How To Protect Your 401k From A Stock Market Crash 2021

Diversification, Dollar Cost Averaging, Indexing, Cash-rich Stocks, CD’s, Bank Stocks or Gold. There Are Many Strategies, But Which Are The Best?

Moving to Cash, Diversification, Dollar Cost Averaging, Indexing, Cash-rich Stocks, CDs, Bank Stocks, or Gold. There Are Many Strategies: Here is a Selection of Options To Choose From?

The total protection of your money from a market crash is impossible. However, you can minimize your risks and protect most of your investments with a few precautions. Thus, keeping most of the assets in your 401K safe in a bear market is possible. However, you must be careful not to sacrifice your portfolios ability to grow to avoid risks.

Instead, you need to balance security and growth. Fortunately, achieving such a balance is easier than most people realize.

How Long Does It Take To Get Your 401k Check From Merrill Lynch

Generally the review takes about 5-7 business days. If your application is approved, you will receive a notification that your promissory note and amortization schedule are available for your review. Once the promissory note terms have been accepted, it takes about 2-3 business days for the check to be mailed out.

Set Up Your New Account

According to the IRS, most pre-retirement payments that you receive from a retirement plan can be rolled over to another retirement plan within 60 days. If you dont roll over your payment, it will be taxable, so its best to have the new account set up and in place well before you close out your old one.

Be sure to take advantage of the resources offered by your new account manager. They should be happy to have your business and should offer up plenty of assistance and maybe even some perks to entice you to use their services.

Of course, if youve been happy with Fidelity, you can consider using them for your new account as well by opening a Fidelity rollover IRA.

Don’t Miss: Can You Roll Over 401k From One Company To Another

What Does It Mean To Cash Out Or Withdraw From Your 401

Cashing out your 401 is just another way of saying taking money out. When you take money out, its yours to spend, invest, or use in whatever way you see fit. This is not to say youll be free of taxes and penalties, though well explore this later.

Note that cashing out your 401 and rolling over your 401 are two entirely different processes with entirely different tax and financial planning consequences. Rolling over your retirement account, if done properly, should result in no tax due cashing out your 401 will typically result in taxes and/or penalties, depending on your age and a variety of other factors.

What Documentation Is Needed For Hardship Withdrawal From 401k

Documentation of the hardship application or request including your review and/or approval of the request. Financial information or documentation that substantiates the employees immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

Read Also: How Do You Withdraw Money From A 401k

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

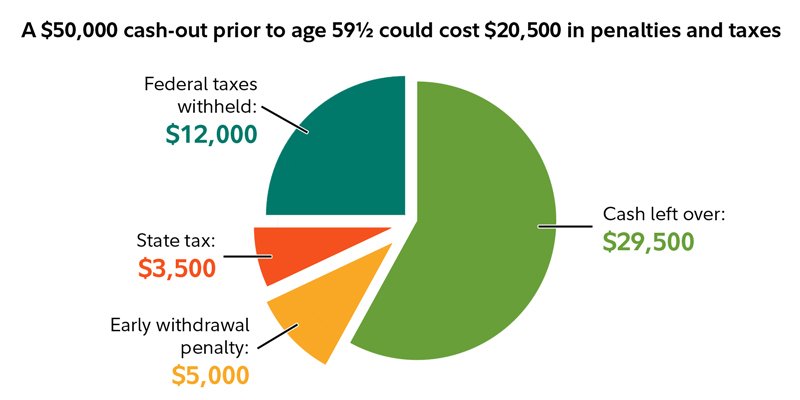

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

Convert To A Roth Ira

Money in a 401 plan isnt taxed when you contribute to it, but the money is taxed when you start taking out funds. When you have a Roth IRA, you pay taxes on the money you contribute, but you withdraw tax-free in retirement as long as you meet the qualifications.

Whereas a 401 is set up through an employer, youll have to open your own Roth IRA account through a bank or investment firm.

Also Check: How To Withdraw From 401k

So Whats Right For You

Use this chart to help see which options match your wants and needs.

Investment and Insurance Products are:

- Not insured by the Federal Deposit Insurance Corporation or Any Federal Government Agency.

- Not a Deposit, Obligation of, or Guaranteed by any Bank or Banking Affiliate.

- May Lose Value, Including Possible Loss of the Principal Amount Invested.

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, or accounting obligations and requirements.

Financial professionals are sales representatives for the members of Principal Financial Group®. They do not represent, offer, or compare products and services of other financial services organizations.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Securities offered through Principal Securities, Inc., 800-547-7754, member SIPC. Principal Life and Principal Securities are members of Principal Financial Group®, Des Moines, IA 50392.

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Its due to an immediate and heavy financial need.

- Its limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Also Check: Where To Rollover 401k To Ira

How To Cash Out 401k Early T Rowe Price

- 1. Leave your assets where they are. If the plan allows, you can leave the assets in your former employers 401 plan, where they can continue to

- 2. Roll your assets into a new employer plan.

- 3. Roll over your assets to an IRA.

- 4. Cash Out Your Assets.

- 3. Roll over your assets to an IRA.

Subsequently, one may also ask,How do I cash out my 401 early?

Furthermore,How does cashing out a 401k affect taxes?

When You Cash Out a 401k How Many Taxes Are Due?

- 401 Cash Out and Federal Tax. The money that you cash out from your 401 plan counts as taxable income on your federal income taxes for the year

- State Taxes on 401 State income taxes also apply to the amount of your 401 plan cash-out.

