Open Your New Ira Account

You generally have two options for where to get an IRA: an online broker or a robo-advisor. The option you choose depends on whether you’re a “manage it for me” type or a DIY type.

-

If you’re not interested in picking individual investments, a robo-advisor can do that for you. Robo-advisors build personalized portfolios using low-cost funds based on your preferences, then rebalance those funds over time to help you stay on track, all for a much lower fee than a conventional investment manager.

-

If you want to build and manage your own investment portfolio, an online broker lets you buy and sell investments yourself. Look for a provider that charges no account fees, offers a wide selection of low-cost investments and has a reputation for good customer service.

» Ready to get started? Explore best IRA accounts for 2021

What Are Exceptions To The Early Withdrawal Penalty

While the 10% penalty generally applies if you take money out of a 401 early, the IRS allows some exceptions for financial hardship. If you meet all the qualifications, and your employer allows hardship withdrawals, you may be able to take a hardship distribution without penalty to cover certain expenses.

- Medical care that would be allowed as a medical expense deduction, regardless of whether you actually take such a deduction

- Costs directly related to buying a principal residence, excluding mortgage payments

- Paying tuition and college expenses, including room and board, for yourself, a spouse, your children or other dependents

- Making payments to prevent eviction from, or foreclosure, on your home

- Funeral expenses

- Expenses related to repairing damage to your home caused by a qualifying disaster

And, earlier in 2020, the federal government made provisions in the Coronavirus Aid, Relief and Economic Security Act to allow people affected by COVID-19 to draw on their retirement accounts, including 401s. More on that here.

How Does A Cares Act 401k Withdrawal Work

Plan participants should speak to their plan administrator to ask about the process for requesting a 401k or IRA withdrawal. The participant may need to complete a withdrawal form and provide documentation to substantiate the nature of their hardship.

The request will need to be approved by either a committee or a designated person responsible for making hardship-withdrawal decisions. If the participant qualifies for a hardship withdrawal based on IRS regulations, the plan administrator will process the request. Depending on the plan administrator, approving and processing the hardship request can take several weeks. For that reason, a hardship withdrawal may not be a great option for the most time-sensitive financial needs.

If the participant doesnt qualify for the distribution, the administrator will deny the request and notify the participant.

Prior to the CARES Act, plans would automatically withhold 20% of early withdrawals for tax purposes. The CARES Act eliminated the 20% automatic withholding on 401k withdrawals. However, participants may want to avoid spending the full amount withdrawn in order to have funds available to cover the tax bill later.

You May Like: What Is Max Amount To Contribute To 401k

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Borrowing From And Rolling Over Your 401

Cashing out isn’t the only way for those who need it to get money out a 401. Many plans also allow employees to take loans from their 401 to be repaid with after-tax funds at pre-defined interest rates. The interest proceeds then become part of the 401 balance. The benefit of this type of loan is that the borrower repays himself — by eventually putting the borrowed money back into the 401 — rather than a bank.

If loans are permitted under terms of the 401 plan, the employee may borrow up to 50 percent of the vested account balance up to a maximum of $50,000 without the money being taxed. The borrower must repay the loan within five years unless the loan is used to buy a primary residence, and loan repayments must be made at least quarterly in substantially level amounts. If the borrower defaults on the loan, the money becomes a taxable distribution with all the same tax penalties and implications of a withdrawal.

401 holders looking for extra cash should keep all these options in mind when considering whether to tap into retirement savings early. Other savings tools may also provide penalty-free ways to get at money, depending on the holder’s circumstances. For more information on 401s and retirement savings strategies, check out the related articles and links on the next page.

Also Check: What Is An Ira Account Vs 401k

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, you’ll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

You May Have To Sell Investments At A Bad Time

Pulling cash out of investment accounts after the market has fallen means youre locking in any losses youve incurred. Even if you reinvest these funds down the road, youll have missed reaping any gains those investments would have seen in the interim.

In 2020, the S& P 500 had its largest first-quarter decline in history, finishing down 20%. Stats like this can lead to panic selling, or, coupled with the loosened withdrawal rules, may tempt you to dip into retirement accounts to prevent further losses.

But remember: You havent lost anything until you sell. So if your cash crunch isnt an emergency, you can avoid losses by riding out the storm, and benefit from the rebound whenever it eventually occurs.

