Option #: Single Stocks

When you buy single stocks, youre basically betting on the performance of one company. Most people who dabble with buying and selling stocks try to time the market. Theyll buy a stock when its value is low and then plan to sell after its value rises in order to make a profit.

Instead of taking a buy and hold approach to investingwhich means you hold on to your stocks for longer periods of time regardless of what the stock market is doingmost stock traders will try to sell their stocks after just a few days or weeks to make a quick profit.

The Bottom Line: Lets be really clear herewe do not recommend investing in single stocks! Theres just too much risk in having your investments tied to the performance of just a handful of companies. And unless you have a crystal ball lying around, its very difficult to pick out the winners from the losers. Investing in single stocks is more like going to a casino in Vegasyou walk in expecting to make a small fortune but youll probably walk out with shattered dreams and empty pockets.

How Do Day Traders Pay Taxes

How day trading impacts your taxes. A profitable trader must pay taxes on their earnings, further reducing any potential profit. … You’re required to pay taxes on investment gains in the year you sell. You can offset capital gains against capital losses, but the gains you offset can’t total more than your losses.

Drawbacks Of 401 Trading

Day trading in a 401 account has some limitations. One of these limitations is that aggressive trading may result in losses if you take too many risks. Day traders buy and sell funds based on daily price fluctuations, and it can be a gamble making accurate predictions. Most investors find it difficult to outperform stock indexes when investing in the long term.

Also, if you break the 401 rules for day trading, the plan sponsor could lock you out from using your 401 to trade. This may occur if you exceed the number of trades allowed within a specific period, or if you take too many risks.

Read Also: How To Transfer My 401k To My Bank Account

Why I Am Buying Amazon Stock

I first bought AMZN when it was $298 a share. I have bought AMZN a few times over the past 3 years, most recently in February 2016 at around $511. I think this stock has significant long term growth potential and I plan on continuing to invest in the company.

Not only have they continued to dominate the e-commerce game.

According to Forbes, A recent report by the Institute for Local Self-Reliance claims that roughly half of all U.S. households are subscribed to Amazon Prime, half of all online shopping searches start directly on Amazon, and Amazon captures nearly one in every two dollars that Americans spend online.

Thats crazy. I dont see Amazon slowing down anytime soon and they have become such an institution they have become the definition of online shopping which is still in its infancy. Amazon are also continuing to diversify and growth their other lines of business specifically their cloud storage and new logistics offerings. Eventually, I am confident they will also give traditional shippers like UPS, FedEx, and the Post Office strong competition with their own shipping network they have already leased 40 planes and plan to hire over 100,000 new employees in 2017.

How Did You Get Into Tesla Invest In Stocks

You must register to receive a broker card. Fidelity, Vanguard, Schwab, Webull, and Robinhood are actually good options with a low paid or free structure. You can access their brokerage membership through the options on their website or through a handy app.

“Protecting your retirement savings has never been more important. And getting up to $10,000 or more in FREE SILVER to do it This is one of those opportunities you dont turn down!” – SEAN HANNITY

You May Like: Can We Borrow Money From 401k

Get Help With An Investment Professional

There are two things we always tell people when it comes to investing. First, you should never invest in anything you dont understand. And second, you dont have to try to figure it all out on your own.

Thats where an investment professional comes in! Our SmartVestor Pros are here to help you get started. Theyre RamseyTrusted and will sit down with you and help you understand your investing options so that you can make confident decisions that will help you save for the retirement youve always wanted. You can do this!

Recommended Reading: Why Cant I Take Money Out Of My 401k

Can I Choose Individual Stocks In My 401

Only in certain circumstances may employees select individual transfers or investments for their 401 form. In some cases, employers choose 401 courses for their employees that allow them to select individual stocks. However, this may only apply to a certain percentage due to the funds included in the plan.

Don’t Miss: Can You Roll 401k Into Another 401k

Beginners Tips For Investing In Stocks

Nobody loves making up rules more than investment guru types. Many are certified garbage, but one keeper we know is called the 5% rule. This states that proper diversification means that no one investment or sector should account for any more than 5% of an entire investment portfolio. So you want Apple stock? Great, but it should be no more than 5% of your portfolio. Pharmaceuticals? Cool. But keep them below 5%.

