Risks Of Taking Out A 401 Loan

Before deciding to borrow money from your 401, keep in mind that doing so has its drawbacks.

You may not get one. Having the option to get a 401 loan depends on your employer and the plan they have set up. A 2020 study from retirement data firm BrightScope and the Investment Company Institute says that 78 percent of plans gave participants the option to borrow based on 2017 data. So you may need to seek funds elsewhere.

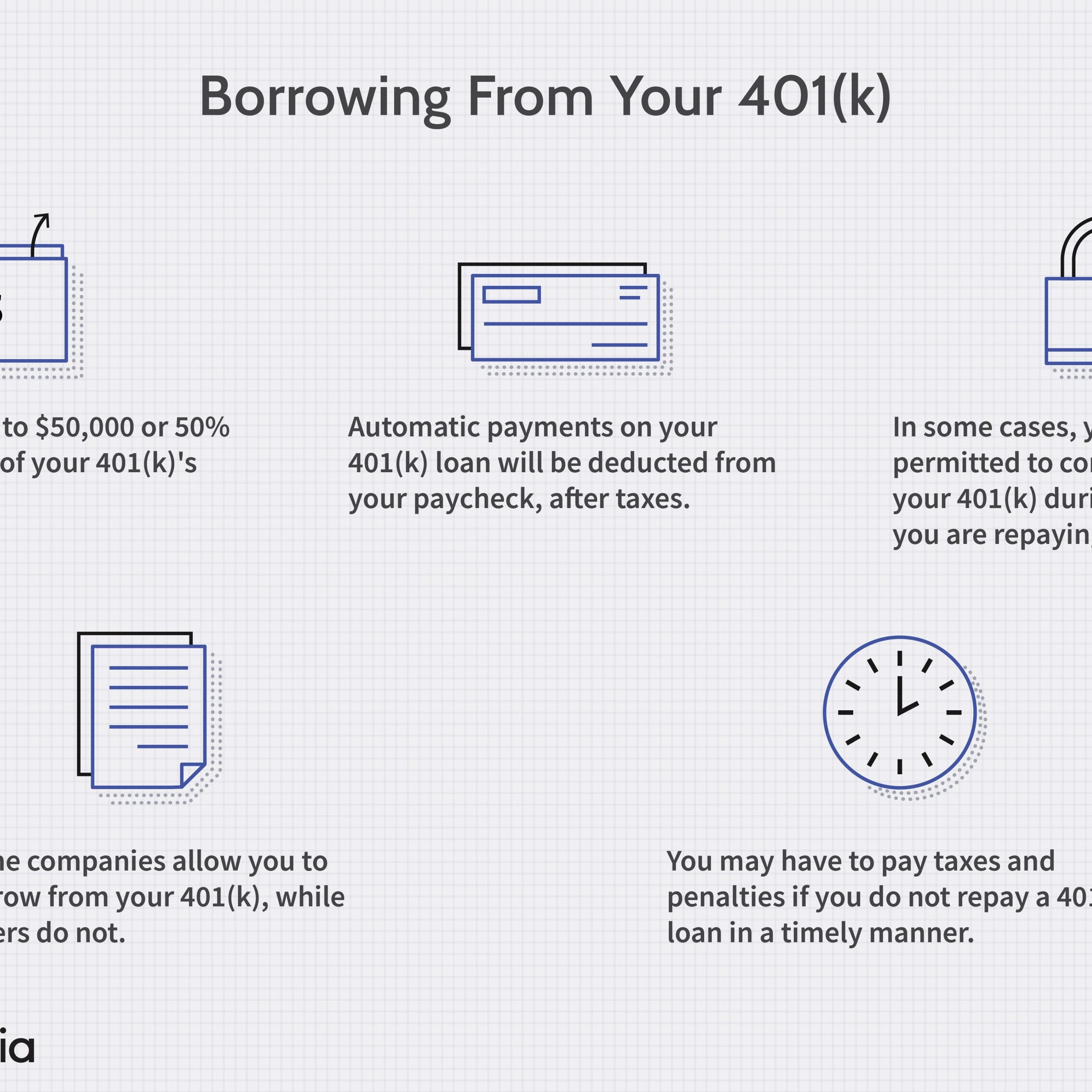

You have limits. You might not be able to access as much cash as you need. The maximum loan amount is $50,000 or 50 percent of your vested account balance, whichever is less.

Old 401s dont count. If youre planning on tapping into a 401 from a company you no longer work for, youre out of luck. Unless youve rolled that money into your current 401 plan, you wont be able to use it.

You could pay taxes and penalties on it. If you dont repay your loan on time, the loan could turn into a distribution, which means you may end up paying taxes and bonus penalties on it.

Youll have to pay it back more quickly if you leave your job. If you change jobs, quit or get fired by your current employer, youll have to repay your outstanding 401 balance sooner than five years. Under the new tax law, 401 borrowers have until the due date of their federal income tax return to repay in such circumstances.

