Can Both Spouses Contribute To 401k

Can you and your spouse contribute to a 401? Find out what IRS rules say, and the various options you have as a married couple.

When saving for retirement, married couples often have an advantage over single people due to the power of numbers. However, it can be challenging for married couples to decide where and how much to contribute when one spouse is the breadwinner or both spouses are working. The IRS provides various guidelines to guide how retirement savers can contribute to their retirement accounts to maximize their savings.

The IRS requires that 401 accounts must remain in each personâs name, and you cannot combine two 401s belonging to two spouses. Each spouse can have a 401 of their own and in their name. If both spouses are working, they can participate and contribute to the employerâs 401 plan. Married couples filing jointly must decide how much they will contribute to their respective retirement accounts to avoid exceeding the IRS contribution limit. For 2021, the IRS 401 contribution limit is $19,500 or $26,000 if you are age 50 or older. If the employer provides a match, the IRS limit is $58,000, or 64,500 if you are age 50 or older.

Contribution For Spouses With A Side Hustle

If you are running a small business as a solopreneur, you can save for retirement using a solo 401. The IRS allows self-employed business owners with no employees to save for retirement using a solo 401, which is a one-participant 401. This retirement account has a contribution limit of 58,000 in 2021 . You can contribute an extra $6,500 in catch up contributions if you are 50 or older.

Although the Solo 401 is a one-participant 401, IRS rules provide an exemption if your spouse earns an income from the business. This means you can increase the amount you contribute as a family, since the spouse can make elective deferrals as an employee of the business, up to the $19,500 IRS limit, plus $6,500 in catch-up contribution if he/she is 50 or older. As the spouse’s employer, you can contribute up to 25% of compensation to the spouseâs retirement account in the form of profit-sharing contribution.

