back, but youll still have to pay income taxes, plus the 10% early withdrawal fee.

The qualifications for hardship withdrawal differ from plan to plan. Check with your employer to see what yours may cover.

If youre looking at your 401 as a way out of debt, youre looking in the wrong direction. Debt is often the result of undisciplined spending or an unforeseen emergency like job loss or medical setback. Its rarely a one-time purchase that sends the consumer into financial despair.

You Administer The Process

One of the nice details about the Solo 401 is that youre in charge of the whole process. You dont need to apply to an outside party for approval or pay fees for someone to administer the loan.

As the trustee and administrator of your 401 plan, its your right and responsibility to run the plan including the loan feature. Youll stay in the clear as long as you maintain the proper documentation for the loan and can show that payments have been made on schedule.

When you take out a loan, youll fill out a few forms and then issue funds from the plan to yourself. You then need to be sure to make regular payments on a monthly or quarterly basis until the loan is paid off.

Solo 401 Contribution Limits

Contribution limits for a Solo 401 are the lesser of $58,000 in 2021 or 25% of your net adjusted self-employed income. This total rises to $64,500 in 2021 if youre 50 or older. This includes contributions as both an employee and as an employeras a self-employed individual, you are both employer and employee.

As an employee, you can contribute up to $19,500 in 2020 and 2021, or up to $26,000 if youre 50 or older. As an employer, you can only contribute up to 25% of your net adjusted self-employed income. The IRS calculates this as your net earnings from self-employment minus one-half of your self-employment tax and employee contributions you made for yourself. Together, employee and employer contributions cannot exceed $58,000 or $64,500 for those 50 or older in 2021. In 2020, these totals were $1,000 lower: $57,000 or $63,500 for those 50 or older.

You have until the tax filing deadline for that tax year to complete all contributions , but you must establish the 401 plan before the end of a calendar year to make contributions for that year.

Read Also: Can I Rollover My 401k To A Roth Ira

Can I Borrow From My Solo 401 Plan

One of the benefits of the Solo 401 is the ability to borrow from the plan.

As a qualified employer 401, a Solo 401 can make a participant loan just as with any larger employer 401 style plan.

For the self-employed entrepreneur, this access to capital can be a game changer if used wisely. You can tap your retirement savings to grow your own business, or engage in lucrative investment opportunities that may not fit well within the self-dealing restrictions of the 401 umbrella.

When you borrow from the plan, you do have an obligation to repay the plan on specific terms. However, how you use the money is up to you the borrowed funds are now outside the plan.

