Debt Relief Without Closing My 401k

Before borrowing money from your retirement account, consider other options like nonprofit credit counseling or a home equity loan. You may be able to access a nonprofit debt management plan where your payments are consolidated, without having to take out a new loan. A credit counselor can review your income and expenses and see if you qualify for debt consolidation without taking out a new loan.

8 MINUTE READ

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

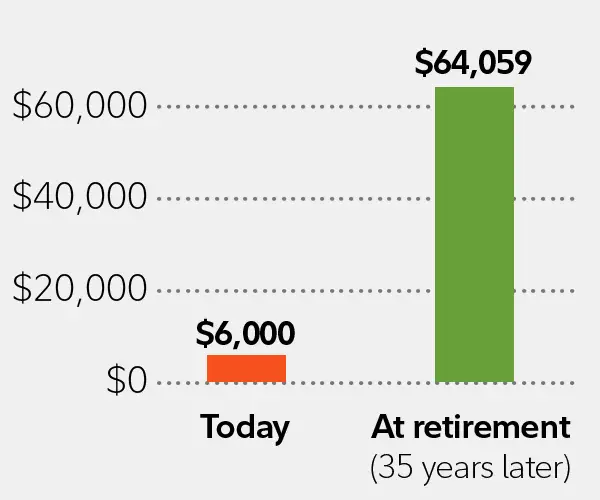

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Request A Hardship Withdrawal

In certain circumstances you may qualify for whats known as a hardship withdrawal and avoid paying the 10% early distribution tax. While the IRS defines a hardship as an immediate and heavy financial need, your 401 plan will ultimately decide whether you are eligible for a hardship withdrawal and not all plans will offer one. According to the IRS, you may qualify for a hardship withdrawal to pay for the following:

- Medical care for yourself, your spouse, dependents or a beneficiary

- Costs directly related to the purchase of your principal residence

- Tuition, related educational fees and room and board expenses for the next 12 months of postsecondary education for you, your spouse, children, dependents or beneficiary

- Payments necessary to prevent eviction from your principal residence or foreclosure on the mortgage on that home

- Funeral expenses for you, your spouse, children or dependents

- Some expenses to repair damage to your primary residence

Although a hardship withdrawal is exempt from the 10% penalty, income tax is owed on these distributions. The amount withdrawn from a 401 is also limited to what is necessary to satisfy the need. In other words, if you have $5,000 in medical bills to pay, you may not withdraw $30,000 from your 401 and use the difference to buy a boat. You might also be required to prove that you cannot reasonably obtain the funds from another source.

Don’t Miss: How Do I Get My 401k From Walmart

You Can Leave Your Money Where It Is

If you have more than $5,000 in your 401k, you can leave it in your old employers 401k plan and even if you have less than that, they still might let you leave the money where it is, but you should ask. If you have less than $5,000, your employer has the option to make you take a distribution, but not all employers will exercise that right.

This is the simplest option, and its the one many people choose when theyre fired suddenly. You usually cant plan for a job loss, so you might not even have time to decide what to do with your 401k money before you get fired or laid off. And you might need some time to process the layoff for a while before you even get around to worrying about the money in your retirement plan.

Well, you might ask, how long do I have to rollover my 401k from a previous employer? Thats a good question. If you want to do a direct rollover, in which your former employer writes a check directly to your new employer for deposit into your new employers 401k plan, you can pretty much wait as long as you want.

However, if you want to do an indirect rollover, where you cash out the money and then deposit it into another tax-advantaged account yourself, you have 60 days from the time you cash out to deposit the money into another such tax-advantaged account, like an IRA. If youre planning to roll over the money into another 401k, you want to avoid this option, since your old employer will be required to withhold 20% from your payout for taxes.

Automatic Enrollment Or Making Changes

Enrollment is Automatic for All Employees

Participation in the Supplemental Retirement and Savings Plan is automatic for all employees. You will automatically be enrolled to contribute 3% of your eligible compensation, as defined under the BU Retirement Plan, on a tax-deferred basis and your contribution will be invested in a Vanguard Target Date Fund closest to the year in which you will turn age 65. Your first contribution to the plan will commence in the month following your hire date.

