Want To Stop Contributing To Your 401 To Resolve A Cash Flow Crunch Read This First

You know the drill: Save 15% of your income to your 401 for a shot at a decent retirement. You’ve played by those rules, but now you’re second-guessing the strategy. With all the economic uncertainty surrounding the coronavirus pandemic, is it really the right time to lock money away for the long term?

You’ve heard the bleak reports about employment in the U.S. since we started shuttering whole communities to contain COVID-19. On April 3, the U.S. Bureau of Labor Statistics reported that nonfarm employers cut 701,000 jobs in March and unemployment rose by 0.9% to 4.4%. Leisure and hospitality workers felt the brunt of the hit, with 459,000 jobs lost in that industry alone. Health care, social assistance, professional and businesses services, retail trade, and construction workers were also affected.

That news might compel you to go into financial defense mode — which usually involves hoarding cash by making minimum payments on debt and, possibly, pausing your 401 contributions. It’s natural to feel nervous about those 401 contributions, even with the recent legislation that allows you to borrow your retirement savings without penalty. But is your situation dire enough to justify reducing your contributions? If more than two of the following four indicators apply to you, the answer might be yes.

When Your Employer Doesnt Offer Matching 401 Contributions

One of the biggest benefits offered by the 401 is matching contributions. With matching contributions, your employer matches the money you deposit in your 401 dollar-for-dollar, up to a certain threshold. This helps turbocharge your retirement savings at no extra cost to you.

However, not all employers offer matching contributions. You can still contribute to your 401 even if your employer doesnt offer a match, but a lack of matching contributions might make you consider other retirement savings options, such as an individual retirement account , depending on your savings goals.

What Are 401 Tax Rules

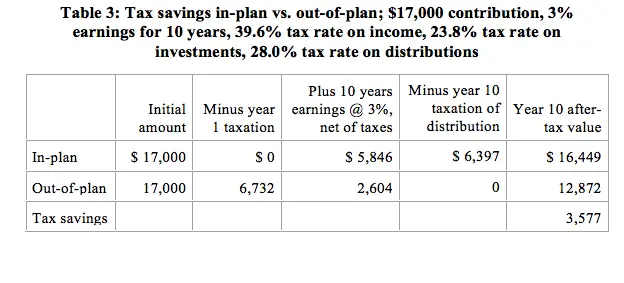

Under the current federal tax law, the amounts you withdraw from your 401 will be taxed to you as ordinary income. If your plan allows after tax contributions these monies will be returned to you free of any tax consequence. If you withdraw $10,000 of deferrals and earnings from your 401 in a certain year, you must generally include that amount in your income for tax purposes. Keep in mind any distributions that are made prior to attaining age 59 1/2 or before a death or disability are subject to a 10% early withdrawal penalty tax, as well as regular income tax.

You may be able to avoid immediate tax consequences by transferring your eligible distribution to an Individual Retirement Account or to a new employer’s tax-qualified retirement plan. This way you will not owe any taxes until you take a withdrawal from the rollover IRA or the new plan. After-tax contributions can roll over into a Roth IRA. In any case you should consult your tax advisor concerning your particular tax situation.

You May Like: How Can I Take Money Out Of My 401k

Stick To The Default Contribution Percentage

If your employer automatically enrolls you in your 401, that’s a great thing. More employees usually end up participating in the plan than if they had to sign up on their own. Sticking to the default contribution rate, however, is not that good. The average default contribution rate for plans with automatic enrollment is just 3.4%.

There are two reasons why this won’t help your 401 grow.

How Are My Plan Contributions Invested

You can select the investment or investments that best help you meet your personal retirement goals. You may change your investment elections as often as you wish but you should make your choices for the long term. You may also transfer money among these choices. You should refer to your enrollment materials for the list of fund choices available in your plan.

You May Like: How To Check My Walmart 401k

Can You Take Money Out Of A 401

You are able to take money out of a 401, but there are rules to consider on the timing of your withdrawals. Withdrawing funds before you reach the governments legal retirement age, you will have to pay penalties in addition to any taxes due. The current withdrawal age to avoid a penalty is 59 and ½ years of age or older. The early withdrawal penalty is 10%.

You also have the option to take a loan from a 401 account and pay it back at a later date, but this is a risky proposition and it is best to be avoided outside of a worst case scenario.

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path. Below is a chart that shows the maximum 401k contributions in 2021 by employee and employer.

After you contribut a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Just imagine 30 years from now, the government deciding to raise penalty free 401k withdrawal to age 75 from 59.5? Unfortunately, you need the money at age 60. Because you withdraw, the government imposes a 30% penalty on top of the taxes you have to pay. Dont think it cant happen. Expect it to happen!

