How Much Should You Contribute To Your 401

When youre young, its hard to visualize your life in 30 or 40 years and predict how much money youll need.

Just a couple of decades ago, pensions were common benefits offered by many employers, and life expectancies were much lower making it easier to finance your retirement.

Today, employers offering pensions are less common, the future availability of Social Security is less certain and, more importantly, people are living longer.

While your grandparents may have lived only 10-15 years in retirement, odds are your retirement years may span 20 to 30 years! Thats a much longer period youll need to finance.

For that reason, many experts recommend investing 10-15 percent of your annual salary in a retirement savings vehicle like a 401.

Of course, when youre just starting out and trying to establish a financial cushion and pay off student loans, thats a pretty big chunk of cash to sock away. You may need to begin at a smaller percentage and set a higher number as your ultimate goal.

Here are a few considerations to keep in mind:

Do I Have A 401k I Don’t Know About

If you think that you may have enrolled in a 401K plan with a previous employer, but youre not quite sure, there are a few ways to find out if you did.

The easiest way is to contact the HR department of your former employer and ask them whether you ever contributed to a 401K while in their employment. Youll need to give them your personal details along with the dates that you worked for them, so keep this information to hand.

If your old employer has since gone bust or you cant remember which companies youve worked for in the past, check the National Registry of Unclaimed Retirement Benefits website. Youll be able to see whether youve been listed on their database by your old employer as someone with unclaimed retirement plan funds.

If you havent been listed on the National Registry of Unclaimed Retirement Benefits database, there are a couple more options to explore. Visit NAUPA or missingmoney.comwhere you can search by state based on where youve lived or worked to find out whether any unclaimed assets belong to you.

If You Get Terminated From Your Job You Have The Option Of Cashing Out Your 401 However This Is Probably Not The Smartest Move

Image source: Andrew Magill.

If you get terminated from your job, you have the ability to cash out the money in your 401 even if you haven’t reached 59 1/2 years of age. This includes any money you’ve contributed and any vested contributions from your employer — plus any investment profits your account has generated. However, you may face a 10% early withdrawal penalty from the IRS for cashing out early, so this might not be the best option. Here’s what you need to know to make an informed decision about your 401 after you’re no longer with your employer.

How to cash out and the implications of doing soThe procedure for cashing out is usually rather simple. All you need to do is contact your plan’s administrator and complete the necessary distribution paperwork. However, there are a few things you need to keep in mind, especially regarding the tax implications of cashing out.

Unless your 401 is of the Roth variety, all of the money you withdraw will be treated as taxable income, no matter how old you are or the reason for the withdrawal. So, even if you are older than 59 1/2, it’s important to consider how cashing out will affect your tax status for the year. If you have a large 401 balance, cashing out could easily catapult you into a higher tax bracket. Your plan provider will be required to withhold 20% of the amount you cash out for taxes , and will also file a form 1099-R to document the distribution.

Recommended Reading: How To Split A 401k In Divorce

How Much Can I Put In A Roth Ira 2021

More On Retirement Plans Note: For other retirement plan contribution limits, see the Retirement Topic Contribution Limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $ 6,000 , or.

Can I put 50000 in a Roth IRA? Your alternative Roth IRA can contribute up to $ 19,500 per year in 2021 and $ 20,500 in 2022 . Some employers even offer a Roth version of a 401 with no income limit.

I Wish That I Had Let Myself Be Happier

This is a surprisingly common one. Many did not realise until the end that happiness is a choice. They had stayed stuck in old patterns and habits. The so-called comfort of familiarity overflowed into their emotions, as well as their physical lives. Fear of change had them pretending to others, and to their selves, that they were content, when deep within, they longed to laugh properly and have silliness in their life again.

Nowhere in these five regrets did people talk about making more money! Meanwhile, regret number two talks specifically about wishing they didnt work too hard.

The global pandemic has shown us that tomorrow is not guaranteed. Even if you dont have my recommended 401k amount by age 60, you should focus on living your life to the fullest today.

Under a Joe Biden Presidency, at the margin, there will be more social safety nets. There will also be higher income and capital gains taxes.Therefore, theres no longer a need to grind as hard. Enjoy your one and only life every day!

