Rollover To A Traditional Ira

Transferring funds between a traditional 401 and a traditional IRA or between a Roth 401 and a Roth IRA is relatively straightforward. In many cases, you can do a direct rollover, also called a trustee-to-trustee transfer. This involves your 401 provider wiring funds directly to your new IRA provider. Alternatively, your 401 provider may send you a check that you then deposit into your new IRA.

Look out for any taxes your provider may have preemptively deducted. You shouldnt owe any taxes or penalties as long as you deposit money in a tax-advantaged retirement account within 60 days.

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to rollover an old 401 into an IRA, you will have several options, each of which has different tax implications.

Don’t Miss: Can You Roll A 401k Into A Self Directed Ira

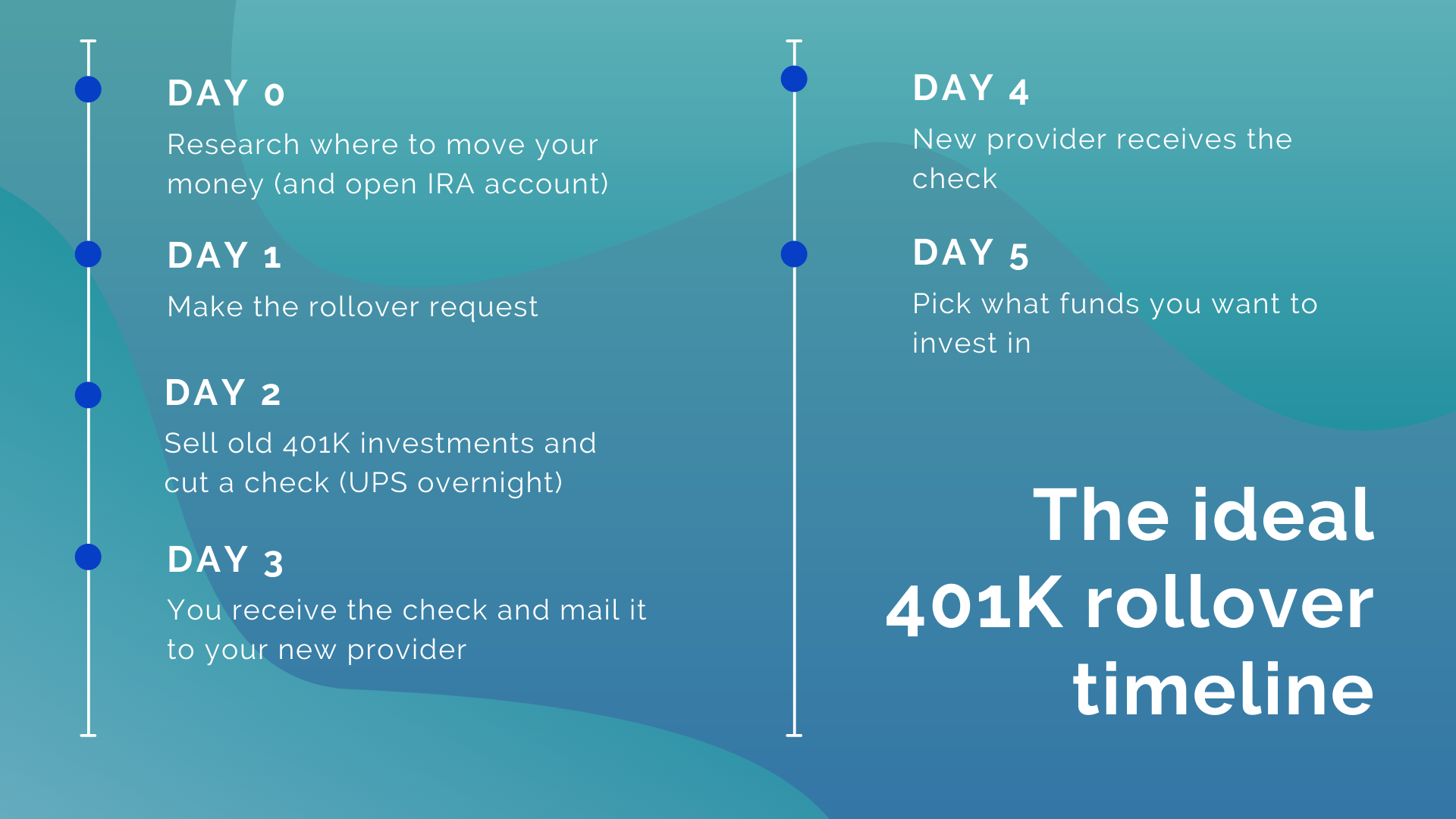

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty. Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method, Ford says, is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Also Check: How Do I Find My Old 401k Account

Leave Your Account Where It Is

Many companies allow you to keep your 401 savings in their plans after you leave your job. Often that’s only if you meet a minimum balance requirement, typically $5,000. Since this option requires no action, it is often chosen by default. But leaving your 401 where it is isnt always a result of procrastination. There are some valid reasons to do it.

You can take penalty-free withdrawals from an employer-sponsored retirement plan if you leave your job in or after the year you reached age 55 and expect to start taking withdrawals before turning 59 1/2.

Other reasons you may want to keep your retirement plan where it is include:

Dmitriy Fomichenko President Sense Financial

The value of your 401k minus loan balance can be rolled over into an IRA if your plan permits doing partial rollovers. Some plans don’t and require you to rollover the entire balance. That is if your 401k is with the past employer. If it is with the current employer the chances are – you can not . So if you get OK to rollover the balance and continue paying the loan – you are OK. Otherwise the outstanding loan balance will be considered a distribution which will result in taxes . You need to contact your plan administrator or custodian and discus this.

Also Check: How To Collect My 401k Money

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

Don’t Miss: How To Take My Money Out Of 401k

How To Roll Over Your Merrill Lynch 401k

Rolling over your Merrill Lynch 401k is actually pretty easy. You and Your 401K

