Consider The Costs Of Taking Retirement Money

Giving Americans the ability to take $100,000 in penalty-free withdrawals is probably rooted in the right place, says Timothy Ellis Jr., a certified financial planner with Memphis-based Waddell & Associates.

But those withdrawals could have a long-term negative impact on retirement plans and needs moving forward, Ellis says.

Especially because the worst time to withdraw investment assets is in the middle of a dramatic market downturn. Because the investments are worth less, consumers may have to withdraw a larger percentage of the account, Ellis says.

Then there’s the opportunity cost to raiding your retirement savings early. “Accessing retirement plan accounts, especially for younger workers, can put a permanent dent in plan balances,” Ellis says. In fact, for an investor who makes steady retirement contributions over their career, the amounts saved during the first 10 years may end up accounting for half of their retirement account balance at age 65.

That’s because compounding is one of the most powerful tools to boost retirement savings, and making a withdrawal, especially during the early stages of investing, reduces that ability, Ellis adds. Even a smaller withdrawal adds up in the long run. A $5,000 balance today could be worth $57,900 in 35 years, assuming a 7% annual rate of return.

Your Retirement Money Is Safe From Creditors

Did you know that money saved in a retirement account is safe from creditors? If you are sued by debt collectors or declare bankruptcy, your 401k and IRAs cannot be liquidated by creditors to satisfy bills you owe. If youre having problems managing your debt, its better to seek alternatives other than an early withdrawal, which will also come with a high penalty.

You May Need To Take Money Out Of A 401 Here’s What You Need To Know

401s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but it also enforces certain rules to discourage you from taking distributions before retirement. In some cases, breaking those rules and taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you’ll owe on withdrawn funds.

Let’s look at all the approved ways you can take money out of a 401 and look into the penalties you’ll incur if your early distributions don’t fall within one of those exceptions.

Recommended Reading: How To Check 401k Balance Adp

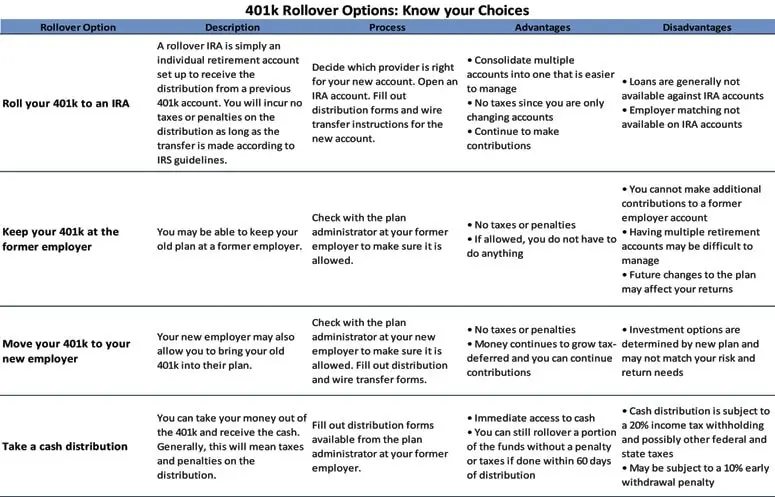

Youre Rolling Over Funds

If you leave, quit, or get fired from the company at age 55 or older, you can cash out that account in a lump sum withdrawal without incurring a penalty.

If youre under 55 years of age , you have up to 60 days to rollover your funds to a new 401 or IRA without triggering a taxable event. The best way to accomplish the rollover is to transfer the money directly from the old custodian to the new custodian to avoid having 20% automatically withheld for income tax.

If you fail to put the entire amount into a new retirement account within two months, it will be considered a distribution that is not only taxed but penalized if youre under 59 ½.

Does Ira Withdrawal Affect Social Security

Traditional IRA payouts that are included in your taxable income are taken into account when assessing whether you meet the Social Security income requirement. As a result, taking a bigger IRA distribution may result in greater Social Security taxes in some situations.

Distributions from a Roth IRA, on the other hand, are not counted for these purposes. As a result, you can take as many Roth IRA distributions as you like without affecting your Social Security benefits. As a result, many financial consultants advise carefully evaluating withdrawals from various retirement funds in order to reduce your overall tax payment.

Social Security benefits are unaffected by IRA distributions. However, because of the way tax rules work, if you dont take steps to prevent them, you may end yourself paying more in taxes.

Recommended Reading: Should I Invest My 401k

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How To Transfer 401k To Different Company

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

How Much Tax Do You Pay On Retirement Withdrawals

There is a mandatory withholding of 20% of a 401 withdrawal to cover federal income tax, whether you will ultimately owe 20% of your income or not. Rolling over the portion of your 401 that you would like to withdraw into an IRA is a way to access the funds without being subject to that 20% mandatory withdrawal.

