How Do I Find My Old 401

If you’re not sure where your old 401 is, there are three places it could likely be. Here’s where to find your old 401:

Right where you left it, in the old account set up by your employer.

In a new account set up by the 401 plan administrator.

In the hands of your states unclaimed property division.

Heres how to start your search:

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

What Are 401 Matching Contributions

If your employer offers 401 matching contributions, that means they deposit money in your 401 account to match the contributions you make, up to a certain threshold. Depending on the terms of the 401 plan, an employer may choose to match your contributions dollar-for-dollar, or they may offer a partial match. Some employers may also make non-matching 401 contributions.

Matching contributions arent required by law, so not all employers offer them as part of their 401 plans. But according to Katie Taylor, vice president of thought leadership at Fidelity Investments, a 401 match can be a core employee benefit that helps an organization retain talent and build strong teams.

About 85% of the employers we work with offer some sort of matching contribution, said Taylor. The average employer contribution dollar amount into 401s in 2019 was $4,100, which equates to a little bit more than $1,000 per quarter.

Some 401 plans vest employer contributions over the course of several years. This means you must remain at the company for a set period of time before you fully take ownership of your employers matching contributions. Employers use vesting to incentivize employees to remain at the company. When you complete the schedule, you are said to be fully vested.

Recommended Reading: How Long Does A 401k Rollover Take

How Can I Determine What Guidelines Affect Me

To fully understand the vesting policies of your company, speak with the human resources department. They should be able to explain your companys vesting policy and schedule. Being aware of this policy can help you to make the most of your retirement contributions and accounts.

It can also help you determine the right time to begin looking for a new job. For example, if you are only six months away from becoming fully vested in your retirement account, it may be worth waiting to switch jobs.

How Much You Can Afford To Save

In 2021, the annual contribution limit for both traditional and Roth 401s is $19,500, plus an additional $6,500 catch-up contribution for participants age 50 or over.

This is much more than allowed with a Roth IRA, where contributions are limited to $6,000, plus an additional $1,000 for participants age 50 or over. That could make Roth 401s an attractive option for people who want to save more post-tax.

But it’s important to note that even if you choose a Roth 401, all company matches will go into a traditional 401. That means that you will owe income tax on any employer contributions, and the earnings on those contributions, when you withdraw the money during retirement.

A few other things to know: With both types of 401s, you’re required to begin taking minimum distributions at age 72. And early withdrawals made before you turn 59½ are typically subject to an additional 10% penalty.

Also Check: How Much Money Should I Put In My 401k

Vs Roth : How Do They Differ

The key difference between a 401 and a Roth 401 is the tax treatment of contributions and distributions.

A 401 is a type of retirement savings account that is funded with pretax dollars. When you contribute to a 401 account, the contribution is deducted from the employee’s taxable income. When you take a distribution from a traditional 401 account, the amount withdrawn will be subject to income taxes. For example, if you have accumulated $1 million in your 401, and you are in the 32% tax bracket, it means you will pay $320,000 in income taxes to the IRS.

In comparison, a Roth 401 is a post-tax retirement account that is funded with post-tax dollars. This means that the taxes are already taken out, and you remain with reduced pay. Since you paid income taxes when contributing to the Roth 401 account, you wonât pay any taxes if you withdraw money in retirement. However, if your employer contributed a match to your retirement account, you will be required to pay taxes on the employerâs match. For example, assume that you have $1 million in your Roth 401, out of which $100,000 represents the employerâs match. When you take a distribution, you wonât owe any income taxes on the $900,000 you contributed from your paycheck. However, if you are in the 22% tax bracket, you will owe $22,000 in taxes on the employerâs match.

Tags

A Note On Individual Retirement Accounts

If your employer doesnt offer a 401 and you decide to contribute to a traditional IRA instead, your taxes will work very similarly. However, your employer doesnt manage your IRA. You are responsible for making contributions, so your employer wont consider any of those contributions when reporting your earnings at the end of the year. Because your employer isnt excluding IRA money from your earnings, you will need to deduct your contributions on your tax return if you want to get the tax benefits. One big difference with 401 plans and IRAs is that IRAs have a much lower contribution limit. You can only deduct $6,000 in IRA contributions for the 2021 tax year. There are also income limits above which you cant contribute this full amount.

