Pick The Right Funds For Your 401

Without a thorough understanding of your mutual fund options, its easy to make bad investing choices. For instance, lets say a sample companys 401 materials have 19 investment choices that arent target date funds: six growth funds, four growth and income funds, two equity income funds, two balanced funds, four bond funds, and one cash-equivalent money market fund.

If youre trying to invest according to our advice by splitting your 401 portfolio evenly between growth, growth and income, aggressive growth, and international funds, youre already in trouble. According to the brochure, you dont have any aggressive growth or international options! You meet with an investment professional and they let you know that of the six options the brochure has listed as growth funds, two are actually international funds and one is an aggressive growth fund. Thats exactly the kind of insight you need to help you make smart investment selections.

A lot of people dont know you can work with an outside professional to select your 401 investments, but you can!

Other investors worry that working with their own investing pro will be expensive. Your investing professional may charge a one-time fee for a 401 consultation, and thats a reasonable cost for the time they spend to help you make smart 401 selections. Just make sure you know what to expect before your appointment so there are no surprises.

Improve Your Investment Knowledge

Improving your retirement investing knowledge is always a great choice. We have some amazing resources here to get started. Check out our guide to how to start investing.

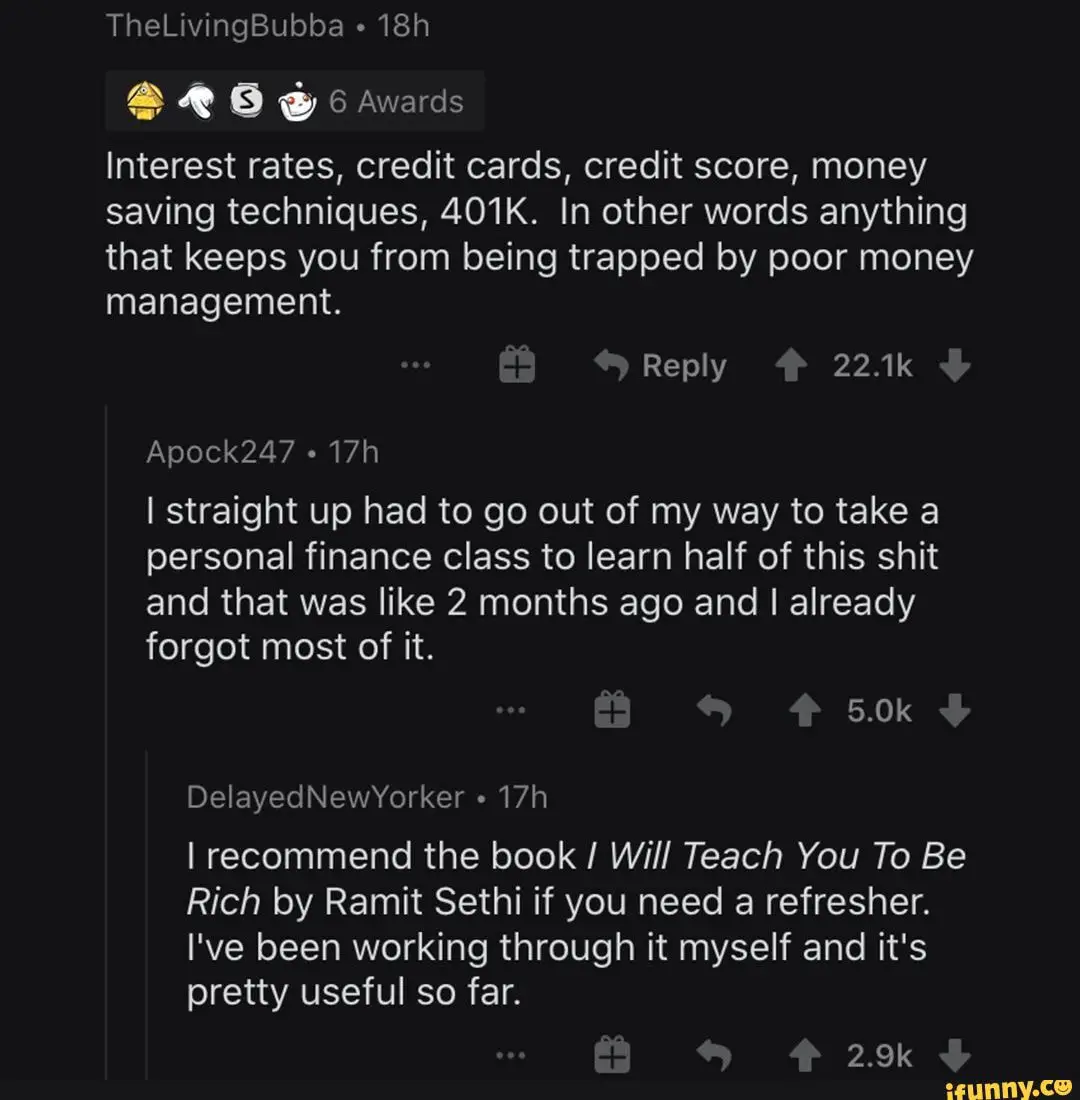

If you’re looking for a little more info, here are a few good books to get you started:

