You Want To Leave Heirs Tax

A Roth conversion could also make sense if you want to leave your heirs tax-free income. This way could be particularly beneficial if you intend the money to go to someone other than a spouse, where the IRA inheritance rules are special and more advantageous.

Under the SECURE Act if you leave your traditional IRA to someone you are not married to, they have to withdraw all the funds from that account in 10 years, says Keihn. Depending on the size of the account, this can have significant tax consequences.

But the Roth IRA gets your heirs out of the tax consequences, says Keihn. While the 10-year rule would still apply in this case if your non-spouse beneficiary inherited your Roth IRA, your beneficiary would not have to pay income taxes on the withdrawals, she says.

Who Should Use A Roth Conversion Ladder

A Roth conversion ladder is specifically useful for people who want to retire early. For example, if you plan to retire after you are 59 ½, you will only lose out by transferring your money into a Roth IRA since it is no longer tax-protected. The positive aspect of the Roth conversion ladder is that it allows you to withdraw money to live in during early retirement.

You should NOT use this method to supplement your income to achieve a lifestyle you cant otherwise afford. Instead, the money should realistically stay in your retirement accounts to accrue as much tax-free interest for as many years as possible, or you will find retirement quite a challenge.

Converting 401k Into A Roth Ira: Potential Benefits

Most workers still have the lions share of their retirement money tucked inside a traditional 401. In part, thats because nearly one-third of employers simply dont offer a Roth option. And a lot of folks simply feel more comfortable with a this more vanilla investment choice. According to a 2019 survey by the Plan Sponsor Council of America, only 23 percent of employees who were offered a Roth version chose to go that route.

Those traditional 401s certainly have their advantages. Workers kick in pre-tax dollarsoften through a payroll deduction and watch their money grow on a tax-deferred basis, thereby amplifying their potential gains. In retirement, they pay income tax on whatever they pull out.

But for a lot of workers who have separated from their employer, moving those 401 accounts into a Roth IRA provides an even bigger benefit, says Mark Pearson, founder of Nepsis Inc., a Minneapolis-based advisory firm. One drawback is that you have to pay income tax this year on the amount you convert, although a down market helps take away some of that sting.

Roth IRAs basically work in reverse from other tax-advantaged plans. You invest post-tax money now, but have the ability to withdraw the funds completely tax-free once youve owned the account for five years and reach age 59½. You dont have to take requirement minimum distributions, or RMDs, at age 72 either, which gives you greater planning flexibility as you reach your later years.

Recommended Reading: How Much Will I Have When I Retire 401k

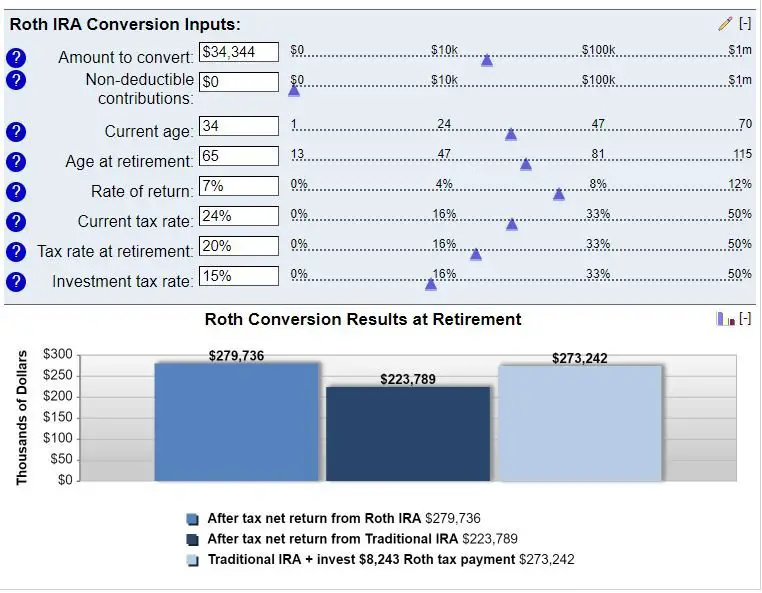

Calculating The Tax Impact

That said, income reported on a Roth conversion increases income before credits or deductions so a Roth conversion could potentially increase taxable income and trigger various phaseouts.

An increase in taxable income is fairly easy to figure out. Take a look at the for the year in which you’re converting. An increase in taxable income will cost you roughly your marginal tax rate times the conversion value.

Analyzing various phaseouts is a bit more complicated. Having more income could result in more Social Security benefits being subject to taxation, or it could trigger a phaseout or elimination of various deductions or tax credits.

The best way to figure out the impact of a Roth conversion in these various circumstances is to run a projection in your tax software to analyze the tax increase resulting from a Roth conversion.

The Benefits Of Rolling Over Your 401 When You Leave A Job

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Whenever you change jobs, you have several options with your 401 plan account. You can cash it out, leave it where it is, transfer it into your new employer’s 401 plan , or roll it over into an individual retirement account .