Transitioning between jobs can be a trying time in your career, even when its a change for the positive. Such a transition might require some serious adjustments to your life. However, in the midst of all this, theres one change you shouldnt forget: rolling over your 401k.

Failing to roll over your 401k could make things more difficult later on. Luckily, the process of rolling over your Merrill Lynch 401k is abundantly simple in most cases.

Heres a look at what you need to do to execute a successful 401k rollover.

If Youre Thinking Of Quitting Your Job

Timing is important here. If your company offers matching contributions, dont walk away and leave that money on the table. Check your plans vesting schedule to see whether working longer will let you vest more in your employer contributions. Also, find out when matching contributions are deposited into your account. Some companies make the deposit every pay period some only once a year. If you leave before that years contribution is made, youll lose it. *

Read Also: How Much Can You Put In Your 401k A Year

Rollovers With An Advisers Help

When you move money from one retirement account to another , there are three possible methods. The first two are the methods financial advisors use to roll accounts over, which is either a direct rollover or a trustee-to-trustee transfer.

The details of each vary, but the important thing is the advisor sets up your new account and has the money transferred directly to the custodian of the new account . Because the money stays within your two accounts, the IRS treats it as though you never touched the money even though you are the owner of both accounts. This means the rollover happens with no tax implications.

Should I Roll Over My 401

Theres a lot to consider when deciding whether to roll over your 401 after a job change. The available options of keeping your account with your former employer or rolling it over into a new tax-deferred plan pose a number of pros and cons, all of which factor into the decision that you will ultimately make. A financial advisor can help guide you through this decision and others like it. Lets break down the reasons for rolling over and not rolling over your 401.

Read Also: What’s The Maximum Contribution To A 401k

Do I Have To Leave My Job To Withdraw My Retirement Plan Money

Not necessarily, although thats what most plans require. If your employer terminates your retirement plan, or if you become disabled, you may be given an opportunity to take a distribution. Also, some retirement plans permit you to draw on your retirement plan money after a fixed number of years or upon reaching a certain age, such as 59½ or the plans designated retirement age.

