Delay Rmds With A Qlac

Using funds from a traditional IRA or traditional 401 to purchase a qualified longevity annuity contract can potentially reduce your RMDs.

A QLAC is a form of deferred annuity, and you can postpone QLAC annuity payouts as late as age 85, effectively putting off the tax bill on some of your retirement funds for an extra decade or more beyond age 72. Its not a permanent solution, but it keeps some of your savings away from RMDs and the tax man for a while.

Can The Penalty For Not Taking The Full Rmd Be Waived

Yes, the penalty may be waived if the account owner establishes that the shortfall in distributions was due to reasonable error and that reasonable steps are being taken to remedy the shortfall. In order to qualify for this relief, you must file Form 5329 PDF and attach a letter of explanation. See the instructions to Form 5329 PDF.

Why Some People Dont Like Rmds: Taxes And Medicare Premiums

For many people, having to take money out of an account might seem like a good thing. But some retirees may find the RMD rules onerous, especially if they dont need the money when the withdrawals are required.

They likely dont want to have to pay taxes on the withdrawals because it could place them in higher tax brackets. The withdrawals can also lead to Medicare premium surcharges because they count as income in calculating those premiums.

In general, wealthier individuals would benefit more than others if they didnt have to take RMDs. Thats because people who have less wealth are more likely to need to withdraw a certain amount from their retirement funds to pay their costs. The amounts they must withdraw are less likely to have a substantial impact on their overall tax bracket or their Medicare premiums.

On the other hand, wealthier individuals are more likely to face significantly higher Medicare premiums. In 2017, for example, the standard Medicare Part B premium for most new enrollees was $134 a month. However, a married couple with income more than $428,000 in 2015, would have paid $10,000 for Medicare Part B premiums in 2017.

In fact, some wealthy people avoid the higher premiums by putting money into IRAs, but RMDs can nullify that strategy.

Also Check: Can You Roll Over 401k From One Company To Another

Rmd Rules When A Spouse Inherits A Traditional Ira

If you inherit an IRA from your deceased partner, you can roll over the assets into your own IRA. Or, you can rollover the assets into what is known as an inherited IRA as all other types of beneficiaries can. If you rollover assets into your own IRA, you can use the favorable Uniform Life Expectancy Table to calculate RMDs after you turn 72.

In addition, you get another exclusive benefit. If youre better than 59.5, you can begin withdrawing money from your IRA without facing the 10% IRS early-withdrawal penalty.

But if youre under the age of 59.5 and want to start taking distributions, you might want to roll over the assets into an inherited IRA. Why? Because you can withdraw money from an inherited IRA without facing the 10% early-withdraw penalty no matter what your age is.

And youd calculate the RMDs for an inherited IRA based on your age and life expectancy factor in the IRS Single Life Expectancy Table.

But when would you need to start taking RMDs from an inherited IRA? It depends on the age of your spouse at the time of his or her death. We explain below.

If your spouse was older than age 72: start taking RMDs by Dec. 31 on the year after your spouses death.

If your spouse was younger than 72: you can delay RMDs until your spouse would have reached age 72.

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

Recommended Reading: How To See How Much 401k You Have

What To Know About Rmds

An RMD is an IRS-mandated amount of money that you must withdraw from traditional IRAs or an employer-sponsored retirement account each year. It’s important to understand when you need to take an RMD, how to avoid potential costly penalties for late distributions, and maximize your withdrawal strategy.

Age requirement:The IRS requires you to start taking RMDs at 72.*

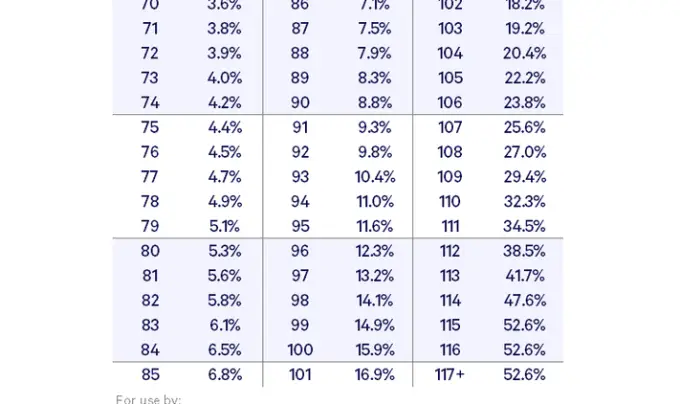

RMD amounts:If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table . However, if you are married and your spouse is the only primary beneficiary and is more than 10 years younger than you, your RMD is calculated using the IRS Joint Life Expectancy table. If your spouse is no more than 10 years younger, your RMD is calculated using the IRS Uniform Lifetime Table .

