Withdrawing From Your 401

The 401 is intended to be a retirement plan, so withdrawals are restricted in your younger years. There are a few exceptions, but most withdrawals before age 59 1/2 come with a 10% penalty.

Retirement withdrawals: You can start taking retirement withdrawals once you’ve reached age 59 1/2. You may be able to begin withdrawals at age 55 without penalty if you no longer work for the company. These withdrawals are taxed as ordinary income.

Required minimum distributions: If you don’t need the money, you can leave it in the account until you are 72. In the first quarter of the year after you turn 72, the IRS requires you to take taxable withdrawals annually. These are known as required minimum distributions, or RMDs. The amount of your 401 RMD for each year is based on your age and your year-end account balance.

401 loan: Your plan may allow you to borrow against your 401 balance, which would not incur a penalty. You do pay interest on the loan however, youre paying interest to yourself. And, if you change jobs, you normally must repay the loan by the time your next tax return is due.

Other Unique Features Of Brokerage Accounts

Invest for non-retirement goals. With a 401, IRA, or Roth IRA, there are limits as to when you can use the fundsand for what purposewithout incurring a penalty. With a brokerage account, there are no such restrictions . Any money you need access to in the short-term should be kept in a high-yield savings account, but for goals with an intermediate or long-term time frame a brokerage account can be a great solution.

Avoid required minimum distributions. Just as there are no rules on how early you can access the funds, there are also no regulations on when you must begin tapping the account, as with Traditional IRAs, 401s, pension plans, and so forth. This is important as retirees who dont need the income can avoid unnecessary tax consequences, fees, and the disruption to their portfolio by staying invested.

Tax-efficient way to leave a legacy. The tax rules change when a beneficiary inherits a taxable brokerage account. If the original account owner sells a position during their life, the difference between their cost basis in the investment and the sale price will determine the gain thats subject to capital gains taxes . When an investor has highly appreciated securities in a taxable account, there may be a significant tax liability if the position is sold. However, if your spouse or heirs inherit a taxable brokerage account, the assets can pass on a stepped-up cost basis, which steps-up their inherited cost basis in the asset to the value on the date of your death.

Do Not Get Carried Away With Your Companys Stock

While its smart to take advantage of discounted employee stock purchase plans, you shouldnt dedicate more than 10% to your retirement portfolio.

In fact, your portfolio should not be heavily concentrated in any one particular stock. But if you lean too heavily on employer stock, you could suffer a significant investment loss if your company goes bust.

Read Also: Can A Qualified Charitable Distribution Be Made From A 401k

How Aggressive Should My 401k Be

If you are five or more years away from retirement, you should invest aggressively in the funds available in your 401 plan. This means allocating at least 70% to 80% to stocks. This is the biggest stumbling block the average investor is unable to overcome. Most sell out of risky investments when markets crash.

Who Is Eligible For A Roth 401

If your employer offers it, youre eligible. Unlike a Roth IRA, a Roth 401 has no income limits. Thats a fantastic feature of the Roth option. No matter how much money you earn, you can contribute to a Roth 401.

If you dont have access to a Roth option at work, you can still take advantage of the Roth benefits by working with your investing pro to open a Roth IRA. Just keep in mind that income limits do apply when you contribute to a Roth IRA.

Also Check: How To Transfer My 401k To My Bank Account

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

How Much Should I Invest In A Roth 401

We recommend investing 15% of your income into retirement savings. If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth account. See? Investing for the future is easier than you thought!

Don’t Miss: How To Lower 401k Contribution Fidelity

When Should You Avoid Maxing Out Your 401

Of course, not all people are in a position to add $19,500 a year to a retirement plan. For example, if you earn $50,000 a year, then that’s 39% of your total incomesome of which you may need to live on. Its okay that you may not have the excess cash flow needed to make this happen. Each year brings a new enrollment period, so over time if your financial situation improves, you can always choose to increase your contribution.

There are other reasons to think about maxing out 401 contributions. Employer-sponsored plans come in many forms. Most, though, are managed by outside investment firms with their own rate and package options. Your retirement plan at work may have a great track record with a past of steady growth, or it may be more modest. You may be able to have some say in whether your money is invested aggressively or cautiously, or you may have only one option. It’s possible that your plan charges high fees. You can usually find these details in your summary plan description and annual report. You should think about all these factors when you sign up and decide how much of your earnings each pay period will be put toward your plan.

Lastly, your 401 is only one of many potential retirement vehicles. You can always opt out of your company plan and save for retirement in an independent fund, like an IRA through your bank or credit union.

