Roth Ira Or Roth : Which Is Better

Determining which account will best suit your needs depends on your current and future financial situations, as well as your own specific goals.

High earners who want to make contributions to retirement accounts each year should consider a Roth 401, because they have no income caps. Additionally, individuals who want to make large contributions can put more than three times the amount in a Roth 401 as in a Roth IRA.

Those who want more flexibility with their funds, including no required distributions, might lean toward a Roth IRA. This would be especially helpful if you want to leave the account to an heir. But Roth 401 accounts can be rolled over into a Roth IRA later in life anyway.

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

What Is The 5

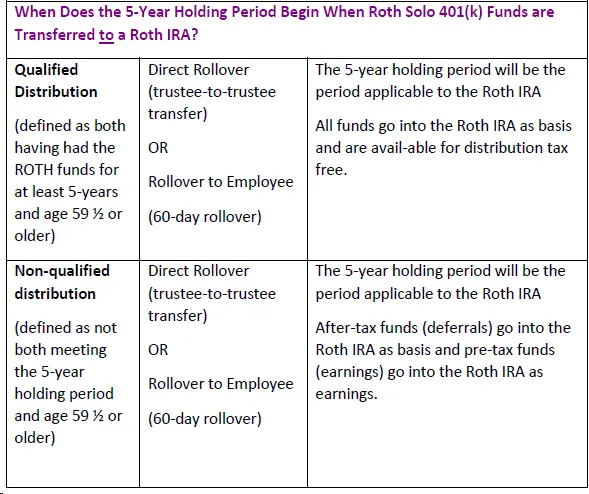

Generally speaking, the 5-year rule concerns the withdrawal of funds from an Individual Retirement Account . However, several different types of 5-year rules actually exist. Two apply specifically to Roth IRAs and the waiting period before funds can be withdrawn. Another relates to the distribution schedule of funds from inherited IRAs, either Roth or traditional ones.

Also Check: How To Avoid Penalty On 401k Withdrawal

Can You Roll An Ira Into A 401

posted on

If you have multiple retirement accounts, you can often move money between them without tax consequences, and you might want to combine accounts for several reasons. The most common move is to roll from your 401 to an IRA, but its also possible to do the opposite: You can roll a pretax IRA into a 401.

There are pros and cons to everything, and that includes moving an IRA into your 401 or 403b. You might like the investment choices better, or your employers retirement plan might have less expensive investments. Simplifying is another reason to transfer IRAs to a 401: Clean up those old accounts instead of spending mental energy and time to keep track of multiple accounts.

Does Separate Account Refer To The Actual Funding Vehicle Or Does It Refer To Separate Accounting Within The Plan’s Trust

Under IRC Section 402A, the separate account requirement can be satisfied by any means by which an employer can separately and accurately track a participants designated Roth contributions, along with corresponding gains and losses.

Read Also: Can You Convert Your 401k To A Roth Ira

Converting A Nondeductible Ira Contribution To A Roth Ira

You may know that if you or your spouse have a retirement plan available at work, it limits the deductible contributions you can make to a traditional IRA.3 If you’re in that boat and want to make the most of your tax-advantaged saving options, you can still make nondeductible IRA contributions. Earnings on these contributions will be tax-deferred but you do have the option of converting to a Roth IRA. In that case, your nondeductible contributions wont be taxed again, although any earnings would be treated as pre-tax balances, which means they would be taxable when converted. This type of conversion is sometimes called a backdoor Roth IRA.

If you do decide to convert either pre-tax or non-deductible contributions, the timing can be a little bit tricky. Some time should pass between the date of the contribution and the date of the conversion, but it’s not completely clear how much is enough. If you do decide to convert, consult your tax advisor first to ensure that you understand the full scope of potential tax consequences.

Rollover Relief For 2020 Rmds Waived Under The Cares Act

Section 114 of the Setting Every Community Up for Retirement Enhancement Act of 2019, P.L. 116-94, amended Sec. 401 to change the required beginning date for RMDs for Sec. 401 plans and other eligible retirement plans, including IRAs. For distributions required to be made after Dec. 31, 2019, for individuals who attain age 70½ after that date, the new required beginning date is generally April 1 of the calendar year following the calendar year in which the individual attains age 72.

Usually, RMDs from eligible retirement plans and individual retirement plans cannot be rolled over ). And during the year of a Roth IRA conversion, if the account holder fails to receive an RMD, the first dollars distributed during the year are considered an RMD until the amount of the RMD has been distributed ). However, since RMDs from defined contribution plans and IRAs were waived for tax year 2020 under Section 2203 of the Coronavirus Aid, Relief, and Economic Security Act, P.L. 116-136, any distribution received in 2020 from a defined contribution plan or IRA technically is not an RMD accordingly, taxpayers may have the opportunity to roll over such distributions.

