Do I Have To Leave My Job To Withdraw My Retirement Plan Money

Not necessarily, although thats what most plans require. If your employer terminates your retirement plan, or if you become disabled, you may be given an opportunity to take a distribution. Also, some retirement plans permit you to draw on your retirement plan money after a fixed number of years or upon reaching a certain age, such as 59½ or the plans designated retirement age.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

What Happens To My 403 When I Leave A District

You may be tempted to cash out, but thats not the wisest move.

Its that time of yearyou may have retired, are changing districts, or have been hit with the news that you will not be returning to your job next year. Among the many questions you may have about such a move, top on the list may be, What happens to my 403? or Does my 403 transfer?

When you leave your district, your 403 does not follow youit stays tied to the district where you have worked. While its not held by the district directlyits held with an insurance or investment companythe account itself is tied to your employment record with the district. For educators who may change employment various times throughout their career, this can leave a trail of 403s which make it hard to manage your financial situation. Ultimately, you have five 403 transfer options to choose from:

Recommended Reading: How To Take Out 401k Early

Betterment Makes Rolling Over Your 403 Simple And Efficient

-

Remember that a traditional, tax-deferred 403 should be rolled over to a traditional IRA .

-

At Betterment youll benefit from personalized investment advice, automated investing, tax-smart tools, and transparent, low fees.

There is a lot of talk in the finance space about 401s. While corporate employees are typically the beneficiaries of these plans, those who work for non profit organizations, hospitals, or educational institutions may be more familiar with a similar retirement savings plan, the 403.

Just as a 401 does, a 403 provides you with a tax-advantaged way to save for retirement. You benefit from tax-free growth over time and depending on the options your employer offers, youll also get a tax break on either current contributions or future withdrawals .

Move Money Into The Tsp

Whether youre a civilian employee, a member of the uniformed services, or a separated participant, you can move money from other eligible plans to your existing TSP account. However, you cannot open a TSP account by transferring money into it.

Things to know:

We will accept both transfers and rollovers of tax-deferred money from traditional IRAs, SIMPLE IRAs, and eligible employer plans such as a 401 or 403 into the traditional balance of your account.

We will accept only transfers of qualified and non-qualified Roth distributions from Roth 401s, Roth 403s, and Roth 457s into the Roth balance of your account. If you dont already have a Roth balance in your existing TSP account, the transfer will create one.

We will not accept Roth rollovers that have already been paid to you and will not accept transfers or rollovers from Roth IRAs.

Also Check: Can You Convert A Roth 401k To A Roth Ira

When Switching Or Leaving Jobs Dont Forget Your 403

When you leave a job where you have a 403, you have a few options for what to do with your retirement savings:

Rolling over your 403 into an IRA can be a good choice because it gives you more control over your investment options, tends to have lower fees, and can ultimately hold funds from all of your previous work retirement accounts.

At Betterment, your IRA is invested in our diversified, globally diversified portfolio of 12 asset classes. The portfolio is made up of index-tracking exchange-traded funds , and you can personalize your own level of risk.

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Don’t Miss: How To Transfer 401k From Charles Schwab To Fidelity

Short Of Cash Be Cautious

It may be tempting to pull money out of your 401 to cover a financial gap. Or, when you are considering rolling money over from a 401 to an IRA, you may wish to roll over only a portion of your retirement savings and take the rest in cash. But do you know the true cost? Use our 401 Early Withdrawal Costs Calculator first.

Investment and Insurance Products are:

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

Investment products and services are offered through Wells Fargo Advisors. Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, Members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo & Company.

WellsTrade® and Intuitive Investor® accounts are offered through WFCS.

Retirement Professionals are registered representatives of and offer brokerage products through Wells Fargo Clearing Services, LLC . Discussions with Retirement Professionals may lead to a referral to affiliates including Wells Fargo Bank, N.A. WFCS and its associates may receive a financial or other benefit for this referral. Wells Fargo Bank, N.A. is a banking affiliate of Wells Fargo & Company.

How To Transfer From 457b Plan To 403b Plan

An employee makes contribution to a 457b from his pre-tax wages and there is a maximum limit to the annual contribution amount, which is prescribed by the Internal Revenue Code. For 2007, the maximum limit is lesser of $15,500 or 100 percent of the employees salary. This is for people who are below 50 years. Those who are 50 and above can contribute an additional $5,000 as a part of the catch up plan.

