What About Employer Contributions

Employers are not obligated to match your Roth contributions, but if they do, the match is a pre-tax contribution. The funds will go into a separate pre-tax account, and funds from it will be subject to tax when distributions are made at retirement.

Your employers contribution does not count towards your individual maximum permitted contribution, but they do count towards the overall limit. Currently, the maximum amount that you can put into all your 401 plans, Roth or traditional and including employer contribution, is $57,000 for individuals under 50 or $63,500 for those aged 50 and over.

Whats This Whole Employer Match Vesting Thing

A lot of employers use a vesting schedule for their 401 matches. Its a way to help them hedge their bets on you as an employee by reducing the amount of money theyd lose if you were to leave the company. Its also meant to give you a shiny incentive to stay.

A vesting schedule determines how much of your employers matching contributions you actually own, based on how long youve worked there. For example, if your employer contributions vest gradually over four years, then 25% of your employer contributions belongs to you after youve been there one year, 50% belongs to you after two years, 75% belongs to you after three years, and theyre all yours once you hit your fourth work anniversary.

Theres another type of vesting schedule, called cliff vesting. This ones more of an all-or-nothing scenario. With a four-year cliff, 0% of the contributions are yours until you hit your fourth workiversary, then 100% of them are all yours, all at once.

All the contributions made after your vesting schedule ends are usually fully vested right away. Oh, and dont worry: 100% of the money you put in yourself is always fully vested.

Taxes And Employer 401 Matching Contributions

You dont have to pay any income taxes on employer 401 matching contributions until you start making withdrawals.

Gross income includes wages, salaries, bonuses, tips, sick pay and vacation pay. Your own 401 contributions are pre-tax, but still count as part of your gross pay. However, your employers matching contributions do not count as income, said Joshua Zimmelman, president of Westwood Tax & Consulting.

Your employers matching contribution grows tax-deferred in a traditional 401, boosting your compounding returns over the years. You dont have to pay any taxes on the employer match until you start making withdrawals, said Zimmelman. Traditional 401 withdrawals are taxed as ordinary income at whatever tax bracket youre in when you make those withdrawals..

Recommended Reading: How To Borrow From 401k For Home Purchase

Employers Have A Higher Contribution Ceiling

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $58,000 in 2021, up from $57,000 in 2020. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $290,000. Even at that level, the employer would have to contribute a hefty amount to reach the $58,000 limit.

Need More Information On Retirement Planning

Important Disclosures

1 Contribution limits change slightly each year and may vary by plan. For specific information about your employer-sponsored retirement plan, see your benefits website or contact your Human Resources department.

Withdrawals from an IRA or qualified retirement plan are subject to ordinary income tax. Prior to age 59 ½, they may also be subject to a 10% federal tax penalty.

Investing involves risk, including loss of principal. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

The information provided is not intended to be a substitute for specific individualized tax, legal or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends that you consult with a qualified tax advisor, CPA, financial planner or investment manager.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Recommended Reading: What To Do With Your 401k