Solo 401k Contribution Limits

November 9, 2021 by Eric Restrepo

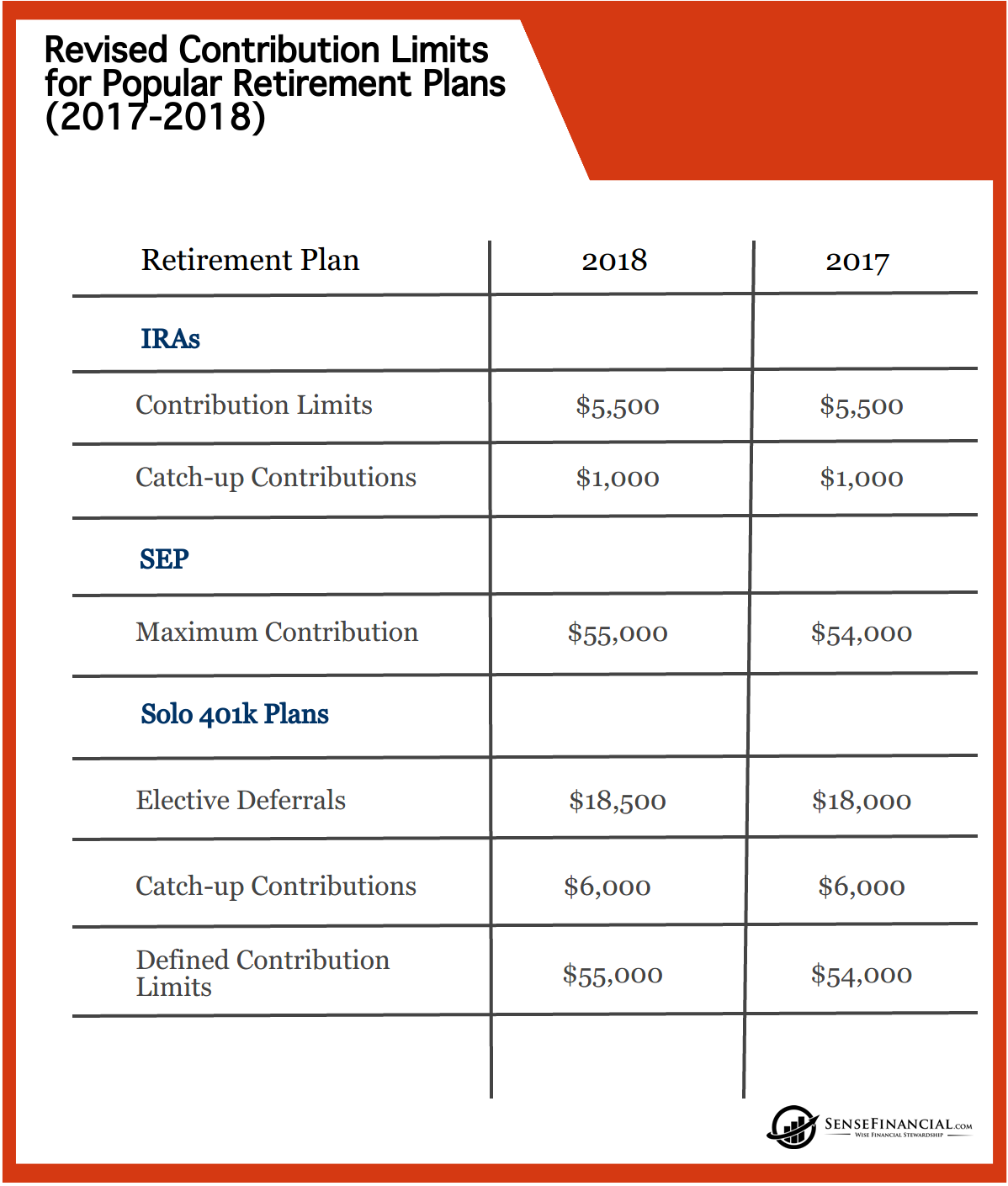

Solo 401k contribution limits are very high and they keep getting higher, year after year. Because of this its very advantageous for freelancers, independent contractors, and small businesses to save for retirement. These increases continue to encourage adoption of these Uni-k, Solo-k, or One participant 401k plans.

In addition to high contribution limits, there is also a lot of flexibility in how to contribute. You can do tax deductible traditional Solo 401k contributions to help lower your taxable income. Or you can also do after-tax Roth Solo 401k contributions. Or you can do a combination of both all within the same Solo 401k plan. High contribution limits can mean big changes for your financial future. The more money you put away, the more your money can grow. When you contribute funds to a retirement plan, they grow tax-deferred or tax-free. Therefore, you can grow your investment profits without paying taxes. This often results in meaningful improvements for your retirement goals.

Read Also: Is 401k A Pension Plan

Can You Open A Joint 401 As A Married Couple

While it is possible for married couples to open a joint bank account, you cannot open a joint 401 even if you are a couple. IRS rules require that retirement accounts such as 401s and IRAs be individually-owned, and you cannot co-own your spouseâs 401 account or move funds between the retirement accounts.

Spouses suffer no harm in maintaining their own retirement account. The two 401s can grow in tandem by choosing investments that meet their financial goals. The goal of the spouses should be to create a diversified portfolio comprising a mix of short-term and long-term assets.

However, it is possible to have joint taxable investment accounts as a couple. For example, you can open a joint brokerage account as a married couple to buy and sell securities such as stocks, bonds, and ETFs. A brokerage account has various pros such as no income limits, tax benefits, and no funding restrictions, which make it more flexible than a 401 account. On the downside, brokerage accounts may have higher fees and higher risks than a traditional retirement account.

K Contribution Limits 2022

- The contribution maximum for workers 401 plans has been raised to $20,500, from $19,500 before.

- Single taxpayers now have a tax bracket of $68,000 to $78,000, up from $66,000 to $76,000 before.

- The threshold for married couples filing jointly has been raised from $105,000 to $125,000 to $109,000 to $129,000, an increase from $105,000 to $125,000.

- The maximum contribution amount for an IRA donor has been raised from $198,000 to $208,000, a $204,000 to $214,000 increase.

- Separate returns filed by a married person are not subject to an annual cost of living adjustment and stay between $0 and $10,000.

- The catch-up deposits for savers over the age of 50 will remain at $6,500.

You can find further information about 401k Contribution Limits 2022 on the IRS website, which you may access here: https://www.irs.gov/newsroom/irs-announces-401k-limit-increases-to-20500

Also Check: Can I Buy An Annuity With My 401k

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

How To Fix Excess Deferrals

If you over-contribute to your 401, immediately let your plan administrator know you made an excess deferralhopefully before March 1 of the year following the one in which you over-contributed. The excess amount and any related earnings should be returned to you by April 15. If the excess amount isn’t returned to you by that date, you may end up paying taxes on the amount twice: once in the year you contributed too much and once when the excess amount is returned to you.