Recommended Reading: How To Calculate Employer 401k Match

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

Also Check: How To Take Out 401k Money For House

How To Find Out If You Had A 401

Keeping track of your 401 benefits is essential to retirement planning.

Saving enough money to retire often means taking advantage of multiple retirement savings accounts. Employers only match your 401 contributions while you are on the payroll. However, the money in your account still belongs to you after you leave your job. If you arent sure if you had a 401 with a previous employer, there are several ways to find out.

Recommended Reading: How To Figure Out Your 401k Contribution

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

How Do I Change My 401 Investments

Understanding how to change your 401 investments is important if you want to maximize your returns.

Adjusting your account allocations is the process of realigning the weightings of the assets in the portfolio.

This can involve periodically buying and/or selling assets in the portfolio in order to maintain the initial desired level of asset allocation.

Understanding how to rebalance is critical because things change and you want your account to reflect these changes.

For example, your risk tolerance may change. Market conditions change, as do tax regulations.

If you arent rebalancing, you may run the risk of unmanaged allocations experiencing much larger losses in down markets and miss the opportunity for growth during good markets.

Make sure to ask the following questions of your 401 plan provider:

- Can I make changes to my investments online?

- Do I have to go through the plan provider or fill out a form?

- How often am I able to make changes?

Its not only important to know how to make changes to your investment menu, but you also need to know how to review and verify these changes to ensure theyre accurate.

If you are able to verify online, make sure you have access to this information and understand what it is that youre looking at.

Don’t Miss: How To Direct Transfer 401k To 403b

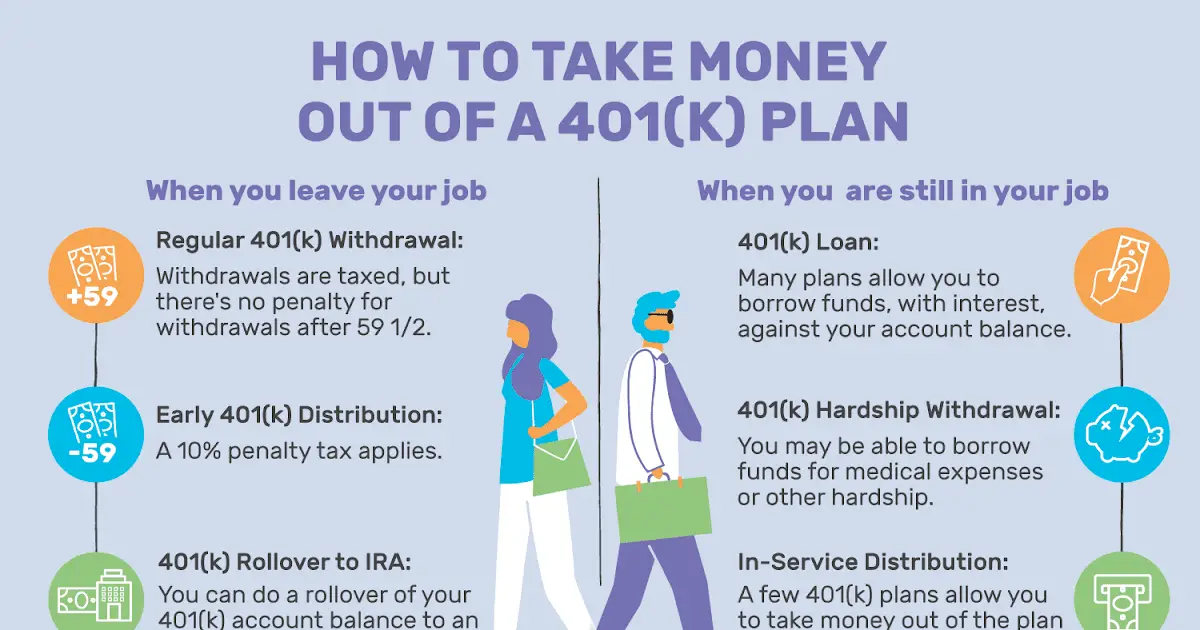

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Contributions After Age 72

With some retirement accounts, you cannot contribute once you turn 72, even if youre still working. That means any money you might have contributed on a pre-tax basis is instead taxed at your current rate. And thats likely to be higher than the rate youll pay once you retire.

Notably, 401s dont have this drawback. You can continue to contribute to these for as long youre still working. Even better, while youre working, youre spared from taking mandatory distributions from the plan provided you own less than 5% of the business that employs you.