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

Read Also: How To Transfer 401k From Fidelity To Vanguard

What Is The Safest Place To Put Your Money

Key Takeaways. Savings accounts are a safe place to keep your money because all deposits made by consumers are guaranteed by the FDIC for bank accounts or the NCUA for credit union accounts. Deposit insurance for savings accounts covers $250,000 per depositor, per institution, and per account ownership category.

Are There Types Of 401 Investment

Sure, there are two major types of 401 investments: A Roth and A traditional 401k.

- A Roth 401: This is one type of 401 commonly used by most employers. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

- A Traditional 401: Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

Read Also: Can You Convert A Roth 401k To A Roth Ira

Is A 401 A Good Idea

Put simply, no. The 401k is a terrible investment vehicle for most Americans.

As I frequently say, 401s make a lot of sense if you dont think about it and little sense if you do.

In contrast to the 401, there are plenty of smart financial options that will produce income for you throughout your lifespan.

Examples of income-producing investments include rental real estate, peer-to-peer lending, real estate funds, income-producing businesses, mortgage tax liens, corporate and municipal bonds, and dividend paying stocks, funds and ETFs held outside a 401, to name a few.

Ready to learn more? Explore the finance section of the blog or join a half million readers who are learning how to budget, increase income, invest for cash flow, and so much more.

Are we connected on social media? Lets do it so I can share in your world too: | | | | Podcast

*Disclaimer: Im not a financial planner and nothing in this article should be construed as financial advice. Before making any decisions, you should consult with a professional adviser, such as a financial planner or CPA.

4.75

Scale Up Contributions Over Time

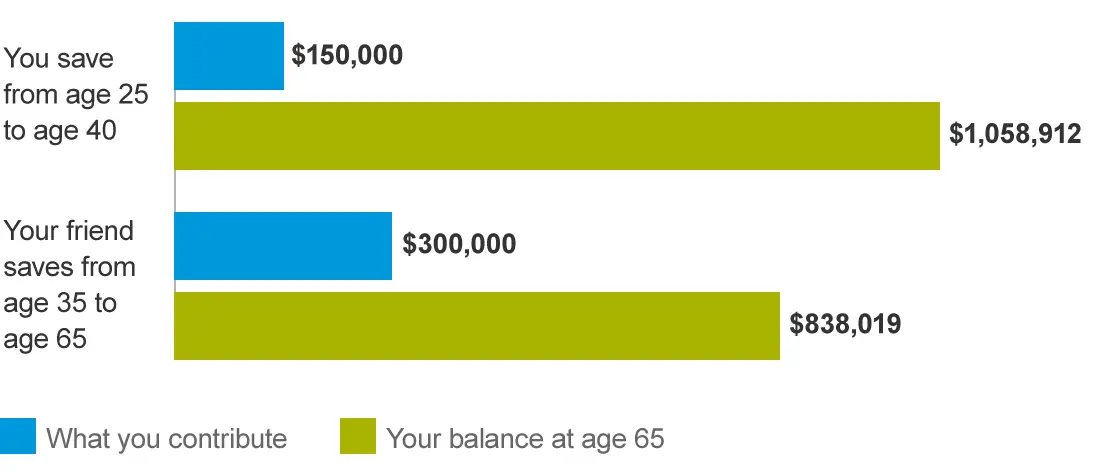

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

Don’t Miss: How Do You Max Out Your 401k

What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Investment Choices Can Be Limited

When you open an IRA, you’re generally given the choice to hand-pick stocks for your retirement portfolio. Doing so could help you grow a lot of wealth in your retirement plan, especially if you know how to research companies well.

With a 401, you generally can’t invest in individual stocks. That limits your choices and may create a situation where the options you’re presented with don’t align with your personal strategy or goals.

Recommended Reading: Can I Roll My Roth 401k Into A Roth Ira

What Happens If You Put Too Much In Your 401k

Avoid the Tax on Excess 401 Contributions

As of 2019, that maximum is $19,000 each year. If you exceed this limit, you are guilty of making what is known as an excess contribution. Excess contributions are subject to an additional penalty in the form of an excise tax. The penalty for excess contributions is 6%.

Make The Best Decision For You

When it comes to deciding what to do with an old 401, there may be factors that could be unique to your situation. That means the best choice will be different for everyone. One thing to remember is that the rules among retirement plans vary so it’s important to find out the rules your former employer has as well as the rules at your new employer.