Forget about cashing it outtaxes and other penalties are likely to be staggering. For most people, rolling over a 401or the 403 cousin, for those in the public or nonprofit sectorinto an IRA is the best choice. Below are seven reasons why. Keep in mind these reasons assume that you are not on the verge of retirement or at an age when you must start taking required minimum distributions from a plan.

You May Like: Why Cant I Take Money Out Of My 401k

Calculating Income To Report On A Roth Conversion

The first step is to figure out your Roth conversion income. If you’re converting deductible IRA funds, you’d report the current value of the funds on the day you make the conversion as your income. Your basis in a deductible IRA is zero because you received a tax deduction for your savings contributions.

If you’re converting nondeductible IRA funds, report as income the current value of the funds on the day you convert, less your basis. If you contributed $5,000 to a traditional IRA in 2016 and received no deduction for that contribution, your basis in those funds would be $5,000: $5,000 of income minus zero for the deduction.

Now let’s say you decide to convert that IRA to a Roth two years later in 2018. The value is now $5,500. You would report $500 of income on your tax return: $5,500 current value minus the $5,000.

Your Income Is Low This Year

It could even make sense to do a conversion during a year when your income is unusually low.

This year we have seen millions of people quit their jobs to take time to consider new career moves,says Keihn. If you have opted to take a few months off before starting a new career, a Roth conversion could be a great option for you this year due to temporarily lower income.

Read Also: How Do You Take Money Out Of 401k

What To Do With Employee Stock

If you have employee stock through your former employer, youll also have to decide what to do with those shares. In the case of stock you already own, Deering advises that it might make sense to sell those shares. At the very least, ensure the stock doesnt make up a disproportionate percentage of your portfolio, as can sometimes happen with employee stock.

According to Deering, the primary consideration is whether theres anything that prevents you from selling the stock. In some cases, there may be lock-up periods that bar you from selling your shares for a particular amount of time. And if youve owned the shares for less than one year, then it makes sense to hold them until the one-year mark when you qualify for long-term capital gains tax treatment.

If you have any remaining stock options, those will likely expire within three months of leaving the company. Whether you choose to exercise those should depend on the current stock price compared to the price your options allow you to purchase them at, as well as how much of the companys stock you already have in your portfolio.

Paying Taxes On Your Contributions

The point of a Roth IRA is that the money gets taxed as income upfront, then grows tax-free. But the money in your 401 was shielded from taxes. So youll now need to pay income tax on that money so that it qualifies for a Roth.

The funds you roll over are added to your taxable income for the year you do the rollover. Income taxes you owe will be calculated from that new total. Since the income from your IRA isnt coming from a paycheck, though, the tax you owe on it wont be withheld. Itll have to come out of your pocket, and to avoid a penalty, you may need to make an estimated tax payment before filing your taxes for the year.

Youll need to make an estimated tax payment if the taxes withheld from your paycheck arent enough to cover at least a) 90% of the taxes youll owe for the tax year of your rollover or b) 100% of the taxes you paid for the previous tax year . Once you know your estimated payment, you can either pay it all at once or split the amount between the quarters remaining in the tax year. Quarterly estimated tax payments are due on or before April 15, June 15, Sept. 15 and Jan. 15 of the next year.

If you overestimate how much your tax bill is going up and overpay your estimated tax payments, thats OK. Youll get a refund if you end up paying more than you owe.

Don’t Miss: Should I Roll 401k To Ira

Rollovers To Multiple Destinations

Distributions sent to multiple destinations at the same time are treated as a single distribution for allocating pretax and after-tax amounts . This means you can roll over all your pretax amounts to a traditional IRA or retirement plan and all your after-tax amounts to a different destination, such as a Roth IRA.

Example: You withdraw $100,000 from your plan, $80,000 in pretax amounts and $20,000 in after-tax amounts. You may request:

A direct rollover of $80,000 in pretax amounts to a traditional IRA or a pretax account in another plan, A direct rollover of $10,000 in after-tax amounts to a Roth IRA, and A distribution of $10,000 in after-tax amounts to yourself.

What Are Roth 401 Contribution Limits

For 2021, the 401 contribution limit is $19,500. This contribution limit applies to your 401 contributions, whether theyre in a Roth or traditional 401. That means if youre contributing to both, the combined total of your contributions cant exceed that amount.6 And in case you were wondering, your employers contributions do not count toward the limit.

If youre 50 or above, the contribution limit increases to $26,000.7

Read Also: Whats The Most You Can Contribute To A 401k

Also Check: What Are Terms Of Withdrawal 401k

Two: Convert Your Traditional Ira To A Roth Ira

No doubt, there are significant advantages to moving your 401 money to a Roth IRA. But, as noted earlier, it will be a taxable event. You will owe taxes not only on your contributions and your companys contributions if it has a matching program, but also on your earnings, which include capital gains and dividends. This bump in income could boost you to a much higher income bracket so that you are paying more tax than if you left the money in a traditional IRA and paid taxes as you made withdrawals in retirement.

