The Bottom Line On Retirement Savings Goals

There is no perfect method of calculating your retirement savings target. Investment performance will vary over time, and it can be difficult to accurately project your actual income needs.

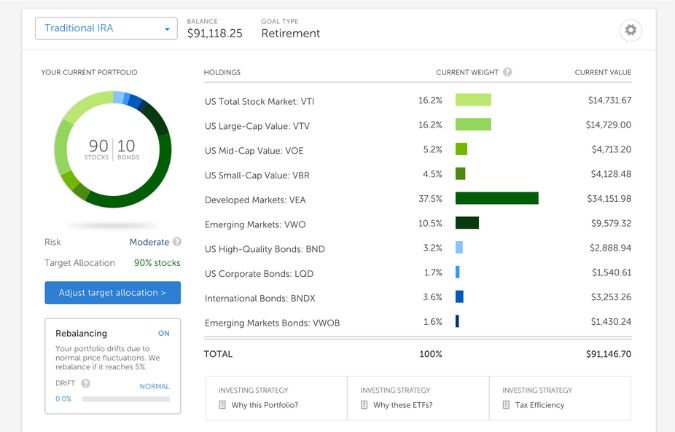

Furthermore, it’s worth mentioning other considerations. For one thing, not all retirement plans are equal when it comes to income. Money you withdraw from a traditional IRA or 401 will be considered taxable income. On the other hand, any money you withdraw from a Roth IRA or Roth 401 is generally not taxable at all, which may change the calculation a bit.

That’s just one example, and there are other possible considerations as well. While we’re trying to present the broad strokes here, it’s still a good idea to consult a financial advisor who can not only tailor a retirement savings goal to your particular situation but can also help set you on the right path with a savings and investment plan that can make sure you reach your goals.

How To Build Up 500k Dollars In Your Retirement Fund

If your goal is to save up 500k dollars in retirement, how do you do it? How can you save up 500k in retirement?

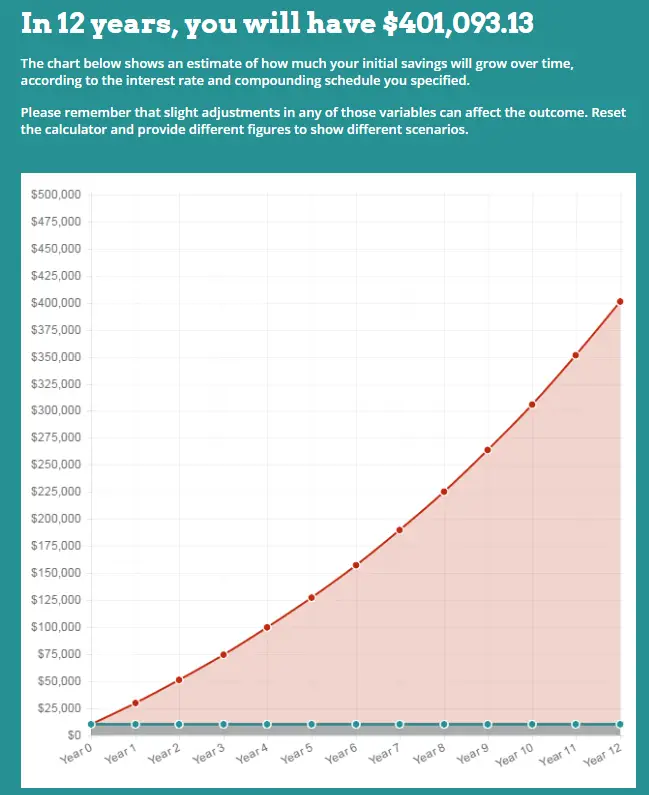

For me personally, I would invest in a few index funds that have proven to return between 8% and 12% for the past 20+ years of their existence.

If you could earn 8% on your money, how much would you need to stash away each month to reach $500k in 40 years? 20 years? 10 years?

Advantages Of Defined Benefit

Guaranteed payments continue throughout your life and are protected by the Pension Protection Fund . Most DB pensions increase every year by some form of inflation protection.

Simple you know how much youre going to get every month, like a wage.

Subsidised youll likely get a lot more back than you paid in.

Don’t Miss: How To Sell 401k Investments

How Much Should I Have Saved For Retirement By Age 50

At age 50, retirement is closer than you think and its time to get serious about saving, if you havent already. It might seem ambitious to save up to seven times your annual salary, but meeting this goal could set you up for success. If your salary is $50,000 or higher, you should have at least $350,000 saved.

Can I Retire At 55 With 500k

Alright, now were getting into the more difficult calculations. Is it possible to retire at 55 with $500k?

First of all, youll need to fund your own medical insurance since youre under the age of 62, so factor that into your calculations.

Second, you already know that $500k will last for 29 years. If you plan to live longer than 84 years old, then $500k just isnt going to cut it.

What if though, you could live on just $30k a year? Then could you retire at 55 years old with $500k in retirement?

If you earned 6% on your money, your $500k would last 57 years! Youd be 112 years old! Whoa!