Don’t Miss: How To Figure Out Employer Match 401k

How Can I Find Out My 401k Balance

Over $5.3 trillion is held in 401 plans as of September 2017, according to the Investment Company Institute. If you’re using a 401 to help you save for retirement, it’s important to know how much you have in your plan so you can determine if your savings are in line with the amount you’ll need to fund your golden years. If you don’t receive paper statements with your 401 balance, there are other ways you can check how much you’ve saved.

Why Does My Income In Retirement Need To Be So Much Higher Than It Is Now

My Retirement Plan uses an estimate of what your income will be in the year before you retire to estimate what you may need in retirement. This preretirement income is adjusted based on the income replacement rate, which is defaulted on 80% and can be changed on the Calculator Assumptions tab. We use government demographic income data to estimate how your current income may grow between now and retirement. The further from retirement you are, the more likely this number will grow.

Also Check: What To Do With 401k When You Retire

Contact Your Hr Department

If you don’t know where to check your 401 balance, your HR department can at least direct you to the entity that manages your company’s 401 plan. Then, you can contact the 401 plan administer by phone or over the internet to check the balance of your 401 plan. You can also check how the money is invested and whether it’s time for you to rebalance your portfolio.

Video of the Day

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Don’t Miss: How To Access My Fidelity 401k Account

How Borrowing From Your 401 Works

Most 401 programs let you set up a loan all on your own, without any assistance, via the website you use to handle other 401 tasks, such as changing your contribution amounts and allocating your savings to different investment funds.

Setting up the loan is as simple as finding the loan page on the 401 site and specifying the amount you want to borrow. The online form won’t let you borrow more than you’re entitled to, and interest rate and payroll deduction payments based on a standard five-year repayment period will be calculated automatically.

Once you authorize the loan, the amount of the loan will likely be included with your next paycheck .

If you have any questions about the process, you’ll find an option for contacting fund administrators on the webpage.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: How To Collect My 401k Money

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

Registered Retirement Income Fund

By the end of the year in which you turn age 71, all RRSP contributions must cease. At this time, CRA requires that the RRSP be used as retirement income. The vehicle to accomplish this is a Registered Retirement Income Fund, which provides you with a steady flow of retirement income.

At 71 you can go to your financial institution and transfer your money from your RRSP to a RRIF, explains France Tisi, Bank Manager with the National Bank Financial Group.

At that time, you decide what monthly payment you want from the RRIF. It can be as high or as low as you like, as long as it is at least the minimum set out by the government. You can also change the monthly amount anytime you wish.

Tisi notes that minimum payments vary and are based on a calculation that uses your age. They are considered income and are subject to annual income tax.

If you choose, you can withdraw the entire amount in one lump sum. However, you may want to consider the effect this could have on your income tax bracket for the year.

Don’t Miss: Can I Rollover My 401k Into An Existing Ira

Move Your Money To More Stable Investments

If you’re nearing retirement age and you see your 401 declining, you may not be able to wait for your portfolio to recover before you need to begin using that money. In this case, move more of your money to more stable investments like bonds. When you buy a corporation’s or a government’s bonds, you’re lending money to that entity, which it promises to pay back with interest over time. The only way you wouldn’t be repaid would be if the entity defaults on the loan, which doesn’t happen often — unless you’re talking about .

Another option for the conservative investor is low-volatility ETFs, also known as minimum variance ETFs. These are known for experiencing fewer ups and downs than most ETFs.

These investment products may not provide as large a return as individual stocks, but they also tend to be more stable, so there’s less risk of them losing a lot of their value.

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

You May Like: How To Get A Loan From My 401k

Think About How Much You’ll Need In Retirement

Contributing the maximum to your 401 requires a lot of money especially as an ongoing, year-after-year commitment. It may or may not be enough to fund your retirement, or it could be even more than you need. Your 401 contribution amount should be guided by your retirement savings goal.

How much money you’ll need in retirement depends on when you plan to retire, how much of your current income youd like to replace and how much you want to rely on Social Security.

