Don’t Risk Your Retirement By Making The Wrong Choice

The coronavirus crisis has led to an unprecedented number of layoffs across the country. If you’re one of the many workers whose job has been affected, you have a lot on your plate right now.

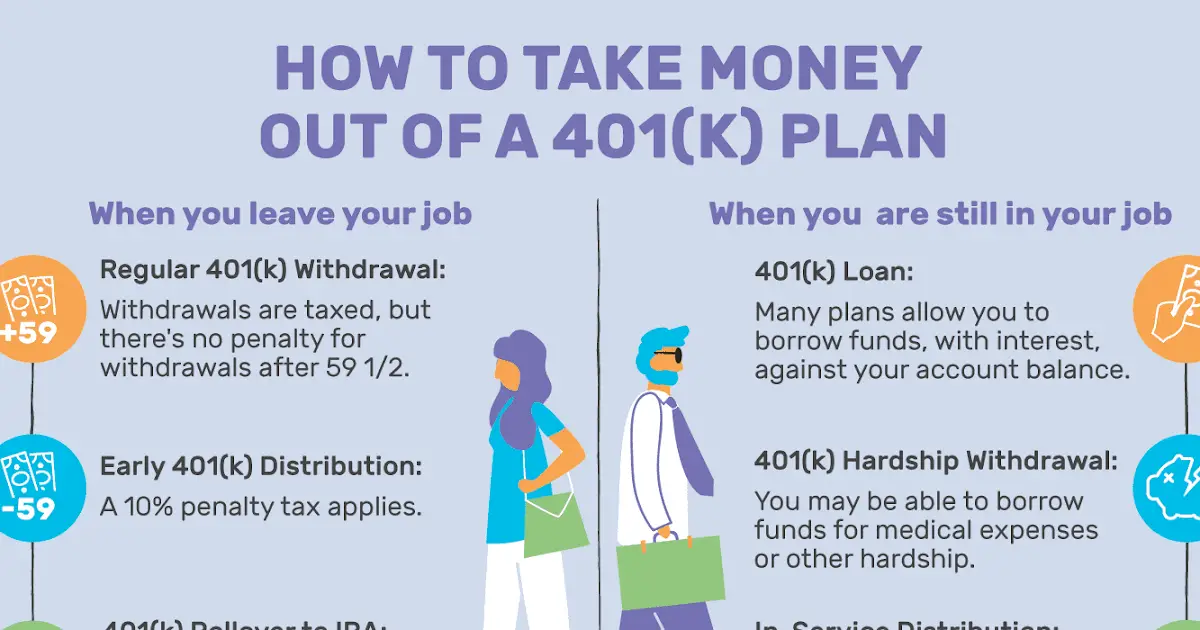

One decision you don’t want to let fall through the cracks is the choice about what to do with your 401. If you’re leaving your job, you have three primary choices, only two of which are good ones.

Find Out Your Fully Vested Account Balance

When you check the account balance of your 401 online or on a paper statement, you may not be looking at the amount that you would take with you if you were to quit, be fired, or laid off today. While your personal pre-tax or post-tax contributions are always fully vested, matching contributions and profit sharing contributions from your employer may be subject to avesting schedule.

Take a look at the provisions of your 401 plan regarding employer contributions, because they may state that if you leave within a certain period of time, youll lose some of the proceeds. Under acliff vesting schedule, employer contributions only become fully vested after a minimum number of years. Under agraded vesting schedule, employer contributions are gradually vested over time.

If you have a dispute about 401 vesting with your employer, contact theEmployee Benefits Security Administration for assistance.

What Happens To Your 401 When You Leave

Since your 401 is tied to your employer, when you quit your job, you wont be able to contribute to it anymore. But the money already in the account is still yours, and it can usually just stay put in that account for as long as you want with a couple of exceptions.

First, if you contributed less than $5,000 to your 401 while you were with that employer, theyre legally allowed to tell you, Your money doesnt have to go home, but you cant keep it here. . If you contributed less than $1,000, they might just mail you a check for that amount in which case you should deposit it into another retirement account ASAP so that you dont get hit with a penalty from the IRS . If you contributed between $1,000 and $5,000, your employer might move your money into an IRA, which is called an involuntary cashout.

Also, if you had a 401 match, then you only get to keep all of that money if the contributions had fully vested before you left. If not, your employer would get to take back any unvested contributions.

Also Check: How To Borrow Money From 401k Fidelity

Reasons To Keep Your Money In A 401

Money in a 401 is typically protected from creditors, bankruptcy proceedings, and civil lawsuits, whereas IRAs have more limited protections. Also, you can sometimes take out loans against your 401 … but theres no such thing as IRA loan.