Read Also: How Do You Take Money Out Of 401k

Learn Which Type Of Retirement Accounts Can Be Combined

The most common types of retirement accounts can be transferred into one IRA and one Roth IRA. For example, once you have left your employer, you can move your 401 to an IRA. When you move money from a 401 to an IRA using an IRA rollover, there are no taxes due, as it is considered a direct transfer from one type of retirement account to another. In your new IRA, you’ll pay taxes only as you take withdrawals. If you are between age 55 and 59 1/2, make sure that you understand the 401 retirement age rules before you decide to move money out of a 401 plan.

401s, 403s, SEP accounts, SIMPLE accounts, KEOGHs, Individual 401s, and some 457 plans can all be transferred into one IRA account. Having everything in one account makes it easy to update and change beneficiaries, manage investments, and take withdrawals. When you reach age 72, you are required to take a minimum withdrawal amount, and that can be challenging to manage if your accounts are spread out.

If you have after-tax contributions in your 401 plan or other retirement accounts, those can usually be transferred into a Roth IRA account. Alternatively, you may find it advantageous to convert a portion of your pre-tax 401 contributions to a Roth IRA. Doing so will trigger an immediate tax bill, but future tax-free growth may position you better for the long-term. A financial advisor and/or tax professional can provide some guidance on that front.

When Do You Plan To Move To Canada And Will It Be Permanent

Transferring 401s and IRAs to RRSPs only makes sense for people who are moving to Canada permanently , since its not possible to transfer RRSPs to IRAs.

Lets assume the move is permanent. If she knows several years in advance, and her marginal tax rate isnt too high, it may make sense for her to convert from an IRA to a Roth IRA so shell have paid tax on the capital at a lower rate.

Read Also: What Is An Ira Account Vs 401k

Roll Over Traditional Money Into The Tsp

A rollover is when you receive eligible money directly from your traditional IRA or plan and then you later put it into your TSP account. You cannot roll over Roth money into the TSP and you must complete your rollover within 60 days from the date you receive your funds. Use Form TSP-60, Request for a Transfer Into the TSP, to roll over eligible traditional money.

Choose Investments In Your Ira

Once the money is consolidated into one account, you can choose what types of investments belong in that account. Make an investment plan, and make sure the investments you choose will match up with the expected withdrawals you will need to take.

For example, if you know that you will need to take $20,000 out next year, you don’t want that $20,000 invested in something aggressive, risky, or volatile, like a stock fund. You want it in something safe so you that you won’t have to worry about that part of your account being worth less than $20,000 when you need it.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal.

You May Like: What Is A Pension Vs 401k

You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

How To Roll Over A 401 To An Ira In 4 Steps

If you decide to do a 401 rollover to an IRA, typically the money from an old 401 must go into the new IRA account within 60 days. There are four steps to do a 401 rollover into an IRA.

Choose which type of IRA account to open

Open your new IRA account

Ask your 401 plan for a direct rollover or remember the 60-day rule

Choose your investments

Don’t Miss: What Is Max Amount To Contribute To 401k

Types Of Coins You Can Own With Your Gold Ira

Depending on the fineness standard, you can own certain types of gold and other precious metals like silver or platinum coins with your Gold IRA, in compliance with the Internal Revenue Code.

Few examples of the coins you can own in an IRA are:

- American gold Eagle coins

- American Platinum Eagle coin

- Canadian gold maple leaf coin

These coins are tested to have a fineness of 99.9% or more. Anything with a fineness below that will not be allowed, no matter how popular or in-demand the coin is.

Transfer Of An Ira To An Rrsp

Under Canadian tax law, an IRA is considered to be a foreign retirement arrangement. The rules and consequences for transferring an IRA to an RRSP are very similar to the 401 plan transfer rules. One important distinction, however, involves the concept of an eligible amount. For the purpose of transferring an amount from an IRA to an RRSP, an eligible amount is an amount included in income, received as a lump sum, and derived from contributions made to the plan by either you or your spouse or former spouse. Any contributions made to the plan by your employer wouldnt qualify as an eligible amount and consequently wouldnt be eligible to be transferred to an RRSP and deducted from your income.

It should also be noted that theres no requirement for you to be a non-resident for your IRA contributions to be considered as an eligible amount. As was the case with the transfer from the 401 plan to an RRSP, the taxable amount transferred from an IRA to an RRSP will be subject to withholding taxes that will be eligible for the foreign tax credit or similar deduction when filing your Canadian income tax return. Similarly, the early withdrawal tax is eligible for purposes of computing your foreign tax credit.

