Safe Harbor 401 Plan Provision Deadlines

What is the deadline to start a new Safe Harbor plan?

The Safe Harbor provisions must be in place for at least 3 months if you are adopting a new 401 or 403b plan.

What is the deadline to add a Safe Harbor provision to an existing 401 plan?

Safe Harbor provisions can only be added to an existing plan before the beginning of the plan year and require you to provide a 30-day notice to your employees. If your new plan year begins January 1st, youll need to request the addition a Safe Harbor provision to your 401 plan before November 30th.

Safe Harbor provisions cannot be changed or eliminated during the year except if the plan is terminated completely. In the event of plan termination, the Safe Harbor contribution up through the date of termination would still apply.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How To Set Up A 401

Some employer responsibilities come with setting up a 401 plan for a small business. You might be met with some fees for establishing the plan.

Establishment fees typically range from $1,500 $3,000 but could be more or less depending on the business. Some companies might be able to get the fee waived, but this is typically reserved for large businesses. And remember, thanks to the SECURE Act, you can deduct qualifying setup costs.

To set up a 401 plan, follow these steps:

Read Also: Where Do I Go To Borrow From My 401k

Understand The Eligibility Requirements For A Solo 401

Because the IRS limits solo 401 plans to only one participant, theyre a good choice for self-employed individuals and small business owners with no full-time employees. They can cover just a business owner with no employees or that person and their spouse.

Solo 401 plans require a plan administrator, also known as an investment provider, to help with regulatory paperwork. If you plan to hire employees in the future, a solo 401 plan can convert to allow full-time employees within the companys 401 plan.

Youll need an EIN before you can open a solo 401 account. You can obtain one online, by fax, or by mail. If you apply online, you can have your EIN in about 10 minutes.

Disclose Information To Employees

Furthermore, you should disclose the 401k plan information to your small business employees. Create a summary of your plan that explains your employees rights and responsibilities as a 401k participant. For example, include when and how your employees can become eligible to sign up. You can also use this step to talk about when employees can receive benefits. In addition, list steps and requirements to file a claim and receive benefits. You should also provide your employees with the Employee Retirement Income Security Act description so they know what theyre legally entitled to. This way, they can start the retirement planning process and get the coverage they need. Definitely, disclose your small business 401k benefits for your employees.

There are several steps to set up a 401k plan for your small business employees. First, research your options to find the best 401k plan that suits your business. Next, choose a plan based on your contribution and vesting requirements. In addition, you should determine your policy details to create a custom 401k plan that meets your business requirements. You can also consider other benefits like loans and deduction contribution limits. Furthermore, disclose your policy information to your employees with full transparency. Follow this post to learn how to set up a 401k plan for your small business employees.

Recommended Reading: Can You Pull Money Out Of 401k

Building The Fund Lineup

When we say fund lineup, were referring to the menu of investment options that are available to plan participants. Getting this right is arguably the most important part of building a successful 401 plan.

Having risky, poorly-performing, or unnecessarily expensive mutual funds can significantly limit the amount your employees have in their accounts come retirement. It may even expose you to costly lawsuits.

If you feel any uncertainty around how to build an optimal 401 fund lineup thatll protect you from costly lawsuits, consider hiring an advisor. Not only do the good ones take this off your plate, but theyll even assume legal responsibility for it as well!

Attractive Benefit To Recruit And Retain Talent

Retirement benefits are increasingly important to job seekers. Many workers ask during the job application process whether a company has a retirement plan such as a 401, and they seriously consider the availability of such a plan when deciding whether to accept or remain in a job.

There can also be big financial benefits from a 401 in helping to retain and attract top talent and the associated cost savings and productivity gains, said Stuart Robertson, CEO of ShareBuilder 401k.

Robertsons research shows that replacing an employee costs 29% to 46% of an employees annual salary, depending on whether that team member is in a managerial position.

Its estimated that an employee who earns $50,000 a year can cost $14,500, on the low end, to replace, he said. A 401 plan is a small price to pay, not only for retirement but also for building and keeping a great team.

Did you know?: While a 401 is a retirement vehicle, employees can also borrow against a 401 as an asset, giving them some leverage should they need an infusion of liquid cash without incurring tax penalties.

Read Also: Can I Make My Own 401k

Why Small Business Saturday Matters

Its hard to overstate the importance of small businesses in the U.S. According to a 2019 U.S. Small Business Association report, enterprises with fewer than 500 employees accounted for 44 percent of U.S. economic activity. These businesses provide employment opportunities, pay taxes and reduce blight.

Moreover, small businesses tend to be particularly active in their local communities. According to American Express, 67 cents of every dollar spent in a small business stays in the local community, and SCORE found that small businesses donate 250 percent more than larger businesses to local nonprofits and community causes.

