Investment Options: The Diy Approach

Target-date funds arent for everyone, and some prefer to adopt more of a hands-on approach. You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

So what kinds of funds and investments can you expect to see?

You can bet that almost every plan will have large-cap stock funds. These are funds made up entirely of large-cap stocks, of stocks with a market capitalization of over $10 million. Large-cap stocks make up the vast majority of the U.S. equity market, so your 401 will almost certainly have multiple funds to choose from that invest in them. Notable large-cap funds include the Fidelity Large-Cap Stock Fund and the Vanguard Mega Cap Value ETF .

Another type of mutual fund youll likely find in your 401s catalog of option is a bond fund. A bond fund is a mutual fund that invests solely in bonds. Within this category exists several categories like corporate bond funds, government bond funds, short-term bond funds, intermediate-term bond funds and long-term bond funds. Bond funds are popular because, as a general rule, they provide the safety of investing in bonds, but theyre much easier to buy and sell than individual bonds. Still, bonds arent risk-free: Longer term bonds can be hurt by rising interest rates, and so-called junk bonds are at risk of default.

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Avoid Choosing Funds With High Fees

It costs money to run a 401 plan. The fees generally come out of your investment returns. Consider the following example posted by the Department of Labor.

Say you start with a 401 balance of $25,000 that generates a 7% average annual return over the next 35 years. If you pay 0.5% in annual fees and expenses, your account will grow to $227,000. However, increase the fees and expenses to 1.5% and you’ll end up with only $163,000effectively handing over an additional $64,000 to pay administrators and investment companies.

You cant avoid all of the fees and costs associated with your 401 plan. They are determined by the deal your employer made with the financial services company that manages the plan. The Department of Labor has rules that require workers be given information on fees and charges so they can make informed investment decisions.

Basically, the business of running your 401 generates two sets of billsplan expenses, which you cannot avoid, and fund fees, which hinge on the investments you choose. The former pays for the administrative work of tending to the retirement plan itself, including keeping track of contributions and participants. The latter includes everything from trading commissions to paying portfolio managers’ salaries to pull the levers and make decisions.

You May Like: Can I Invest In 401k And Roth Ira

Tips For Choosing The Best 401k Investments

Determining which investments are the best investments is not a one size fits all endeavor. Everyone starts saving at different ages, with different goals, different incomes and expenses, and varied retirement expectations. All of these factors affect which investments are most likely to fit your particular needs. Your decision may be further complicated by the investment options made available to you by your employer.

After Establishing The Plan

Once your portfolio is in place, monitor its performance. Keep in mind that various sectors of the stock market do not always move in lockstep. For example, if your portfolio contains both large-cap and small-cap stocks, it is very likely that the small-cap portion of the portfolio will grow more quickly than the large-cap portion. If this occurs, it may be time to rebalance your portfolio by selling some of your small-cap holdings and reinvesting the proceeds in large-cap stocks.

While it may seem counter-intuitive to sell the best-performing asset in your portfolio and replace it with an asset that has not performed as well, keep in mind that your goal is to maintain your chosen asset allocation. When one portion of your portfolio grows more rapidly than another, your asset allocation is skewed in favor of the best performing asset. If nothing about your financial goals has changed, rebalancing to maintain your desired asset allocation is a sound investment strategy.

And keep your hands off it. Borrowing against 401 assets can be tempting if times get tight. However, doing this effectively nullifies the tax benefits of investing in a defined-benefit plan since youll have to repay the loan in after-tax dollars. On top of that, you will be assessed interest and possibly fees on the loan

Recommended Reading: How Much Money Do I Have In My 401k

Take Fees Into Consideration

Heres a golden rule of investing: past performance does not guarantee future performance.