You May Like: How To Take Out 401k Early

You Can Roll Over A 401 Account

Workers generally have four options for their 401 when they leave a company: You can take a lump-sum distribution you can leave the money in the 401 you can roll the money into an IRA or, if you are going to a new employer, you may be able to roll the money to the new employer’s 401.

It’s usually best to keep the money in a tax shelter, so it can continue to grow tax-deferred. Whether you roll the money into an IRA or a new 401, be sure to ask for a direct transfer from one account to the other. If the company cuts you a check, it will have to withhold 20% for taxes. And whatever money isn’t back in a retirement account within 60 days will become taxable. So if you don’t want that 20% to be considered a taxable distribution, you’ll have to use other assets to make up the difference.

You May Want To Use Both

If youre torn between the two, you can also consider putting some money into both, since tax risk diversification is important too, Slott says. Again, trying to predict future tax rates is challenging. Just like investment diversification reduces risk, putting money into retirement accounts with various tax advantages can reduce tax risk.

Contributing to just one option is like having all your eggs in one basket, Slott says.

However, keep in mind that you can still only contribute a combined $19,500 in 2021.

Also Check: Why Cant I Take Money Out Of My 401k

Also Check: Who Do I Call About My 401k

Basics: When It Was Invented And How It Works

Tim Stobierski

Whether you want to retire to a quiet life on the beach or spend your golden years globetrotting to exotic locations, one thing is for sure: Retirement is likely to be the most expensive thing you ever pay for.

And unlike other major life purchases there are no loans for retirement. That means youll have to save for it.

Enter the 401. Itâs a special account that you can sign up for at work, if your employer offers one, and itâs designed specifically to help you save for retirement. Hereâs the 101 on 401s.

Contact Your Current Employers Hr Department

Contacting your employerâs human resources department should be easy enough. Theyâll have records if you have a 401 with them.

Along with identifying if you have a 401, they can get your information updated so you can receive vital information such as statements and notifications. They can also help you set up your online account access if they provide one. This is a great way to actively monitor your account, identify any fees youâre paying, and change your contribution amounts.

If you donât currently have a 401 with your employer, make sure you sign up for one as soon as possible. Choosing not to contribute to a 401 is much worse than forgetting whether you had one in the first place.

Recommended Reading: Who Has The Best 401k Match

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

How To Know If Your 401 Is Being Invested Properly

With the possible exception of a decent health insurance plan, a good 401 plan, complete with an employer matching contribution, is just about the best employee benefit you can have. But 401 plans run the gamut from one employer to another. How do you know your 401 is being invested properly?

Read Also: What’s The Max You Can Put In A 401k

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Roll Your 401k From Previous Employer

Does Your Plan Feature Automatic Enrollment

Some companies automatically enroll their employees in their 401 plan, taking deferrals out of your wages unless you specifically instruct them not to. Your employer is required by law to give you the option to forgo participation or to change the amount of your paycheck that will be withheld.

Saving for retirement is almost always a sound financial decision, but if youre paying off debt or dealing with some other financial matter, you may not be ready to make large deferrals right away. On the other end of the spectrum, you may want to contribute more to your 401 than the automatic enrollment stipulates. Either way, knowing how your plan works ahead of time will help you make informed, intentional decisions about your investments.

What Happens To Your 401 When You Leave Your Job

You basically have four options when you leave your job: Do nothing and leave the money in your old 401, roll it over into an IRA, roll it into your new employers 401 plan, or cash out your 401.

Lets get this out of the way: Do not cash out your 401plan. Bad idea! Heres why: When you cash out your 401, you dont even get to keep all of the money! Youll owe taxes on the total amount as well as a 10% withdrawal penalty.

Lets say youre in the 24% tax bracket and decide to cash out the $10,000 you have in your 401 plan when you leave your job. Even though you started with $10,000 in your 401, youll be left with only $6,600 after taxes and penalties.

Your best option is to roll over your 401 funds into an IRA because it gives you the most control over your investments and what mutual funds to choose from.

If you rolled that $10,000 over to an IRA and let it grow for 30 years, it could be worth about $267,000! Even a small cash-out has a big impact on your savings. Your financial advisor can help you roll over any old 401s so you get the most out of your investment.

Recommended Reading: Can You Move Money From One 401k To Another