Retirement Savings Plan Contribution Limits

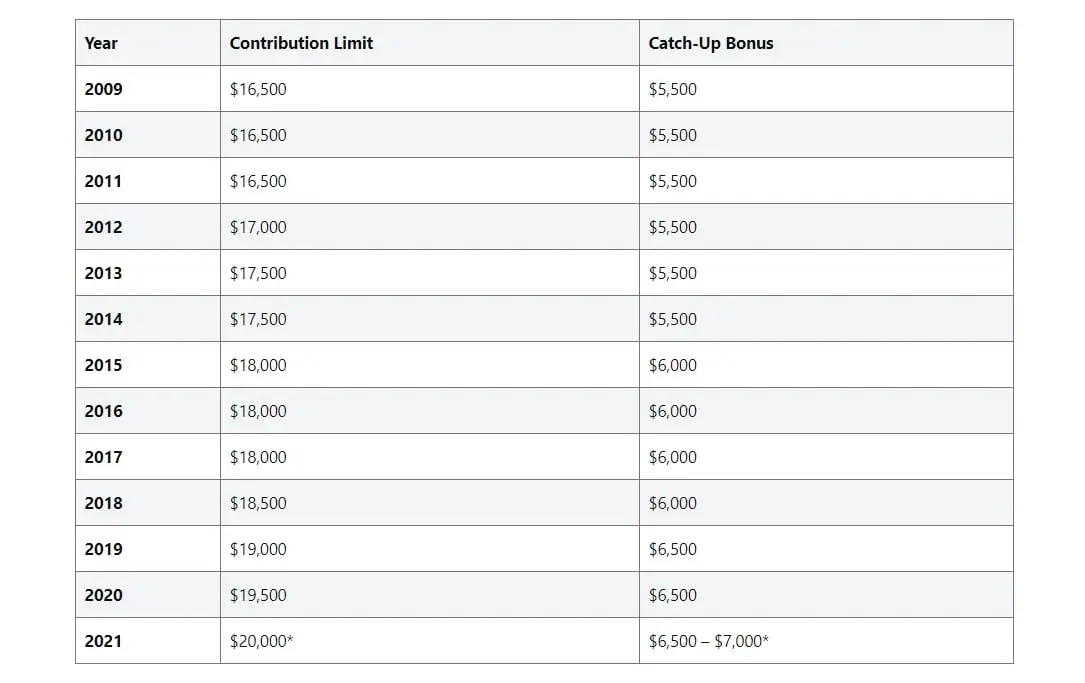

The information below summarizes the retirement plan contribution limits for 2021.

| Plan |

|---|

More details on the retirement plan limits are available from the IRS.

457 Plans

The normal contribution limit for elective deferrals to a 457 deferred compensation plan is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000. Employees taking advantage of the special pre-retirement catch-up may be eligible to contribute up to double the normal limit, for a total of $39,000.

401 Plans

The total contribution limit for 401 defined contribution plans under section 415 increased from $57,000 to $58,000 for 2021. This includes both employer and employee contributions.

401 Plans

The annual elective deferral limit for 401 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 401 defined contribution plans under section 415 increased from $57,000 to $58,000 .

403 Plans

The annual elective deferral limit for 403 plan employee contributions is unchanged at $19,500 in 2021. Employees age 50 or older may contribute up to an additional $6,500 for a total of $26,000.

The total contribution limit for both employee and employer contributions to 403 plans under section 415 increased from $57,000 to $58,000 .

IRAs

Review The Irs Limits For 2021

The IRS has announced the 2021 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

Don’t Miss: How To Take A Loan From 401k

Vesting And Employer 401 Contributions

Some 401 plans include a vesting schedule for employer contributions. With vesting, you must wait for a period of time before taking ownership of the 401 contributions made by your employer.

Note that most 401 plans let you start contributing to your account as soon as you join the company. Contributions that you make to your 401 account are always considered fully vestedthey are always 100% owned by you. Extended vesting periods only cover employer contributions.

According to Vanguard, 40% of 401 participants were in plans with immediate vesting of employer matching contributions. Smaller plans, meaning plans with fewer participants, used longer vesting schedules, with employees only becoming fully vested after five or six years.

If you have a 401 and your employer matches your contributions, be sure to ask about the vesting schedule. If your plan has a vesting schedule, you dont own your employers contributions to your 401 until you are fully vested. If you take a new job before that point, you could lose some or even all of your employers 401 contributions.

Understand The Value Of An Employer Match

A 401 or similar employer-sponsored retirement plan can be a powerful resource for building a secure retirementand an employer match can add a substantial amount to your nest egg. Let’s assume you are 30 years old, make $40,000 and contribute 3 percent of your salary$1,200to your 401. And, for the sake of this example, let’s assume you continue to make the same salary and the same contribution each year until you are 65. After 35 years, you will have contributed $42,000 to your 401.