Recommended Reading: How To Open A Solo 401k

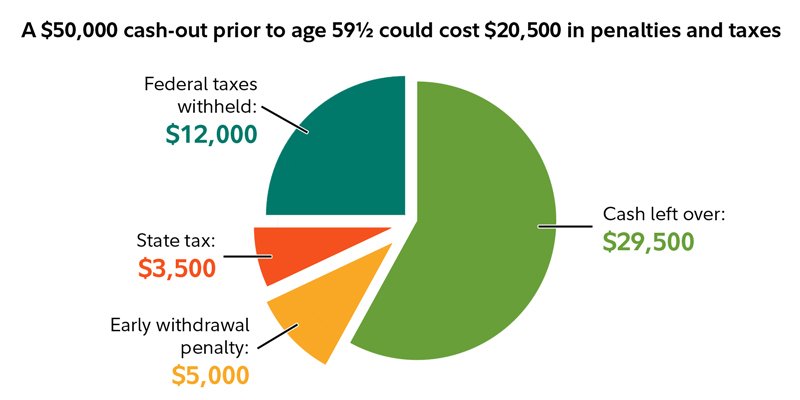

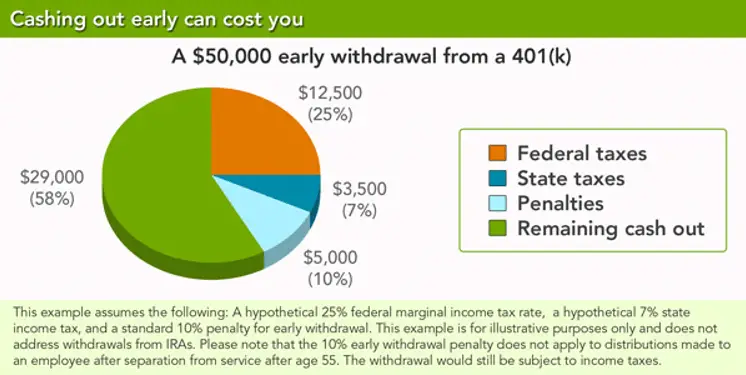

Withdrawal Taxes And Early Distributions

You might find yourself in a situation where you need the money in your 401 before you reach 59 1/2 years of age. The account is designed to be part of your retirement plan, but circumstances come up where you cant avoid dipping into the money for other reasons. Down payments, emergency medical bills and education costs are a few examples of expenses some people pay with 401 funds.

If this is the case for you, expect to pay a 10% penalty fee. This is on top of the income tax youll pay for withdrawing the funds. Remember, even if its paying for an emergency, its still counted for tax purposes as income. Youll want to run the numbers, adding the tax and penalty tax, to see if it makes sense to pull money out early. Its also important to factor in the opportunity cost of pulling your investments out of the market.

In some cases, there is an exception to the 10% additional tax. The IRS lists the circumstances where the tax doesnt apply. Losing your job at 55, or starting a SOSEPP plan are two examples. Youll still be on the hook for income taxes, of course.

Given the tax hit and opportunity cost of early withdrawals, its not ideal solution. Before you commit to a penalized withdrawal, consider if borrowing the money from your 401 might be a better solution.

Substantally Equal Period Payments

Substantially equal period payments may be another option for withdrawing funds without paying the early distribution penalty. SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

Recommended Reading: What Happens When You Roll Over 401k To Ira

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses don’t necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Small Loans Vs Credit Cards

The ubiquity of credit cards may be one reason for the dearth of small personal loan providers. There are very few places that don’t take credit cards nowadays. When you put something on your plastic, you are basically financing the purchaseit’s actually not that different from borrowing money from any other source. You repay the lender when your monthly statement arrives, either in full or in part. If it’s in part, you pay interest, of course.

Unlike banks, credit card issuers love to lend you moneyeither by you charging your purchase or by you taking out a cash advance. They’ll even raise your to let you do so if you’ve got a good record. The catch, of course, is the interest they charge credit card interest rates tend to be higher than those on personal loans, especially for cash advances.

But it depends on the card issuer and personal loan lender in question. You need to do the math and see which option costs less overall. Some special circumstances might apply, too. If you have a rewards credit card and can cover your expense while earning points or cash back, you should. Or if a card is offering a special zero-APR promotion on balance transfers for, say, 24 monthsabout the time you’d take to pay back a personal loanthat could be a better deal too.

Generally, though if you want to save on interest or dont have a credit card, look into a small personal loan.