Because the taxation of your money is changing, the switch from a traditional IRA to a Roth is called a conversion rather than a rollover. More importantly, it is a permanent process. So you should make sure this is what you really want to do before you do it.

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Recommended Reading: What Is A 403b Vs 401k

Taxes On Roth Ira Conversions

One of the biggest reasons investors gravitate toward Roth IRAs is the tax benefit. The money is put into the account after tax, so when its time to retire, youll be able to take the money out tax-free. That makes the Roth IRA a natural contender for rolling over 401s since it allows you to enjoy tax-free distributions during your golden years.

However, its important to understand the rollover 401 to Roth IRA tax consequences. You didnt pay taxes when you put money into your 401, with the understanding that youd pay when you took it out. A Roth IRA is funded with money youve already paid taxes on, which is why you dont pay taxes when you take it out. This means that the IRS has to get its money now, when youre putting the money into the Roth IRA account.

Should I Convert My 401 To A Roth

You might consider converting your 401 account into a Roth IRA in the following situations:

-

If your tax liabilities are likely to increase in the future: You might want to make Roth contributions and pay taxes now, so you can make tax-free withdrawals later.

-

If you want to make withdrawals at any time: Roth IRAs give you the flexibility to withdraw money whenever you want. They do not bind you with RMDs when you reach 70 ½ years.

-

If you want to diversify your taxation: If you are not sure how your tax liability will impact your income in the future, you might want to set up a Roth IRA in addition to a traditional retirement account, so you can make both taxable and tax-free withdrawals after.

Read Also: How Do I Find My Old 401k Account

How A Rollover Works

You cant roll a 401 directly into a Roth IRA. First, youll have to make something called a traditional IRA stop. That means youll roll the 401 to the traditional IRA, tax-free, then do a Roth IRA conversion. A brokerage firm can handle the conversion, usually through a trustee-to-trustee transfer.

It’s essential that the money is transferred directly from one financial institution to the other. In other words, dont have your former employer issue you a check for the amount, which you then put into a Roth IRA. If you do it that way, the employer will be required to withhold 20 percent for taxes, plus youll be responsible for penalties unless you meet the minimum age requirement of 59½.

Rolling 401 Assets Into An Ira

When you retire or leave your job for any reason, you have the right to roll over your 401 assets to an IRA. You have a number of direct rollover options:

Rolling your traditional 401 to a traditional IRA. You can roll your traditional 401 assets into a new or existing traditional IRA. To initiate the rollover, you complete the forms required by both the IRA provider you choose and your 401 plan administrator. The money is moved directly, either electronically or by check. No taxes are due on the assets you move, and any new earnings accumulate tax deferred.

Rolling your Roth 401 to a Roth IRA. You can roll your Roth 401 assets into a new or existing Roth IRA with a custodian of your choice. You complete the forms required by the IRA provider and your 401 plan administrator, and the money is moved directly either electronically or by check. No taxes are due when the money is moved and any new earnings accumulate tax deferred. Earnings are eligible for tax-free withdrawal once the IRA has been open at least five years and you are at least 59½.

Rolling your traditional 401 to a Roth IRA. If your traditional 401 plan permits direct rollovers to a Roth IRA, you can roll over assets in your traditional 401 to a new or existing Roth IRA. Keep in mind youll have to pay taxes on the rollover amount you convert.

Also Check: Is There A Maximum You Can Contribute To A 401k

Youll Owe Taxes On The Money Now But Enjoy Tax

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve been diligently saving for retirement through your employers 401 plan, you may be able to convert those savings into a Roth 401 and gain some added tax advantages.

Rmds For $10 Million Accounts

Currently, RMDs for account owners are tied to age instead of wealth. Roth IRA owners also aren’t subject to these distributions under current law.

The House legislation would add to those rules, asking wealthy savers of all ages to withdraw a large share of aggregate retirement balances annually. They’d potentially owe income tax on the funds.

The formula is complex, based on factors like account size and type of account . Here’s the general premise: Accountholders must withdraw 50% of accounts valued at more than $10 million. Larger accounts must also draw down 100% of Roth account size over $20 million.

The distributions would only be required for individuals whose income exceeds $400,000. The threshold would be $450,000 for married taxpayers filing jointly and $425,000 for heads of household.

The provision would start after Dec. 31, 2028.

People with millions of dollars in retirement savings would likely change their financial plans to circumvent the rules’ impact if they’re adopted, Keebler said.

“There may be people already at $6 million who might decide not to put more money into their IRAs, but into life insurance or other statutory tax shelters,” Keebler said.

Recommended Reading: Can You Transfer An Ira Into A 401k