Since the contributions are made before taxes, you will have to pay taxes once you withdraw money from your 457b account. However, unlike the 403b plan, there is no penalty for early withdrawal.

However, the money that is put into a 457b plan does not belong to the employee. This is quite unlike other retirement plans. The assets in a 457b plan are, in fact, a promise from the employer to the employee.

More Articles :

You May Like: Should I Convert My 401k To A Roth Ira

Rollovers And Direct Transfers

The ability to rollover assets into the U-M plan from another employers retirement program and to transfer assets between TIAA and Fidelity depends on a number of factors, including the plan type, your age, and if you are a current employee, a former employee or U-M retiree. Talk with a tax professional or financial advisor and ask questions so that you understand the limitations, requirements and consequences before you take any action.

Are Distributions From My Roth 401 And Roth 403 Accounts Taxable

Qualified withdrawals from Roth 401 or Roth 403 accounts, including earnings, are tax-free. Only the earnings portion of nonqualified withdrawals from Roth accounts is taxable. Withdrawals from Roth accounts are tax-free if the account was established at least five years before, and if youre at least 59½ years of age or if withdrawals are made because of disability or death. Withdrawals from non-Roth accounts are generally taxable.

You May Like: How To Find Your 401k Account Number

A Rollover Of Retirement Plan Assets To An Ira Is Not Your Only Option

A rollover of retirement plan assets to an IRA is not your only option. Carefully consider all of your available options which may include but not be limited to keeping your assets in your former employer’s plan rolling over assets to a new employer’s plan or taking a cash distribution . Prior to a decision, be sure to understand the benefits and limitations of your available options and consider factors such as differences in investment related expenses, plan or account fees, available investment options, distribution options, legal and creditor protections, the availability of loan provisions, tax treatment, and other concerns specific to your individual circumstances.

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: What To Do With Your 401k

You Can Cash Your 403 Out

Please dont do this! Even if you maintain your 403 in an old district, its still meant for retirement. If you cash it out and you are under the age of 59.5, youre going to pay a 10 percent penalty on the balance in addition to income taxes. Cashing out a $10,000 403 for a teacher in a 28 percent tax bracket will include a $1,000 penalty and $2,800 in taxes.

Are You A Us Citizen Or A Us Person For Tax Purposes

If yes, your client will likely have a bigger tax bill from collapsing a retirement plan than someone whos not. But it depends.

While Canadian residents are only taxed 15% on 401 and IRA withdrawals, withdrawals for U.S. persons are taxed as ordinary income at their marginal rate, which is usually higher than 15%. So, a 60-year-old U.S. person in the 33% bracket would only net $67,000 when collapsing a $100,000 IRA. If he transferred his IRA to an RRSP, his FTC would be $33,000 and he would need to owe $33,000 in Canadian tax to be in a tax-neutral position. The larger the FTC, the more unlikely it is that the person has enough Canadian tax owing to offset the entire FTC.

In the Go Public case mentioned earlier, the couples bank overlooked the fact that the husband was a U.S. citizen. Which brings us to

You May Like: Can I Take 401k Money To Buy A House

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Sign up for Bankrates myMoney today to track your finances in one place.

Direct And Indirect Rollovers

Direct rollovers, trustee to trustee, are not subject to tax withholding. A direct rollover is when the retirement plan administrator makes the payment directly to another retirement plan or an IRA. It’s important to note that the administrator may issue a check made payable to the new account, which would need to be deposited within 60 days. No taxes will be withheld from the transfer amount, but there could be a penalty if the money is not re-deposited into the new IRA within the 60-day period.

The safest way to process a direct rollover is to have the administrator process a trustee-to-trustee transfer, which electronically transfers the funds from the old plan to the new one. The IRA owner does not receive a check, and there are no taxes withheld nor any penalties.

Indirect rollovers are when the check is made out to and sent directly to the plan participant. An indirect rollover is subject to 20% withholding. For an indirect rollover to remain completely untaxed, the participant has to make up the withheld amount.

For example, Bill has decided to request an indirect rollover of $10,000 from his 403. His plan trustee withholds 20%. Bill gets a check for $8,000. He has to come up with $2,000 from other sources, or his rollover will only be $8,000. The $2,000 will be taxable income to him, subject to an early distribution penalty of 10% if Bill is under age 59½.