Now let’s assume you get a match from your employer. One of the most common matches is a dollar-for-dollar match up to 3 percent of the employee’s salary. Taking full advantage of the match literally doubles your savings, even assuming no increase in the value of your investments: Instead of having set aside $42,000 by the time you retire, you will have set aside $84,000, with $42,000 in free contributions. Look at it this way: it’s a no-cost way for you to increase your contributions by 100 percent.

In reality though, the impact will be even bigger than that. That’s because when you invest money its value compounds. Check out The Time Is Now: The True Value of Time for Young Investors to learn how taking full advantage of a match early in your career can add up.

Recommended Reading: Can I Open A 401k Without An Employer

Are There Any 401 Employer Match Rules

Along with the contribution limits and match percentages, there is another important catch when it comes to 401 matches: the vesting schedule. Some employers require you to work at the company for a set amount of time before youre fully vested.

Vested just means that you fully own the employer contributions to your 401. You always own the contributions you put into the account but if you leave a company early, you might not get to take the money your employer put in.

For example, say your companys vesting schedule works like this: youre 0% vested for the first year, 20% vested for the second year, 50% vested for the third year and 100% vested by year four. If your employer contributes $2,000 and you leave halfway through your second year of employment, youll only get to keep $400 of it , whether you cash it in or roll it over. This amount is known as your vested balance. But if you switch jobs 10 years in, youll get the full value of your 401 employer match in other words, youll be fully vested.

If youre not sure what you vested balance is or how your companys vesting schedule works, you can always check with an HR rep for further clarity.

Does Employer Match Count Toward 401 Limit

Dear Dr. Don,Do employer contributions to a 401 plan count against the maximum limits you can contribute to the plan? Do they affect the amount you can put into a traditional or Roth individual retirement account? Pat Plans

Dear Pat,The employer matching contributions dont count toward the maximum limits that you can contribute to a 401 plan. There is, however, a combined contribution limit of $53,000 for the employer and employee contributions in 2015.

Also, in 2015, the employees contribution limit is $18,000. Plans may permit catch-up contributions of up to an additional $6,000 for employees ages 50 and older at the end of the calendar year, which raises the employee and combined contribution limits for these employees to $24,000 and $59,000, respectively.

Your participation in a 401 plan may limit your ability to make tax-deferred contributions to a traditional IRA, although you can make nondeductible contributions if you have sufficient taxable compensation to do so. There are income limitations on contributing to a Roth IRA, but no income limitations on converting a traditional IRA to a Roth IRA.

Get more news, money-saving tips and expert advice by signing up for a free Bankrate newsletter.

You May Like: How Much Can You Put In Your 401k A Year

What Are 401 Income Limits

The IRS doesnât limit 401 plan participation by how much an individual makes. Whether employees earn $25,000 or $250,000, everyone can contribute to a 401 plan if their employer provides one.

However, the total contributions are limited by how much an individual makes. In 2021 the total 401 contribution limit is $58,000. Those that make less than $58,000 in 2021 wonât be able to contribute that full amount. Thatâs because the IRS limits total contributions to the lesser of 100% of gross compensation or $58,000 for 2021.

So, in essence, there is an income limit to 401 contributions in that total contributions canât exceed a participantâs total annual income. This falls back on the rule across all retirement accounts that in order to be eligible to contribute towards a retirement account, an individual must have earned income during that year.

What Are Highly Compensated And Key Employees

The IRS defines a highly compensated employee as:

- Someone who owns more than 5% interest in the company regardless of how much compensation that person earned, or

- Someone whose salary is $130,000 or greater

Key employees are either:

- A company officer who makes more than $185,000

- A 5% owner of the business, or

- An employee who owns more than 1% of the business and makes more than $150,000

These definitions remain unchanged from 2020.

The Employee Retirement Income Security Act requires employers to undergo 401 discrimination testing every year to ensure plans are not favoring higher-income employees over those who earn less.