Read Also: Should I Pay Someone To Manage My 401k

How Much Can You Put In A 401 Per Year

The IRS sets the maximum 401 savings rate each year. It is common for the total to stay the same or just increase slightly depending on economic conditions. For 2020, the maximum you can save in a 401 is $19,500.

Individuals 50 years of age and older are allowed to make an additional catch up contribution on top of the regular 401 limit. For 2020, this total is $6,500. The total savings limit for these individuals is $26,000 including both the regular maximum and catch up contribution allowance.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: How To Find Out If I Have An Old 401k

When Your 401 Fees Are Too High

If your employer doesnt offer matching contributions, a good way to gauge whether the 401 plan is a good choice for your retirement savings is to look at the fees. If the fees charged by your employers 401 plan are higher than you like, consider other retirement savings options.

Fees charged by 401 plans fall into three broad categories: investment fees, 12b-1 fees and administrative fees.

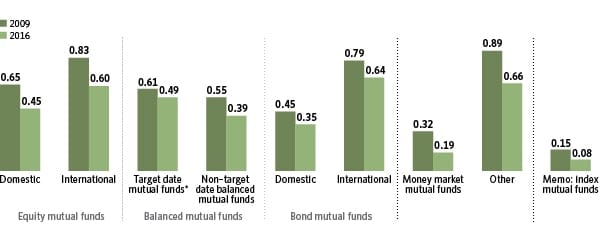

- Investment fees: These fees cover the cost of managing the investments and are disclosed in mutual fund or ETF prospectuses. Some funds charge a load fee, which is an industry term for a sales charge or commission. This can be charged up front, in which case it is called a front-end load. Or, it may be paid when the shares are sold, known as a back-end load or redemption fee.

- 12b-1 fees: This is a type of investment fee, named after the Securities and Exchange Commission rule requiring its disclosure. This fee covers a mutual funds marketing and distribution costs, and broker commissions. Some mutual funds charge a 12b-1 fee in place of a load fee.

- Administrative and service fees: Typically charged as flat fees, these cover the costs of administering the plan, or special add-on costs for 401 loans or hardship withdrawals. Administrative fees run to a few hundred dollars per participant, per year. They may not always be disclosed.

What Happens To Your 401 When You Leave

Since your 401 is tied to your employer, when you quit your job, you wont be able to contribute to it anymore. But the money already in the account is still yours, and it can usually just stay put in that account for as long as you want with a couple of exceptions.

First, if you contributed less than $5,000 to your 401 while you were with that employer, theyre legally allowed to tell you, Your money doesnt have to go home, but you cant keep it here. . If you contributed less than $1,000, they might just mail you a check for that amount in which case you should deposit it into another retirement account ASAP so that you dont get hit with a penalty from the IRS . If you contributed between $1,000 and $5,000, your employer might move your money into an IRA, which is called an involuntary cashout.

Also, if you had a 401 match, then you only get to keep all of that money if the contributions had fully vested before you left. If not, your employer would get to take back any unvested contributions.

Don’t Miss: Which 401k Investment Option Is Best

Why Stop Contributing To A 401k

The most common reason that people stop contributing to 401ks is that they stop working for the company that supports their 401k. If you go from one company to another, you can take the funds in your 401k and transfer them to another companys 401k.

If you do not want to transfer your funds to another companys 401k, most companies allow you to leave the funds in your original 401k, as long as it is over a certain amount, which is usually $5,000.

If you have less than the minimum amount, your company will either pay you out with a check or help you transfer it to another company.

When you leave your funds in the original 401k, your money will continue to grow, which depends on the fund.

For example, if you have a portfolio of stocks and bonds, your money will grow based on the markets growth. If you have a 401k savings account, your money will grow based on the interest rate of your account.

When you roll your money over between two companies, make sure it is through an automatic transfer.

If you withdraw your money from the first 401k, then place the money into the new account, you may need to pay taxes or fees on the money. You also may face issues with company restrictions like annual maximums.

If you do not leave your funds in the original account or roll them over to a new account, your money will not grow.

The Final Blow: You Can Only Withdraw A Small Percentage Every Year

Even if you have $2.5M in 2043, there is a final problem. Exactly how long are you going to live again?

Making money last through retirement is an increasing problem, largely because life spans keep increasing. .

You might live to 70. You might live to 80. You might live to 100.

How much of your money can you afford to peel off every year? Do you know if youll live to 70, 80 or 100?

So how much of your money can you afford to peel off every year? Exactly.

Research has shown that a well-diversified, low-fee, tax-efficient portfolio can afford to throw off about 4% per year, and still preserve its capital long term. This is just a high likelihood markets are volatile, and there are still scenarios where you run out of money. But lets assume 4%.