How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

You May Like: Can I Roll An Old 401k Into A New One

No Opportunity For An Advisor To Add Value To Your Asset Allocation

Depending on the options in your plan and your own investing acumen, there might not be an opportunity for a professional money manager to add value to your asset allocation. Most 401 plans limit the investment choices they offer participants, but some plans are better than others. Morningstar reports the average 401 plan offers 21 funds .

It’s not just about the number of funds, though. The characteristics of the funds, expense ratios, breadth of styles and asset classes, etc., are factors to consider. Some plans achieve bread diversification with fewer than the average 21 options so it’s important to consider quality and quantity. Assuming you have the time to select and monitor the investments, and are comfortable with the outcome, you might not need an advisor to manage the account.

What Options Do 401 Plans Have

While some 401 plans do allow you to manage your own account â more on that later â the majority of them do not. And most 401 plans between companies all around the country have similar investment options for their employees to choose from. While there will of course be some differences from company to company, it is common for many of the same investment options to pop up no matter who youâre working for.

In most 401 plans, youâll have the option of investing into five main asset categories. These categories include U.S. large cap, U.S. small cap, international markets, emerging markets, and bond allocations. Large and small cap funds refer to the market capitalization of the companies within. For example, the S& P 500 Index comprises the 500 largest companies in the United States. So a fund that mimics the S& P 500 would be an example of a large cap fund.

While these options are good for most average investors, there isnât a whole lot of variety in what you can invest in. And you wonât really have any chance of beating the overall market as you work towards retirement. So before we get into managing your own account, letâs learn about how 401 accounts are usually managed.

Also Check: Should I Borrow From My 401k

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

What Kind Of Investments Are In A 401

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Don’t Miss: When Can I Sign Up For 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Give Yourself Flexibility To Figure It Out

You might think that you want to spend your retirement painting, cooking, and reading, but then find out that all that time spent at home doesnt fulfill the lifestyle you dreamed about. After 30 years in the workplace, you finally have time to experiment with what you really want.

There are many different ways you can spend your time. And fortunately, theres no need to figure it all out right away. It will likely take a fair amount of experimenting to help you find just the right balance of how you want to spend your time. You can always increase social activities later or develop new hobbies if you want to stay busier.

The joy of retirement is that youll have plenty of opportunities to experiment. Its up to you to design the type of dayand kind of lifethat you want to live.

You May Like: When Leaving A Company What To Do With 401k

Recommended Reading: Can I Get My 401k Early

Do I Need A 401 Solo Plan

For sole proprietorship businesses, solo 401 plans are very effective ways to set aside and grow a large amount of money for retirement. If youre a small business owner and dont yet have a retirement plan set up, a solo 401 is an excellent way to save for retirement.

If you happen to need to hire employees at some time during your businesss lifetime, youll need to be sure to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.

Read Also: Jp Morgan 401k Investment Options

Making The Most Of Your 401 By Using Your Own Adviser

Dont want to rely on your employers investment choices? A self-directed 401 account could help you maximize your retirement savings, and working with a professional adviser could give you the personalized attention you need.

We have ended up in a world where employees have to find ways to manage their own funds for retirement, at their own risk. Fortunately, many plans have begun to offer an option called a self-directed brokerage account . Some plans even allow you to hire your own adviser to manage your account. And, with the help of a professional adviser, you can put yourself in an ideal position to optimize your retirement plan and meet your overall financial goals.

This self-directed brokerage account option gives you access to a broader universe of investments, such as individual stocks and bonds, exchange-traded funds, and many other mutual fund options depending on your companys restrictions. However, while you may want the advantage of those additional investment choices, you may not be comfortable with making all your own decisions, particularly since the investment risk is on you. Fortunately, a professional investment adviser can help you manage your self-directed 401 brokerage account.

Read Also: How To Borrow Against 401k Fidelity

Why Not Open A Self

- If you plan to perform sweat equity work on the property, you should not open a self-directed 401k plan.