Do also compare the fees and expenses associated with the accounts you’re considering. If you find it confusing or overwhelming, speak with a financial professional to help with the decision.

Don’t Miss: How Is 401k Paid Out

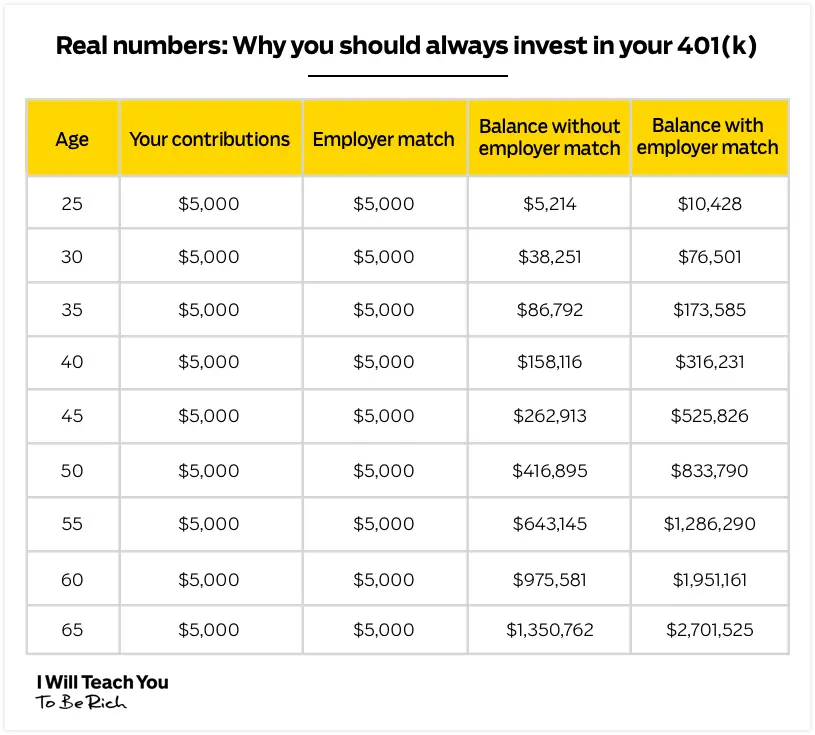

Grab All The Free Cash From Your Companys Match

To get started on a tangible level, take a look at your companys 401 options, says Driscoll. Many companies offer an incentive match, encouraging you to invest part of your paycheck into a retirement fund. Whatever they match, put that percentage into your retirement fund its free money.

The incentive match is one of the best parts, maybe the single best, of the 401 plan. And the employer match is the easiest, safest money you could ever make, offering you an immediate return for doing what you need to do anyway.

Many employers will match 50 percent of your contribution and sometimes as much as 100 percent up to a certain amount. A few employers do even better than that, although many employers do not offer a match at all.

Ensure you have contributed enough to get the full company match, says Kirk Kinder, certified financial planner at Picket Fence Financial in Bel Air, Maryland. There isnt any legit reason not to get the full match.