Four percent of $2.5M is $100K. Given the fact that youve saved $250K by the age of 30, odds are this is below your current income / lifestyle.

Whoops, forgot about inflation! That $100K really feels like $41.5K. Definitely less than you are used to. Im not going to even run the number for what happens if your returns were 6% net of fees instead of 8%.

Read Also: Can I Transfer Money From 401k To Ira

How It Could Grow

If you routed as much as you’re legally allowed to contribute to your 401 for 30 years, and your investments generated an average annualized rate of return of 7%, your balance at the end of that period would be $1,970,924.

With an 8% annualized rate of return, that would grow to $2,385,744, and with a 9% rate of return, it would reach $2,897,217. An average rate of return of 10% would net you $3,528,397.

Rates of return like those are not unreasonable for investors to expect. According to a model constructed by the investment firm Vanguard, between 1926 and 2020, portfolios that consisted of 20% stocks and 80% bonds grew by an average of 7.2% a year. Increasing the stock exposure to 40% boosted the annual return to 8.2%, a 60% stock/40% bond split lifted it to 9.1%, and an aggressive 100% stock allocation returned on average a 10.1% rate of return. However, the higher the stock exposure in your portfolio, the higher the risk. Increasing the proportion of stock added to the number of years in which those average portfolios declined in value, and increased the magnitude of the losses in their worst years.

Financial Samurai 401k Savings By Age Guide

From the results, we can see that even after 38 years of consistent saving, youll only have around $1,000,000 to $5,000,000 in your 401k in a realistic cycle of bull and bear markets. In other words, I believe everybody should become 401k millionaires by 60.

If youre just starting your 401 savings journey, you could get lucky and achieve the high end column with consistent 8%+ annual growth and company profit sharing after 38 years. After all, the maximum 401 contributions will be much higher over the next 38 years than the previous 38 years.

But its most likely that most people reading this article should follow the middle-to-low end columns as a 401 savings guide. The median age in America is roughly 36. Meanwhile, the median age of a Financial Samurai reader is closer to 38.

Don’t Miss: Should You Always Rollover Your 401k

You Could Withdraw The Money

Technically, youre allowed to withdraw your money from your old 401, but unless youre facing some really dire financial circumstances, we advise against it. Thats because youd get hit with big penalties from the IRS and likely owe taxes on the money, too which could all add up to as much as 50% of the balance in your account. Yeah ouch.

If I Leave My Job Do I Lose The Money I Put In The Plan

The contributions you put in the plan along with any earnings are owned by you. If your employment ends for any reason, the money is yours to take with you. The contributions made by your employer may be subject to a vesting schedule. You should check your Summary Plan Description you received when you enrolled in the plan to determine the vesting schedule.

Don’t Miss: When Can You Take Out 401k

What Happens When You Stop Contributing To Your 401

Halting 401 contributions might be financially necessary, but you should keep in mind what youre giving up in exchange.

- You stop reducing your taxable income. Your 401 contributions are made with pre-tax dollars from your salary, lowering your taxable income. This can either bump up your refund or lessen what you owe. If you arent making contributions, you dont have the opportunity to reduce your taxable income. This might mean your tax return wont be as high next year or you could end up owing money.

- You could miss out on employer 401 matching contributions. If your employer makes matching 401 contributions, youre missing out on the extra 401 pay bump. Regardless of how much or little your employer contributes, you wont get to take advantage of the money from matching contributions.

Learn More About 401ks

Everyone needs to plan for retirement, but it can be an overwhelming process. These books on Amazon.com will help you learn more about retirement planning and 401ks to have a successful retirement plan.

- Retirement Plan For Dummies: This book is a great place to start learning about retirement planning, as it is easy to understand, and will teach you how to proactively plan for retirement, understand your finances, and know what online and professional resources are available.

- How Much Money Do I Need? Uncommon Financial Planning Wisdom for a Stress-Free Retirement: Many people ask this simple question, and this book will help you answer it. You will learn what not to do when planning your retirement, how to not over-invest for retirement, and what strategies you can use to have a successful retirement.

- Five Years Before You Retire, Updated Edition: Retirement Planning When You Need it The Most: No matter how old you are and when you plan to retire, it is not too late to enhance your retirement, even if you do not have enough money saved. If you have between five and ten years before retirement, this book will help you with the last-minute steps you can take to have a better retirement.

- IRAs, 401s and Other Retirement Plans: Strategies for Taking Your Money Out:Once you have a retirement plan started, you need to understand how to access your money, when you need to withdraw your money, and more information about your retirement plan that you need to know about.

Recommended Reading: How To Do A Direct 401k Rollover