Don’t Miss: How Do I Find Out Where My Old 401k Is

Transfers To Simple Iras

Previously, a SIMPLE IRA could only accept transfers from another SIMPLE IRA plan. A new law in 2015 now allows a SIMPLE IRA to also accept transfers from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403, or 457 plan. However, the following restrictions apply:

- SIMPLE IRAs may not accept rollovers from Roth IRAs or designated Roth accounts of employer-sponsored plans.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law only applies to transfers to SIMPLE IRAs made after December 18, 2015, the date of enactment.

- The one-per-year limitation that applies to IRA-to-IRA rollovers also applies to rollovers from a traditional IRA, SIMPLE IRA, or SEP IRA into a SIMPLE IRA.

Can My Outstanding Plan Loan Be Part Of An In

Yes. If the plan allows, you may roll over your outstanding loan balance from the plans non-Roth account into the plans designated Roth account through a direct rollover as long as there is no change in the loans repayment schedule. The loans taxable amount when rolled over as an in-plan Roth direct rollover would be the balance of the loan at the time of the rollover.

Read Also: How To Collect My 401k Money

Avoiding The Ira Aggregation Rule Via 401 And Other Employer Retirement Plans

While the IRA aggregation rule does combine together all IRA accounts to determine the tax purposes of a distribution or conversion, its important to note that the rule only aggregates together IRA accounts, and only the traditional IRA accounts for that individual.

Thus, a husband and wifes IRA accounts are not aggregated together across the marital unit . Nor are an individuals own IRAs aggregated together with any inherited IRA accounts on his/her behalf. And any existing Roth IRAs and the associated after-tax contributions that go into Roth accounts are not aggregated either.

In addition, any employer retirement plans e.g., from a 401, profit-sharing plan, etc. are not including in the aggregation rule. However, a SIMPLE IRA or SEP IRA, both of which are still fundamentally just an IRA, are included.

The fact that employer retirement plans are separated out from the IRA aggregation rule means first and foremost that as long as assets stay within a 401 or other employer plan, they can avoid confounding the backdoor Roth strategy. Thus, in the earlier example, if Jeremys $200,000 IRA was a $200,000 401 instead, then the $5,500 non-deductible contribution to an IRA really could be converted on its own, because that would be the only IRA involved.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early-withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

Recommended Reading: How To Take Out 401k Money For House

What Kind Of Plan Is It And Have You Already Started Withdrawing From It

If the client has already started withdrawing from the plan, she cannot transfer it into an RRSP, says Power. She adds 401s that have been rolled over into annuities cannot be transferred.

There are considerations for each plan. For 401s, only the employee-contributed amounts can be transferred to an RRSP without using up RRSP room. Any employer contributions can still be transferred, but the client needs commensurate RRSP room. To get around that, We always recommend converting from a 401 to an IRA first, says Altro. Thats not a taxable event, he adds, and it allows both portions to be transferred to an RRSP without using up contribution room.

Another reason to convert is if a client was a Canadian resident while she participated in the 401 planfor instance, a cross-border commuter, says Wong. Thats because shes ineligible for a direct 401 to RRSP transfer.

For IRA-to-RRSP transfers, Wong says that the transferred value cannot include amounts contributed from someone other than the taxpayer or taxpayers spouse, such as employer pension amounts.

With 401s, the employer plan administrator is responsible for keeping track of the after-tax and pre-tax contributions. With IRAs s are rolled over to IRAs), that tracking responsibility shifts to the individual, says Altro. Advisors must ask clients if they have any after-tax contributions in their U.S. plans.

How Required Minimum Distributions Work

With a traditional IRA, contributions or deposits are made with pretax dollars, meaning you get a tax deduction on that contribution in the tax year that you made it. In return, you pay income tax on the distribution amounts when the money is withdrawn in retirement. At age 72, you must begin taking annual required minimum distributions , which is calculated based on the total amount saved in all of your traditional IRAs.

Conversely, Roth IRA contributions are with after-tax dollars, meaning you don’t get a tax deduction in the year of the contribution. However, you get to withdraw the money tax-free in retirement. Also, there are no RMDs with Roths.

However, there was an exception for RMDs in 2020. RMDs were waived as a result of former President Trump signing the Coronavirus Aid, Relief, and Economic Security Act into law on March 27, 2020. The suspension of required minimum distributions from IRA accounts was designed to help the IRA savings of retirees to recover from any corrections or downturns in the stock market in 2020.

But if you are 72 in 2021, you must resume RMDs and continue for every year after.

Recommended Reading: When Leaving A Company What To Do With 401k