401s and traditional IRAs both make you take required minimum distributions at age 72, or youll face penalties. With a 401, though, you can push off your RMDs if youre still working. Also, you can start withdrawing your money from a 401 as early as age 55 if you retire from the same company that provides that 401. Roth IRAs, on the other hand, dont have RMDs, and contributions can be withdrawn at any age without taxes or penalties.

What Happens To Your 401 After You Leave A Job

It’s becoming increasingly common for professionals to switch jobs several times throughout their working careers, meaning that most people have to decide what to do with 401 after leaving the job. When you switch jobs or get laid off, you have to evaluate your options on what do you with your 401 account.

After leaving your current job, you have up to 60 days to decide what happens to your retirement savings. Otherwise, your savings will be automatically transferred to another retirement account. In most cases, employers have clear guidelines indicating what you can do with your 401.

Recommended Reading: What Percentage Should I Be Putting In My 401k

Leave The Money In Your Retirement Account

It may seem simpler or easier to keep the 401k plan with your former employer. While this is one option of what to do with a 401k after leaving a job or getting laid off/furloughed, you should note that you wont be able to keep contributing to the plan. You also may not have as much control over how the funds are managed. Leaving your money with your former employer can also make it easy to forget how to access the funds, or that your 401k is still there.

Leave The Money Or Move It

Your first option for handling your retirement savings is to leave it in your former employer’s plan, if permitted. Of course, you can no longer contribute to the plan or receive any employer match.

However, while this might be the easiest immediate option, it could lead to more work in the future.

“The risk is that you are going to forget about it down the road,” said Will Hansen, executive director of the Plan Sponsor Council of America.

Basically, finding old 401 accounts can be tricky if you lose track of them.

Don’t Miss: Can I Borrow Against My 401k

Rolling Over To A New 401

If your new employer allows immediate rollovers into its 401 plan, this move has its merits. You may be used to the ease of having a plan administrator manage your money and to the discipline of automatic payroll contributions. You can also contribute a lot more annually to a 401 than you can to an IRA.

For 2020 and 2021, employees can contribute up to $19,500 to their 401 plan. Anyone age 50 or over is eligible for an additional catch-up contribution of $6,500.

Another reason to take this step: If you plan to continue to work after age 72, you should be able to delay taking RMDs on funds that are in your current employer’s 401 plan, including that roll over money from your previous account. .

The benefits should be similar to keeping your 401 with your previous employer. The difference is that you will be able to make further investments in the new plan and receive company matches as long as you remain in your new job.

Mainly, though, you should make sure your new plan is excellent. If the investment options are limited or have high fees, or there’s no company match, the new 401 may not be the best move.

If your new employer is more of a young, entrepreneurial outfit, the company may offer a SEP IRA or SIMPLE IRAqualified workplace plans that are geared toward small businesses plans). The IRS does allow rollovers of 401s to these, but there may be waiting periods and other conditions.

Option #: Leave Your 401 Account With Your Former Employer

Your first option is as simple as it gets: Do nothing.

Theres nothing stopping you from simply leaving your money where it is inside your current 401 account and letting it sit. As we covered above, your 401 account is portable, so it remains yours even if you leave the employer its tied to. And while this isnt the worst option you could choose , it does come with a few notable disadvantages.

Fund Availability

The first disadvantage of leaving your funds inside your old 401 account has to do with the lack of low cost, high quality funds available for you to invest in.

Many companies rely on third party administrators to run their 401 plans for them, which tend to have relationships with other mutual fund companies that want their funds to be featured in the plans. Often, these plan administrators will offer to manage a companys entire 401 program either for free or at a very low cost. Thats great for the employer, but theres a catch: the way they make money is through the high fees and sales commissions that go along with the funds available in the plan. Unsuspecting employees will think their money is being invested wisely, when in reality, its being subjected to onerous fees that are being kicked back to the plan administrators.

Difficulty of Managing Your Portfolio

Maintaining Financial Discipline

Recommended Reading: How To Do A 401k Rollover

Roll The Assets Into New Employers 401 Plan

This is an option I am strongly considering, but it will depend on several factors notably my new 401 plans investment options. The other factor that I like is simplifying the number of investment accounts I need to keep track of, maintain, and balance.

Possible Advantages: Your investment maintains its tax advantages and there are no penalties to transfer or rollover your money. You will be able to borrow against your 401 holdings if you wish to do so, and you will minimize the number of retirement accounts you have.

Possible Disadvantages: You are limited to your new plans investment options. This is a biggie if your plan has limited options or higher than average expense ratios, which eat away at your returns. There may also be a waiting period before you can sign up for your new companys 401 plan, which means you would have to wait to roll it over.

Verdict: Consider this option if your new plan has strong investment options and/or you want to maintain simplicity in your retirement holdings.

