Roll Over 401 Into An Ira

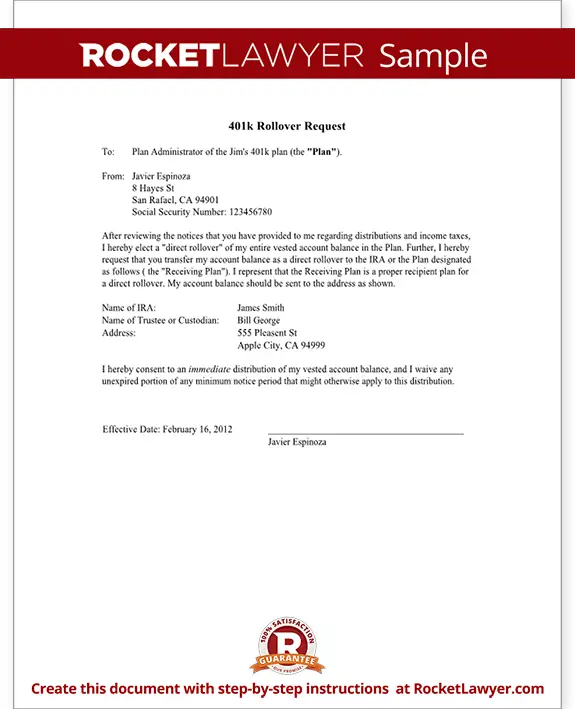

For those who would prefer not to rely on their new companys 401 plan’s investment offerings, rolling over a 401 to an IRA is another option. Again, rollovers can be direct, direct trustee-to-trustee transfers, or indirect, with the distribution paid to the account owner. But either way, once you start the process, it has to happen within 60 days.

The best option might be rolling the money over into the new companys 401 plan. The 401 plan is simpler because the plan is already set up for you. It’s also less expensive, because costs are spread over many plan participants.

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Differences Between A Transfer And Rollover

Transferring over a 401k to a new employer is a pretty straightforward process. A 401 transfer occurs when both retirement accounts are of the same type. So if you have a 401 from your old employer and want your funds with your new employers 401, a transfer occurs. This is not the same as a rollover.

With a rollover, youre moving your funds between two different types of retirement accounts. For example, if you have a 401 account and youre looking to move it to a traditional IRA, this is when a rollover occurs. Or if you moved your traditional IRA to a , a rollover would occur here as well.

Overall, when it comes to a 401 transfer, you simply need to make a decision on how you want to do it, or if you want to do it. Its also clear what you dont want to do leave a 401 behind and forget all about it.

Capitalize, a financial services company that specializes in 401s, estimated in 2021 that at the end of the year that there were going to be almost 25 million abandoned 401 accounts. Thats worth about 20% of all 401 assets in the United States.

But you have time to think about what you want to do lots of time, in fact. There is no time limit that youre under to transfer a 401. You can do it as fast or as slowly as you like. But while you have time, if youve switched jobs, and your new one doesnt have a 401, you may not want to take too much time deciding what to do.

Don’t Miss: How Do I Open A Roth 401k

Why Move Your Old 401

Your previous employer could require you to move your 401 out of their plan. They may not want to manage the cost and administrative work of letting you maintain your account after you leave. In this case, you would have to move your savings somewhere else.

Even if you can keep money in the old 401, there are advantages to consolidating your savings into your new retirement account.

Life happens and people do forget about money in old retirement plans. In fact, the National Registry of Unclaimed Retirement Benefits is a free resource that can help you locate lost or forgotten benefits. By rolling over to your current 401, you donât risk losing track of an old account.

Also Check: How To Find A Deceased Personâs 401k

How Long Do I Have To Roll Over My 401

You can roll over a 401 at any point after you switch jobs or retire. Bear in mind, though, that the IRS gives you just 60 days after you receive a retirement plan distribution to roll it over to an IRA or another plan. And youre only allowed one rollover per 12-month period from the same IRA.

If you miss the 60-day deadline, the taxable portion of your 401 distribution will be taxed. And if you are under the age of 59½, there will be an additional 10 percent tax penalty.

Recommended Reading: How Do I Invest My 401k In Stocks

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You Enjoy More Tax Advantages With An Ira If You Care About Charitable Giving

The new tax code makes charitable giving less tax advantageous for many donors. However, if you are over 70½, you can give to charity tax-free from your IRA via a qualified charitable distribution . Employer plans dont allow QCDs. Starting to consolidate everything into IRAs today allows you to take advantage of QCDs in the future.

Also Check: How Do I Transfer My 401k To A Roth Ira

Also Check: How Much Can You Put Into 401k Per Year

What If I Have Employer Stock In My Employer

You can choose to roll company stock into an IRA or a taxable brokerage account. If you decide to roll the stock to an IRA, its full value will be taxed as income at your regular rate if you move the stock to a taxable brokerage account, you might be able to save money by paying capital gains taxes on the difference between the stocks value and the price you paid for it. There are tax benefits to each, so consult your tax advisor and ask about the net unrealized appreciation strategy.

