Properly Planning For Retirement

Any mental health professional will tell you that comparing yourself to others isn’t good for your peace of mind. However, when it comes to retirement savings, having an idea of what others do can be good information.

It can be hard to determine exactly how much you’ll need for your own post-career days, but finding out how others are planningor notcan offer a benchmark for setting goals and milestones.

Taxable Investment Portfolio Is Key

The only thing you can count on is after-tax money youve invested or saved. This is why after maxing out your 401k, its good to open up an after-tax brokerage account. Consistently contribute a percentage of your paycheck each mont into your taxable investment portfolio.

Your goal should be to then build as many passive income streams as possible. The more passive income streams and active income streams you have, the more financially free you will be.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

A straightforward way to maximum savings is to make your 401k maximum contribution automatic. Save every other paycheck for the rest of your working life.

Max out your 401k and save over 50% of your after-tax income for at least 10 years in a row. If you do, you will be financially free to do whatever you want!

How Does A 401 Loan Work

Madelyn Goodnight / The Balance

Borrowing from your 401 isn’t the best ideaespecially if you don’t have any other savings put toward your retirement years. However, when it comes to a financial emergency, your 401 can offer loan terms that you won’t be able to find at any bank. Before you decide to borrow, make sure you fully understand the process and potential ramifications. Below are seven things you need to know about 401 loans before you take one out.

Also Check: Can I Cancel My 401k And Cash Out

Ways Of Finding My Old 401s Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some free help to find your 401 accounts from companies like Beagle.

Two Favorite Real Estate Platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most investors, investing in a diversified portfolio is the best way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations. They also have higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Ive personally invested $810,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

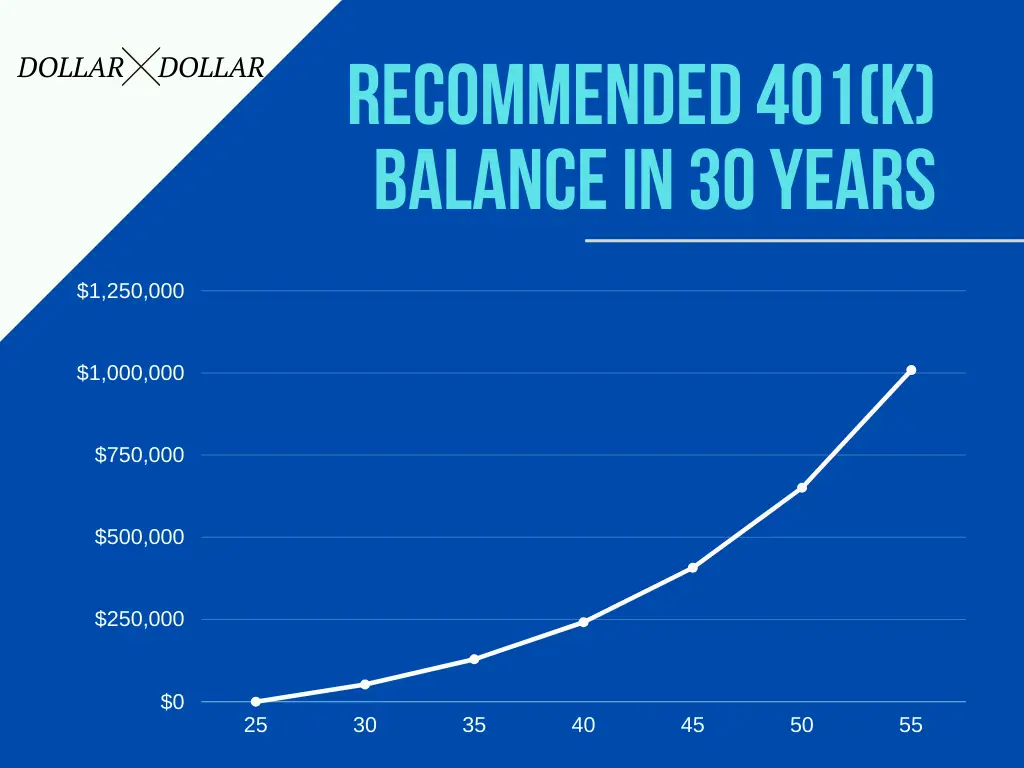

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

How Much Should I Have Saved In My 401k By Age is a Financial Samurai original post.