You may change or stop your contribution at any time. You may also change the investment allocation of your contributions at any time.

Automatic Enrollment and BU Matching Contribution After Two Years of Service

Once you have completed two years of service with at least a nine-month assignment at 50% or more of a full-time schedule, you will be eligible to receive the University matching contributions to the Boston University Retirement Plan.

In addition, you will automatically be enrolled in the Supplemental Retirement and Savings Plan to contribute 3% of your eligible compensation as defined under the BU Retirement Plan on a tax-deferred basis if you are not already doing so when you complete two years of service. BU matches your contribution dollar-for-dollar up to 3% of your eligible compensation as defined under the BU Retirement Plan.

You may make the following changes at any time:

You May Like: How To Access My 401k Money

Compare Your Options For Cash Withdrawals And Loans

Following are overviews of your options for making withdrawals or receiving loans from each plan type. For details, see Eligibility and Procedures for Cash Withdrawals and Loans.

| Work Status | ||

|---|---|---|

| Not Available | ||

| Former Employee | Employee contributions and earnings at any age, university contributions and earnings at age 55 or older | Not Available |

| Not Available | ||

| Rehired Retiree or Rehired Former Faculty or Staff Member |

At age 59½ or older, if you are rehired into a job title that is not eligible to participate in the Basic Retirement Plan The following job titles are not eligible to enroll in the Basic Retirement Plan and may take a cash withdrawal or rollover at age 59½ or older as a rehired retiree or rehired former faculty or staff member:

The following job titles are eligible to enroll in the Basic Retirement Plan and cannot take a cash withdrawal or rollover at any age as a rehired retiree or rehired former faculty or staff member:

|

Not Available |

| Current Employee |

At age 59½ or older hardship disability |

At any age |

|---|---|---|

| Rehired Retiree or Rehired Former Faculty or Staff Member | At age 59½ or older hardship disability | At any age |

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Recommended Reading: Can You Transfer Money From A 401k To An Ira

Traditional Rollover Sep And Simple Iras

If you are considering a withdrawal from one of these types of IRAs before age 59½, it will be considered an early distribution by the IRS.

In many cases, youll have to pay federal and state taxes. There may also be a 10% penalty unless you are using the money for exceptions such as a first-time home purchase, birth or adoption expense , qualified education expense, death or disability, health insurance , and some medical expenses. A 25% penalty may apply if you take a distribution within the first 2 years of opening a SIMPLE IRA.

If any of these situations apply to you, then you may need to fill out specific IRS forms. Always consult your tax advisor about your specific situation.

Withdrawal Taxes Before Retirement

Cashing out 401k early in employment or before the age of 59 and a half can result in significant losses in three ways:

If an employee wants to make an early withdrawal of $10,000, they will only get $7,000 after taxes. Yet, the retirement fund would be $10,000 shorter.

There are several ways to circumvent the traditional 401 penalty. Some of them include qualifying for hardship withdrawals, taking out loans, IRA rollovers, leaving a job after a certain age, life-changing circumstances, and even overcontributing to the retirement fund.

Read Also: How To Find Out If Someone Has A 401k

Take A Cash Withdrawal

Partial, total, and systematic cash withdrawals allow you to receive income only as you need it and provide a high degree of flexibility. Your remaining accumulations continue to be tax-deferred until you take a distribution, and will continue to experience the investment performance of your chosen funds. See Cash Withdrawals and Loans for details. Keep in mind the following:

-

Income tax is due on cash withdrawals.

-

Your contributions and earnings are available for cash withdrawal at any age once you have terminated employment with the University.

-

University contributions and earnings are available for cash withdrawal at age 55 or older once you have terminated employment, or at any age as an official University of Michigan retiree .

Just Because You Can Cash Out Your 401 Doesnt Mean You Should

Technically, yes: After youve left your employer, you can ask your plan administrator for a cash withdrawal from your old 401. Theyll close your account and mail you a check.