One caveat: since mutual funds and ETFs often contain many individual stocks and sectors within them, you might very well hold more than 5% of your portfolio in one ETF or mutual fund and still be following the 5% rule.

You May Like: What Is A Pension Vs 401k

Is Nua Right For Me

It generally makes sense to utilize NUA when you believe your current tax rate is the same or lower than what you expect it to be in the future. Consider the following 3 conditions, which may indicate that your income will not fall sharply in the future and may even rise:

|

If yes is answered to all 3 conditions, an NUA may be to your advantage, although its no guarantee, so be sure to consult with a tax or financial planning professional regarding your personal situation before making any decisions.

“In general, it’s important to work out the various tax scenarios because you’ll eventually have to pay taxes on gains from selling company stock,” says Pomerance. “However, you don’t want to let taxes dictate investing decisions. Working with your Fidelity financial professional or on your own, make sure to first consider the sale of NUAs in light of your asset allocation, cash flow needs, and long-term retirement goalsthen consult your tax professional to make the determination if this tax strategy makes sense for you.”

How to qualify for NUA tax treatment

You must meet all 4 of the following criteria to take advantage of the NUA rules:

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: Can You Take From Your 401k To Buy A House

Calculate Your Risk Tolerance

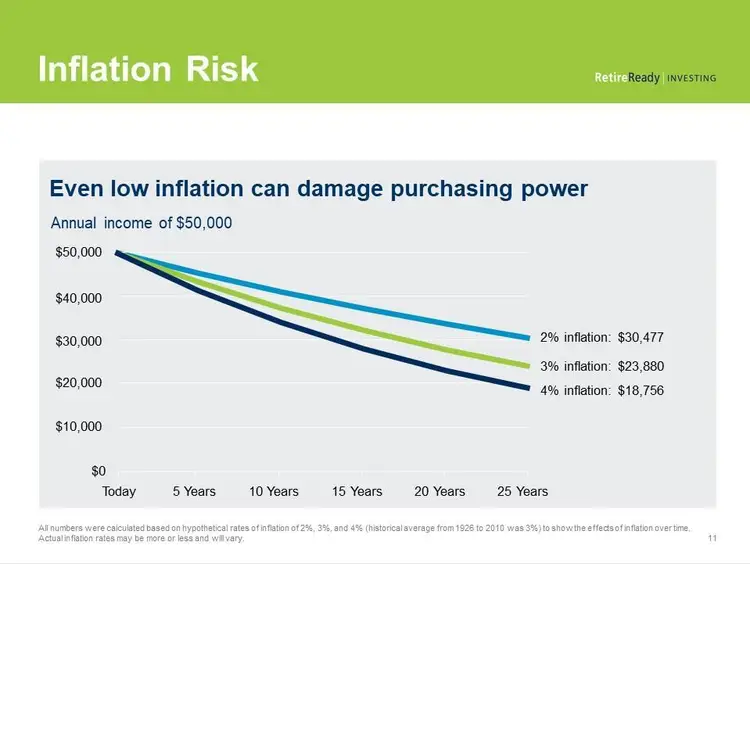

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you donât want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

Youâll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in âsaferâ investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until youâre going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When youâre older, youâll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

Its Easier With An Ira 401s Are More Complicated

Whether or not you can roll funds from a 401 or an individual retirement account into a more liquid investment fund depends on a few factors. You may be able to change your investments in an IRA, but doing so within a 401 is a different matter, as these plans typically have limited options from which to choose.

Speaking in general terms, IRA and 401 assets that are distributed and not rolled over to another IRA or eligible retirement plan will be subject to income tax. They may also be subject to an early-withdrawal penalty of 10% if you are under age 59½.

Also Check: How To Recover 401k From Old Job

Read Also: How To Take A Loan From 401k

Reinvest Extra Money In An Indexed Fund

You can provide an additional layer of protection by automatically reinvesting extra cash in an indexed fund.