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

Borrowing From Your 401 To Buy A House

Doretha Clemons, Ph.D., MBA, PMP, has been a corporate IT executive and professor for 34 years. She is an adjunct professor at Connecticut State Colleges & Universities, Maryville University, and Indiana Wesleyan University. She is a Real Estate Investor and principal at Bruised Reed Housing Real Estate Trust, and a State of Connecticut Home Improvement License holder.

Buying a home is an exciting milestone, but it often requires a significant financial investment. While it’s important to calculate how much home you can afford and how your monthly mortgage payments will affect your budget, there are other costs to consider.

Two of the most important are your down payment and closing costs. According to the National Association of Realtors, the median home down payment was 12% of the purchase price in 2019. That would come to $24,000 for a $200,000 home. Closing costs, which include administrative fees and other costs to finalize your mortgage loan, add another 2% to 7% of the home’s purchase price.

While the seller may pay some of the closing fees, you’re still responsible for assuming some of the costs. You can borrow from a 401 to buy a house if you don’t have liquid cash savings for the down payment or closing costs. Here’s what to consider before you make that move.

Don’t Miss: How Much Money Should I Put In My 401k

Alternatives To Taking Out A 401 Loan

If youre unsure about using a 401 loan, think about other ways to get money for the time being.

- Stopping 401 contributions. Instead of continuing to stash that money away, pause contributions so you can pocket more of your cash right now.

- Take a hardship distribution from your 401. The CARES Act waives the 10% penalty for hardship distributions, which means if you are younger than 59 ½, you can take money out of your retirement without facing the extra tax charge.

- Take out a different type of loan. A personal loan doesnt borrow from your future self and doesnt require any collateral. A home equity loan or line of credit might get you a lower interest rate and longer repayment terms, but youd be borrowing against your home, like a second mortgage. Even so, this might be an easier or less-expensive way to borrow money quickly.

Repaying A Retirement Plan Loan

Generally, qualified-plan loans must be repaid within five years. An exception is made if the loan is used towards the purchase of a primary residence. It is important to note that your employer may demand full repayment should your employment be terminated or you choose to leave.

The Tax Cuts and Jobs Act of 2017extended the deadline to repay a loan when you leave a job.Previously,if your employment ended before you repaid the loan, there was generally a 60-day window to pay the outstanding balance. Staring in 2018, the tax overhaul extended that time frame until the due date of your federal income tax return, including filing extensions.

If you are unable to repay the amount at this point, and the loan is in good standing, the amount may be treated as a taxable distribution. The amount would be reported to you and the IRS on Form 1099-R. This amount is rollover eligible, so if you are able to come up with the amount within 60 days, you may make a rollover contribution to an eligible retirement plan, thereby avoiding the income tax. Note that if you are younger than 59½, you will likely also owe an early withdrawal penalty, unless you meet certain exceptions.

Also Check: How To Switch 401k To Ira

Under What Circumstances Can A Loan Be Taken From A Qualified Plan

A qualified plan may, but is not required to provide for loans. If a plan provides for loans, the plan may limit the amount that can be taken as a loan. The maximum amount that the plan can permit as a loan is the greater of $10,000 or 50% of your vested account balance, or $50,000, whichever is less.

For example, if a participant has an account balance of $40,000, the maximum amount that he or she can borrow from the account is $20,000.

A participant may have more than one outstanding loan from the plan at a time. However, any new loan, when added to the outstanding balance of all of the participants loans from the plan, cannot be more than the plan maximum amount. In determining the plan maximum amount in that case, the $50,000 is reduced by the difference between the highest outstanding balance of all of the participants loans during the 12-month period ending on the day before the new loan and the outstanding balance of the participants loans from the plan on the date of the new loan.

A plan may require the spouse of a married participant to consent to a plan loan. )

A plan that provides for loans must specify the procedures for applying for a loan and the repayment terms for the loan. Repayment of the loan must occur within 5 years, and payments must be made in substantially equal payments that include principal and interest and that are paid at least quarterly. Loan repayments are not plan contributions. -1, Q& A-3)

When A 401 Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401 plan probably is one of the first places you should look. Let’s define short-term as being roughly a year or less. Let’s define “serious liquidity need” as a serious one-time demand for funds or a lump-sum cash payment.

Kathryn B. Hauer, MBA, CFP®, a financial planner with Wilson David Investment Advisors and author of Financial Advice for Blue Collar America put it this way: “Lets face it, in the real world, sometimes people need money. Borrowing from your 401 can be financially smarter than taking out a cripplingly high-interest title loan, pawn, or payday loanor even a more reasonable personal loan. It will cost you less in the long run.”

Why is your 401 an attractive source for short-term loans? Because it can be the quickest, simplest, lowest-cost way to get the cash you need. Receiving a loan from your 401 is not a taxable event unless the loan limits and repayment rules are violated, and it has no impact on your .