But you should rarelyif everdo this until youre at least 59 ½ years old!

Let me say this again: As tempting as it may be to cash out an old 401, its a poor financial decision. Thats because, in the eyes of the IRS, cashing out your 401 before you are 59 ½ is considered an early withdrawal and is subject to a 10% penalty on top of regular income taxes. Oh, yes, thats another thing: Since the 401 is funded with pre-tax money, you also have to pay taxes on it when you cash out.

In most cases, your plan administrator will mail you a check for 70% of your 401 balance. Thats your balance minus 10% for the withdrawal penalty and 20% to cover federal income taxes .

Its financially prudent to save for retirement and leave that money invested. But paying the 10% early withdrawal penalty is just dumb money its equivalent to taking money youve earned and tossing it out the window.

Don’t Miss: Why Rollover Old 401k To Ira

Withdrawal Taxes After Retirement

The account holder can cash out their savings without a penalty tax after retiring.

However, for a traditional 401 plan, the holder still must pay income tax on the money. The tax rate will depend on the federal tax bracket at the withdrawal time.

After retirement, the pensioner must watch out for the required minimum distribution, which is obligatory after 72 years. If they dont take the RMD, the IRS can penalize them by taking 50% of the amount that they didnt distribute.

What Are The State Tax Implications Of An Annuity Distribution

State tax withholding laws on retirement distributions vary. Your state of legal residence is determined by the legal address you have on file with Fidelity. If you do not have a legal residence on file, Fidelity uses the state from your mailing address. Your states tax regulations may require that Fidelity withhold state tax from your distribution if you have elected to have federal tax withheld. When requesting an annuity distribution, the state tax withholding information and withholding options are displayed for your state of legal residence.

Your states tax regulations may require Fidelity to withhold a portion of the gross distribution . For some states, the state tax withholding information and options that apply for your annuity withdrawal may depend on whether you elect to withhold federal tax.

For more information on state tax withholding requirements, call a Fidelity representative at 800-634-9361. If you need specific information, consult a tax advisor. Whether you elect to have a portion of your withdrawal withheld, you are responsible for the full payment of any state or local taxes, federal income tax, and any penalties that may apply to your distribution. You may be responsible for estimated tax payments and could incur penalties if your estimated tax payments are not sufficient.

Read Also: How Can I Pull Money From My 401k

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Here’s what you need to know to make an informed decision about your 401 after you’re no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plan’s administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, it’s important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.

Can I Cash Out My 401 Without Quitting My Job

You donât need to quit your job to cash out a 401. Most plans allow access to a 401 to their current employees. Knowing your options will help you choose the best one.

Cashing out a 401 may be tempting, especially if youâre facing financial difficulties or a significant medical emergency or repair. Most 401 participants only access their 401s when they leave a job.

Normally you can’t cash out your 401 without quitting your job. However, some plans allow participants to cash out their 401s via a 401 loan or through a hardship withdrawal. A 401 loan will prevent you from having to pay taxes and penalties, but the loan plus interest will need to be repaid into the account. Hardship withdrawals are categorized by the IRS. Youâll still need to pay taxes however, youâll be exempt from the 10% penalty tax.

Retirement accounts are built and intended to help you save a nest egg to last throughout your retirement years. The best advice is to simply leave it to grow. But if you need access to your 401, it may not be necessary for you to quit your job to do so.

Recommended Reading: How Can I Invest My 401k

What If You Cant Pay Back The 401 Loan

The main downside of a loan occurs if you either cant repay the loan or, in some cases, if you leave the employer prior to having paid off the loan.

If you default on the loan this becomes a distribution that is subject to taxes and to a 10% penalty if you are younger than 59 ½.

In some cases, leaving the company with an unpaid loan balance may trigger a distribution, but your plan may have repayment provisions that extend after you leave the company that allow for repayment without triggering taxes or a penalty.

Its always best to check with your companys plan administrator so you can fully understand the provisions of the loan.

Dont Miss: Is There A Max Contribution To 401k