What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

Can I Withdraw From My 401k If I Have An Outstanding Loan

Most 401 plans allow participants to tap into their retirement savings. Find out if you can withdraw from your 401k if you have an unpaid 401 loan.

When contributing to a 401 plan, most people have every intention of accumulating a sufficient retirement nest egg that they can live off in retirement. However, when heavy financial emergencies occur and you do not have an emergency fund, you could be forced to raid your retirement savings to settle the urgent financial needs.

Most 401 plans allow you to take a 401 loan against your retirement savings, or a hardship withdrawal if you are below 59 ½. However, there are circumstances when you can withdraw from your 401 if you have an unpaid loan. For example, if you leave your job or are fired, you could rollover your 401 to an IRA or the new employerâs 401 even if you have an outstanding 401 loan. When this happens, the outstanding 401 balance will not be rolled over, and you will have until the tax due date to pay off the loan balance.

Don’t Miss: What Is A 401k Profit Sharing Plan

Is There A Limit On 401 Loans

Plans can set their own limits for how much participants can borrow, but the IRS establishes a maximum allowable amount. If your plan permits loans, you can typically borrow $10,000 or 50% of your vested account balance, whichever is greater, but not more than $50,000.

For example, if you have $150,000 vested in your 401 account, then you wouldnt be able to borrow the full 50%, or $75,000, of your vested balance. The most you could borrow in that scenario would be $50,000.

On the other hand, if 50% of your vested account balance amounts to less than $10,000, your plan may include an exception and allow you borrow up to $10,000.

You may be able to take more than one loan from your 401, but the total amount of your loan balance cant exceed these limits.