For instance, you can invest dividends or bank account interest in an S& P 500 indexed fund. Thus, you could lock in a 10% growth rate for at least part of your money.

Therefore, you can make compound interest part of your 401K and ensure that some of your money is growing. Moreover, you can enhance compound interest by combining it with the S& P 500, which has a long history of growth.

Can I Day Trade In My Retirement Account

A regular strategy of day trading buying and selling a stock during the same market day can only be accomplished in a brokerage account designated as a pattern day trading account. A day trading account must be a margin account, and since an IRA cannot be a margin account, no day trading is allowed in your IRA.

Read Also: How To Transfer 401k From Charles Schwab To Fidelity

Recommended Reading: What Do With 401k After Leaving A Job

Retirement Rollovers And Withdrawals

First, consider how withdrawals from a retirement plan normally work when you retire.

Normally you would roll your 401k into an IRA to take advantage of better investment options, get professional help, or simply because your 401k plan requires it when you retire. You can handle the investments you roll over in one of two ways:

- You roll your investments as-is into the IRA. The stocks, bonds, and mutual funds you hold in the retirement plan are transferred into the IRA.

- You sell everything and move the cash. You purchase new investments in the IRA.

Then, you would withdraw from the IRA by selling a portion of the investments and withdrawing the cash.

In a traditional IRA, your withdrawals from the IRA are taxed at your ordinary income tax rate.

We will revisit this process in a moment when we discuss distributing employer stock.

Changing Your Asset Allocation As You Age

Remember, too, that your asset allocation isnt forever. Many financial experts suggest adjusting it as you grow older, opting for a more conservative mix as you get closer to retirement age. For 30-something Kendra in our example above, 75%/25% may be about right. When she reaches age 60, however, an allocation closer to 50%/50% could make more sense.

Read Also: How To Cash Out A Fidelity 401k

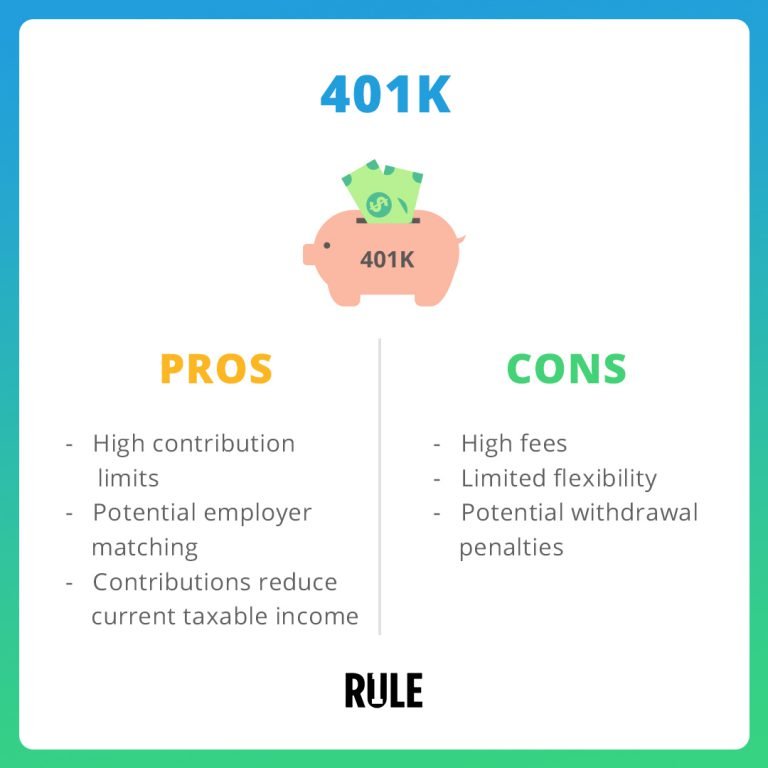

Mistake #: Failing To Take Full Advantage Of Retirement Saving Plans

If your companys 401 or other qualified employer sponsored retirement plan , including 403 and governmental 457, offers a company match , you have an extra incentive. If you neglect to invest enough to receive the full company match, youre leaving money on the table. If you get a raise, consider increasing your QRP contribution.

