Considering A 401 Rollover Consider Your Options First

If you decide a 401 rollover is right for you, we’re here to help. Call a Rollover Consultant at .

One great thing about a 401 retirement savings plan is that your assets are often portable when you leave a job. But what should you do with them? Rolling over your 401 to an IRA is one way to go, but you should consider your options before making a decision. There are several factors to consider based on your personal circumstances. The information provided here can help you decide.

Pros Of Roth 401 To Roth Ira Rollovers

A unique fact that only applies to Roth 401s is that, beginning at age 70.5, you must take required minimum distributions from your account. This is similar to a traditional 401 or IRA. So if you would rather let your retirement funds grow tax-free until you need them, rolling them into a Roth IRA might be the best move for you.

In fact, you can leave rollover funds in a Roth IRA indefinitely if need be. That may be something of interest to you, particularly if youre looking to maximize the assets you leave for your beneficiaries.

How Much Money Can I Put In An Ira

The most you can contribute to all your traditional and Roth IRAs is the least of: For 2020, $ 6,000 or $ 7,000 if you are 50 years or older by the end of the year or. your taxable allowance for the year. For 2021, $ 6,000 or $ 7,000 if you are 50 or older by the end of the year or.

Can I put more than 7000 in my IRA? In general, the annual contribution limit for 2021 is a maximum of $ 6,000 or $ 7,000 if you are 50 years of age or older at any time during the calendar year however, for Roth IRA contributions, your modified adjusted gross income may reduce or eliminate this limit.

Also Check: Can I Borrow Against My 401k

Direct And Indirect 401 Rollovers

Before you roll over your 401, youll need to open an IRA account. You can do this at virtually any major brokerage firm, mutual fund company or robo-advisor. Do some research, then head to your financial institutions website to open your account. At some point, youll want to talk to a customer representative to find out whether the rollover and conversion can be done at once or if they are done sequentially. If its the former case, youll just have to pick your investments once. If its the latter, youll want to keep the money liquid in the IRA before converting to a Roth.

Once youve opened the IRA, you can contact the company managing your 401 account to begin the rollover process. You can do this online or over the phone. Your 401 plan administrator will then transfer your funds into your new IRA account. This is called a trustee-to-trustee or direct rollover, and its the easiest way to do it.

Another path is an indirect rollover. In this case, the balance of the account is distributed directly to you, typically as a check. Youll have 60 days from the date you receive the funds to transfer the money to your custodian or IRA company. If you dont deposit the funds within the 60 days, the IRS will treat it as a taxable withdrawal, and youll face a 10% penalty if youre younger than 59.5. This risk is why most people choose the direct option.

Is A Roth 401k Worth It

The Roth 401k is likely to make you richer than the traditional 401k and is one of the best investment decisions you can make as a young investor in your 20s and 30s in an uncertain future due to the benefits of leaving the franchise. Why the Roth 401k is the best 401k system. Roth 401ks pile up and grow over time without paying taxes.

Recommended Reading: How To Find Your 401k Account Number

How Does A 401 Rollover Work

There are two ways to roll over a 401 accounteither directly or indirectly.

With a direct transfer, you will fill out paperwork to transfer funds from your old 401 account into a new retirement account . The money will get transferred from one account to another, with no further involvement from you.

With an indirect transfer, you would close, or cash out, the 401 account with the intention of immediately reinvesting it into another retirement fund. To make sure you actually do transfer the money into another retirement account, the government requires your account custodian to withhold a mandatory 20% taxwhich youll get back in the form of a tax exemption when you file taxes.

The hitch: You will have to make up the 20% out of pocket and deposit the full amount into your new retirement account within 60 days. If you retain any funds from the rollover, they may be subject to an additional 10% penalty for early withdrawal.

Are Separate Bank Accounts Marital Property

Are separate bank accounts marital property? In most states, money in separate bank accounts is considered marital property or property acquired during a marriage. On the same subject : 3 Ways a Roth IRA Is Icing on the Retirement Cake. About 10 states operate under common property laws, which means that any property money, cars, houses, etc.

How do I protect myself financially from my spouse?

Here are eight ways to protect your assets during the difficult experience of going through a divorce:

- Legally establish separation / divorce.

- Get a copy of your credit report and monitor activity.

- Move half of common bank balances to a separate account.

What gets split in a divorce?