Assuming you pay back a short-term loan on schedule, it usually will have little effect on your retirement savings progress. In fact, in some cases, it can even have a positive impact. Let’s dig a little deeper to explain why.

Don’t Miss: Can You Convert A 401k Into A Roth Ira

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. That means if you left your job in January 2020, you would have until April 15, 2021 when your 2020 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Unfortunately, this worst-case scenario isnt rare. A 2014 study from the Pension Research Council at the Wharton School of the University of Pennsylvania found that 86% of workers in the sample who left their jobs with a loan outstanding eventually defaulted on the loan.

Borrowing Or Withdrawing Money From Your 401 Plan

Presented by Tim Weller

If you have a 401 plan at work and need some cash, you might be tempted to borrow or withdraw money from it. But keep in mind that the purpose of a 401 is to save for retirement. Take money out of it now, and you’ll risk running out of money during retirement. You may also face stiff tax consequences and penalties for withdrawing money before age 59½. Still, if you’re facing a

financial emergency for instance, your child’s college tuition is almost due and your 401 is your only source of available funds borrowing or withdrawing money from your 401 may be your only option. Also, due the Coronavirus Aid, Relief, and Economic Security Act, some of the rules surrounding getting access to your 401 money have been temporarily relaxed in 2020.

Recommended Reading: Should I Pay Someone To Manage My 401k

Rules You Need To Know

If you want to become a real estate investor through your IRA, there are a few rules you’ll need to follow. Recall in the previous section that I mentioned that you and your IRA are considered to be two separate entities. As a result, the following rules apply:

- Any real estate you buy with a self-directed IRA needs to be purely for investment purposes. There are some definitions of the term “investment property” that allow for a small amount of personal use, but this is not the case with the property you own through an IRA.

- Property expenses must be paid by the IRA, not by you directly. For example, if the property needs a new roof, the check needs to come from the IRA. For this reason, it’s very important to leave some funds available in the IRA to cover any unforeseen expenses.

- You can’t use any personal possessions in the property.

- Any rental income needs to be paid to the IRA, not to you.

- You can’t buy a property that is currently owned by you or a relative in a self-directed IRA.

If You Lose Your Job You May Have To Repay The Money By Tax Day Next Year

Departing from your job used to trigger a requirement that you repay your loan within 60 days. However, the rules changed in 2018. Now, you’ll have until tax day for the year you took the withdrawal to pay what you owe.

So if you borrowed in 2020 and lost your job, you’ll have to repay the full balance of your loan by April 15, 2021 . The CARES Act did not change this rule for loans taken in 2020. Similarly, if you borrow in 2021, you will need to repay the full balance by April 15, 2022 .

This longer deadline does slightly reduce the risks of borrowing. But if you take out a loan now, spend the money, and then are faced with an unexpected job loss, it could be hard to repay your loan in full.

Read Also: Should I Convert My 401k To A Roth Ira

How Do You Repay

Since youre borrowing from your 401 plan, you have to repay the loan. This is typically done by taking a portion of each paycheck and applying it toward your loan. In most cases, you can borrow for a term of up to five years, but longer-term loans may be allowed if youll use the money to buy your home. Again, borrowing is risky, and longer-term loans are riskier than shorter-term loans .

When you repay money that youve borrowed from your 401 plan, you dont get any tax benefits. That money is treated as normal taxable income to you, so it wont be like any pre-tax contributions that youve been making to the plan. You can still contribute to the plan with pre-tax dollars contributions if your plan allows) but you dont get to double-dip and get a tax break on loan repayments. Remember: You werent taxed on the money you received when you took the loan.

If you leave your job before you repay the loan, you should have an opportunity to repay any money you borrowed from the 401. But thats not always easy. You probably took the loan because you needed cash, and its therefore unlikely that you have a lot of extra money sitting around. Try to repay if possible, otherwise, you may face income taxes and tax penalties as described below. If youve been recruited to a new job, you might be able to get some help from your new employer .

Can I Take A Loan From My 401k If I Am Unemployed

Workers 55 and older can access 401 funds without penalty if they are laid off, fired, or quit. Unemployed individuals can receive substantially equal periodic payments from a 401. These payments are distributed over a minimum of five years or until the individual reaches age 59½, whichever is greater.

Don’t Miss: How To Access My Fidelity 401k Account

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Recommended Reading: How To Put 401k Into Ira

Not All 401 Plans Will Allow You To Borrow

Not all 401 plans allow you to borrow against your retirement account. If your employer doesn’t permit it, you won’t have this option available to you.

Further, while the CARES Act allows employers to enable larger loans, it doesn’t require them to do so. Even some 401 administrators that generally permit borrowing may not double the loan limits.

You’ll need to check with your plan administrator to see if you’re allowed to borrow at all and, if so, how much you can borrow.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

You May Like: How Much Do You Get From 401k