Also Check: How Do You Know If You Have An Old 401k

When To Choose An Nua Tax Strategy

Consider the following 4 factors as you decide whether to roll all your assets into an IRA or to transfer company stock separately into a taxable account:

Tax rates. The larger the difference between the ordinary income tax rate and the long-term capital gains tax rate, the greater the potential tax savings of electing an NUA tax treatment of company stock.

Absolute NUA. The larger the dollar value of the stock’s appreciation, the more the NUA rule can save you on taxes.

Percentage of NUA. An NUA that is a higher percentage of total market value creates greater potential tax savings because more of the proceeds will be taxed at the lower capital gains rate and less will be taxed at income tax rates.

Time horizon to distribution. The longer you plan to keep your assets invested in an IRA or taxable account before liquidating them, the greater the potential benefit of tax-deferred growth, and therefore, the less you would benefit from NUA. A shorter time frame, on the other hand, makes the NUA election more attractive.

Don’t Miss: Can You Roll A 401k Into A 403b

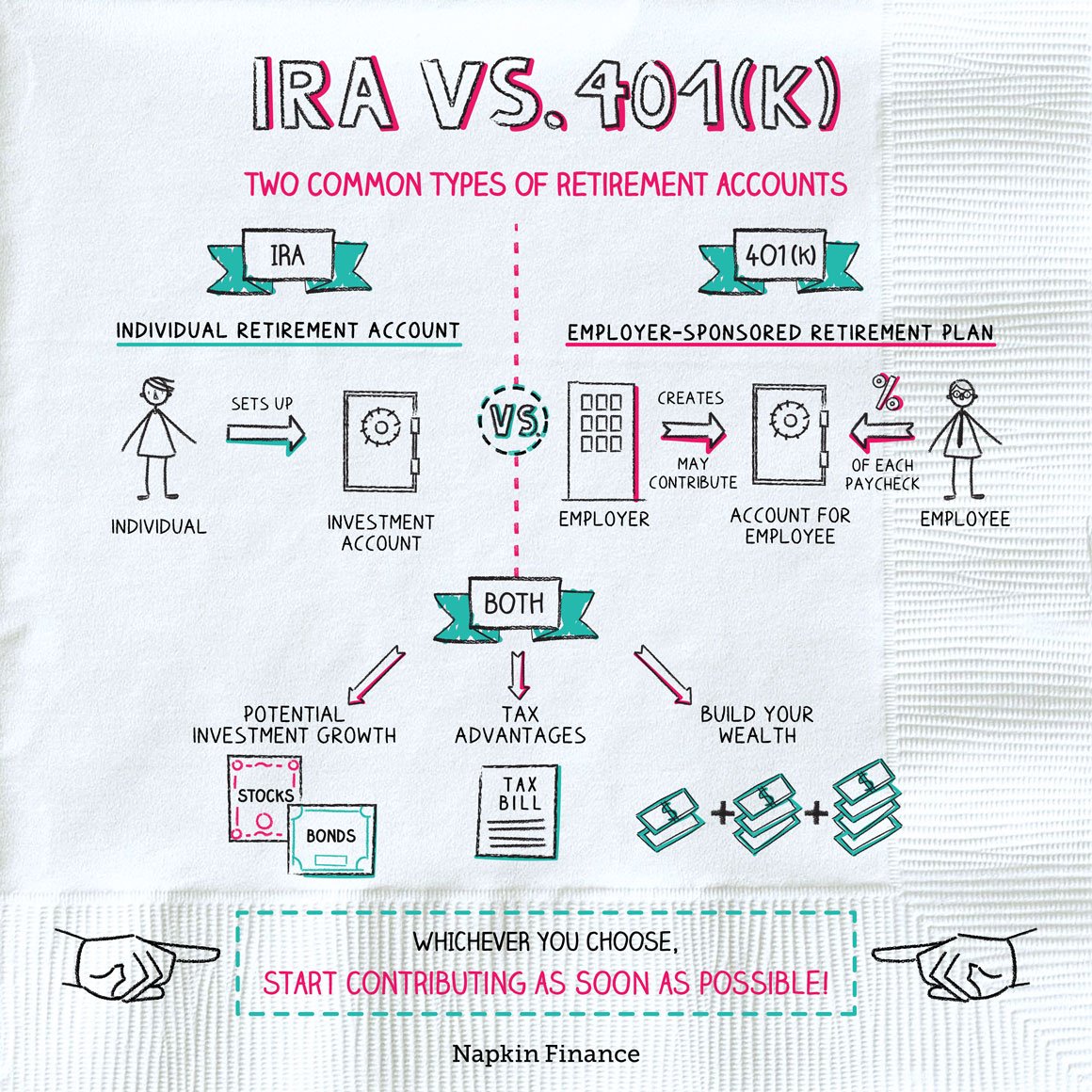

What Is The Difference Between An Ira And 401k

As outlined above, the key differences between an IRA and 401k are as follows:

- Anyone who falls within the income criteria can set up an IRA, whereas a 401k must be established by an employer.

- There are no income limits for investing in a 401k.

- Individuals can only invest up to $6,000 in an IRA each year vs. up to $19,000 in a 401k.

- Money can be withdrawn from an IRA at any time, whereas a person must have reached a distribution event before they can access their 401k savings.

- Investment selection may be more limited when investing in a 401k vs. an IRA.

How Long Do 401k Trades Take

If you use your 401 to trade, the investment options you choose will take different periods to settle. Find out how long 401 trades take.

If you are using your 401 to trade, you will be required to pick the investments from a list of pre-selected investment options. The average 401 plan offers 8 to 12 investment options, which may include stocks, mutual funds, company stock, variable annuities, and guaranteed investment contracts. These investments take different durations to settle.

If you trade stocks in your 401, the trade can take two business days to settle after the day when the trade is executed. For example, if the trade is executed on Monday, the stocks will settle on Wednesday. If you hold mutual funds in your 401, the funds will settle on the next business day after the trade is executed. Some investments may have a provision that requires investors to allow more time to settle trades.