Also Check: How To Find My 401k Money

Tips For Maximizing Your 401 Match

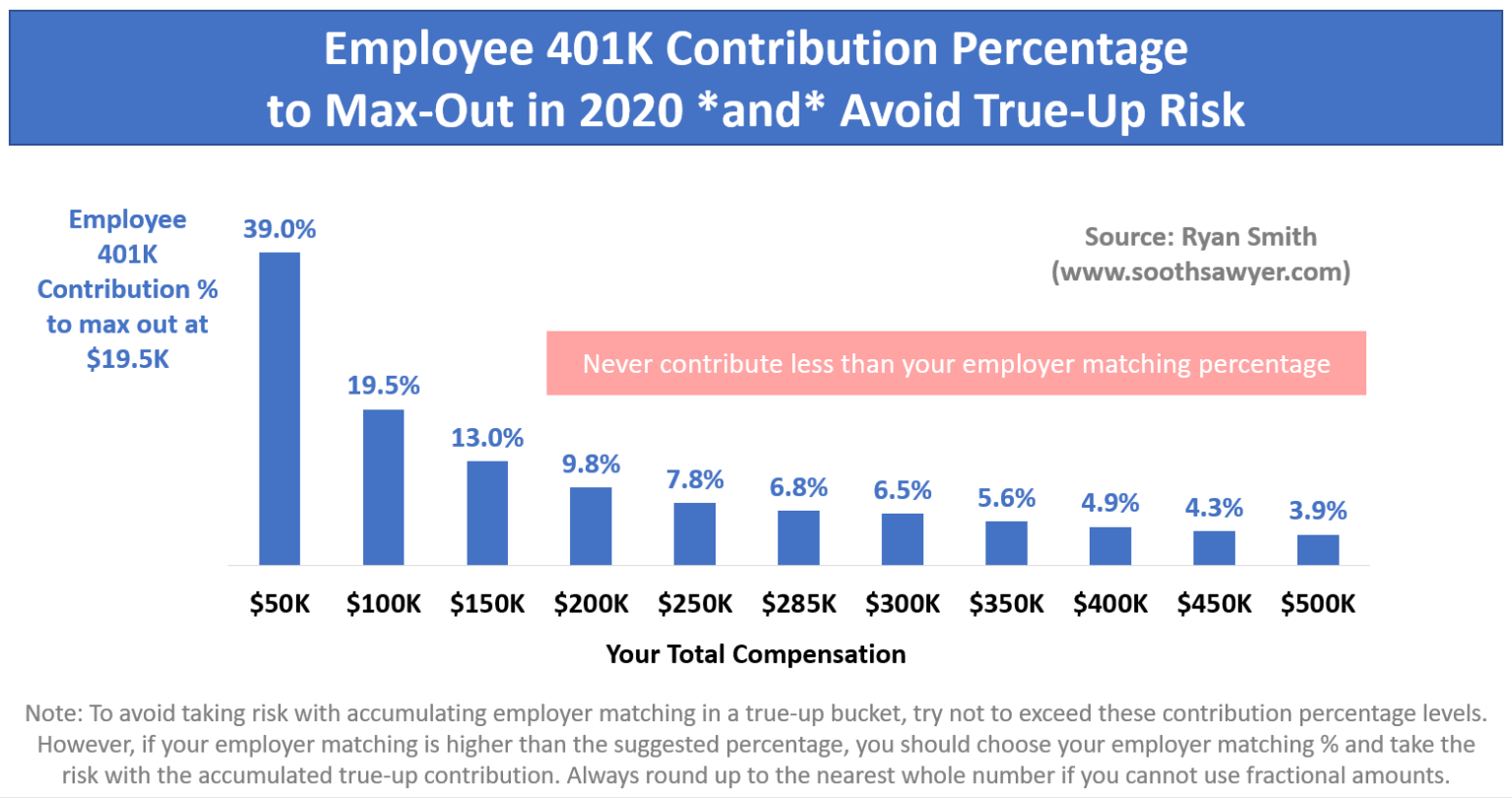

We tackle reader questions about annual contribution limits, how your contribution amount could be too high, and how the match math works.