If all your retirement accounts are at Fidelity, you can calculate your RMD.

|

There are no RMDs for Roth IRAs, unless they are inherited.

Deadlines:April 1 Deadline for the first RMD in the year after you turn 72. You do not have to take an RMD from your workplace plan until you terminate or retire.

Note that if you delay your first RMD until April, you’ll have to take 2 RMDs your first year. The first will still have to be taken by April 1 the second, by December 31.

Penalties:Don’t miss your RMD deadline, because regardless of your account type, the IRS penalty may be severe50% of the amount not taken on time.

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Also Check: When Can You Take Out 401k

What Is A Required Minimum Distribution And Why Should I Care About It

An RMD is the smallest amount you must withdraw from your tax-deferred retirement accounts every year after a certain age. At some point in your life, you may have put money into tax-deferred retirement accounts, such as Individual Retirement Accounts and 401 workplace retirement accounts. The key words here are tax-deferred. You postponed taxes on your contributions and earnings you didnt eliminate them. Eventually, you must pay tax on your contributions and earnings. RMDs make sure that you do that.

How To Calculate Rmds

To calculate your RMD, divide your year-end account balance from the previous year by the IRS life-expectancy factor based on your birthday in the current year.

If you own multiple IRAs, you need to calculate the RMD for each account, but you can take the total RMD from just one IRA or any combination of IRAs. For instance, if you have an IRA thats smaller than your total RMD, you can empty out the small IRA and take the remainder of the RMD from a larger IRA.

A retiree who owns 401s at age 72 is subject to RMDs on those accounts, too. But unlike IRAs, if you own multiple 401s, you must calculate and take each 401s RMD separately.

You can take your annual RMD in a lump sum or piecemeal, perhaps in monthly or quarterly payments. Delaying the RMD until year-end, however, gives your money more time to grow tax-deferred. Either way, be sure to withdraw the total amount by the deadline.

Also Check: When Do You Need A 401k Audit

What If I Withdraw Too Little Or Dont Take An Rmd

If you dont make a proper RMD by the appropriate deadline, Uncle Sam will tax you 50% of the difference between the amount you withdrew that year and the amount you were supposed to take out that year.

However, you dont have to take your RMD in one lump sum. You can take it in increments throughout the year. Just make sure you withdraw the total RMD amount for the year by December 31. In some cases, however, you can delay RMDs.

Tips On Retirement Income Planning

- A financial advisor can be a big help in putting together a retirement income plan that accounts for living expenses, taxes and other considerations. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- To avoid a stiff penalty, make sure you withdraw your RMDs by the appropriate deadline. But dont worry. Most people satisfy their RMDs and then some within a given year. And to help you avoid some pitfalls, our retirement experts published a report on tips for understanding required minimum distribution rules.

You May Like: Should I Roll 401k To Ira

Which Retirement Accounts Are Subject To Rmd Rules

According to the IRS rules, if you have any of these plans, youre required to take annual RMDs:1

- 401, 403 and 457

- Traditional IRAs, SEP and SARSEP

- SIMPLE IRAs and Roth 401 accounts

Any investment or savings accounts you fund with money youve already paid taxes on are not subject to RMD rules, like Roth IRAs.1

Withdrawal rules differ for IRAs and 401s. If you have more than one IRA, you can total your IRA RMDs and, if you wish, withdraw that amount from just one account. For 401s, a separate RMD must be calculated for and withdrawn from each of your 401 accounts.2

Is There A Penalty If I Dont Take An Rmd

The penalty for not taking an RMD is severe: 50 percent of the amount that should have been withdrawn.1 If, for example, you did not take a required distribution of $10,000, your penalty would be $5,000.