Filed Under: Most Popular, Retirement

I spent 13 years working at Goldman Sachs and Credit Suisse. In 1999, I earned my BA from William & Mary and in 2006, I received my MBA from UC Berkeley.

Current recommendations:

You May Like: Can You Borrow Money Against Your 401k

The Number Of Workplace Retirement Accounts With $1 Million Or More Hit An All

Despite surging covid cases and climbing inflation, Americans retirement account balances continue to rise to record levels. Others, though, are fighting to pay rent unable even to think about investing for the future.

Lets look at the haves who are saving for retirement in workplace plans.

Fidelity Investments just released its quarterly analysis of more than 30 million 401 and 403 retirement accounts. Average retirement account balances maintainedan upward trend for the third straight quarter.

Workers who continue to contribute to their plans, even as the pandemic produced some heart-clutching moments in the stock market, were rewarded with significant increases in their account balances, according to Fidelity, the largest administrator of workplace retirement accounts.

In fact, as the pandemic caused people to lose their jobs, 38 percent of 401 savers increased their savings rate. And this wasnt just among older workers, who you might expect would contribute more as they get closer to retirement.

People are really seeing the benefit of long-term investing, said Jessica Macdonald, vice president for thought leadership at Fidelity.

Macdonald said 85 percent of the growth in account balances came from stock market performance.

Maximum 401 Contribution Limits For 2020 And 2021

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $57,000 in 2020 or $58,000 in 2021. Catch-up contributions for employees 50 or older bump the 2020 maximum to $63,500, or a total of $64,500 in 2021. Total contributions cannot exceed 100% of an employees annual compensation.

Don’t Miss: Why Rollover Old 401k To Ira

Other Common Types Of Vesting

Aside from 401s, employers may offer other forms of compensation that also follow vesting schedules, such as pensions and stock options. These tend to work a little bit differently than vested contributions, but both pensions and stock options may vest immediately or by following a cliff or graded vesting schedule.

Average 401 Balance By Age

Overall, Americans average 401 balance as of Q2 2020 is $104,400, according to data from Fidelity. That represents an increase of $13,000 from Q1 to Q2. Heres the average breakdown by generation:

- Average balances for employees continually invested for 10 years

- Baby Boomer: $389,800

Recommended Reading: Where To Put My 401k

Contact Your Former Employer

The first place you should look is your prior employer. Contact their human resources department. There, they should have all of the information as to the whereabouts of the 401 account you had with them.

They should send you the proper paperwork and be able to facilitate the transfer of your funds to whatever account you choose.

If they are unable to locate any information on your account, they should be able to provide you the contact information of the administrator who handled your 401 on their behalf.

Let the administrator know your situation, and just like the HR department, should be able to assist you in moving your money properly.

Real Estate Investing Suggestions

In addition to aggressively investing in your 401k, I highly recommend investing in real estate. Real estate is my favorite asset class to build wealth. Real estate provides shelter, produces income, and is a tangible asset. You cant live in your stocks, but you can in your properties.

If youre interested in a hands off approach to real estate investing, consider investing in a publicly traded REIT or in real estate crowdfunding.

My favorite two real estate crowdfunding platforms are:

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Read Also: When Can I Roll A 401k Into An Ira

Can I Withdraw That Money

Access to funds in your retirement account depends on your situation.

After You Leave Your Job

Once you quit, retire, or get fired, you should have access to your vested balance. You can withdraw those funds and reinvest in a retirement accountor cash out, although there may be tax consequences and other reasons to avoid doing so.

While Still Employed

While youre still employed, you typically have limited access to money in a retirement planeven your fully vested balance. Rules may require that you meet specific criteria and that your plan allows you to access your money. There are several potential ways to withdraw money before you leave your employer:

Other Situations

You might become fully vested in all of your balances if your employer terminates or shuts down the retirement plan. Likewise, death or disability can trigger 100% vesting. Check with your employers plan administrator to learn about all of the plans rules.

How Much You Should Have Saved In Your 401k By Age 50

The assumptions for the below chart are as follows:

* The Low End column accounts for lower maximum contribution amounts available to savers above 45.