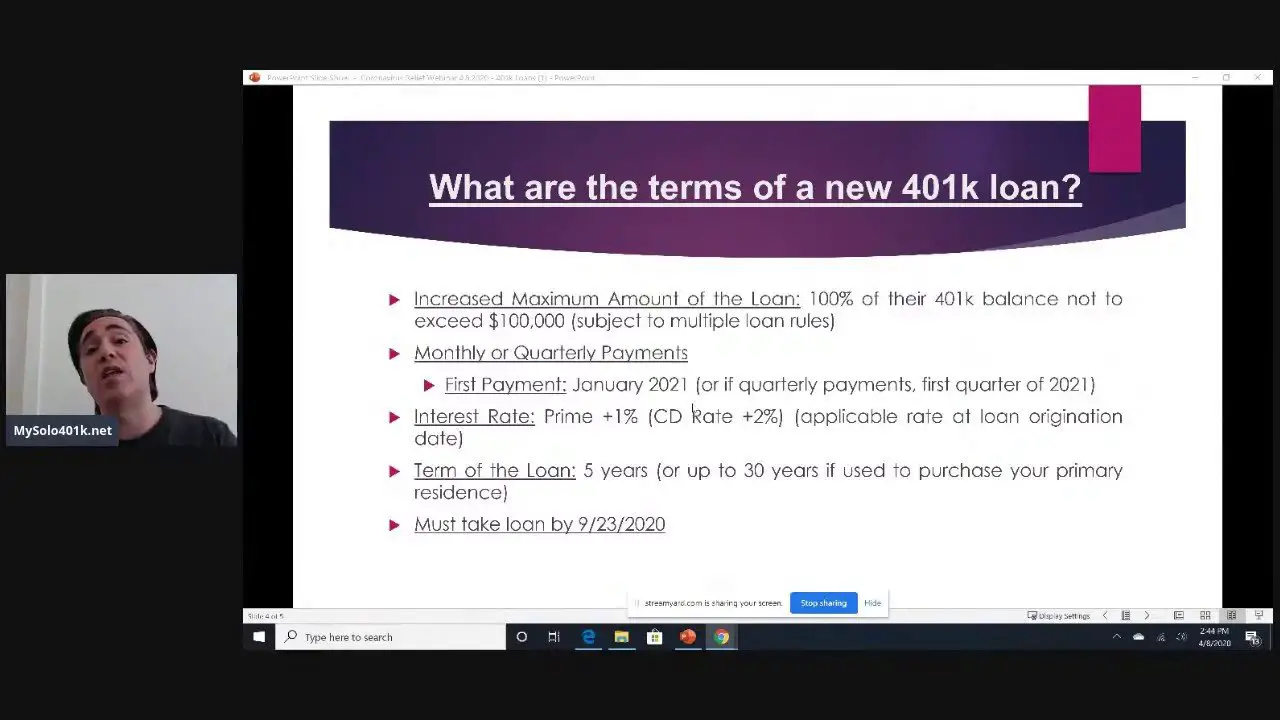

What Is The Solo 401k Loan Interest Rate

Almost all solo 401k loans have an interest rate equal to the prime rate plus one point.

The prime rate is the lowest rate at which banks in the US will lend money. The Wall Street Journal is a reliable source for what the current prime rate is. So if the prime rate is 4.75% when you apply for your solo 401k loan, which it is at the time of writing, then your solo 401k loan interest rate will likely be something around 5.75%.

Also Check: How To Open A 401k Plan

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

Fidelity |

|

|

$0/trade |

$0/trade |

Some notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax years 2020 and 2021. If you are over 50, an additional $6,500 catch-up contribution is allowed for tax years 2020 and 2021. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $57,000 for tax year 2020 and $58,000 for tax year 2021. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to be $63,500 for 2020 and $64,500 for 2021.

Compensation from your business can be a bit tricky. This is calculated as your business net profit minus half of your self-employment tax and the employer plan contributions you made for yourself plan). The limit on compensation that can be factored into your tax year contribution is $285,000 for 2020 and $290,000 for 2021.

Recommended Reading: Is There A Maximum You Can Contribute To A 401k

Reporting Solo 401k Loan Defaults

If a Solo 401k loan is defaulted, the loan value at the time of default is taxable and reported to the plan participant and to the IRS on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. Distribution code L is used only for defaulted loans when there is no offset of the plan balance as a result of a distribution triggering event under the plan. If an offset occurs, the actual distribution is reported as usual , code L would not apply. The following example illustrates Form 1099-R reporting on a defaulted loan.

How Is My Solo 401k Participant Loan Secured

Up to 50 percent of the present value of a participants account balance can be used to secure a loan. This is determined at the time the Solo 401k loan is made. See

Therefore, if a Solo 401k participant borrows one half of his or her account balance and then takes a Solo 401k hardship distribution before the loan is repaid, he or she will still be in compliance with this rule.

Also Check: Who Do I Call About My 401k

Withdrawing Funds From A Self

As with traditional 401 plans, the self-employed 401 is intended to help you save money for retirement, and there are regulations in place to encourage you to do so. For example:

- Withdrawals prior to age 59½ may be subject to a 10% early withdrawal penalty, along with any applicable income taxes1

- You must take required minimum distributions from self-employed 401s beginning at age 722

- Plans can be structured to allow loans or hardship distributions3

- Plans can be structured to accept rollovers from other retirement accounts, including SEP IRAs and traditional 401s, into your self-employed 401

- You can roll your self-employed 401 assets into another 401 or an IRA

Because of its high contribution levels, flexible investment options, and relatively easy administration, the self-employed 401 is an attractive option for small-business owners or sole proprietors who want to be able to save aggressively for the future.

If there is the potential that your business might add employees at a later date, however, know that you will either have to convert your self-employed 401 plan to a traditional 401, or else terminate it. But if you’re confident that you will remain a one-person operation, and you want the high savings options that these plans offer, this type of account may be a good fit.

Drawbacks To The Solo 401

The solo 401 has the same drawbacks of typical 401 plans, plus a couple others that are specific to itself. Like other 401 plans, the solo 401 will hit you with taxes and penalties if you withdraw the money before retirement age, currently set at 59½. Yes, you can take out a loan or may be able to access a hardship withdrawal, if needed, but those are last resorts.

In addition, it can take more paperwork to open a solo 401, but its not especially onerous. You usually wont be able to open the account completely online in 15 minutes, as you would a typical brokerage account. Plus, youll need to get a tax ID from the IRS, which you can do online quickly. On top of this, youll have to manage the plan, choose investments and ensure that you dont exceed annual contribution limits.

Another wrinkle: Once you exceed $250,000 in assets in the plan at the end of the year, youll need to start filing a special form with the IRS each year.

These drawbacks arent especially burdensome, but you should be aware of them.

Don’t Miss: How Do You Roll A 401k Into An Ira

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

Solo 401k Loan Grace Period For Late Payment

Effective January 1, 2002, Treas.Reg.1.72 -1, Q& A 10, provides for a cure period that allows a loan participant to avoid an immediate deemed distribution following a missed payment. The cure period may not extend beyond the last day of the calendar quarter following the calendar quarter in which the required payment was due.

