Rolling Over A 401 To A Roth Ira: Should You Convert To A Roth

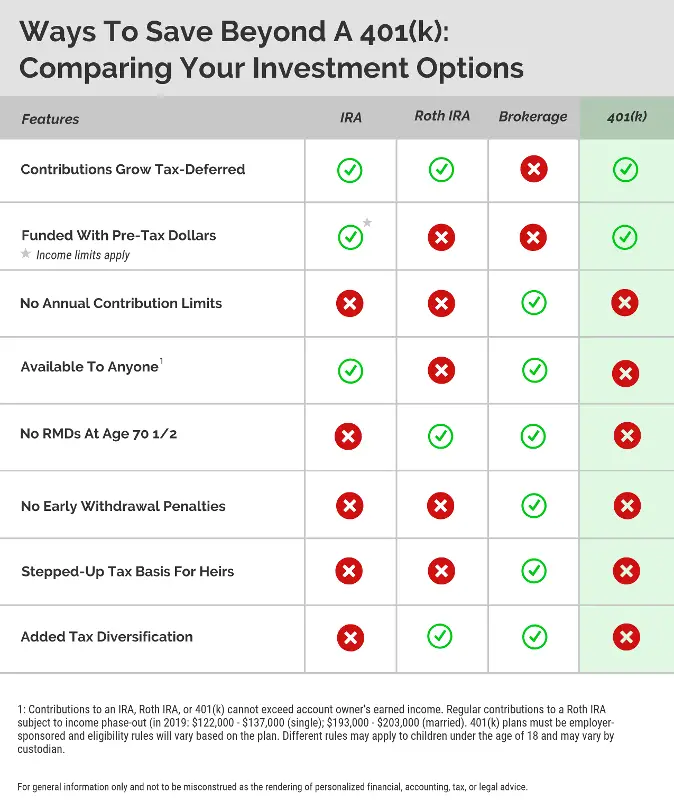

What are your 401 rollover options? You may consider rolling over an old 401 to a Roth IRA, which is properly described as a Roth conversion. Converting your old 401 or 403 to a Roth IRA is worth considering. A Roth IRA offers unique benefits unavailable in other types of retirement accounts: no RMDs, tax-deferred growth and tax-free withdrawals. But a 401 to Roth IRA conversion doesnt make sense in every situation. For high-earners, it may not make sense to pay tax on your retirement savings now.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

How Can I Roll Over My 401 Into An Ira

You can convert your 401 into an IRA fairly easily. Let us go through the steps:

Read Also: How To Set Up 401k For Small Business

Roth 401 With A Match

Theres one important thing to remember about the Roth 401: Only your contributions grow tax-free. If your company offers a match, youll have to pay taxes on retirement income from the match side of the account.

Still, the Roth 401 is an amazing deal. It could literally save you hundreds of thousands of dollars in retirement. And yet, only 26% of workers are making contributions to their company plans Roth option.5

If youre just starting out with a company and they give you this option, take the ball and run with it!

But if you still have debt to pay off and dont have a fully funded emergency fund, pump the brakes. You need to get your financial house in order before you start saving for retirement.

If youd like a specific, step-by-step plan to becoming a millionaire by the time you retire, weve got one. Theres a whole group of millionaires called Baby Steps Millionaires whove followed Ramseys 7 Baby Steps to hit the million-dollar mark. By following the Baby Steps, they were able to pay off all their debt and reach a million-dollar net worth in about 20 years.

Option : Roll Over The Funds Into An Ira

Most of the time, transferring the money from your old 401 into an IRA is your best option. Thats because an IRA gives you the most control over your investments.

You see, an IRA gives you potentially thousands of mutual funds to choose from. You can pick from the best of the best instead of just a few so-so options. You can work with an investment professional who can walk you through the rollover and help you manage your investments for the long haulno matter where your career takes you.

Also Check: How Do I Close Out My 401k

The Option To Convert To A Roth

An IRA rollover opens up the possibility of switching to a Roth account. s, a Roth IRA is the preferred rollover option.) With Roth IRAs, you pay taxes on the money you contribute when you contribute it, but there is no tax due when you withdraw money, which is the opposite of a traditional IRA. Nor do you have to take required minimum distributions at age 72 or ever from a Roth IRA.

If you believe that you will be in a higher tax bracket or that tax rates will be generally higher when you start needing your IRA money, switching to a Rothand taking the tax hit nowmight be in your best interest.

If you’re under the age of 59½, it’s also a lot easier to withdraw funds from a Roth IRA than from a traditional one. In most cases, there are no early withdrawal penalties for your contributions, but there are penalties if you take out any investment earnings.