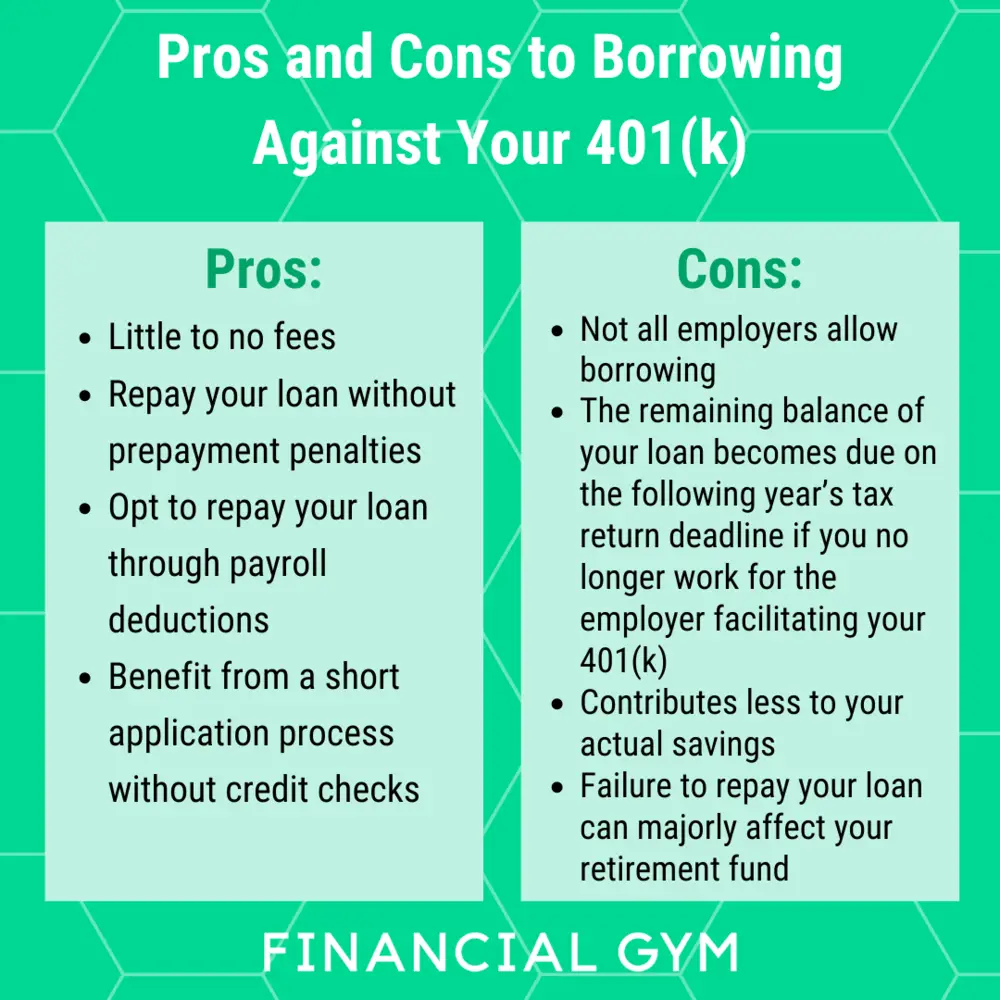

Cons Of Borrowing From A 401

On the flip side, there are several risks when taking out a 401 loan. They include:

· Missed investment growth: When you take out a 401 loan, that money is no longer invested. Consequently, especially in a bull market, you can be missing out on big investment returns.

· If you leave your job, youll have to pay back your loan quicker: Whether you leave your job voluntarily or otherwise, you may be required to pay back your loan within 60 days.

· Defaulting means potential taxes: If you cant repay your loan, your loan balance will be considered a deemed distribution and you could be taxed by the IRS and be assessed a 10% penalty if you are under 59 ½ years old.

· You can be denied: If you are nearing retirement, you could be denied since you would be deemed a higher risk because youll no longer have payments automatically coming out of your paycheck. Other reasons you can get denied include exceeding your loan limit, your plan allows for only one loan at a time, or the reason you want the loan doesn’t meet the plans criteria .

· 401s from previous employers dont count: unless you rolled over money from previous 401s, youll only be able to borrow money from your current 401 plan.

As you can see, borrowing from a 401 has many drawbacks, and thats why youll often read about why a 401 loan should only be considered as a last resort.

Don’t Miss: How Can I Lookup My 401k

What Happens If I Have A 401k Loan And Quit My Job

If you quit working or change employers, the loan must be paid back. If you cant repay the loan, it is considered defaulted, and you will be taxed on the outstanding balance, including an early withdrawal penalty if you are not at least age 59 ½. You have no flexibility in changing the payment terms of your loan.

Failing To Repay A 401 Loan

If you fail to make scheduled payments for a 401 loan, the entire remaining balance of the loan will be treated by the IRS as a distribution. Also, if you leave your job before repaying the loan, you have a limited amount of time to repay it or it will be treated as a distribution. A 401 loan thats treated as a distribution is classified as taxable income by the IRS. In addition, workers below age 59 1/2 in this situation are subject to a 10 percent IRS penalty for early withdrawal from their retirement account. Retired workers with reduced incomes should carefully consider 401 loan repayment after leaving the job to avoid the tax penalties for defaulting.

Also Check: Can You Transfer Money From A 401k To An Ira

The Risks Of Borrowing From Retirement Funds

One risk is that you could lose your job, not be able to pay back the loan in time and get hit with taxes and penalties. Also, before determining how much you can afford to borrow, take into consideration that when you’re paying back the loan, you’ll be able to afford 401 contributions on top of your loan payments. Then you may end up contributing less to your 401 during your career. And of course, a downside of borrowing from a 401 is that the money you borrow doesn’t earn an investment return for you until you pay it back. The nature of investments and compound earnings is that it’s always better to invest sooner rather than later, so taking money out now and paying it back in the future can lower the amount you have available for retirement.

Gift Money After Reviewing The Gift Tax Rules

Beginning in 2018, you can gift up to $15,000 to a person in a year without IRS interfering with your transaction. If you are gifting more than that amount, you need to file a gift tax return. That doesnt mean that you have to pay a tax on the gift. It means that $15,000 is eligible for lifetime exclusion. This is the amount you can gift away during your lifetime without incurring a gift tax. The total lifetime tax exclusion for gifts is $11.2 million per individual so, gift tax rules are not much of a concern for most people.