Recommended Reading: How To Calculate Employer Contribution To 401k

An Ira Might Be A Better Option

If you are already contributing up to your employer match, another way to invest additional cash is through a traditional or Roth individual retirement account. The IRA contribution limit is much lower $6,000 in 2021 and 2022 so if you max that out but want to continue saving, go back to your 401.

Some 401 plans, typically at large companies, have access to investments with very low expense ratios. That means youll pay less through your 401 than you might through an IRA for the very same investment. In other cases, the opposite is true small companies generally cant negotiate for low-fee funds the way large companies may be able to. And because 401 plans offer a small selection of investments, youre limited to what’s available.

Lets be clear: While fees are a bummer, matching dollars from your employer outweigh any fee you might be charged. But once youve contributed enough to earn the full match or if youre in a plan with no match at all the decision of whether to continue contributions to your 401 is all about those fees. fee analyzer.) If the fees are high, direct additional dollars over the match to a traditional or Roth IRA.

Limits For Highly Compensated Employees

All 401s are subject to annual nondiscrimination tests to ensure the plans don’t provide unfair advantages to HCEs and key employees that lower-earning employees don’t get. These tests ensure HCEs aren’t contributing substantially more of their earnings or receiving more in employer contributions compared to non-HCEs. They also place limitations on how much of a 401 plan’s assets can be in the hands of HCEs. Failing a nondiscrimination test could result in the 401 plan losing its tax benefits, so companies want to avoid this at all costs.

Companies that fail can remedy the situation in a few ways. First, they can provide additional nonelective contributions to lower-earning employees to bring the plan into compliance, or they can place additional limits on HCE contributions, refunding them in some cases if employees have already contributed too much for the year. They can also do a combination of the two.

If a company has to limit HCE contributions, they may not be able to contribute the full sums listed in the table above. Their maximum contribution limits depend in part on how much lower-earning employees are contributing to their 401s. HCEs should talk to their company’s HR department to learn about how much they’re eligible to contribute annually.

Also Check: Does 401k Roll Over From Job To Job

How Are Solo 401k Contribution Limits Calculated

The IRS sets contribution limits each year. The maximum limit went from $57,000 in 2020 to $58,000 in 2021. If you are 50 years old or older the maximum contribution limit went from $63,500 in 2020 to $64,500 in 2021. As a self-employed person you play multiple roles in your Solo 401k. Because of this, there are multiple ways to contribute to a Solo 401k that allow you to get to the maximum contribution amount for 2021.

You are the employee of your business, so you can do an employee salary deferral which can total $19,500 in 2021. This contribution can be up to 100% of your net compensation or W2 depending on your business structure. If you are 50 years old or older, you can also make a catch up contribution of $6,500. This makes the total possible employee salary deferral for 50 year old or older $26,000.

Since you are also the employer, you can also contribute as an employer profit sharing contribution. This contribution can be between 20-25% of your net business self employment income or W2, depending on your business structure. The more you earn, the more you can contribute. If your spouse works in your business and receives compensation you can double your contribution amount. Imagine being able to tax-shelter over $100,000 per year!

New 401 Contribution Limits For 2022

Retirement savers are eligible to put $1,000 more in a 401 plan next year. The 401 contribution limit will increase to $20,500 in 2022. Some of the income limits for 401 plans will also increase.

Heres how the 401 plan limits will change in 2022:

The 401 contribution limit is $20,500.

The 401 catch-up contribution limit is $6,500 for those age 50 and older.

The limit for employer and employee contributions will be $61,000.

The 401 compensation limit will climb to $305,000.

The income limits for the savers credit will increase to $34,000 for individuals and $68,000 for couples.

Pay attention to these new 401 rules when making retirement savings decisions for 2022.

The 2022 401 Contribution Limit

The contribution limit for 401s, 403s, most 457 plans and the federal governments Thrift Savings Plan is $20,500 in 2022, up from $19,500 in 2021. You can take advantage of the higher contribution limit by contributing up to about $83 more per month to your 401 plan beginning in 2022.