Read Also: How To Move 401k To New Job

Come To Terms With Risk

Some people think investing is too risky, but the risk is actually in holding cash. Thats right: Youll lose money if you dont invest your retirement savings.

Lets say you have $10,000. Uninvested, it could be worth less than half that in 30 years, factoring in inflation. But invest 401 money at a 7% return, and youll have over $75,000 by the time you retire and thats with no further contributions. calculator to do the math.)

Clearly youre better off putting your cash to work. But how?

The answer is a careful asset allocation, the process of deciding where your money will be invested. Asset allocation spreads out risk. Stocks often called equities are the riskiest way to invest bonds and other fixed-income investments are the least risky. Just as you wouldnt park your life savings in cash, you wouldnt bet it all on a spectacular return from a startup IPO.

Instead, you want a road map that allows for the appropriate amount of risk and keeps you pointed in the right long-term direction.

Track And Manage Your Portfolio

You cant just stop at buying stocks now you have to manage your portfolio.

If you went the financial advisor or robo-advisor route, much of the work of maintaining your portfolio will likely be done for you. But if you used an online broker or trading app, youre going to need to regularly check in on your portfolio and make sure its still meeting the goals you set when you first started buying stocks.

Diversification is a critical part of managing a portfolio. A diversified portfolio will have a mix of stocks, bonds and cash that aligns with your goals and risk tolerance. Within each of those asset classes, you should have diversification as well. The benchmark S& P 500 Index contains 11 industry sectors, and experts say its a good idea to have stocks from a wide range of different industries in your portfolio. You should also have different company sizes and locations represented in your portfolio: large-cap, mid-cap and small-cap stocks, as well as both U.S. and international businesses. There are also different kinds of stocks to include, like growth stocks and value stocks.

If you invest solely in funds, some of this diversification will be done for you, but if you want to buy individual stocks, experts say having at least 20 in your portfolio is a good rule of thumb. A diversified portfolio ensures that even if one area of your portfolio tanks, you wont lose everything, since assets perform differently depending on market conditions.

Don’t Miss: How To Get Money From 401k Fidelity