For many of those small businesses, the holiday season is critical. According to the 2021 American Express survey, 78 percent of small business owners said their holiday sales would likely determine whether they can stay afloat in 2022. And Small Business Saturday helps spread the message to consumers: The survey found that 70 percent of respondents reported that Small Business Saturday makes them want to encourage others to shop at small, independently-owned retailers.

How To Increase The Number Of Participants In A Retirement Plan

In traditional retirement plans, participants have to actively enroll in the plan to begin saving. The Law of Inertia tells us that this may not be the best way to get people to start saving, but whats the solution? Automatic enrollment.

Automatic enrollment achieves the miracle of getting people to start saving. In a plan with auto enrollment, employees who dont want to participate are required to proactively opt out, while employees who do nothing are, you guessed it, automatically enrolled in the plan. Employees who are somewhat interested in saving in the plan will be more likely to continue participating than they are to go out of their way to un-enroll, thus increasing participants. Again, bodies in motion.

So, auto enrollment gets people to start saving. But how do you get them to save more? Behavioral economists Richard Thaler and Shlomo Benartzi devised an ingenious method to help overcome participant inertia, initially called the SMarT plan, or Save More Tomorrow plan. In the SMarT plan, the contribution rate for participants would automatically increase periodically, incrementally raising participant deferral rates over time. Now called automatic escalation, 60 percent of plan sponsors are utilizing this increased savings technique .

You May Like: How To Find All 401k Accounts

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

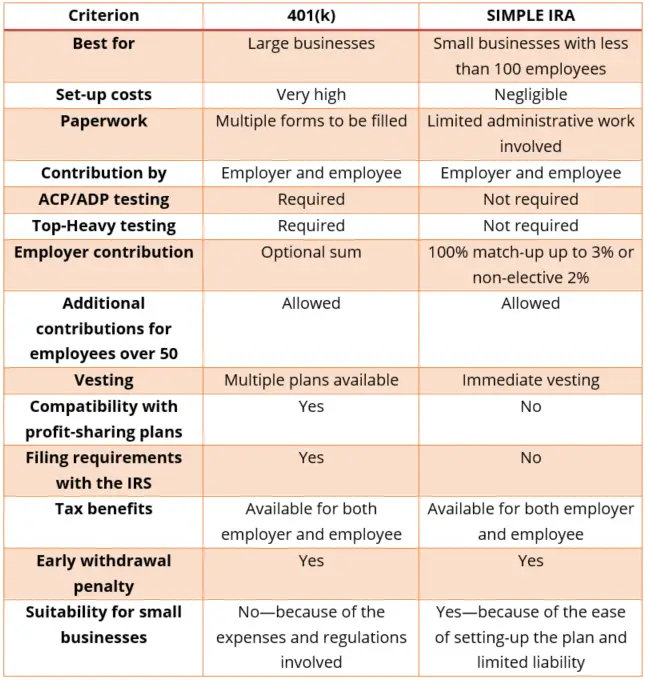

What Are The Benefits Of A 401k Compared To Other Retirement Options

Compared to simplified employee pension individual retirement accounts and savings incentive match plans for employees , 401k plans have higher annual contribution limits. Thus, employees may be able to save more money in a shorter amount of time with a 401k, making it ideal for those who are older and short of their savings goals. It also allows employees to borrow money from their retirement savings accounts. SEP IRA and SIMPLE IRA plans do not.

Don’t Miss: How Does Company Match Work For 401k

% Of Small Businesses Add Profit Sharing

Bar none, profit sharing contributions are the most flexible type of employer contribution a small business can make to their 401 plan. These contributions are not only discretionary, but they can be made to any eligible plan participant even if the participant does not make salary deferrals themselves. They can also be allocated using dramatically different formulas allowing employers to meet a broad range of 401 plan goals with them.

What Are The Contribution Levels And Limits Of A Solo 401

To take full advantage of contributions to a Solo 401 plan you must understand your limits as an employee and employer, as well as contributions allowed on behalf of a spouse if applicable.

When contributing as the employee, you are allowed up to $19,500 or 100% of compensation in salary deferrals for tax year 2021 and $20,500 or 100% of compensation for tax year 2022. If you are over 50, an additional $6,500 catch-up contribution is allowed bringing the total contribution up to $26,000 for 2021 and $27,000 for 2022. This is the type of contribution that can be made as pre-tax/tax-deferred or Roth deferral or a combination of both. Additionally, as the employer, you can make a profit-sharing contribution up to 25% of your compensation from the business up to $58,000 for tax year 2021 and the maximum 2022 solo 401k contribution is $61,000. When adding the employee and employer contributions together for the year the maximum 2020 Solo 401 contribution limit is $57,000 and the maximum 2021 solo 401 contribution is $58,000. If you are age 50 and older and make catch-up contributions, the limit is increased by these catch-ups to $64,500 for 2021 and $67,500 for 2022.