When you get divorced, the joint ownership is basically divided equally between the spouses, while each spouse is allowed to keep his or her separate property. Fair distribution: In all other states, assets and earnings accumulated during marriages are distributed fairly , but not necessarily equally.

Also Check: What’s My 401k Balance

When It Might Make Sense

Here are some of the most common reasons people roll IRAs into 401 accounts.

Avoid required minimum distributions : After you reach age 70 1/2, the IRS may require you to take money out of pre-tax retirement accounts, which helps generate tax revenue. But if you are still working, you might be able to wait until you retire to take RMDs from your 401 . Some owners of the business even partial owners arent allowed to use that strategy, so check with the IRS or a good CPA before you attempt this. Switching from an IRA to your 401 allows you to delay taxes, potentially resulting in more compounding.

Backdoor Roth and conversions: If you plan to convert traditional IRA money to Roth IRA money or make back door Roth contributions you might want to minimize pre-tax money in IRAs. Doing so may neutralize the pro-rata rule, which causes complications and taxes when you have pre-tax money in an IRA. By shifting that pre-tax IRA money to your 401, only post-tax money remains in the IRA, which simplifies things substantially.

Age 55 withdrawals: 401s can be more flexible than IRAs if youre between the ages of 55 and 59 1/2. With an IRA, you have to wait until age 59 1/2 to take withdrawals without penalty taxes . With a 401, you can take withdrawals without penalty if you retire at 55 or older. Its probably not ideal to cash out all of your retirement money when youre that young, but its an option.

Are You Planning Roth Conversions

If you are planning Roth conversions in your traditional IRA and your traditional IRA includes amounts from nondeductible contributions , then it can be wise to avoid rolling 401 money into a traditional IRA, because doing so would increase the amount of tax youd have to pay on your conversions.

This wouldnt necessarily mean, however, that you should roll your old 401 into the new 401. It might just mean that you should temporarily leave your old 401 where it is, with the plan to roll it into an IRA in some future year .

Read Also: How To Transfer 401k From Old Job

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Are 401ks Traditional Or Roth Retirement

Roth 401 is an after-tax retirement savings account. This means that your contributions were taxed before you logged into your Roth account. On the other hand, a traditional 401 is a pre-tax savings account. When you invest in a traditional 401 plan, your pre-tax premiums are paid, reducing your taxable income.

Read Also: Can You Get 401k If You Quit

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

Can You Roll An Ira Into A 401

posted on

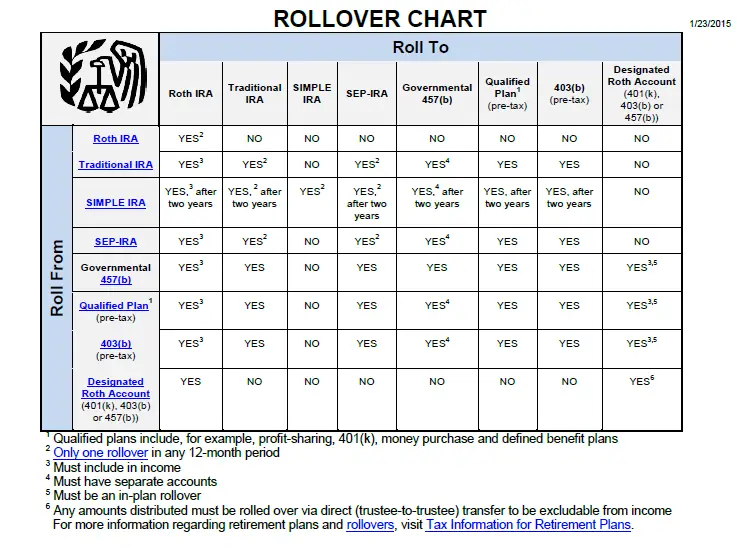

If you have multiple retirement accounts, you can often move money between them without tax consequences, and you might want to combine accounts for several reasons. The most common move is to roll from your 401 to an IRA, but its also possible to do the opposite: You can roll a pretax IRA into a 401.

There are pros and cons to everything, and that includes moving an IRA into your 401 or 403b. You might like the investment choices better, or your employers retirement plan might have less expensive investments. Simplifying is another reason to transfer IRAs to a 401: Clean up those old accounts instead of spending mental energy and time to keep track of multiple accounts.