Also Check: Can You Borrow From Your 401k Twice

Your Spouse’s 401k In Divorce

When you file the Qualified Domestic Relations Order to have all or part of your former spouses 401K distributed to you, you have an opportunity to take cash out of the account without paying the IRSs 10% penalty . To take advantage of this, when dividing a 401K in divorce, have the portion you need, paid directly from the account to you. It does not need to be the full amount that you are receiving. This is important, though. Don’t roll it into an IRA first and then take it out because if you do, then you will be subject to the penalty. You only avoid the penalty when the distribution is made directly from your former spouse’s 401K to you directly.

Related post: Should I leave my Ex’s retirement as is?

Can You Take Money Out Of Your 401k Without Being Penalized

The CARES Act allows individuals to withdraw up to $ 100,000 from a 401k or IRA account without penalty. Early withdrawals are added to the participants taxable income and taxed at ordinary income tax rates.

Can you withdraw from 401k without being taxed?

Withdrawals of contributions and earnings are not taxed until the distribution is deemed qualified by the IRS: The account is held for five years or more and the distribution is: Cause of disability or death. At the age of 59½ or later

Also Check: How To Collect Your 401k

Youll Be Assessed A 10% Penalty

First, the IRS will issue a 10% penalty immediately upon withdrawal of any funds taken out before turning 59½.

This penalty is taken out immediately from the amount you withdraw from your 401.

Say you take out $10,000 from your employer-sponsored 401. You speak to your HR department or your plan administrator and take all of the necessary steps. By the time the money reaches you, youâll only have $9,000.

The IRS implements this penalty to make you think twice about shorting your retirement too early.

Hardship Withdrawal May Also Be Barred

Despite the fact that many plan sponsors aren’t allowing CRDs, there are still other ways Americans can access their retirement savings early. Dee persisted, requesting instead a disaster hardship withdrawal. Typically, these types of withdrawals are available if you have suffered a loss of income because you live in an area that the Federal Emergency Management Agency has designated a disaster.

But to get a hardship withdrawal approved, the disaster declaration must include individual assistance. In other words, it’s not enough that the area has been declared a disaster “individual assistance” also must be available. And there’s some debate whether Montana’s coronavirus-related disaster declaration was designated for individual assistance, or just public assistance.

“The Montana governor’s office sent an email stating Montana had been approved for state, public and individual assistance from FEMA,” Dee says. But her husband’s plan provider disagrees. “It’s very frustrating.”Yet Hadley says it appears Montana has not yet been designated for individual assistance, just public assistance. But at the end of the day, “this is, in fact, an idiosyncrasy in the IRS hardship rules,” Hadley says. “The coronavirus pandemic has revealed this quirk.” No one really paid much attention to the nuance until Covid-19 hit, he adds, saying that the IRS only recently changed its rules around hardship withdrawals in the wake of federally declared disasters.

Read Also: How To Invest Money From 401k

To Meet Additional Essential Needs

Money for items such as medical expenses, prescriptions, food, or elder care add up fast. If you do decide pulling money from 401 or other retirement funds makes sense in a disaster scenario, consider taking out only what you need and set up a plan to pay back the amount no later than the three-year time frame.

How Can I Cash Out My 401k Without Penalties

If you are in dire need of funds, you may be able to tap into your 401 funds without penalty, even if youre under 59½. If you qualify for a hardship withdrawal, certain immediate expenses wont incur a tax penalty, including education, healthcare, and primary residence expenses.

- If you leave, quit, or get fired from the company at age 55 or older, you can cash out that account in a lump sum withdrawal without incurring a penalty. If youre under 55 years of age , you have up to 60 days to rollover your funds to a new 401 or IRA without triggering a taxable event.

Don’t Miss: Where To Rollover 401k To Ira

Should You Cash Out Your 401k Before Divorce

Rember that withdrawals from a 401K prior to age 59.5 are subject to a 10% early withdrawal penalty. The withdrawal will be reported as income on your tax return. If the withdrawal happens before the divorce is final, the owner is responsible for the taxes and penalties unless you negotiate otherwise. If you are cashing out a portion of the 401K for the non-owner spouse, wait until after the divorce is final and do it through a QDRO so you can avoid the 10% penalty.

When Can I Withdraw From My 401 Before Retirement But Without Tax Penalties

You don’t have to be in retirement to start withdrawing money from your 401. However, there are penalties involved depending on your age. If you wait until after you are 59 1/2, you can withdraw without any penalties. If you can’t wait until you are 59 1/2, then you will experience a 10% penalty on the amount withdrawn.