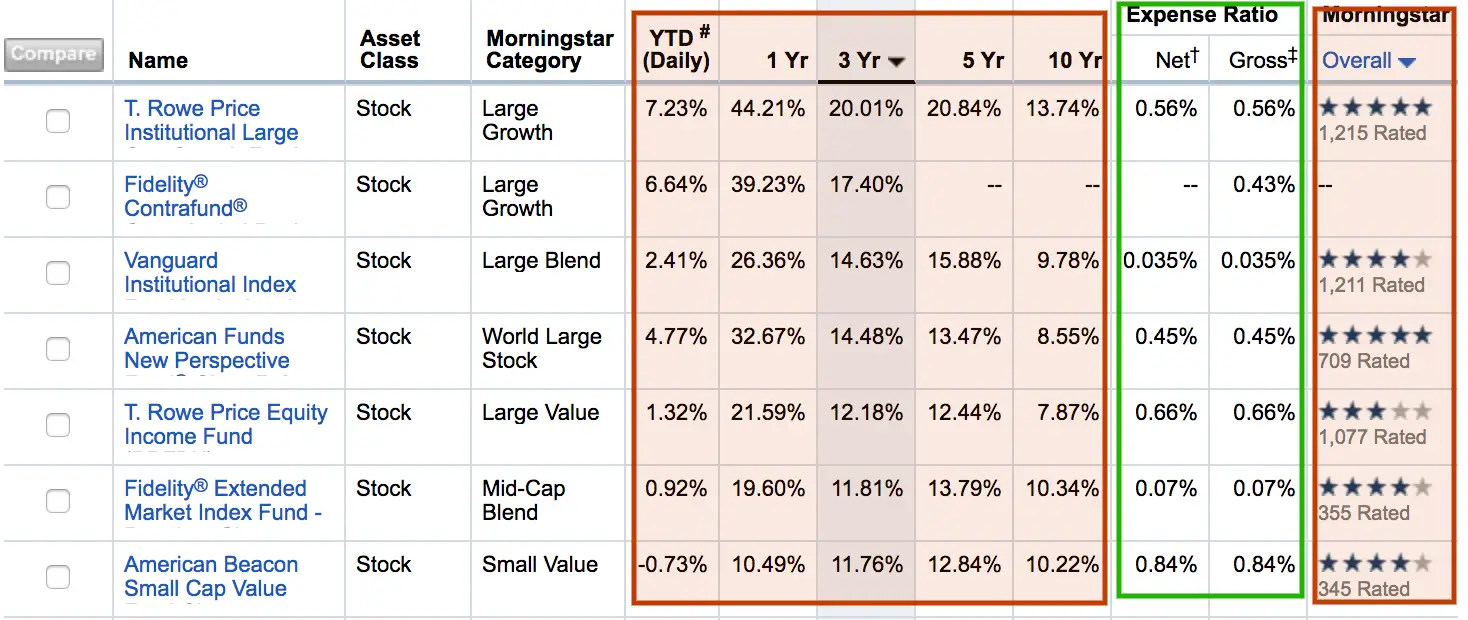

You cant control how well your investments will do, but you can control how much you pay to invest. Yes, it costs money to invest. You pay annual fees, an expense ratio, based on the percentage of the assets. This is why I ignore stats like past performance and ratings, and only pay attention to the Expense Ratio column .

Looking at the chart, paying a fee like 0.84% seems like nothing, and the most expensive option in the example, 1.02%, sounds totally reasonable. But fees can make a drastic difference in your returns.

When comparing expense ratios, also be sure to note the decimal points. At a quick glance, 0.7% and 0.07% can easily look the same.

Lets compare how those fees can play out over time. If you started with $10,000, and invested $5,000 each year for 30 years with a 6% return, heres how much each will cost you.

A 0.63% difference can end up costing you almost $50,000 more over a span of 30 years. To me, anything over 1% is expensive. Generally, my benchmark for funds are ones that cost less than 0.5%, but it all depends on what options you have in your 401k plan. If many of them are expensive, then you may have a crappy 401k plan.

Besides expense ratios, there are other fees you can incur, like load fees and redemption fees, but they arent in this specific example. Anyway, I avoid those, too.

Know Your Investment Risk Tolerance

Whats the difference between investment types and asset classes? A lot centers around risk vs. return.

In general, the higher the potential for return the higher the potential for risk of lossand vice versa.

Risk tolerance is how much you can keep the emotion out of investing. Healthy markets typically go up and down, but those short-term market changes can stir both excitement and regret.

Some people are more comfortable knowing they could lose money in the short run if there are possible gains in the long run. Others are more conservative, preferring less risk.

To learn about coping with market volatility, watch our video.

Also Check: Can I Rollover My 401k To An Existing Ira

How To Pick The Best And Safest Investments For Your 401k

Managing 401k

401 plans offer a variety of investments from which to choose.