Read Also: How To Use Your 401k

Best For Lowest Borrowing Amounts: Navy Federal Credit Union

This whole list is devoted to sources for small loans. But Navy Federal Credit Union offers really small loansas low as $250. Usually, a usurious payday loan provider is your only source for such minimal sums . Navy Federal not only offers them, but it also does so on reasonable terms and at competitive interest rates.

-

Varied repayment terms: Shorter loans of up to 36 months are available as well as longer loans of 37 months to 5 years

-

Co-applicants allowed: If your credit score or financials are weak, a co-borrower can help you secure a loan at a lower rate

-

No prequalifying option: Application triggers a hard credit inquiry, which can hurt your credit score

- Maximum/minimum amount you can borrow:$250 to $50,000

- :7.49%18.00%

- Fees: None

- Recommended minimum credit requirements: Not listed

- Other qualification requirements: Need to be a member of the credit union

- Repayment terms: Up to 60 months

- Time to receive funds: Often same day

- Restrictions: Hard inquiry only

Read the full review: Navy Federal Personal Loans

What Is A 401k Cares Act Withdrawal

Normally, participants who withdraw money from a tax-deferred retirement account before reaching age 59½, must pay a 10% early withdrawal penalty in addition to including the distribution in their taxable income for the year.

There are a few exceptions to the rule, including one for hardships, such as avoiding foreclosures, repairing your home after a disaster, or covering out-of-pocket medical expenses. However, these hardship withdrawals are normally limited to the amount needed to meet a limited list of hardships.

The CARES Act provided more flexibility for making emergency withdrawals from a tax-deferred retirement account by eliminating the 10% early withdrawal penalty. Participants are allowed to withdraw up to $100,000 per person without being subject to a tax penalty. Any early withdrawals above that amount dont qualify for special tax treatment.

It is important to note that the withdrawal is taxable income the special tax treatment waives the tax penalty but not the taxable event. However, the CARES Act allows people who take hardship distributions to elect to pay federal income taxes on the distribution over a three-year period or repay the distribution amount over a three-year period and avoid tax consequences entirely. The three-year repayment period starts on the day of the distribution.

Also Check: Can I Contribute To Traditional Ira And 401k

How 401 Hardship Withdrawals Work

A hardship withdrawal is an emergency removal of funds from a retirement plan, sought in response to what the IRS terms “an immediate and heavy financial need.” It’s actually up to the individual plan administrator whether to allow such withdrawals or not. Manythough not allmajor employers do this, provided that employees meet specific guidelines and present evidence of the hardship to them.

According to IRS rules, a hardship withdrawal lets you pull money out of the account without paying the usual 10% early withdrawal penalty charged to individuals under age 59½. The table below summarizes when you owe a penalty and when you do not:

A 401 hardship withdrawal isn’t the same as a 401 loan, mind you. There are a number of differences, the most notable one being that hardship withdrawals usually do not allow money to be paid back into the account. You will be able to keep contributing new funds to the account, however.

Things To Consider When Withdrawing From Your 401 At Age 55

A common question people ask is, When can I withdraw money from my 401? After all, you worked hard for many years, and its only natural to want to know when you can reap the benefits of that time and effort.

You can technically withdraw money out of your 401 at any age. But if you take out money before youre at least age 59 ½, then your withdrawal will incur a 10% penalty in addition to the income taxes you must already pay.

However, you do have an opportunity to dig into your 401 starting at age 55 and not pay penalties on that withdrawalprovided you meet two criteria:

- You are no longer employed by the company with whom the 401 is affiliated

- You left that employer during or after the calendar year in which you reached age 55

Keep these four things in mind if youre thinking about taking 401 withdrawals from an old employer planbetween the ages of 55 and 59 ½:

Read Also: Can I Roll My Roth 401k Into A Roth Ira

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

Calculating The Total Penalty

In the example above, assume your employer-sponsored 401 includes a vesting schedule that assigns 10% vesting for each year of service after the first full year. If you worked for just four full years, you are only entitled to 30% of your employer’s contributions.

If you remove funds from your 401 before you turn age 59.5, you will get hit with a penalty tax of 10% on top of the taxes you will owe to the IRS.

If your 401 balance is composed of equal parts employee and employer funds, you are only entitled to 30% of the $12,500 your employer contributed, or $3,750. This means if you choose to withdraw the full vested balance of your 401 after four years of service, you are only eligible to withdraw $16,250. The IRS then takes its cut, equal to 10% of $16,250 , reducing the effective net value of your withdrawal to $14,625.

You May Like: Should I Do Roth Or Traditional 401k