Recommended Reading: How To Roll Roth 401k To Roth Ira

What Are The Requirements For Repaying The Loan

Typically, you have to repay money youve borrowed from your 401 within five years by making regular payments of principal and interest at least quarterly, often through payroll deduction. However, if you use the funds to purchase a primary residence, you may have a much longer period of time to repay the loan.

Make sure you follow to the letter the repayment requirements for your loan. If you dont repay the loan as required, the money you borrowed will be considered a taxable distribution. If youre under age 59½, youll owe a 10 percent federal penalty tax, as well as regular income tax on the outstanding loan balance .

Will A 401 Loan Affect My Credit

Taking out a 401 loan has no direct impact on your credit scores.

- You dont need a credit check to qualify for a 401 loan, so taking one out doesnt trigger a hard inquiry and result in a temporary dip in credit scores.

- Payments on 401 loans are not tracked by the national credit bureaus , so they do not appear in your credit reports and cannot factor into credit score calculations. If you miss a payment or even default on the loan, your credit scores will not change.

Note, however, that the extra tax and penalty expenses that come with a 401 loan default can make it difficult to pay your credit bills, which can jeopardize your credit standing indirectly.

Recommended Reading: What Is A 401a Vs 401k

How Do 401 Loans Work

When individuals are in a tight spot financially, they often turn to 401 loans. The interest rate for the 401 loans is usually a point or two higher than the prime rate, but they can vary. By law, individuals are allowed to borrow the lesser of $50,000 or 50% of the total amount of the 401.

How Much Can I Borrow As A Second 401 Loan

IRS rules allow 401 participants to have two 401 loans at a time, as long as the total loan amount does not exceed the maximum loan limit. When evaluating how much a participant can borrow as a second loan, the employer considers the highest outstanding loan balance during the previous 12 months ending on the day before the second loan is issued. The total outstanding balance for both loans should not exceed $50,000, or 50% of the vested loan balance.

For example, assume that Mary has a vested balance of $98,000. She has an outstanding 401 loan balance of $5000, and the highest outstanding balance in the last 12 months was $10,000. When calculating the second 401 loan, the maximum allowed amount depends on the highest outstanding balance in the previous 12 months. If Mary plans to take another 401 loan, she qualifies to get $40,000 i.e. Maximum 401 loan limit â highest outstanding balance in the last 12 months.

You May Like: What Is An Ira Versus 401k

Withdrawals Are An Alternative To 401 Loans

A 401 loan is generally preferable to a 401 withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. A loan is a better alternative because:

- You avoid the 10% early withdrawal penalty that applies if you take money out of your 401 before age 59 1/2.

- You’ll repay the money to your 401 so it will not permanently lose out on all of the investment gains it could have earned between the time of the withdrawal and the time you retire.

Before considering a 401 withdrawal and incurring both the penalties and losing gains for the remainder of the time until retirement, you should seriously think about taking out a loan instead if your plan allows it.

Youre Close To Retirement

Many employers might reject your application for a 401k if you have less than five years to retirement. The explanation for this has a lot to do with the IRS-stipulated repayment period for such loans, which is five years.

For illustration, lets assume you take a loan two years before your retirement. In this case, your repayment period would stretch beyond your retirement date.

More often than not, repayment periods that stretch beyond the retirement year increase the risk of default. Thats because 401k loans are typically repaid through payroll deductions, and retirees dont receive these.

So if you take out a loan two years before retirement, there will be a three-year period after retirement where youre repaying the loan out-of-pocket. For many individuals, paying out-of-pocket increases the chances of default.

And even if this doesnt apply to you, your employer might not trust you to keep repaying after retirement.