- If you plan to draw a salary for managing the self-directed 401k owned property, you should not open a self-directed 401k plan.

- You plan to use the self-directed 401k owned property for personal or business use even if you pay a fair market rent rate, you should not open a self-directed 401k.

- You plan to have your children or parents use the self-directed 401k owned property for personal or business use even if a fair market rate rent is paid, you should not open a self-directed 401k.

- You or your children or parents later plan to vacation in the self-directed 401k owned property.

- You plan to sale, exchange or deposit real estate that you own personally or through your business, or your parent or children personally own or through their business into the self-directed 401k plan.

Why Managing Your Own Retirement Portfolio Is A Good Idea

In 1956 Alice B. Morgan published the book, Investors Road Map. The book grew out of a series of investing classes that Morgan gave over the years to people in Bristol, Rhode Island.

The classes Mrs. Morgan gave were free, and the book was a summation of her tips, a source of advice for those who couldnt get to the class. Whats especially interesting, however, isnt the advice itself. Mrs. Morgan was a plain-spoken Yankee of the old school and her rules were appropriate for the market as it ran in the 1950s. What was unique was the length to which she went to convince the women who made up a large part of her classes that they could actually do investing on their own.

One big reason for managing your own retirement portfolio is that nobody cares more about your money than you do. So why would you leave it in the selections you made when you funded your IRA in 1980? Or why would you pay someone else to decide where you invest it?

Theres less mystery surrounding investing on your own these days. With so much information at your fingertips, do-it-yourself investing is much easier than it was 70 years ago or even 10 years ago.

Read Also: What Is Ira And 401k

You May Like: How Do You Pull Money Out Of Your 401k

Keep It With Your Old Employers Plan

One of the simplest things you can do with your old 401 account is to just leave it right where it is this requires no further action on your end.

Most companies allow you to do this so your money continues to grow in the investment option you selected , said Jessica MacDonald, the Vice President of Thought Leadership at Fidelity. And, youll still be able to make withdrawals penalty-free once you hit age 59 1/2.

Just keep in mind, though, that if you have an account balance of less than $5,000, the account may be rolled over into an IRA.

Another reason you may opt to keep your money in your old employers plan is if you just really liked the investment options it provided. Some employers may provide more access to certain types of 401 investments, like a wider range of mutual funds rather than just a target date fund.

However, there are a few potential downsides you should be aware of when deciding to go this route. For starters, you typically wont be able to make additional contributions to this plan once you switch jobs. And, the plan administrator for your old employer may charge additional fees for bookkeeping, administrative charges and legal fees to continue managing the account.

And, you would be unable to take out a 401 loan on your balance.

Whats So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan thats available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they havent met this criterion yet.

In 2021 youre allowed to contribute up to $19,500 to a 401 or up to $26,000 if youre 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but youll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Recommended Reading: How Does Taking Money Out Of 401k Work

What Is A Self

Self-directed 401 plans let savers decide how to invest their pre-tax retirement contributions. Rather than being limited to the pre-approved funds typically offered by traditional 401 plans, self-directed 401 plans allow you to choose exactly where youll invest your money. Heres a full rundown on self-directed 401s so you can decide if its the right option for your retirement savings.

A financial advisor could help you create a financial plan for your retirement needs and goals.

Note Transaction With Spouses Solo 401k Question:

Unfortunately, it would still be prohibited for your solo 401K to lend funds to your spouses solo 401K. Unfortunately, there is no way around this rule. The IRS still views your wifes solo 401k as a disqualified party because the solo 401k is for her benefit. Also, the rules do not allow for a solo 401k to obtain a loan for investing in tax liens or notes. However, the solo 4o1k plan can obtain a non-recourse loan when investing in real estate.

Also Check: Can I Use My Fidelity 401k To Buy A House

Do You Have A Complicated Situation

Sometimes its a good idea to enlist the help of a professional, especially if you have a complex situation. For example, you inherited a few accounts from your father who, turns out, invested in a few businesses in another country. Or you have Bitcoin and are looking for ways to invest it in new Bitcoin or crypto brokerage companies.

The good news is you dont have totally hand off your accounts to someone to fully manage. You can hire a professional for one-off help or advice on what to do. Maybe you want to hire a tax and investing professional to help you liquidate your late fathers accounts and invest it somewhere in the U.S. Or you work with someone for a few months to learn about Bitcoin investing and take it over yourself afterward.

Navigating complex investing situations can have some major consequences like owing taxes or losing more than you bargained for. Sure, you can save money by managing it yourself, but in the long run it could be more advantageous to pay for portfolio management services, especially if itll save you money overall.