The main thing for employees to know at the beginning of the year is what their maximum allowable contribution is, says Eric Maldonado, a certified financial planner for Aquila Wealth Advisors in San Luis Obispo, California. Then update your percentage or dollar-based employee deferrals to automatically fund your 401 each pay period.

The 2022 401 Catch-Up Contribution Limit

The 2022 401 Limit for Employer Contributions

The 2022 401 Compensation Limit

More from U.S. News

Recommended Reading: How To Rollover Fidelity 401k To Vanguard

Are Roth Iras Still A Good Idea

If you have earned an income and meet income limits, a Roth IRA can be an excellent tool to save for retirement. But remember, its only part of an overall retirement strategy. If possible, its a good idea to contribute to other retirement accounts as well.

Is a Roth IRA a good idea right now?

Roth IRAs are ideal retirement savings accounts if youre in a lower tax bracket now than you expect to be in retirement. Millennials are well positioned to make the most of the tax benefits of a Roth IRA and decades of tax-free growth.

Are ROTH IRAs high risk?

But they should follow Thiels example in one respect: Roths accounts are a great place for high-risk, high-return investments. Unlike a traditional individual retirement account or 401, Roths are funded with after-tax dollars.

Read Also: Do I Have To Pay Taxes On 401k Rollover

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

Recommended Reading: Do I Have To Pay Taxes On 401k Rollover

Extension Apply To Both Contribution Types Question:

Self-directed 401k contributions deadlines are based on the type of entity sponsoring the solo 401k so you are correct. Please see the following.

- If the entity type is a Sole Proprietorship, the annual solo 401k contribution deadline is April 15, or October 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an LLC taxed as a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is a Partnership , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an S-Corporation , the annual solo 401k contribution deadline is March 15, or September 15 if tax return extension is timely filed.

- If the entity type is an C-Corporation , the annual solo 401k contribution deadline is April 15, or September 15 if tax return extension is timely filed.

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2021-2022 limit on catch-up contributions is $6,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2021, for example, you can contribute an additional $6,500 above the $19,500 401 contribution limit for the year for a total of $26,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

You May Like: How To Open Up A 401k

Solo 401k Contribution Calculator

If you are in doubt about how much you can contribute as both an employee and an employer in your Solo 401k plan, a great place to start is by using this handy contribution calculator. Make sure to select your business type from the drop down menu, either unincorporated or a single owner corporation. For the unincorporated sole proprietorship you would enter your net income after deductions. For a single owner corporation you would enter your W2 wages paid from the corporation. Of course enter your age and then hit calculate.

If you want you can also view the report that will break down your contributions into both employee and employer. Remember to always work with your tax professional to help you get your final numbers correct based on your businesses earnings.

You can also compare your Solo 401k contribution limits relative to other small business retirement plans like a Simple IRA, Sep IRA and Profit Sharing Plan. For any given self employment income, the Solo 401k allows for higher tax deductible contributions.

Where To Invest After Maxing Out Your 401

If you have maxed out your 401, there are other types of tax-advantaged accounts you may be interested in investing in. These include the following:

- Traditional or Roth IRAs: These accounts have a lower contribution limit than a 401. There are income limits for making deductible IRA contributions or for investing in a Roth IRA, but they provide more flexibility in what you invest in. Also, Roth IRAs allow you to invest with after-tax dollars and take tax-free withdrawals, which could provide more tax savings than a 401 if you expect your tax rate to be higher in retirement.

- Health savings accounts: These are open only to individuals with qualifying high-deductible health insurance plans. You contribute with pre-tax funds, money grows tax-free, and withdrawals for qualifying health expenditures are also tax-free. These are the only accounts offering a triple tax benefit. Seniors can also make penalty-free withdrawals for any reason after reaching age 65, but they would be taxed on those withdrawals at their ordinary tax rate.

You can invest in these accounts after maxing out your 401 if you are eligible for them. You can also choose to split your contributions between your 401 and these other types of accounts after putting enough into your 401 to get the maximum employer match — even if you haven’t yet put the full $20,500 or $27,000 into your 401 account.

Recommended Reading: Is Rolling Over 401k To Ira Taxable