So, while it would be quite difficult to live on just $30k a year , it technically is possible to retire at 55 years old!

And actually, you may be able to retire even earlier! You could retire at 50 years old, 45 years old, and maybe even 40 years old! .Especially if you have another source of retirement in your later yearslike social security!

Related: Early Retirement Is It Possible??

Don’t Miss: How Do I Get My 401k

Can I Retire On 500k Plus Social Security

Many of you are probably asking if you can retire on 500k along with your Social Security payment each month. Its a valid question.

First off, if youre in your 30s like me, dont plan on any benefit from Social Security. It likely will never go away completely, but the benefits will reduce over timeso much so that Im just not planning on getting any of it in retirement. If I do get some sort of payout, bonus.

If youre 55 years old or older, then youll likely get something when you retire . It may even start out as a full payment, but then degrade down to 75% or 50% of that payment in your final years as the program continues to fail.

How Long Will Your $500k Last In Another Country

If you can live on $2,000 a month in retirement, how long would your $500k last?

Even if you only earned 4% on your money for your entire retirement, your nest egg would still last for 42 years!

Moving to another country for your retirement? Its certainly something to consider!

Related: Can I Retire on 750k Dollars?

Also Check: What To Know About 401k

How Much Should You Have In 401k By 60

Honesty says by age 60 you should have eight your current salary saved. So, if you are earning $ 100,000 at that time, your 401 share should be $ 800,000. How much do you need to pay your bills each month?

How much retirement should I have at 60?

What is the average 401K balance for a 61 year old?

Those with pension funds do not have enough money in them: According to our research, 56- to 61-year-olds have an average of $ 163,577, and those aged 65 to 74 already have very little.

Where Do You Stand So Far

As shown below, only 26% of people in their 60s have over $500,000 set aside for retirement. You can see the average retirement savings ranges at different ages, but everybodys situation is unique.

Average Retirement Savings at Age 65

| Avg. | |

|---|---|

| 517,085 | 289,736 |

Reminder: The median is the middle of all answers from biggest to smallest. Data source: Hou .

Example: Assume you want to retire on $500k of assets in your IRA, 401, and taxable accounts. You want to spend roughly $52,000 per year. Your Social Security benefits amount to $24,000 per year, and you have an additional pension of $6,000 per year.

Subtotal: You have $30,000 of income per year, and you need an additional $22,000.

Recommended Reading: Should I Transfer 401k To Roth Ira

Consider Consulting Or Freelancing

Likewise, you might see retirement as a second act to sell your services to the highest bidder. Your years of experience would prove valuable to many employers looking to hire someone seasoned in their line of work and not in need of training.

Because youve got the chops to be an authority in your industry, you can command top dollar for your knowledge and expertise. This keeps your skills relevant and gives you the option of remaining attached to the workforce for earning extra money.

You might also lean into a different career path closely related to your previous line of work. For example, if you worked in accounting for 30+ years, you might think about translating this experience into becoming a financial content writer for large online publishers or a local newspaper.

Can You Retire With 200k

Can you retire at 200k and live a comfortable life? Yes, you can, but there are some further questions you may want to ponder before pulling the trigger on retirement and their figures. This is primarily due to the state retirement age and when you can receive your state pension.

What pension is good at 55? How much should you retire at 55 in the UK? According to Kang? magazine, you will need to have at least £ 26,000 a year to have a comfortable retirement. That adds around £ 2,200 a month. See the article : How retirement is calculated. When you have a lot of money, you should be able to cover all your needs easily.

How many people on average should retire at age 55? Experts say to have at least seven times your salary saved at age 55. That means if you make $ 55,000 a year, you should have at least $ 385,000 saved for retirement. Remember that life is unpredictableâ economic factors, medical care, how long you live will also affect your retirement costs.

You May Like: Can You Move Money From Ira To 401k

Is $150 000 A Good Retirement Income

The Final Multiple: 10-12 times your annual income at retirement age. If you plan to retire at 67, for example, and your income is $ 150,000 per year, then you should have between $ 1. On the same subject : How long retirement money will last.5 and $ 1.8 million for retirement.

What is a good retirement income per month? According to 2016 data from the Bureau of Labor Statistics, an average of 65-plus households earn $ 48,885 per year, which works around $ 4,000 per month.

What is the retirement income of the rich? Among those surveyed, comfortable retirees had annual incomes of $ 40,000 to $ 100,000 and nest eggs of $ 99,000 to $ 320,000. Â Affluentâ retirees report at least $ 100,000 in annual income and assets of $ 320,000 or more.

What is a good average retirement income?

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $19,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Read Also: How To Find My 401k Balance

Using This Simple 401 Calculator

Our 401 Growth Calculator is a simple and easy way to estimate the long-term growth of your 401 retirement account by the time you want to retire. Knowing how much your current 401 account may accumulate in the future can help you determine if you should adjust your annual 401 contributions to help reach your retirement goals. After answering a brief series of questions, you will get your results, including your estimated accumulated plan balance at retirement, total out-of-pocket costs, and a summary table and bar graph illustrating your retirement plan accumulation over time.