Don’t Miss: How To Transfer 401k When Changing Jobs

How To Support Small Businesses This Small Business Saturday

As a consumer, there are plenty of ways you can support small businesses on this special day and beyond. For example:

- Leave positive online reviews. Take to social media platforms such as Twitter, Instagram, and Facebook, as well as review platforms such as Yelp and Google reviews to extol the virtues of the business.

- Spread the word among your friends. Word of mouth is an excellent way to alert friends and family about a great place in your neighborhood. While youre at it, bring them in with you the next time you shop.

- Buy gift cards. If you cant shop in person or people you want to give presents to do not live close by, a gift card to that establishment is the next best thing to shopping in person.

- Order takeout directly. Third party apps take a significant cut from a restaurant or café. Instead, order directly from the website or over the phone, and pick up your own food if they dont have their own delivery service.

- Host an event. Galleries, bars, restaurants, cafes, and retail shops are often eager to rent their space on off hours. Considerate it as a location for your next event.

Use A Robs To Finance Your Business

The second option you have for using a 401 to start a business is called ROBS, which, as we mentioned earlier, stands for rollovers as business startups. ROBS gives you another way to access retirement funds from a 401, IRA, or another eligible retirement account without having to pay income taxes and early withdrawal penalties.

Compared to a 401 loan, a ROBS offers more flexibility for entrepreneurs because theres no obligation that you have to remain employed in order to use this financing option. In fact, with a ROBS, you cannot use a retirement account from a current employer. This being said, however, doing a ROBS is also more complicated than taking a loan from your retirement plan.

To explain, with a ROBS, you first have to structure your business as a C-corporation. Then, you have to set up a new retirement plan under the C-corp. At that point, you can rollover the funds from your existing retirement plan into the new companyâs retirement plan. Finally, your new corporation sells stock to the retirement plan, and the company uses the proceeds from the sale as a source of capitalâwith one catchâyou canât pay ownersâ salaries from these funds.

Recommended Reading: How To Get My Walmart 401k

Read Also: How To Find Your Old 401k

Be Prepared For The Large Plan Audit

Once the number of employees in your plan passes the 100 mark, you may have to undergo an annual 401 audit. As anyone whos ever been through one will tell you, these are a huge hassle that are costly and can eat up a ton of time. So our advice? Be sure to partner with a 401 provider that takes point on 401 audits.

Research Retirement Options For Your Business

Whats the difference between a traditional and a Roth 401?

You can offer a traditional 401 or a Roth 401 plan. A traditional 401 plan allows employees to make pretax contributions to their retirement savings, but it taxes any withdrawals made. A Roth 401 offers employees a different tax-advantaged option. Employees make contributions with after-tax dollars, but any withdrawals are fully tax-free, as long as certain conditions are met.

What is a SIMPLE IRA?

Many small business owners opt to administer SIMPLE IRAs for their employees as opposed to 401s. SIMPLE stands for Savings Incentive Match PLan for Employees and as the name implies, it allows employees and employers to contribute to traditional IRAs set up for employees.

In this plan, an employer is required to either:

- Match each employees salary contributions, dollar for dollar, up to three percent of the employees compensation or

- Make a nonelective contribution of two percent of each eligible employees compensation .

Because SIMPLE IRAs are easy and inexpensive to set up and operate, they are well suited for small employers who dont have a retirement plan. But employer contributions are less flexible in this type of plan and it has lower contribution limits than other plans.

If you have more questions about retirement account options, take a look at the IRS website.

You May Like: How Much Tax On 401k Withdrawal

How Do I Start A 401k If My Employer Doesnt Offer It

The most obvious replacement for a 401 is an individual retirement account . Since an IRA isnt attached to an employer and can be opened by just about anyone, its probably a good idea for every workerwith or without access to an employer planto contribute to an IRA .

Can a single member LLC contribute to a solo 401k?

Yes you can invest both pretax and Roth solo 401k money in a single LLC. There would only be one member of the LLC because there is only one solo 401k with pretax and Roth money in different sub-accounts.

Can my LLC contribute to my retirement? On top of the LLC IRA contribution limits, you can include a 2 percent company contribution or 3 percent matching contribution. An old-school pension or defined benefit plan. These guarantee a set amount of money at retirement rather than depending on the market.

Can I contribute to a Solo 401k and an employer 401k? The solo allows you to pay yourself twice, both as the employer and as the employee. The employee contribution you can make is limited to $19,500. The employer portion is again limited to 25% of compensation. Added together, the employee and employer parts must be $58,000 or below.

Read Also: Can I Rollover 401k To Ira