Read Also: Can You Make Your Own 401k

Can You Use Your 401 To Buy A House

Retirement accounts are just that: money thats being set aside for you to use in your golden years. And if youve been carefully saving, you might be wondering if its OK to tap those funds to use for something right now, like a home purchase, given that its an investment in its own right.

One of the most common type of retirement plans is the 401, which is often offered by companies to their workers. It provides an easy way to earmark some of your salary for retirement savings, along with the tax benefits that a 401 brings. Youll be setting aside money without paying taxes right now and then will pay the taxes when you withdraw it, which ideally will be when you re in a lower tax bracket than you are in now. In many cases, companies also match up to part of your personal savings, which is another reason that 401 accounts are so popular, since thats essentially free money.

But those funds have been set aside specifically for your retirement savings, which means that if your plan allows you to withdraw it earlier, youll pay a penalty, along with the taxes you owe given your current tax bracket. Theres usually the potential to borrow from it, though, which may be a better option.

So, while you can use your 401 for first time home purchase in most cases the question is whether you should.

Dont Miss: How Do I Use My 401k To Start A Business

Repaying The 401 Loan

You should make payments at least quarterly, but commonly, this interval is manageable as youâll repay your loan through payroll deductions. The longest repayment term allowed is five years, though there are exceptions. Some 401 plans do not allow you to contribute to the plan for a certain period after you take out a loan.

If you lose your job while you have an outstanding 401 loan, you may need to repay the balance in full or risk having it be categorized as an early distribution, which can result in both taxes owed and a penalty from the IRS.

You May Like: Where Can I Get 401k Plan

Recommended Reading: Can You Set Up A Personal 401k

Pros And Cons Of Borrowing From Your 401

Experts note investing steadily over the long term is the best way to ensure you have funds for retirement. So it’s a good idea to carefully consider the pros and cons of borrowing from your 401.

Pros

- A 401 loan doesn’t trigger a “hard” credit inquiry from the credit reporting firms and doesn’t appear on your credit report.

- Interest rates are set by the plan administrator and can be less than other kinds of loans.

- Interest on the loan goes back into the 401. You pay your own account for the loan.

- If you miss a payment on a 401 loan it won’t impact your credit score

- If you use the loan to pay off high-interest credit cards and pay the 401 loan back on time, you could reduce the amount you pay in interest overall.

Cons

- If you lose your job, you may have to repay the loan in full.

- Similarly, if you lose your job and don’t repay the loan by that year’s tax deadline, the IRS may consider your loan a withdrawal. If you’re younger than 59 ½, you’ll likely owe a 10% early withdrawal tax penalty.

- You can end up with a smaller retirement nest egg. That’s because investment gains will build off a smaller base while your loan is outstanding.

- If you stop contributing to the plan during the loan, you may miss out on matching funds offered by some employers.

A Deeper Dive On The 401 Loan Option

A loan is more strategic than a withdrawal, which torpedoes your savings altogether. With a full cash-out, instantly you lose a big chunk, paying a 10% penalty to the IRS if you leave the plan under age 55 plus another 20% for federal taxes. For instance, with a $50,000 withdrawal, you may keep just $32,500 and pay $17,500 in state and federal taxes. And the leftover sum you receive, if you happen to be in a higher tax bracket, may nudge you into paying even more taxes for that additional annual income.

Another adjustment in 2020 for workers affected by COVID-19: If your plan allows or through your IRA, you can withdraw up to $100,000 without the 10% penalty even if youre younger than 59½. The standard 20% federal tax withholding does not apply, but 10% withholding will unless you decide otherwise. You also can spread your income tax payments on the withdrawal over three years.

We understand emergencies can leave people with limited choices. Just remember that even the less extreme option of a 401 loan may paint your future self into a corner. The most severe impact of a 401 loan or withdrawal isnt the immediate penalties but how it interrupts the power of compound interest to grow your retirement savings.

At the very least, dont start stacking loans . Some employer retirement plans allow as many as three.

Read Also: How Do You Withdraw From 401k