Recommended Reading: How Does Retirement Work With 401k

What Happens If A Check From My Former Employer Plan Is Made To Me

The distribution will be subject to mandatory tax withholding of 20%, even if you intend to roll it over later. This withholding can be credited to your income tax liability when you file your federal tax return if you roll over the full amount of any eligible distribution you receive within 60 days.

If you are not able to make up for the 20% withheld, the IRS will consider the 20% a taxable distribution it will be subject to regular income tax and, if you are under age 59½, an additional 10% early-withdrawal penalty.

Rolling Over Funds From One Retirement Account To Another

I have a retirement account with my previous employer. Can I roll over those funds into my new employers 403 plan?

To maintain the simplicity of managing only one retirement account, you may be able to roll over your IRA, 401, 457, or other retirement account, into your current employers 403 account. This is called an incoming rollover and depends upon if its allowed by your current employers plan documents.

With this, the benefits of consolidating your retirement accounts, include:

- Ease of access and view of all investments.

- Time savings.

- Possible reduced fees.

- Easier management for future beneficiaries.

Consolidating your accounts is common in the retirement industry. Contact your financial representative if you have further questions regarding this process. You may also contact NBS by phone at 1 274-0503 or by email at for questions about forms and whether incoming rollovers are allowed by your plan.

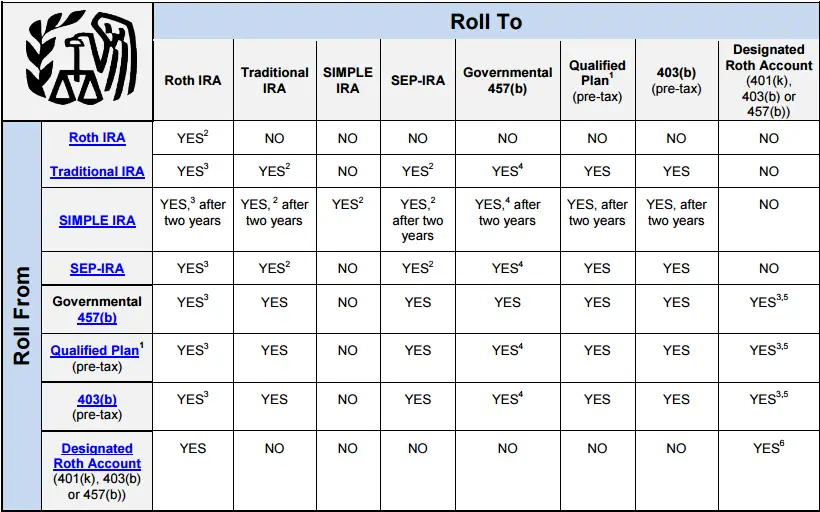

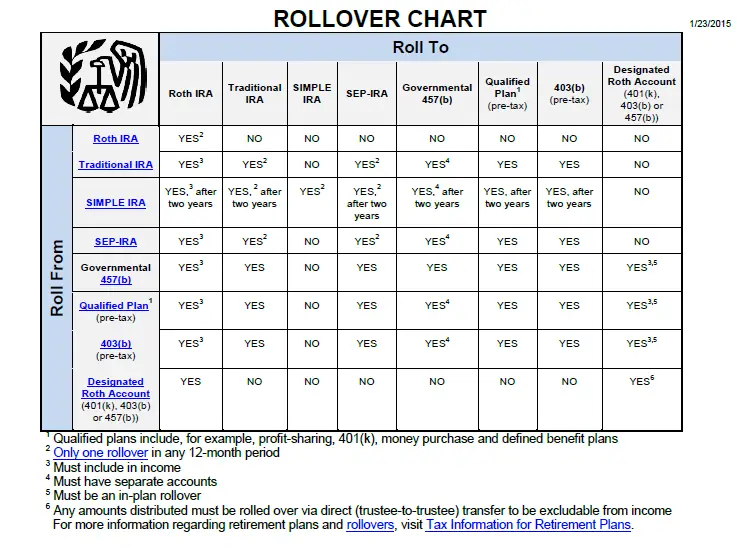

I have a 403 account. Can I transfer my funds into a different type of retirement account, such as an IRA, 401, or 457?

This may be possible, depending on which type of account you are wanting to roll over your 403 funds to, and whether it is allowed by your current employers plan documents.

The IRS has clear rollover rules which are summarized in an easy-to-navigate chart, found below, and linked to here. If you have any questions regarding this possible plan feature and whether it is allowed by your employers plan documents, please consult NBS.

You May Like: What Happens To My 401k If I Switch Jobs