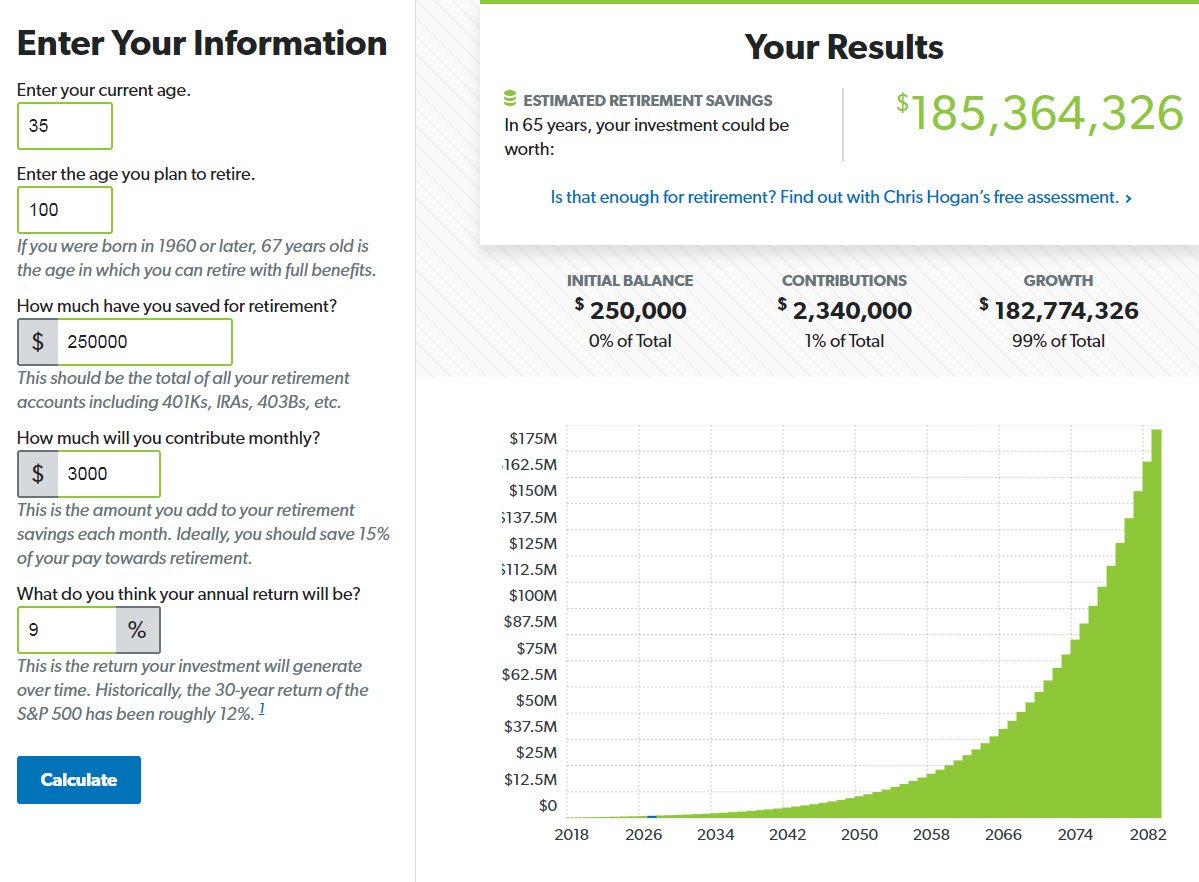

How Much Should I Invest

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. But the combination of an employer match and a tax benefit make it irresistible.

When youre just starting out, the achievable goal might be a minimum payment to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the yearly maximum contribution.

Recommended Reading: How To Open A 401k Plan

From Pension Plans To 401s

Large employers benefited dramatically from these new laws, because 401 plans are substantially less expensive to fund than pensions.

401ks are also more predictable, because the employer is not responsible for making payments to retirees through death. 401ks dont require the lifespan estimations that are central to pension plans.

In short, the 401ks place the burden of retirement investing and taking distributions during retirement squarely onto employees. For the most part, this is healthy for our nation, because we should all want to take responsibility for our own retirement.

However, it means that most Americans are now relying on a system that hasnt existed for even 40 years! Is this how you want to prepare for your financial future?

Its not the approach that Im taking. Below I explain the reasons I think 401ks are an appalling idea.

Before I do though, lets explore the upside they present.

Why We Recommend The Roth 401

If youre investing consistently every monthwhether its in a Roth 401, a traditional 401 or even a Roth IRAyoure already on the right track! The most important part of wealth building is consistent saving every month, no matter what the market is doing.

But if choosing between a traditional 401 and a Roth 401, we’d go with the Roth every time! Weve already talked through the differences between these two types of accounts, so youre probably already seeing the benefits. But just to be clear, here are the biggest reasons the Roth comes out on top.

Read Also: How To Invest My 401k Money

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

Weigh Your Investment Options

401s tend to have a small investment selection thats curated by your plan provider and your employer. Youre not selecting individual stocks and bonds , but mutual funds ideally ETFs or index funds that pool your money along with that of other investors to buy small pieces of many related securities.

Stock funds are divided into categories. Your 401 will probably offer at least one fund in each of the following categories: U.S. large cap which refers to the value of the companies within U.S. small cap, international, emerging markets and, in some plans, alternatives such as natural resources or real estate. Diversify your portfolio by spreading the portion youve allocated to equities among these funds.

You want to allocate more to the biggest asset classes, like U.S. large caps and international. U.S. small cap, natural resources and real estate are not as prevalent asset classes, so youll take smaller bits of those, Walters says.

That might mean putting 50% of your equity allocation into a U.S. large cap fund, 30% into an international fund, 10% into a U.S. small cap fund and spreading the remainder among categories such as emerging markets and natural resources.

The bond selection in 401s tends to be even more narrow, but generally youll be offered a total bond market fund. If you have access to an international bond fund, you might put a bit of your savings in there to diversify globally.

Also Check: How To Cash Out Nationwide 401k