- Early Withdrawal Penalties.

- 2018 Tax Law Changes.

Besides,How can you avoid tax in cashing out of 401k before the retirement period?

rolling the 401 distribution into another retirement account like an IRA

How do I cash out my 401k after being fired?

- Leave it with your former employers plan. As long as you have the minimum amount required , you can leave your money where it is.

- Roll it into a new 401 . If your new job has a 401 plan, you can roll you money over into the new plan.

- Roll it over into an IRA.

- Cash it out.

Roll Your Assets Into A New Employer Plan

If youre changing jobs, you can roll your old 401 account assets into your new employers plan . This option maintains the accounts tax-advantaged status. Find out if your new plan accepts rollovers and if there is a waiting period to move the money. If you have Roth assets in your old 401, make sure your new plan can accommodate them. Also, review the differences in investment options and fees between your old and new employers 401 plans.

Don’t Miss: What To Invest My 401k In

Is It A Good Idea To Cash Out A 401

If you need money today, a 401 may seem like an easy place to find it, but this could end up costing more than you think. When you compare the pros and cons, you may find it better to take out a personal line of credit, a life insurance policy loan, or utilize other assets, rather than pay a 10% penalty.

If you have a true emergency, and this is the only way to get money, then perhaps it is the best option for you. But a 401 is usually not the best place to look for emergency savings.

If a 401 is part of your plan for retirement and you take a withdrawal, realize that you will suffer a loss of compounding and time, and it is not possible to just put the money back into the 401 in a few years.

How To Cash Out A 401 From Your Old Job

By David Carlson

Every day thousands of employees switch jobs from one company to another. One thing that needs to be taken care of in this process is the employees 401k. There are a few options available to the employee including cashing out their 401k and transferring the funds to a rollover IRA.

Are you trying to find out how to cash out your 401k from old jobs? Youre in luck. Weve got some advice for you in this post on how to go about cashing out your 401k, as well as an alternative option to cashing out that may save you more money.

Recommended Reading: Can I Get My Own 401k Plan

Whats The Penalty For Taking Money Out Of A 401k

If you withdraw money from your 401 before youre 59½, the IRS usually assesses a 10% penalty when you file your tax return. That could mean giving the government $1,000 of that $10,000 withdrawal. Between the taxes and penalty, your immediate take-home total could be as low as $7,000 from your original $10,000.

Reinvest Extra Money In An Indexed Fund

You can provide an additional layer of protection by automatically reinvesting extra cash in an indexed fund.

For instance, you can invest dividends or bank account interest in an S& P 500 indexed fund. Thus, you could lock in a 10% growth rate for at least part of your money.

Therefore, you can make compound interest part of your 401K and ensure that some of your money is growing. Moreover, you can enhance compound interest by combining it with the S& P 500, which has a long history of growth.

Also Check: How To Borrow From 401k

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .1 Before-tax assets can roll over to a Traditional IRA while Roth assets can roll directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

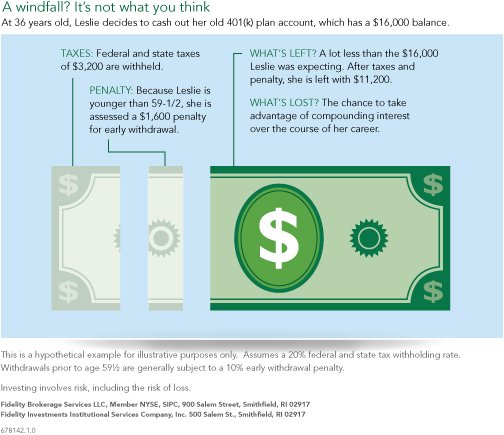

What Happens If I Cash Out My 401k Early

Not only are those funds considered taxable income and subject to an immediate tax withholding, but you may also be subject to a 10% early withdrawal tax penalty if you cash out before age 59½.1 Additionally, withdrawals will lose the potential for tax-deferred growth. Let us handle your rolloverfrom start to finish.

You May Like: Can I Retire With 500k In My 401k

How Long Does It Take To Cash Out Your 401 After Leaving A Job

If you opt to cash out your 401, youll need to contact your 401 plan provider and have them send you the money either electronically or via paper check. This process can take anywhere from a few days to a few weeks. In either case, you should have the money within a reasonable amount of time after requesting it.

How Much Will I Get If I Cash Out My 401

Its worth noting for all withdrawals, that the plan administrator is required to withhold 20% of your withdrawal from a 401 for taxes, even if you expect to get a tax refund in the year you make the withdrawal.

This means if you request a $10,000 withdrawal you can expect to receive a check for only $8,000.

Important Note: Unless you have a Roth 401 plan, all withdrawals/distributions from a 401 are taxable even if there is no penalty for the withdrawal.

Don’t Miss: How To Claim Your 401k

What Happens To My 401k If I Get Laid Off

If you are fired or laid off, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. This is called a rollover IRA. Make sure your former employer does a direct rollover, meaning that they write a check directly to the company handling your IRA.

How Does Severance Pay Affect Your Unemployment Benefits In Texas

Under Texas law, you cannot receive benefits while you are receiving certain types of severance pay. We will mail you a decision on whether your severance pay affects your unemployment benefits. Wages paid instead of notice of layoff are payments an employer makes to an employee who is involuntarily separated without receiving prior notice.

Recommended Reading: Is It A Good Idea To Borrow From Your 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: How Do I Change My 401k Contribution Fidelity

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

It’s important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.