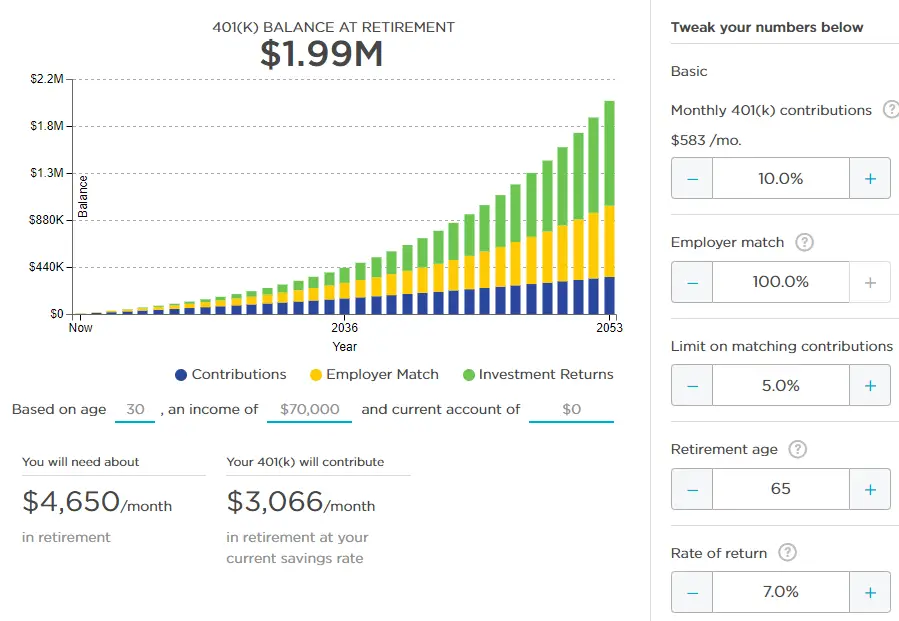

Most experts recommend saving 10% to 15% of your income, but our suggestion is to get a more detailed goal from a retirement calculator.

If you need to start at a lower contribution and work your way up, that’s fine. Aim to contribute at least enough to grab the match, then bump up the percent you contribute by 1% or 2% each year.

Why Does The Calculator Ask About My Highest Level Of Education

All questions in the calculator help us make more informed predictions about your future. Knowing your level of education lets us determine a more realistic estimate of how much youll earn in the future and in turn provide an estimate of what you may need in retirement. And although this information helps us provide you with a more personalized calculation, it is optional.

Recommended Reading: How Do I Cash Out My 401k Early

Drawbacks To 401 Loans

Assuming the loan and repayment process goes perfectly smoothly, there are several major reasons you should think twice before borrowing from your 401 fund:

- A 401 loan uses money that should be invested and helping accumulate wealth for your retirement. The funds you pull out of your 401 cannot gain investment value, and the interest payments you’re making to yourself are unlikely to come close to matching the gains you’d make in a moderately successful stock or index fund. contribution or invest elsewhere.)

- For most borrowers, retirement savings get put on hold until the 401 loan is repaid. Payroll deductions for 401 loan repayment typically eliminate or greatly reduce 401 payments for the five years it takes to pay off the loan. Losing five or so years of retirement savings, and likely forfeiting some or all of your employer’s matching contributions to your 401 in the process, is potentially a huge setback in your retirement savings process. The goal with 401 plans, as with all long-term savings programs, is to stash funds in small, steady amounts over long periods of time, and let money accumulate through the power of compound growth and reinvestment. A 401 loan disrupts that process in a major way, and most funds can never fully recover.

If your 401 loan process doesn’t go smoothly, you could face even worse consequences:

What You Need To Know To Avoid Costly Mistakes

Andy Smith is a Certified Financial Planner , licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

In an ideal world, everybody would leave their 401 funds alone until they need the money for retirement. That might mean rolling your account over to an Individual Retirement Account , but it also means not cashing out the funds prior to reaching retirement age, to allow the money to grow to its maximum potential amount. In investing, time truly is your best asset. At some point though, you will begin taking distributions, and here’s what you need to know.

The best way to take money out of your 401 plan depends on three things:

Don’t Miss: How Can I Borrow From My 401k Without Penalty

K As A Retirement Vehicle By Age 60

The 401k is one of the most woefully light retirement instruments ever invented. Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

The average 401k balance as of August 2021 is around $125,000 according to Fidelitys 12 million accounts, thanks to an incredible rise in the S& P 500 since 2009. Were at new record highs and the S& P 500 is now up close to 200% since the depths of the financial crisis.

Even so, $125,000 is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $28,000. As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401k at age 59 1/2. Meanwhile, I pray to goodness you dont have to work much past 65 because youve had 40 years to save and investment already!