Also Check: Should I Pay Someone To Manage My 401k

Rolling Over Your 401 To A Traditional Ira Vs A Roth Ira

You have the option of rolling your 401 into either a traditional IRA or a Roth IRA. One isnt better than the other, and ultimately its up to you and your investment goals.

You do have to worry about a few things, though, and the major difference is this: Roth IRAs require after-tax contributions. If youre rolling over money from a traditional 401, then you havent paid taxes on that money as it came out of your salary before you got your paycheck. As a result, rolling your traditional 401 balance over to a Roth IRA will require you to pay income taxes on the entire balance in the year that you do the rollover. This could mean thousands of dollars in taxes. So just be cautious of this.

However, rolling a traditional 401 into a traditional IRA is easier, since both contain pre-tax dollars. You dont have to worry about triggering a taxable event.

On the same note, a Roth 401 and Roth IRA are both funded with after-tax dollars, meaning rolling one into the other wouldnt require a tax payment.

Paying income taxes by rolling a traditional 401 into a Roth IRA isnt necessarily a reason not to do it: Roth IRAs can be a powerful retirement savings tool, and some investors may prefer to pay the tax bill now for the benefit of withdrawing the money tax-free during retirement.

But whatever decision you make, its important that you understand the consequences and have your budget ready.

Distributions From Your Rolled

Although it is typically not advisable to tap retirement funds before you leave the workforce, in tight times, the undesirable option may become the only option. If you must withdraw money from your Roth at the time of the rollover, or soon after that, be aware that the timing rules for such withdrawals differ from those of traditional IRAs and 401s. Some of these requirements may also apply to Roths that are rolled over when you are at or close to retirement age.

Specifically, to make distributions from these accounts without incurring any taxes or penalties, the distribution must be qualified, which requires that it meets what is known as the five-year rule. Also applied to inherited retirement accounts, this rule requires that funds had remained intact in the account for a five-year period to avoid or at least minimize taxes and penalties.

You May Like: How To See How Much 401k You Have

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

When Is A Roth Ira A Bad Idea

A Roth IRA is bad if you have high current income levels and expect much lower income levels in the future. If you have $100 before taxes, your $100 will be increased, but if you take it out, you will pay taxes. Let’s say you put in 100 when you go to 500, but you pay 15% tax, so you’re leaving 425.

Roth ira first time home buyer

Don’t Miss: When Can I Borrow From My 401k

Converting A Traditional 401 To A Roth Ira

Because of the significant differences between a traditional 401 and a Roth IRA, youll still owe some taxes in the year you rollover:

- A traditional 401 is funded with a salary from your pre-tax income. This comes right up to your gross income. You dont pay any taxes on the money you deposit or the gains you make until you withdraw the money, possibly after you retire. Then, you will have to pay tax on the entire amount at the time of withdrawal.

- Roth IRAs are funded with post-tax dollars. You pay income tax in advance before it is credited to your account. You wont have to pay any tax on that money or the profit you make when you withdraw it.

Therefore, when you roll over a traditional IRA to a Roth IRA, you will pay income tax on that money in the year you switch.

The total amount transferred will be taxed at your ordinary-income rate, just like your salary. The parentheses did not change for 2022.

Are 401ks Traditional Or Roth

Roth 401 is an after-tax retirement savings account. This means that your contributions were already taxed before they were credited to your Roth 401 account. On the other hand, a traditional 401 is a pre-tax savings account.

Ira vs 401kWhat is the difference between a 401k and Ira? The main difference between a 401k and an IRA is that a 401k must be created by an employer, while an IRA is a personal retirement account that anyone can create for themselves. The amount that can be saved with deferred tax is also significantly higher: 401 thousand.Is 401k better than IRA?Objectively speaking, 401 is simply better in this category. Wit

Don’t Miss: How Much Can You Contribute To 401k Per Year

Preparing For A Backdoor Roth Ira Conversion

If youre considering doing a Backdoor Roth IRA Conversion, one of the first things you need to do is eliminate any money you have in a traditional, SIMPLE, or SEP IRA. The reason for this is that you can run into complexities and potential tax consequences if you have pre-tax money in any of these accounts when you convert.

As we previously discussed in our ultimate guide on how to do a mega backdoor Roth IRA conversion, one of the simplest ways to eliminate money in these pre-tax accounts is to roll it into an employer sponsored 401k. Remember, though, that you can only roll over pretax money into a 401k, so any non-deductible contributions you have made to these accounts dont qualify.