Potentially the most rewarding but also the most intimidating part of managing your 401 plan is deciding how to invest the money youre putting into your account.

Thats because the investments you select make a major difference in how quickly your account balance may increase or decrease in value and the income your plan will be able to provide after you retire.

What’s The Best Investment Strategy When You’re Worried That Your Tax Rate May Be Higher In Retirement

If you’re worried that you will be in a higher tax bracket in retirement, rather than a lower one, then you may want to focus on Roth IRA investments. Roth IRA contributions are made after-tax, so you won’t get any tax benefits upfront, but the money grows tax-free and qualified withdrawals don’t create a taxable event.

Also Check: How Do You Know If You Have An Old 401k

Fill Out Your Portfolio Elsewhere

Remember that even if your 401 is filled with terrible mutual funds, its still worth contributing enough to get the full employer match. Thats still a better deal than youll find elsewhere.

Beyond that, if you dont have a reasonable target date fund and you cant find two low-cost mutual funds to match your target asset allocation, its probably best to contribute to other tax-advantaged accounts before contributing to your 401 above whats necessary to get the employer match.

And remember that when it comes to hitting your target asset allocation, the real goal is to make sure that your portfolio as a whole has the right asset allocation. Each individual account can differ as long as it all adds up when you total everything across all accounts.

So if youre in the situation of having one good S& P 500 index fund in your 401 and nothing else you want to invest in, it could make sense to put 100% of your 401 into that fund and fill out your bond funds in other accounts. You may or may not be able to do that depending on your balance in each account, but its certainly an option.

What Is Automatic 401k Investment

If a plan sponsor chooses to enroll employees automatically in a 401, it chooses a default investment for all participants. It must be a set of target date funds, a balanced fund, or a managed account.

If youre automatically enrolled, you have the right to stick with the default investment or choose a different investment or investments from among those offered through the plan. The same is true of the rate at which you contribute. You may prefer one thats higher or lower than the 3% rate thats the initial default percentage for many automatic enrollment plans. The primary limitation is that most employers require you to contribute at least a minimum often 1% to participate. In some cases, there may be upper limits such as 15% as well.

Recommended Reading: Can Anyone Open A 401k

Types Of 401k Investments For An Ira

When you roll your 401k into an IRA, youâll get the opportunity to invest in a wider range of IRA investment options than was possible in your company 401k account. The types of investments available to you really depend on where you open your IRA.

- Self-Directed IRAs: If you are looking for more control over your investments, you will want to find a firm that offers a self-directed IRA. You have the option to invest in property, gold and a wide variety of investments.

- Bank or Credit Union: If you want more conservative investment options, a bank or credit union is your best option. When you open an account here, your investments will be in Certificates of Deposit. The FDIC guarantees the money up to $250,000. However, the rate of return on these investments is often the lowest.

- Traditional Investment Firm: You can invest in a typical investment firm, and the investments will be very similar to the type you can choose with a 401k. If you like the way your 401k is working, but you want to consolidate your orphaned 401ks, then this is a good option for you.

Buy A Variable Annuity With A Lifetime Income Rider

A variable annuity is not the same type of investment as an immediate annuity. In a variable annuity, your money goes into a portfolio of assets that you choose. You participate in the gains and losses of those investments, but you can add guarantees called riders for an additional fee. Think of a rider like an umbrellayou may not need it, but it is there to protect you in a worst-case scenario.

Riders that provide income go by many names, including living benefit riders, guaranteed withdrawal benefits, lifetime minimum income riders, etc. Each has a different formula that determines the type of guarantee they provide.

Variable annuities are complex, and many people who offer them dont have a good grasp of what the product does or doesnt do. Riders have fees and frequently have variable annuities that total about 3% to 4% a year. That means to make any money, the investments have to earn back the fees and more.

Put a lot of thought into the process before deciding e if you should insure some of your income. You should figure out what account to purchase the annuity in , how the income will be taxed when you use it, and what happens to the annuity upon your death.

Recommended Reading: How To Cash Out Nationwide 401k

Total Bond Market Index Fund

Total bond funds are mutual funds or exchange-traded funds that hold bondsor debtacross a wide range of maturities. The debt securities that these funds hold are usually corporate-level bonds, but you will also see holdings of municipal bonds, high-grade mortgage-backed securities . and Treasury bonds.