Read Also: Should I Do Roth Or Traditional 401k

Okay Im Ready To Take Out A Solo 401k Loan

Thinking of borrowing from your solo 401k or rolling your IRA money into a solo 401k so you can do so? The first step is to talk it through with a professional. Get in touch with your financial planner or advisor and have a conversation about your options.

If you dont have a financial planner or advisor, it might be time to talk to one. Vector Financial Solutions is a good place to start if youre in this situation. Vector Financial is located in north San Diego County and has helped many clients and friends navigate the prospect of borrowing from their solo 401ks. They provide free phone consultations to help get you on the right track.

Call 760-741-3159 or reach out by email to start your conversation with Dave Wilson, Certified Financial Planner® at Vector Financial Solutions and author of the Financial Truths blog.

The opinions voiced are for general information only. They are not intended to provide specific advice or recommendations for any individual and do not constitute an endorsement by Sagepoint. To determine which investments may be appropriate for you, consult with your financial professional. Please remember that investment decisions should be based on an individuals goals, time horizon, and tolerance for risk. Registered Representative may only discuss/and or transact securities business with residents of the following state: AR, AZ, CA, CO, DE, FL, GA, HI, ID, IL, LA, MA, MD, MN, MO, MS, NM, NV, NY, OK, OR, PA, SD, TX, WA.

What Is A Plan Offset Amount And Can It Be Rolled Over

A plan may provide that if a loan is not repaid, your account balance is reduced, or offset, by the unpaid portion of the loan. The unpaid balance of the loan that reduces your account balance is the plan loan offset amount. Unlike a deemed distribution discussed in , above, a plan loan offset amount is treated as an actual distribution for rollover purposes and may be eligible for rollover. If eligible, the offset amount can be rolled over to an eligible retirement plan. Effective January 1, 2018, if the plan loan offset is due to plan termination or severance from employment, instead of the usual 60-day rollover period, you have until the due date, including extensions, for filing the Federal income tax return for the taxable year in which the offset occurs.

Read Also: How To Check How Much Is In Your 401k

How We Chose The Best Solo 401 Companies

To choose the best solo 401 companies, we looked at 10 top providers of solo 401 accounts. In evaluating providers, we focused on pricing, investment options, account features, and trading platforms.

Pricing and fees were the single biggest factor considered, followed by investment choices. The ability to make Roth contributions or take out a 401 loan was the third major factor considered, as they may be less important to some investors. Account trading platforms, both online, desktop, and mobile, were also considered but carried less weight, as they are not as important to the typical retirement account investor.

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Also Check: What Is The 401k Retirement Plan

Is A Deemed Distribution Treated Like An Actual Distribution For All Purposes

No, a deemed distribution is treated as an actual distribution for purposes of determining the tax on the distribution, including any early distribution tax. A deemed distribution is not treated as an actual distribution for purposes of determining whether a plan satisfies the restrictions on in-service distributions applicable to certain plans. In addition, a deemed distribution is not eligible to be rolled over into an eligible retirement plan. -1, Q& A-11 and -12)

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAthese withdrawals are usually tax- and penalty-free

Also Check: How Do I Look At My 401k

When Is This Useful

This can be useful when someone is thinking about distributing money out of their Solo 401k plan for some reason. I recently talked to a man who was going to distribute his 100k IRA to pay for finishing the repairs of 2 fixer upper houses. After we spoke, his strategy was amended to instead:

- Setup a Solo 401k plan and transfer IRA funds into it

- Take a participant loan of $50k

- Use the loan proceeds to finish rehabbing Property #1

- Do a cash out refinance on Property #1 once rehab is complete

- Use refi proceeds to finish rehabbing Property #2 & pay back the Solo 401 participant loan

In his situation, it made sense to pull some equity out of Property #1 to pay for the completion of Property #2 because the rental income of Property #1 covered about 350% of its new loan payments.

Can You Borrow To Repay A 401 Loan

If a 401 loan is at risk of being reported as a withdrawal, you can opt to borrow from another source to avoid tax liability. Depending on how much you owe, borrowing a loan could make sense if the potential tax liability is higher than the interest you would pay on the new loan.

For example, if the outstanding 401 loan to be reported as distribution currently stands at $20,000, it means that will owe up to $6,000 in federal taxes. In this case, borrowing from other sources to evade the tax liability could make economic sense. You can use a 0% balance transfer credit card, home equity loan, or other types of loan to pay off the 401 loan at a considerably lower interest.

However, if you have a $1000 401 balance and there is a potential tax liability of up to $200, you can voluntarily default on the 401 loan and offer to pay the federal taxes before the tax deadline of the following year.

You May Like: Can A Qualified Charitable Distribution Be Made From A 401k