How To Track Down That Lost 401 Or Pension

Tweet This

Can’t Find your old 401 or that old pension? Here is how to track your money down. Shutterstock

At least once every few months a long-term client brings in a retirement account statement and says, I forgot I had this retirement account. Can you help me with it? Sometimes these accounts are tiny but other times they hold a substantial amount of money. All of them are old, and havent been looked at in years. If you find yourself in this position, follow these steps to locating your 401 or other retirement accounts from previous employers.

Do you ever feel like you know you saved more for retirement than your statements indicate? Are you certain you must have forgotten about an old retirement account or pension with a previous employer? You likely arent crazy, and youre definitely not alone.

Americans lost track of more than $7.7 billion worth of retirement savings in 2015 alone by accidentally and unknowingly abandoning their 401.– USA Today, February 25, 2018

The days of graduating college, getting a corporate job and staying with the same employer until the retirement age of 65 are long gone. Today, people are jumping from job to job which often leaves a trail of old retirement accounts and even a few pensions. Because of this, a surprising number of people lose track of these old accounts. Forgetting about these accounts can really hurt your overall retirement security when you factor in compounding interest.

What happens when a 401 plan is terminated?

How To Dissolve An Old 401

Old 401 accounts can be rolled over with no tax penalty.

With employees changing jobs more often, and typically not staying with one employer from the time they begin working until retirement, workers often end up with multiple 401 accounts from their previous jobs. To make it easier to manage your money, you may wish to close some of these old accounts, either after you have changed jobs or during retirement. Fortunately, you can easily move money from your old 401 into a rollover account.

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Also Check: How To Diversify 401k Portfolio

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401 and when you are eligible to participate. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the contents of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check. However, you must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance. Make sure your new 401 account is active and ready to receive contributions before you liquidate your old account.

Consolidating old 401 accounts into a current employers 401 program makes sense if your current employers 401 is well structured and cost-effective, and it gives you one less thing to keep track of, says Stephen J. Taddie, managing partner, Stellar Capital Management LLC, Phoenix, Arizona. Keeping things simple for you now also makes things simple for your heirs should they need to step in to take care of your affairs later.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: How To Find My 401k Money