* The Mid End column accounts for lower maximum contribution amounts available to savers below 45.

* The High End column accounts for savers who are under the age of 25. After the first year, one maximizes their contribution every year to their 401k plan without failure.

* Average starting working age is 22. But you can follow the number of years working as a different guideline if you graduate later or earlier.

* $18,000 is used as the conservative base case maximum contribution amount for ones entire working life. Hopefully the government will increase the max contribution amount over time.

* No after tax income contribution, although more power to you if you have the disposable income to do so.

* The rate of return assumptions are between 0% 10%.

* Company match assumption is between 0% 3%.

* The Low, Mid, and High columns should successfully encapsulate about 80% of all 401K contributors who max out their contributions each year. There will be those with less, and those which much, MUCH greater balances thanks to higher returns.

* You are logical and not a knucklehead. Just by searching this topic, you are taking ownership of your retirement and are thinking ahead with an action plan.

Also Check: How Do You Know If You Have An Old 401k

Average 401 Balance By Gender

In general, men save more for retirement than women.

Across all age levels, Vanguard’s data indicates that women have a median 401 account balance about $10,000 less than that of men. A gender pay gap contributes to lower retirement savings, with the average woman earning 82 cents for every man’s dollar.

Because income is tied to 401 account balances, this gender pay gap has an effect. Here’s the typical amount a person of each gender reported men and women were the only genders considered in this study has saved for retirement across all ages and incomes.

| Gender identity | |

| $88,393 | $22,434 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Benefits Of 401k Saving Plans

401k plans have various benefits that might be of great help now and in the future.

Lifetime Contributions – While there may be some age limits for contributions in some 401k retirement accounts and IRAs, most 401k are designed in such a way that you can contribute and save for your retirement as long as you’re employed.

Employer Matching Contributions – Most 401k plans are structured in such a way that an employer may offer to match the amount of money that you put in your 401k plan. Most employers are known to offer a given percentage of what you put in the plan to even match your exact contribution. Needless to say, this is practically free money and is a great way to swell up your retirement savings. You should, however, keep in mind that your employer’s contributions do not count towards your yearly limit.

Tax Benefits – The savings that you direct to your 401k is pre-tax. This means that the amount of money that you contribute to your 401k plan will not be subject to an income tax and this is a great way of lowering your taxable income. In other words, you won’t have to pay tax on the amount you contribute to your 401k plan until when you withdraw them. This is even beneficial if you take into account the fact that you’ll be in a lower tax bracket during your retirement and this may lower the amount that you’re required to pay in taxes.

Recommended Reading: Can I Borrow From My 401k To Start A Business

Plan Balances By Generation

The good news is that Americans have been making an effort to save more. According to Fidelity Investments, the financial services firm that administers more than $9.8 trillion in assets, the average 401 plan balance reached $112,300 in the fourth quarter of 2019. That’s a 17% increase from $95,600 in Q4 2018.

It’s worth noting that the Q1 2020 amounts will likely be different based on the economic volatility caused by the coronavirus pandemic.

How does that break down by age? Here’s how Fidelity crunches the numbers.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Also Check: Can I Roll My Roth 401k Into A Roth Ira

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Can I Withdraw From My 401k If I Have An Outstanding Loan

Most 401 plans allow participants to tap into their retirement savings. Find out if you can withdraw from your 401k if you have an unpaid 401 loan.

When contributing to a 401 plan, most people have every intention of accumulating a sufficient retirement nest egg that they can live off in retirement. However, when heavy financial emergencies occur and you do not have an emergency fund, you could be forced to raid your retirement savings to settle the urgent financial needs.

Most 401 plans allow you to take a 401 loan against your retirement savings, or a hardship withdrawal if you are below 59 ½. However, there are circumstances when you can withdraw from your 401 if you have an unpaid loan. For example, if you leave your job or are fired, you could rollover your 401 to an IRA or the new employerâs 401 even if you have an outstanding 401 loan. When this happens, the outstanding 401 balance will not be rolled over, and you will have until the tax due date to pay off the loan balance.

Recommended Reading: How To Transfer Roth 401k To Roth Ira