What Is A 401 Rollover

Rolling over a 401 from one employer or account to another involves moving funds from the previous tax-advantaged retirement plan into a new one. Rollover IRAs allow the person with the account to keep the tax-deferred status of their existing retirement assets. A person must roll over the funds to avoid paying tax or early withdrawal penalties during the transfer.

Read Also: How To Find Previous Employer’s 401k

How Long Do I Have To Rollover My 401 From A Previous Employer

When leaving a job many ask, âHow long do I have to rollover my 401?â Usually, your previous employer will rollover a 401 for you. If you receive a check youâll have 60 days to roll it over to avoid penalties.

Leaving a job can be a stressful time. Tying up loose ends and preparing for your next venture can cause certain things to fall through the cracks. Namely, forgetting to bring your 401 with you. There are a few things to remember when you go to rollover your 401 from a previous employer.

If your previous employer disburses your 401 funds to you, you have 60 days to rollover those funds into an eligible retirement account. Take too long, and youâll be subject to early withdrawal penalty taxes.

However, there are alternatives to your previous employer cashing out your 401 when you leave that can make the process much easier.

You May Like: What Is Max I Can Put In 401k

Reasons To Roll Your Money Into An Ira

When you have a lot of retirement accounts in a lot of different places, its hard to a) wrap your mind around where you actually stand and b) make sure that everything you own is properly diversified. If you have all your retirement accounts in an IRA, on the other hand, balancing your investments and forecasting whether youre on track to hit your goals, like we do for you at Ellevest is a lot easier.

Another big reason why many people choose to roll an old 401 into an IRA is to have more choice. When you can decide for yourself which company youll open your IRA with , you often have greater control over things like how much you pay in fees and the types of businesses your money is supporting. With a 401, youre stuck with whatever investment provider and investment options your employer picks for you .

Also, if youre trying to make certain special purchases, the government lets you take money out of an IRA before retirement without facing the 10% early withdrawal penalty. These include things like college costs and your first home. Not so with a 401.

You May Like: How To Allocate Your 401k

What Happens If You Cash Out Your 401

If you withdraw 401 money before age 59 ½, you could face a 10% penalty from the IRS on top of paying applicable income taxes. There are some exceptions, such as if you leave your job at age 55 or later or if you make a hardship or other eligible withdrawal, but its a good idea to consult a tax professional before cashing out your 401.

No matter when you cash out your 401, though, you may owe income tax on what you withdraw if its a traditional account or investment earnings in a Roth account that you didnt start contributing to at least five years before.

Other Things To Look Out For

When rolling over assets to a 401 or IRA, there are a couple of things to keep in mind. First, no amount is too small. Sharma stresses that even a small 401 account can make a big impact.

A small amount of money today can grow into a sizable sum with the power of long-term investing and compounding, particularly because money in an IRA can grow tax-free. For example, $3,000 in assets today could turn into over $40,000 at retirement if invested appropriately.

Kenny Senour, a certified financial planner for Millennial Wealth Management, cautions to keep an eye on investment options and their fees. He says, Your 401 plan may have access to a low-cost institutional share class with a high investment minimum. In this example, you may end up paying higher costs for an investment through a higher expense ratio for a comparable investment option in an IRA.

This means the same investment could be more expensive in a 401 than in an IRA.

Don’t Miss: What Happens To 401k When You Quit Your Job

What Happens To A 401 When Leaving A Job

When an employee leaves a job, they may no longer contribute funds to their employers 401 or retirement plan. The money in the account, however, still belongs to the employee. What happens to those funds often depends on the amount in the account.

The employer can legally close that account if the employee contributes less than $5,000 to that 401. Most employers will do this because it costs them money to maintain every account.

For employees who contributed between $1,000 and $5,000, the employer may move those funds into an IRA. This is aninvoluntary cashout.

When an employer contributes less than $1,000, the employer may choose to mail a check for the dollar amount invested. In this situation, the employee must deposit those funds into another retirement account as quickly as possible. This avoids the 10% tax penalty for early withdrawal.

There are more options for workers who have contributed more than $5,000. It is possible in some cases to do nothing. While the company will no longer provide matching contributions, those funds can continue to sit in the account until the employee decides to do something else. This can be a good option for accounts with unique investment options or low fees.

But for many workers, the most sensible option is to roll the funds over into a new or existing retirement account.

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Recommended Reading: Can A 1099 Employee Have A 401k

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

Also Check: What Happens When You Roll Over 401k To Ira

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Recommended Reading: Who Has The Best 401k Match

Recommended Reading: Can I Check My 401k Online