Are Distributions From My Roth 401 And Roth 403 Accounts Taxable

Qualified withdrawals from Roth 401 or Roth 403 accounts, including earnings, are tax-free. Only the earnings portion of nonqualified withdrawals from Roth accounts is taxable. Withdrawals from Roth accounts are tax-free if the account was established at least five years before, and if youre at least 59½ years of age or if withdrawals are made because of disability or death. Withdrawals from non-Roth accounts are generally taxable.

You May Like: How Much Can I Put In My 401k Per Year

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

How Direct Rollovers Work

A rollover occurs when one withdraws cash or other assets from one eligible retirement plan and contributes all or a portion of this to another eligible plan. The account owner may be subject to a penalty if the transaction is not completed within 60 days. The rollover transaction isn’t taxable, unless the rollover is to a Roth IRA, but the IRS requires that account owners report this on their federal tax return.

To engineer a direct rollover, an account holder needs to ask his plan administrator to draft a check and send it directly to the new 401 or IRA. In IRA-to-IRA transfers, the trustee from one plan sends the rollover amount to the trustee from the other plan. If an account holder receives a check from his existing IRA or retirement account, they can cash it and deposit the funds into the new IRA. However, they must complete the process within 60 days to avoid income taxes on the withdrawal. If they miss the 60-day deadline, the IRS treats the amount like an early distribution.

Read Also: Should I Use My 401k To Pay Off Debt

What If I Own Company Stock In My Plan When I Leave My Job

Your employer may require you to sell your shares when you leave the plan. You can then roll over the proceeds into an IRA or to your new employers plan. Or, if your old plan allows, you can roll over your shares from the plan directly into a rollover IRA established through a broker.

Check with your former employer about the rules governing the buying and selling of company stock, as well as the tax consequences. It may be to your advantage to take your distribution in stock rather than cash. If you intend to continue holding the stock, ask the receiving institution if they can accept another companys stock.

Drawbacks Of A 401 To Ira Rollover

IRA rollovers give individuals more control over their money, but they do come with potential tradeoffs.

Less legal protection: Unlike a 401, money in an IRA may be vulnerable to creditors and civil lawsuits. While blanket bankruptcy protections that 401s enjoy do extend to money that gets rolled into an IRA, those funds may be exposed in other legal proceedings.

Distribution age: The Rule of 55, which 401 investors can tap, does not apply to IRA rollovers. After rolling money over into an IRA, you have to wait to reach age 59.5 to withdraw funds without incurring an extra 10% penalty.

Higher fees: An IRA will give you more investment options than a 401, but you may lose out on access to institutional funds mutual funds that carry the lowest expense ratios and are only available to institutional investors, like 401 plans and hedge funds.

No loan option: Youll also forfeit the option to borrow against your 401. That choice does not exist for IRAs.

Recommended Reading: When Can You Take Out 401k

Benefits Of A Rollover Into A New 401

Distributions at 55: Under an IRS provision known as the Rule of 55, you can withdraw funds from your current companys 401 penalty-free starting at age 55, instead of 59.5 . By combining 401s, you may have access to your older assets at 55.

Loan options: By rolling over an old 401 into a new plan, you may be able to borrow against the account, which is not an option with a 401 that remains with a former employer.

Lower fees: As stated above, the fees associated with your new employers plan may be lower than those of your former plan or a future IRA.

How Do I Complete A Rollover

Read Also: When Leaving A Job What To Do With 401k

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

Balance Less Than $1000

If you have less than $1,000 in your 401, your employer could give you a lump-sum check for the amount.

If you didnât intend to receive your funds in this manner, youâll have 60 days from the date you terminated your 401 to roll the funds over to your current 401 or an IRA. Otherwise, the IRS will hit you with a 10% early withdrawal penalty tax for the amount.

Don’t Miss: How To Pull From 401k

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.