Your 401 plan rules may only permit rollovers to a traditional IRA. If so, you’ll have to do that first and then convert the traditional IRA into a Roth. There are a number of strategies for when and how to convert your traditional IRA to a Roth that can minimize your tax burden. Should the market experience a significant downturn, converting a traditional IRA that is down, say 20% or more, to a Roth will result in less tax due at the time of the conversion. If you plan to hold the investments until they recover, that could be an attractive strategy.

When Converting A 401 To A Roth Ira May Not Make Sense

There are a few reasons you shouldnt convert your 401 to a Roth IRA. If you dont have the cash on hand to pay the estimated tax due, then you should consider rolling over to a traditional IRA instead. Using money from your Roth IRA to pay the tax has been shown to make workers worse off in the long run.

Again, the main reason to convert to a Roth is the assumption that your tax rate will be higher in retirement. If you are in the highest marginal tax bracket now, theres a good chance your tax rate will be lower in retirement.

Recommended Reading: How Often Can I Change My 401k Contribution Fidelity

Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, you’ll pay no taxes until you start making withdrawals, and you’ll retain the right to roll over or withdraw the funds at any point in the future.

The cons: You’ll no longer be able to contribute to the plan, and the plan provider may charge additional fees because you’re no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Option : Do Nothing And Leave The Money In Your Old 401

Now, you could just leave the money in your old 401 if youre really happy with your investments and the fees are low.

But thats rarely the case. Most of the time, leaving your money in an old 401 means youll have to deal with higher fees that cut into your investment growth and settle for the limited investment options from your old plan. Most people come out way ahead by doing a direct transfer rollover to an IRA .

Read Also: Can I Rollover My 401k To A Brokerage Account

Make Sure You Understand These Rules Before Converting Your Retirement Savings

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

Recommended Reading: Can You Get Money From 401k To Buy A House

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

The Ins And Outs Of Opening And Contributing To A Roth Ira

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up for those 50 or over. Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you won’t be eligible to make a Roth IRA contribution.

Read Also: Should You Roll Over Your 401k

You Can Manage All Your Investments In One Place

A recent study found that the youngest baby boomers worked 12 different jobs over the course of their careers.2 Did you hear that? Twelve! Imagine how difficult it is to keep track of a dozen 401s from previous jobs.

The more scattered your retirement accounts are, the harder it is to make good decisions about your investmentsand that can affect your retirement future. Youll be able to manage your retirement funds better by having them all in one place.

What Are The Disadvantages Of Rolling A 401 Into An Ira

Let us discuss some of the disadvantages of an IRA rollover:

You will not be able to take out a loan from an IRA which you can do if you have a 401. This is useful if you need funds on an urgent basis.

There are certain restrictions on withdrawals on an IRA such as you cannot make a withdrawal unless you are above 59.5 years of age. If you withdraw money before reaching the cutoff age, you will have to pay an early withdrawal penalty of 10 percent. This is not the case with a 401 account as you can avoid paying the 10 percent early withdrawal penalty if you leave your job at the age of 55 or after the age of 55. In addition, you can avail favorable tax treatment on withdrawals if your 401 is directed in company stock. This facility is not available to an investor having an IRA.

In an IRA, you may have to pay higher account fees compared to a 401 where you can buy funds at institutional pricing rates, owing to group buying power.

If you have a 401 account, you are better protected against lawsuits, bankruptcy, and creditors since it is covered by federal laws. On the other hand, IRAs are protected only by state laws, which vary from state to state.

Read Also: Should I Take A 401k Loan To Pay Off Debt

Roth Ira Eligibility Contribution Rules

Roth IRAs were not designed for wealthy savers. In fact, there is an income cap on Roth IRA eligibility. The IRS income rules for Roth IRAs use your adjusted gross income as a guide. Your AGI is simply the total of all your taxable income, minus certain qualified deductions such as those for medical expenses and unreimbursed business expenses.

The IRS sets an income eligibility range that tells you whether you can make:

In 2023, the AGI phase-out range for a married couple filing jointly is $218,000 to $228,000 . For a single filer it is $138,000 to $153,000

For 2022, the AGI phase-out range for a married couple filing jointly is $204,000-$214,000. For those filing single, the range is $129,000 to $144,000.

If your income falls below the bottom of the range, you can contribute the full $7,000 to a Roth IRA. If its within the range, you are subject to contribution phase-out rules, meaning that you wont be able to contribute the full $6,000. If your income is above the top of the phase-out range, IRS rules prohibit you from contributing to a Roth IRA.

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Read Also: What Is A Roth Ira Vs 401k