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

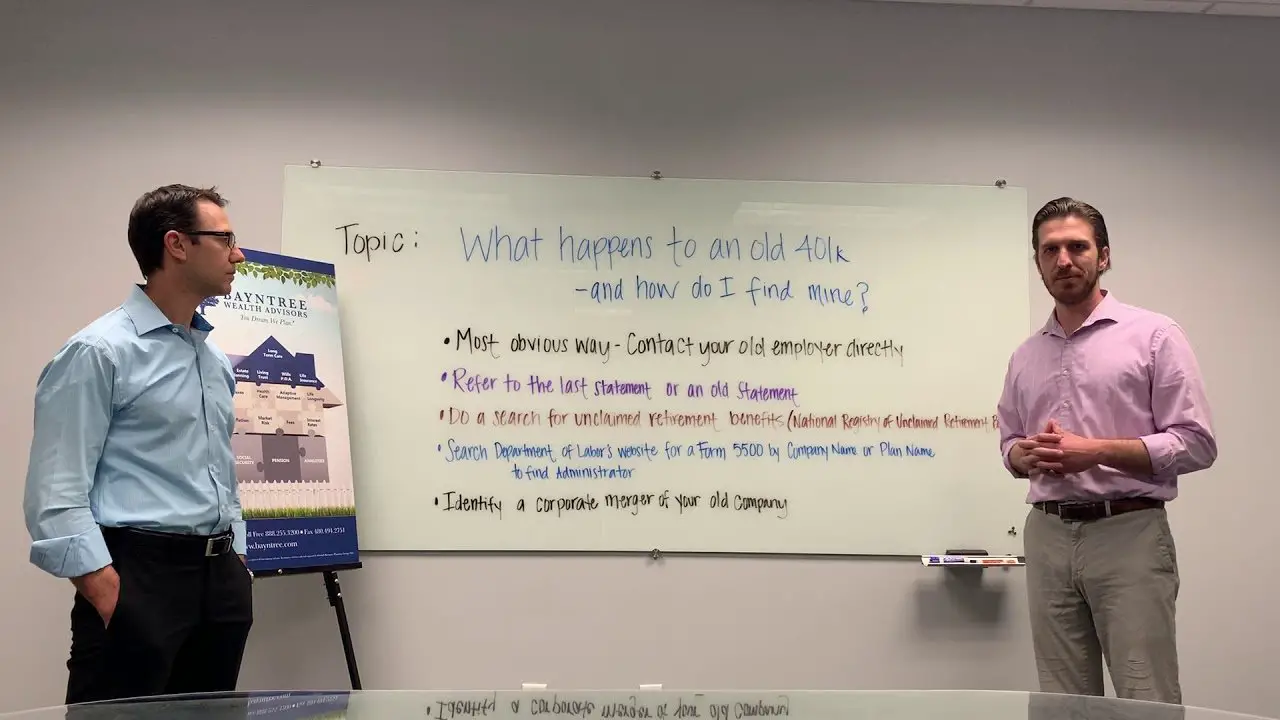

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

Read Also: Can Business Owners Have A 401k

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

What Happens If I Have Unclaimed 401 Funds From A Previous Job

The majority of unclaimed money comes from brokerage, checking, and savings accounts, along with annuities, 401s, and Individual Retirement Accounts. Once an account is considered inactive or dormant for a period of time , companies are required by law to mail abandoned funds to the owners last known address. If theyre returned, or the owner cant be reached, the assets must be relinquished to the state.

Don’t Miss: How To Transfer 401k From Fidelity To Vanguard

How Do I Find My Lost Ira

Back in my 20s, I opened an IRA. I remember doing it because it was my first exposure to index funds. And I know this sounds crazy, butafter a career change and a couple of movesI lost track of the account entirely. Now Im 45. The other day I was checking my 401 balance when it hit me: What happened to that IRA? Id love to have it back, but I dont know where to start. Help!

Victor S., New York, N.Y.

Individual Retirement Accounts , tax-favored accounts that are particularly important if you dont have access to a work-sponsored 401, can be a bit of a paradox. When you set one up during your early working years, you do so expecting your investments to grow on autopilot for decades it falls into the category of set it and forget it. But truly forgetting about an IRA can cost you. Heres what happens to lost IRAs, and what you need to do to find them.

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

You May Like: How Long Does A 401k Rollover Take

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

Option : Leave Your Money Where It Is

Usually, if your 401 has more than $5,000 in it, most employers will allow you to leave your money where it is. If youve been happy with your investment options and the plan has low fees, this might be a tempting offer. Before you decide, compare your old plan with any retirement plans offered at your new job or with an IRA of your own.

Your new employer-sponsored plan might have more limitations on it than your previous plan or other available options. Maybe there are fewer investment choices/options. Maybe it doesnt have an employer match or higher management fees. So youll want to look closely.

Also consider how often you tend to stay at jobs. If you change jobs every few years, you could end up with a trail of 401 plans at all the different places youve worked. Consolidating might be easier in the long run.

Don’t Miss: How To Cash Out Nationwide 401k

Roll Over 401 Into An Ira

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

Ford generally favors rolling the money over into the new companys 401 plan, though: For most investors, the 401 plan is simpler because the plan is already set up for you safer because the federal government monitors 401 plans carefully less expensive, because costs are spread over many plan participants and provides better returns, because plan investments are typically reviewed for their performance by an investment advisor and a company 401 investment committee.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Also Check: How Many Loans Can I Take From My 401k

If Youve Ever Had A 401 Account With An Employer And Lost Track Of It After Youve Left Youre Not Alone

We estimate that there are over 25 million orphaned 401 accounts just like yours. These are accounts tied to former employers that continue to have money in them, but are not actively being monitored or used.

At Capitalize, we help people find these old, orphaned 401 accounts and consolidate them into a new retirement account for free. This helps them better keep track of their retirement savings over time.

The money youve put away in a 401 account remains yours even after youve left that job. Most of the time its still at the same financial institution that managed it while you had it. This financial institution is known as a 401 provider. Its a company engaged by your former employer to hold and manage your 401 assets. You can see a full list of 401 providers here.

Some of the time, though, your money has been transferred to a new institution. That generally happens in one of three cases:

- Your former employer changes their 401 provider when this happens your 401 account will be transferred over to the new institution.

- Your former employer is acquired by another company when this happens your account usually gets transferred to the 401 provider used by the acquiring company.

- Your account balance was under $5,000 and was transferred to an IRA at a different institution this is known as a forced rollover and is allowed by some 401 plans.

Follow These 2 Tips To Prevent This Issue

Read Also: Can 401k Be Transferred To Roth Ira

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.