You only need one good bond fund, and a total bond market index fund will provide diversified exposure to the entire bond market.

How Investments Work Within A 401 Plan

In most 401 plans, the employer will select a menu of investment options that will be available to plan participants. Each employee must then decide which of those investments to purchase with their 401 savings. Some employers provide access to investment education or investment advice services to help employees build their investment portfolio. Others offer investment options, such as TDFs or managed accounts, for employees who do not feel they have the expertise to manage their 401 investments.

Read Also: Should I Keep My 401k Or Rollover To Ira

Other Possible Ways To Choose

What if your retirement plan doesnt offer target retirement funds? Or what if theyre offered, but they have hefty fees attached to them? At this point, there are a handful of factors you could look at:

- Past performance

Many people simply pick the fund that has the highest historical performance numbers. After all, that would seem to indicate that its the best fund, right? Unfortunately, basing your investments entirely upon past performance is almost a sure record for failure.

Why? Because, for most funds, periods of outperforming their peers are typically followed by periods of underperforming. Its as simple as that. History has shown that its exceptionally rare for a fund manager to consistently outperform his peers. As such, betting on funds that have just had streaks of excellent performance is likely to yield poor results.

One way that past performance stats can be helpful, however, is in identifying true losers. While the top funds of last year are often below average this year , its actually fairly common for the very worst funds to hang out on the bottom of the pile year after year. Why? Because

Invest In Income Producing Closed

A closed-end fund is an investment company that offered shares in an initial public offering . After raising funds, they buy securities with them. The company then offers shares on the market for trade.

Money doesn’t flow in and out of the fund. Instead, closed-end funds are designed to produce monthly or quarterly income. This income can come from interest, dividends, or in some cases, a return of principal.

Each fund has a different objective: Some own stocks, others own bonds, and others use something called a dividend capture strategy. Be sure to do your research before buying.

Some closed-end funds use leveragemeaning they borrow against the securities in the fund to buy more income-producing securitiesand are thus able to pay a higher yield. Leverage means additional risk. Expect the principal value of all closed-end funds to be volatile.

Experienced investors may find closed-end funds to be an appropriate investment for a portion of their retirement money. Less experienced investors should avoid them or own them by using a portfolio manager who specializes in closed-end funds.

Don’t Miss: How Do I Get My 401k When I Retire

Know Yourself And Your Time Horizon

Just like most things in life, theres no one-size-fits-all investment plan. Some investors panic if their investment values go down 5%, while others can handle a 25% annual drop and remain cool. Before June tackles the task of choosing a fund, she needs to do a gut check. There are many risk quizzes online, and her 401 provider might even offer one. A risk quiz questionnaire helps you figure out how much volatility you can tolerate in your investments.

The results of Junes risk quiz suggest that shes a moderately aggressive investor. June expects to retire in approximately 40 years at age 67. With many years until she withdraws her retirement funds, June is confident that she wont bail from her investments even if they drop in value 15% to 20% one year.

This risk profile will inform her asset allocation or the percent of stock funds vs bond funds and fixed investments. The outcome of the Junes quiz suggests that an 80% stock and 20% bond allocation is reasonable for now.

Complete Your Plan Enrollment Form

This is the form youve been waiting for! Its the one youll use to officially commit a percentage of your paycheck for retirement. But there are a couple of other things about this form you dont want to miss:

- Pre-tax or Roth: Whats the difference between a traditional pre-tax 401 and a Roth 401? A pre-tax 401 allows you to make contributions from your pay before taxes are taken out. But when you contribute to a Roth 401, your contributions are made after taxes are taken out. We always recommend the Roth option since you wont have to pay taxes on the money you withdraw from your Roth 401 in retirement. Pre-tax contributions will lower your taxable income now, but youll pay taxes on withdrawals in retirement.

Your Action Step: Contact your 401 plan manager to find out if you have the option to choose pre-tax or after-tax contributions. If you can, take advantage of the Roth option with your next paycheck!

Your Action Step: Again, your 401 plan manager can tell you if your plan offers an automatic rebalancing feature for your investment selections. Tip: call the plan manager and speak with an actual person.

Don’t Miss: How To Diversify 401k Portfolio