Choose Which Type Of Ira Account To Open

A 401 rollover to an IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

Recommended Reading: How To Invest In 401k Without Employer

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Leave It With Your Old Employer

As long as your 401 balance is $5,000 or more, you can leave the money in your former employer’s plan. Doing this for a relatively short time may make sense. For example, if you were laid off and don’t have a new job yet, you may want to leave your existing 401 as is until you get a new job that offers a 401, and then do a rollover .

Technically, your 401 money can remain in your former employer’s plan as long as you want it to, but there are some good reasons not to leave it there indefinitely. For one thing, if you start contributing to a 401 plan through your new employer and leave your existing plan intact, you’ll be paying fees on two accounts. These costs can quickly add up, which will eat into your investment earnings. Additionally, if your focus is split between two accounts, you may not be as diligent about monitoring your account and rebalancing your investments as you would if you were concentrating on one plan with your current employer. Another hazard: Your former employer could go out of business. If this happens, your 401 balance is still safe, but accessing the account or rolling over funds may become more complicated.

You May Like: Can I Move Money From 401k To Roth Ira

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Take Stock Of Unpaid Loans From Your 401

Heres another reason why it doesnt always make sense to take a loan from your 401. If your plan allows you to take a loan, youll generally have up to five years to pay the loan back in full. Participants have until tax day of the following year to repay outstanding loans on their 401. For example, if you are terminated in April 2020, you have until April 15, 2021 to repay a loan.

In the event youre unable to pay back the remaining balance, it becomes an early distribution, triggering income taxes and, if under age 59 1/2, a 10% penalty from the IRS. Some states may charge additional income taxes and penalties. And you cant roll over unpaid loans to an IRA or 401, effectively reducing your nest egg.

This is why when doing a cost-benefit analysis of accepting a new job offer, make sure to include the cost of losing a non-vested portion and paying income taxes on early distributions of your nest egg.

Recommended Reading: How Does 401k Work If You Quit

An Ira Is The Best Option For Anyone Unsure When They’ll Return To Work

An IRA is an individual retirement account that can allow you to keep saving for retirement, even without an employer. This type of investment account can be opened on your own through a brokerage firm of your choice.

“We have seen a relatively large uptick of people rolling over 401s into their IRAs,” says Bobby Glotfelty, a senior licensed financial professional with Series 7, 24, and 65 licenses at Betterment. “A lot of these cases are people who are no longer employed or are still looking for employment.”

Leaving your old 401 at your old employer’s provider won’t do much to help your money grow. “By moving into an IRA, you generally have more investment options than you would with a 401. Often, 401s restrict you on what you can invest in,” Glotfelty says. With more investment options, like index funds and ETFs, you can invest more specifically to your goals.

“By switching to an IRA, a lot of times you’ll find lower fees,” Glotfelty says. “It’s easier to figure out the fees you actually pay within an IRA.”

Lastly, your IRA is a good tool to keep retirement money in one place, which can be especially helpful after you’ve had several jobs. Keeping all of your retirement money in one place can help you better assess where you are in relation to your goal, and how much more you need to save plus, one retirement savings account is easier to keep track of than multiple.

Stay In The Existing Plan

Most companies will allow you to keep your retirement savings in their plans after you leave. Your money will continue growing tax deferred. However, if you have less than $5,000 in your account, your money may be automatically cashed out and sent to you.

As you progress through your career it is likely that you will have multiple employers. According to a Bureau of Labor Statistics 2019 study, the average worker who was born between 1957 and 1963 held an average of 12.3 jobs during their career. If you choose to leave your 401 at each employer that you leave, by the end of your career you may have several accounts that you need to keep track of. Multiple 401s may also lead to certain plans not being aligned with your risk tolerance as you move closer to retirement.

Read Also: How To Find Old Employer 401k

Rolling Into An Ira Stay On Top Of The Move

If you decide to roll over your 401 into an IRA not sponsored by your new employer, your IRA sponsor or advisor will help guide you through the process to ensure the money gets to the proper destination in a timely manner.

Be sure your new broker/advisor has experience with rollovers, especially if you have company stock in your 401. Why? Because company stock is liquidated when its rolled into an IRA, and later, when distributed, may be taxed as ordinary income resulting in a higher tax liability.

As recommended above, stay vigilant until your money is safely in its new home and that you have proof typically verified online through the IRA providers website.

If You Have Taken A Loan

If you have an existing 401 loan, regardless of which of the above options you select when you quit your job, all outstanding 401 loan balances must be repaid, usually by the October of the following year, which is the deadline to file extended tax returns.

Any money not repaid is treated as an early withdrawal by the IRS, and you pay taxes on the amount, in addition to being hit with the early withdrawal penalty if you are younger than 59½.

Don’t Miss: How To Borrow From 401k To Buy A House

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917