To get the penalty waived, you have to convince the IRS that your failure to take a distribution was the result of a mistake, and youll need to show proof that youre working to correct the error.

You May Like: Can I Sign Up For 401k Anytime

How Can I Avoid Penalties On Withdrawals From My Ira Or 401

The most obvious and important way to avoid the penalties that come with withdrawals is to avoid taking them . Obviously, there comes times when needs outgrow wantsespecially fiscallyso that might not always be possible and you might find yourself needing to take a withdrawal.

The first step if a withdrawal cannot be avoided is to look into penalty rules and exceptions. Once you are 59 ½, you wont be penalized from taking money out of either a 401 or an IRA. If you can wait to avoid that penalty, that can have a significant effect on how much youll need to withdraw in the first place and how much youll have to pay in order to get your money.

Secondly, consider a retirement plan loan if you have a 401 or other similar employee-sponsored plan. The IRS provides solid information about this here, covering quite a bit about how loans on 401 and other employer-sponsored plans work. This money is not taxed as long as you adhere to the repayment terms and schedule. This might be an option for you to avoid early withdrawal penalties.

If you need to withdraw from your IRA, check to see if you are eligible for a hardship distribution, where you can have the 10% penalty waived on withdrawals made before you reach the age of 59 ½as long as you will be using them in situations that meet certain conditions. For example, you are unemployed and meet specific eligibility criteria , you can use penalty-free distributions to cover your medical insurance premiums.

How To Calculate Your Rmd

So, how can you figure out how much you need to take out based on the above table? Heres how to do the calculation:

Make sure you do this for all of the traditional IRAs you have in your name. Once you add up all of the required minimum distributions for each of your accounts, you can take that total amount out of any of your IRAs. You dont have to take the minimum distribution from each account as long as the total money you withdraw adds up.

This only applies to traditional IRAs, not Roth IRAs. Note that the above RMD table also doesnt apply to you if you have a spouse who is the sole beneficiary of your IRA and who is more than 10 years younger than you.

Also Check: What Are The Best 401k Funds To Invest In

Required Minimum Distributions For Your : How To Calculate Rmds And Rules To Know

Editorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

When you have a 401, you can save your money and put off paying federal taxes for years, even decades. To ensure you eventually do pay taxes on that money, the government requires you to start making withdrawals your required minimum distribution from your account once you reach a specific age.

The rules around RMDs are strict, and if you dont take out the minimum amount each year, you could end up paying hefty penalties. Heres how RMDs work and what you can do to minimize your tax bill.

What Happens If A Person Does Not Take A Rmd By The Required Deadline

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%. The account owner should file Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts PDF, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

Also Check: Can I Transfer My 401k To Another Company

What Are Required Minimum Distributions

Required Minimum Distributions generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 , if later, the year in which he or she retires. However, if the retirement plan account is an IRA or the account owner is a 5% owner of the business sponsoring the retirement plan, the RMDs must begin once the account holder is age 72 , regardless of whether he or she is retired.

Retirement plan participants and IRA owners, including owners of SEP IRAs and SIMPLE IRAs, are responsible for taking the correct amount of RMDs on time every year from their accounts, and they face stiff penalties for failure to take RMDs.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Don’t Miss: How Do I Take Money Out Of My Voya 401k

Retirement Topics Required Minimum Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

You cannot keep retirement funds in your account indefinitely. You generally have to start taking withdrawals from your IRA, SIMPLE IRA, SEP IRA, or retirement plan account when you reach age 70½. However, changes were made by the Setting Every Community Up for Retirement Enhancement Act which was part of the Further Consolidated Appropriations Act, 2020,P.L. 116-94, signed by the President on December 20, 2019. Due to changes made by the SECURE Act, if your 70th birthday is July 1, 2019 or later, you do not have to take withdrawals until you reach age 72. Roth IRAs do not require withdrawals until after the death of the owner.

Your required minimum distribution is the minimum amount you must withdraw from your account each year.

- You can withdraw more than the minimum required amount.

- Your withdrawals will be included in your taxable income except for any part that was taxed before or that can be received tax-free .