Many companies match a portion of their employees’ 401 contributions as an incentive for their workers to save for retirement. But sometimes the rules aren’t clear, and the math can be tricky. Here, we tackle a few reader questions.

Does my company’s matching contribution to my 401 count toward my annual contribution limit? Yes and no. Strictly speaking, the company’s matching contribution does not count against your own employee annual contribution limit, which currently stands at $19,000 . So you can contribute up to that amount, and whatever your employer matches is irrelevant. If you participate in more than one 401 plan, the limit applies to your total contributions to all plans.

Roth 401 Contribution Limits

The contribution limit for Roth 401s is much higher than those for Roth IRAs. However, Roth 401 contribution limits are the same as those for traditional 401s.

Individual Roth 401 contributions limit is $19,500 for 2021. Total contributions made by employees and employer matches to a Roth 401 are limited to $58,000.

Read Also: How To Transfer Your 401k To Another Company

Retirement Isn’t Freebut Your 401 Match Is

Many of us herald this time of year as the arrival of summer, the end of the school year and seemingly longer days with more sunlight. Yet June is also a great time to check in with your employer-sponsored retirement plan.

Are you leaving free money on the table? In addition to offering the potential for free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Here are four steps to get the most out of your retirement savings.

How To Take Full Advantage Of A 401 Match And Build Retirement Savings:

Your minimum goal as a 401 plan participant should be to make sure you dont leave any employer dollars on the table. Find out what the maximum employer match on your plan is, and make sure you contribute enough to qualify for that match.

Beyond that, though, there would most likely still be tax advantages and retirement saving benefits to be had by contributing more than you need to qualify for the full employer match. According to Vanguard, 47% of employees do this, making contributions that go beyond what is necessary to qualify for the full employer match available.

In most cases, you can contribute up to $19,500 to a 401 plan for 2020 . Chances are this is well above what you need to contribute to maximize your employer match, but your goal should be to come as close to this limit as possible. Doing so will enhance your tax savings and build your retirement nest egg more quickly and your employer match should help as well.

Finally, remember that your 401 plan is not your only option for retirement savings.

If you reach the IRS maximum for 401 contributions, there are still other ways from health savings accounts to after-tax savings that you can build a bigger nest egg.

Glossary:

Also Check: How To Rollover 401k From Empower To Fidelity

How Much Can An Employer Match 401 Contributions

One of the most common questions asked when it comes to 401 plans is what is the maximum amount an employer can contribute on a 401. The answer is the employer can match up to 6% of the employees contribution. This matching amount would be repeated each year, but is subject to change.

How this works out for a 50% match is the employer contributes 50 cents for every dollar you contribute to your 401 based on a maximum of 6% of your annual gross income. If your earnings are $50,000 annually and your maximum contribution is $3,000 . In this example, your employer matches half that amount, $1,500, so the annual contribution comes out to $4,500.

With a dollar-for-dollar plan, your employer will match your contribution to the plan until you reach the percent limit allowed. For example, a $50,000 salary with a maximum contribution percentage of 5% would allow you to put $2,500 into your 401. Your employer would match that figure with its 100 percent match resulting in a contribution of $2,500 for a grand total of $5,000 for the year invested into your 401 plan.

Before committing to a plan, its important to know how much your employer will be contributing. Discuss this with your employer or someone in your companys human resources department when you first set up the plan, and every year thereafter, as the contribution amount can vary based on how much your earnings change from year to year.

Can I Contribute To Both A Roth 401 And A Traditional 401

You can. Depending on your personal situation, it may be smart to contribute to both a Roth 401 and a traditional plan, allowing you to diversify your tax strategy. If you participate in both types of plan, you can split your contribution any way you wish up to the maximum contribution limit. For example, you could defer $9,000 into your Roth 401 and $10,500 into a pre-tax 401 plan.

Read Also: Is There A Maximum You Can Contribute To A 401k