Read Also: What To Do With 401k When You Quit Your Job

Is There A Way To Get The Funds Out Of My 401k Early Without Paying A Penalty

Option A: Rollover to an IRA And Withdraw – You can rollover your 401K to an IRA but that will not give you early, penalty-free access to your retirement funds. It simply transfers the funds from your employers retirement account to a personal retirement account that also has early withdrawal restrictions. If you rollover your 401K to an IRA, no taxes are withheld . Rollover transactions are reported on Form 1099-R. You can rollover by having one institution pass the funds to another or you can actually withdraw the funds and move them yourself to a new institution within 60 days. If you choose this latter option, there will be mandatory withholding of 20%, so it is easier to do a direct institution to institution transfer. There may be an option to withdraw the funds early for specific reasons – IRAs are another type of retirement vehicle and have slightly different early withdrawal rules than 401Ks. If you rollover your 401K to an IRA, you may be able to withdraw money early penalty free for the following reasons: first time home purchase, tuition and educational expenses, disability, medical expenses, and health insurance

Early Withdrawal // 11 Ways To Cash Out Without Penalty

If you are in financial need, it might seem extremely tempting to simply withdraw some money from your 401, IRA, or other retirement account to cover the need. However, that withdrawal generally comes with a heavy penalty of 10% of the withdrawal amount. Retirement accounts are intended to be used for retirement, so the IRS imposes this penalty to discourage you from withdrawing money from your retirement savings. But what if you are in a true financial hardship? When can you withdraw from your 401 without this penalty? In some cases, you might be able to take some cash from your 401 without a penalty. Here is everything you need to know about early withdrawals from your 401 plus some ways that you can cash out without a penalty.

Recommended Reading: What Is The Minimum 401k Distribution

Should You Cash Out A 401k In A Divorce

Am I suggesting that retirement plans are a good source of cash when going through a divorce? Let me be clear. No, I am not suggesting that at all. I simply want to share that if you have a cash need and it makes the most sense to take it from a retirement account, the IRS does allow you to take money from a 401K without penalty.

Keep in mind, though, if the funds are in a pre-tax account, they will still be taxable when withdrawn. The plan administrator will withhold taxes when the distribution is made. However, it may not be enough to cover your tax liability, depending on your marginal tax rate, so youll want to plan accordingly.

Other Options If You Need Cash

With Montana on a phased reopening plan, Dee is hoping to head back to work at one of her jobs as early as the end of this week. “I will be going back…for one or two days a week depending on the need,” Dee says. But the financial strain will linger. “I’m sure I’m not the only one in this situation,” Dee says, adding that “little loopholes” are preventing many Americans like her from getting the financial assistance they need.

If you do need to dip into retirement savings and, like Dee, can’t get the new CRD or a hardship withdrawal approved, you could see if your plan allows for 401 loans. These loans are not taxed, and you can take out up to $100,000 if you have been diagnosed with Covid-19, a spouse or dependent has been diagnosed or you can show that you’ve suffered adverse financial consequences as a result of the pandemic.

All 401 loans need to be repaid within five years with interest , or you’ll be hit with taxes. But if you leave your job early , the outstanding balance often becomes due right away. You typically still need to be working at the company to take a loan, most plans do not offer 401 loans to former employees.

If those options don’t work, you could also tap into a Roth IRA if you have one. With these accounts, you can withdraw any money you’ve directly invested into the account at any time, without taxes or penalties.

*Subject asked to be identified only by her nickname to protect her privacy.

Don’t Miss: What Happens To 401k If You Retire Early

If You Are Under Age 59 1/2

If you inherit a spouses 401 plan, but you are not yet age 59 1/2, consider the pros and cons of the following choices.

- You can leave the money in the 401 plan. With this option, you can take withdrawals as needed and not pay the 10% penalty tax that typically applies to people younger than age 59 1/2. You will still pay regular income tax on any amount withdrawn. The beneficiary designations set up by your spouse would continue to apply at your death.

- You can roll the funds over to a specific type of account called an “inherited IRA.” With an inherited IRA, you take required distributions based on your single life expectancy table. You can take out more than this amount, but not less. With this option, withdrawals are not subject to the 10% penalty tax even if you are not yet age 59 1/2 You name your beneficiaries with this option.

- You can roll over the 401 plan to your own IRA account. There will be no taxes on this transaction. However, if you are not yet age 59 1/2, you may not want to do this because once it becomes your own IRA, any distributions you take will be considered early distributions and subject to a 10% penalty tax as well as regular income taxes. You name your beneficiaries with this option.

For most people who are not yet age 59 1/2, the best choice will be the first or second of these options