How Long $500k Will Last In Retirement In Each State

Can you get a whole retirement from half a million dollars? Plan Your Retirement

When pondering the question, How much do I need to retire? there is never a one-size-fits-all answer. What one person could happily live on, another might be dissatisfied with. Although conventional wisdom suggests having a retirement nest egg of at least $1 million, thats a difficult number to achieve for many Americans.

How Much?: From Alabama to Wyoming: The Cost of Living Across America

To paint a more realistic picture of retirement finances, GOBankingRates determined how long $500,000 will last in every state. To do this, the study analyzed average spending data including groceries, housing, utilities, transportation and health care for people ages 65 and older.

- Years, Months, and Days: 5 years, 2 months and 24 days

- Annual expenditure: $95,538.52

- Years, Months, and Days: 7 years, 1 month and 1 day

- Annual Expenditure: $70,523.40

- Years, Months, and Days: 7 years, 3 months and 19 days

- Annual Expenditure: $68,502.94

- Years, Months, and Days: 7 years, 9 months and 7 days

- Annual Expenditure: $64,317.72

The Economy and Your Money: All You Need To Know

Don’t Miss: Do You Need A Tpa For A Solo 401k

How Much Does Average 40 Year Old Have In 401k

According to the results, the average 40-year-old should have between $ 200,000 and $ 750,000 saved in his $ 401,000, depending on the companys match and investment performance.

How much savings should you have by the age of 40? Heres how much money they say you should have hidden at any age: By age 30: the equivalent of your annual salary saved if you earn $ 55,000 a year, you should have saved $ 55,000 by your 30th birthday. Up to 40 years: three times the income. Up to 50 years: six times the income.

Have A Question About Your Retirement Email Us

- Resize icon

Hello,

Ill turn 65 in December, and Id LOVE to retire. First, the good news: Im single and have no dependents . I own a home with no mortgage in a place I love that has low living expenses. I have zero debt. I have $475,000 in savings . I should have $500,000 by the end of the contract Im currently working. I have a very modest lifestyle and am very frugal. I am in good health.

Now the bad news: Other than anticipated Social Security , I have no pension or other income streams. I dont have an impressive work résumé that could lead to lucrative employment in retirement. I do not have a long-term care insurance policy. I have been a hapless investor for most of my life, and am terrified of investing in the markets in the current climate.

Will I ever be able to retire? Is there some way I can make $500,000 in savings last, especially given the abysmally low interest rate environment? Both my parents passed in their early 80s so thats the best guess I have on my longevity.

I would be very interested in hearing your feedback. Thank you for your time.

Sincerely,

See:There are six types of retirees which are you?

Dear MD,

Id like to start by congratulating you on the good news. Owning a home with no mortgage is a huge accomplishment, as is having no debt and nearly half a million dollars in savings. And, of course, its nice to hear youre in good health!

Dont miss:Should I still use the 60/40 rule investing rule for retirement?

You May Like: Can I Rollover From 401k To Roth Ira

Can I Retire At 55 And Keep Working

Yes. Just because youve taken your private pension and decided to retire at 55 doesnt mean you have to stop working.

Maybe you feel like you need to top up your pension by adding a few more years of part-time salary to it. Or maybe you want to access your pension pot at 55 and enjoy more free time, but youre not ready to fully retire just yet.

Just because you choose to access your pension, doesnt mean you HAVE to retire.

Many of our clients will do some freelance or consultancy work on the side to help top up their income each month.

Faq: Can I Retire At 55 With 300k

How much will I need to retire at 55?

- What does life cost you now? DO you want this type of lifestyle at 55?

- You have 2 options. To save up something like 25 x your early desired expenditure or two, create assets that provide you with that income level a year.

Can I retire at 55 with 500k UK?

- You could you might expect to get an income in the region of 15k to 20k from 500k. But there are numerous caveats, including are you hoping to leave any money behind or die with nothing?

How much should I have saved for retirement by age? Fidelity study

Is 300k enough for retirement?

- More detail on that here

What is a good monthly retirement income?

- What would good look like to you? What would you be doing with the money?

How much do I need to retire at 55 if I have no debt?

- Figure out what good looks like and costs x that by 25 to get a rough idea of the fund size you might need.

- Or figure out how to build and create assets that will provide you with that type of income in retirement.

Can I retire at 55 with 250k?

- You could that might bring you an income of something between 7.5k and 10k.

- Would that be enough for you?

How do I retire with no money?

You May Like: When Can I Withdraw From My 401k

How Much Does The Average Canadian Couple Need To Retire

Additionally, if one or both partners have a defined benefit pension, it will further lower the amount of savings required to meet their desired retirement income. Overall, to fund their preferred retirement lifestyle, the couple in the scenario above will need about $1 million in their retirement nest egg.

Average 401k Balance At Age 45

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

You May Like: Can Anyone Have A 401k